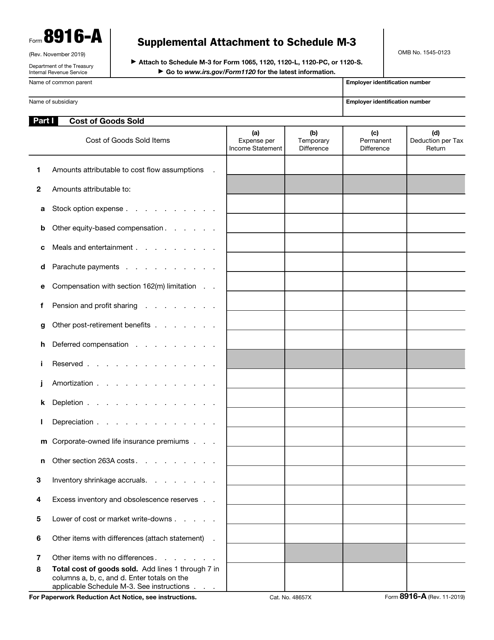

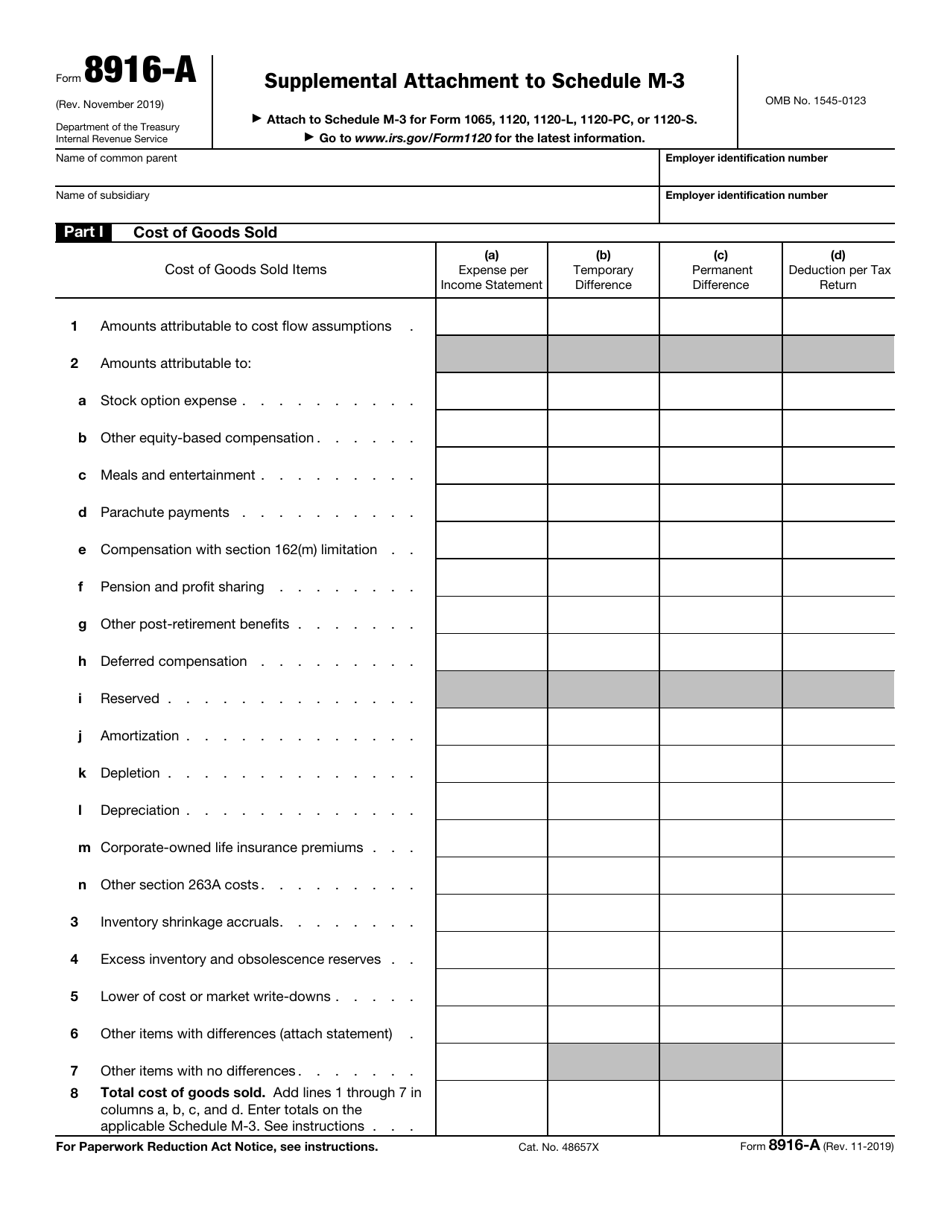

IRS Form 8916-A Supplemental Attachment to Schedule M-3 - Washington

What Is IRS Form 8916-A?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is IRS Form 8916-A?

A: IRS Form 8916-A is a supplemental attachment to Schedule M-3, which is used to report tax adjustments related to certain business activities.

Q: When do I need to use Form 8916-A?

A: You need to use Form 8916-A if you have tax adjustments related to certain business activities that require additional reporting beyond what is provided in Schedule M-3.

Q: What does Form 8916-A include?

A: Form 8916-A includes specific sections for reporting tax adjustments related to research and experimentation expenses and certain deductions, depreciation, and amortization.

Q: Do I need to file Form 8916-A separately?

A: No, Form 8916-A is filed as a supplemental attachment to Schedule M-3, so you don't need to file it separately. It should be included with your tax return.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8916-A by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.