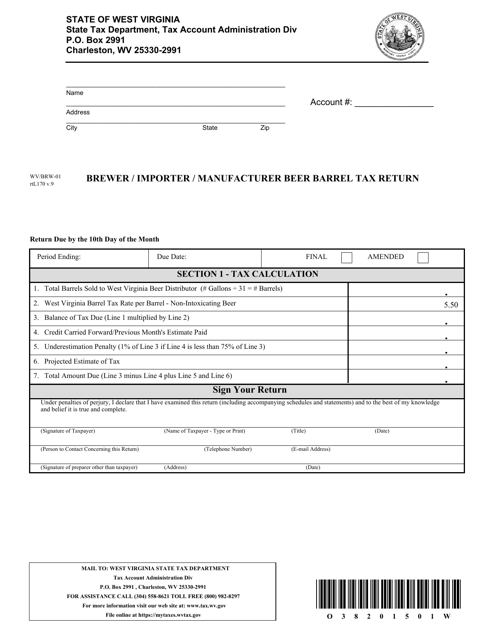

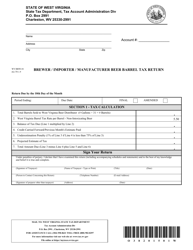

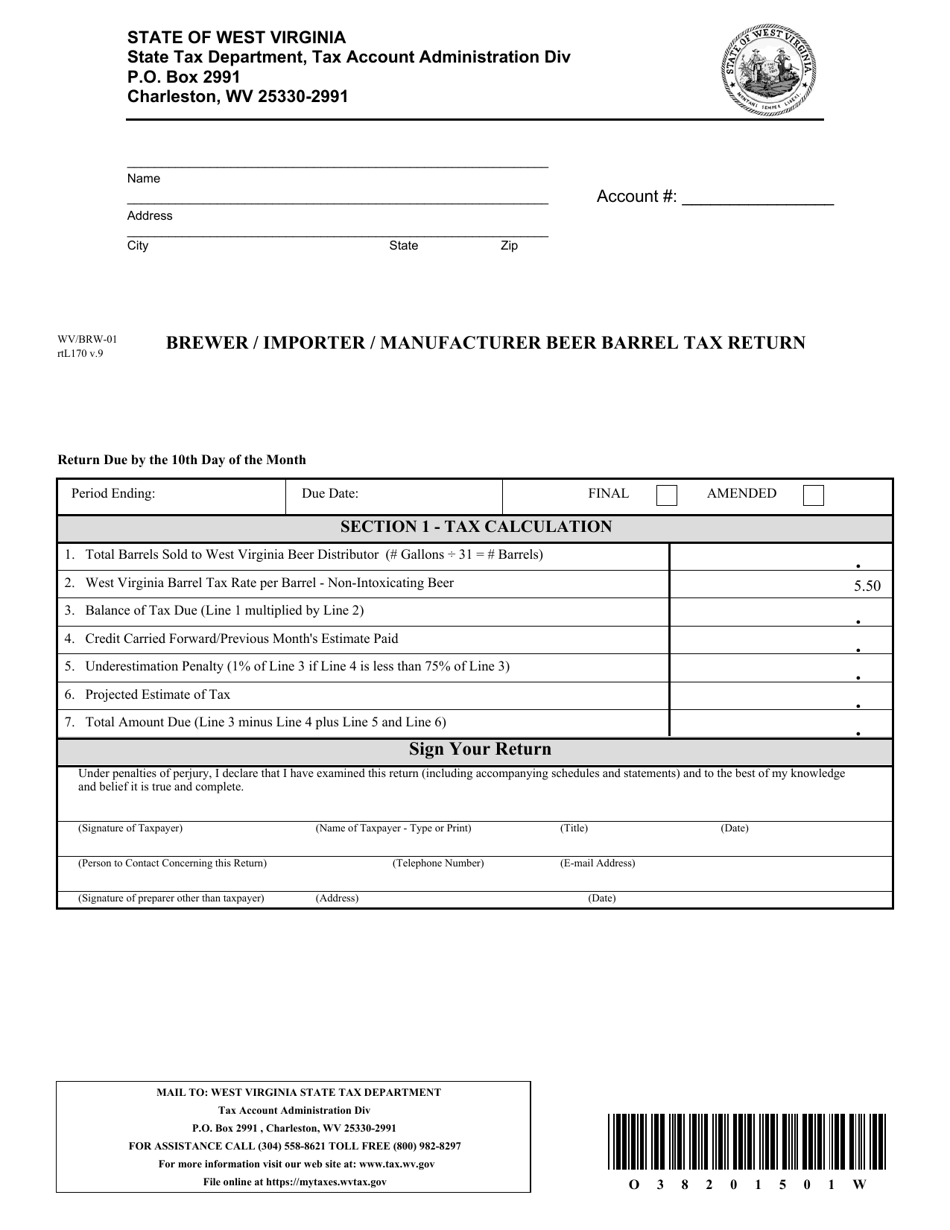

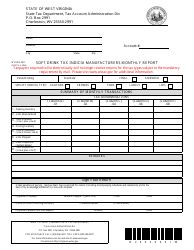

Form WV / BRW-01 Brewer / Importer / Manufacturer Beer Barrel Tax Return - West Virginia

What Is Form WV/BRW-01?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the WV/BRW-01 form?

A: The WV/BRW-01 form is the Beer Barrel Tax Return form for Brewer / Importer / Manufacturer in West Virginia.

Q: Who should file the WV/BRW-01 form?

A: Brewers, importers, and manufacturers of beer in West Virginia should file the WV/BRW-01 form.

Q: What is the purpose of the WV/BRW-01 form?

A: The purpose of the WV/BRW-01 form is to report and pay beer barrel tax for brewers, importers, and manufacturers in West Virginia.

Q: How often should the WV/BRW-01 form be filed?

A: The WV/BRW-01 form should be filed monthly.

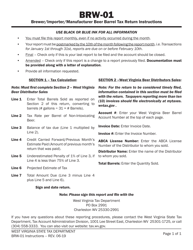

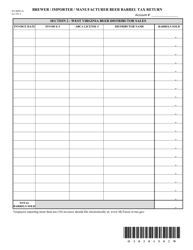

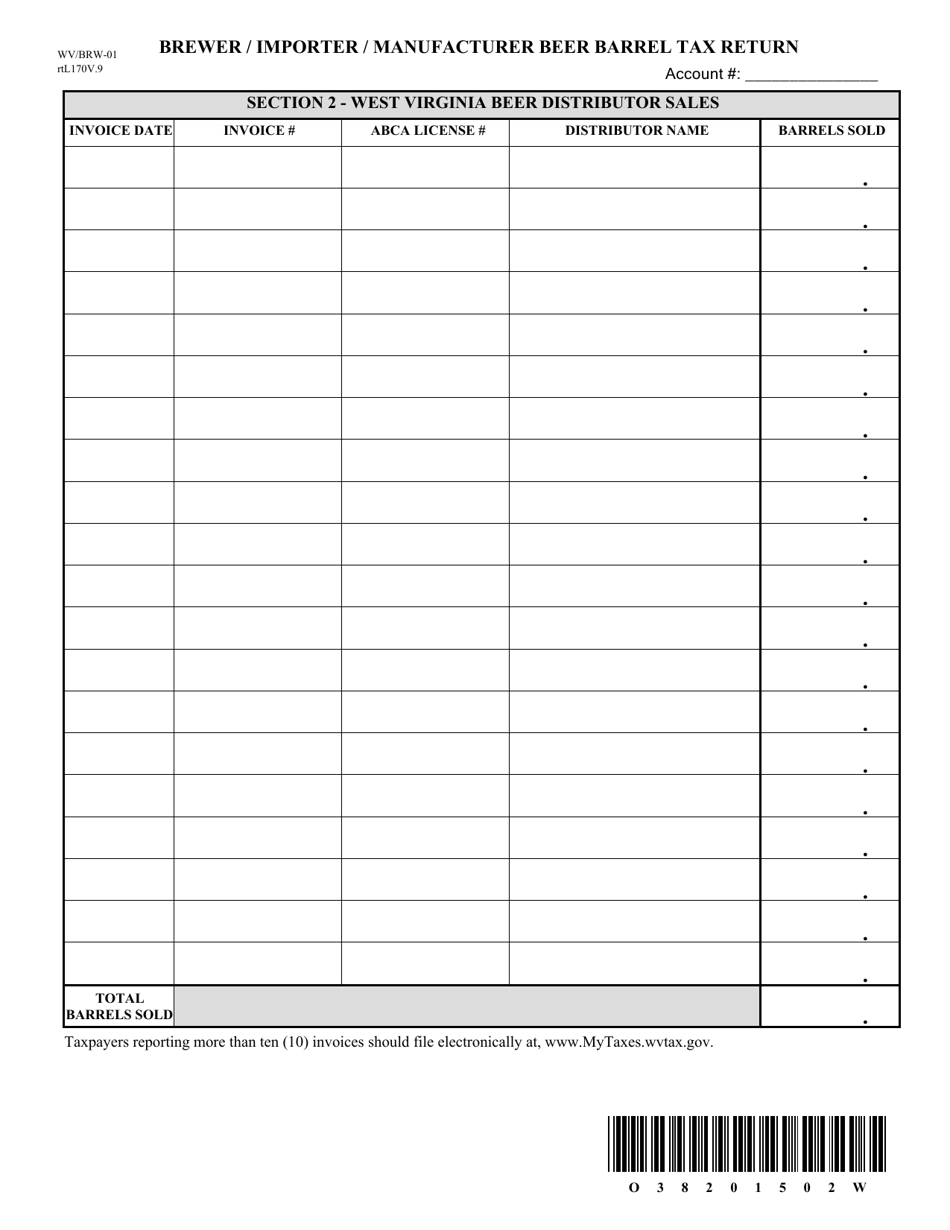

Q: What information is required to complete the WV/BRW-01 form?

A: The WV/BRW-01 form requires information such as the total barrels of beer produced or imported, the tax due, and other related details.

Q: What are the consequences of not filing the WV/BRW-01 form?

A: Failure to file the WV/BRW-01 form or paying the beer barrel tax can result in penalties and interest charges.

Q: Are there any exemptions or deductions available for the beer barrel tax?

A: Yes, certain exemptions and deductions are available for the beer barrel tax. It is advisable to consult the official guidelines or a tax professional for specific details.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/BRW-01 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.