This version of the form is not currently in use and is provided for reference only. Download this version of

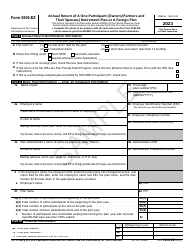

IRS Form 5500-EZ

for the current year.

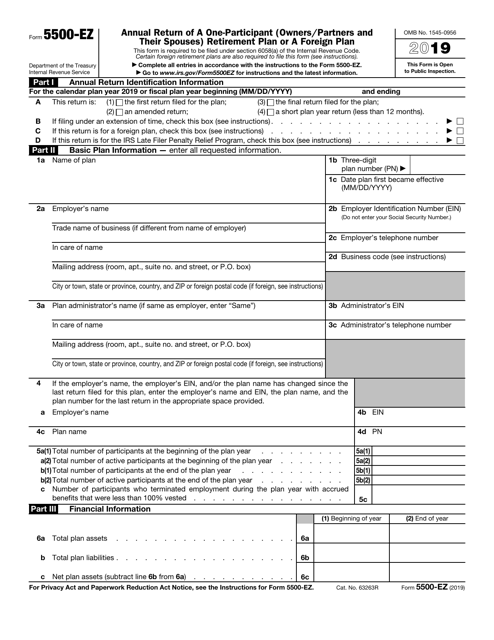

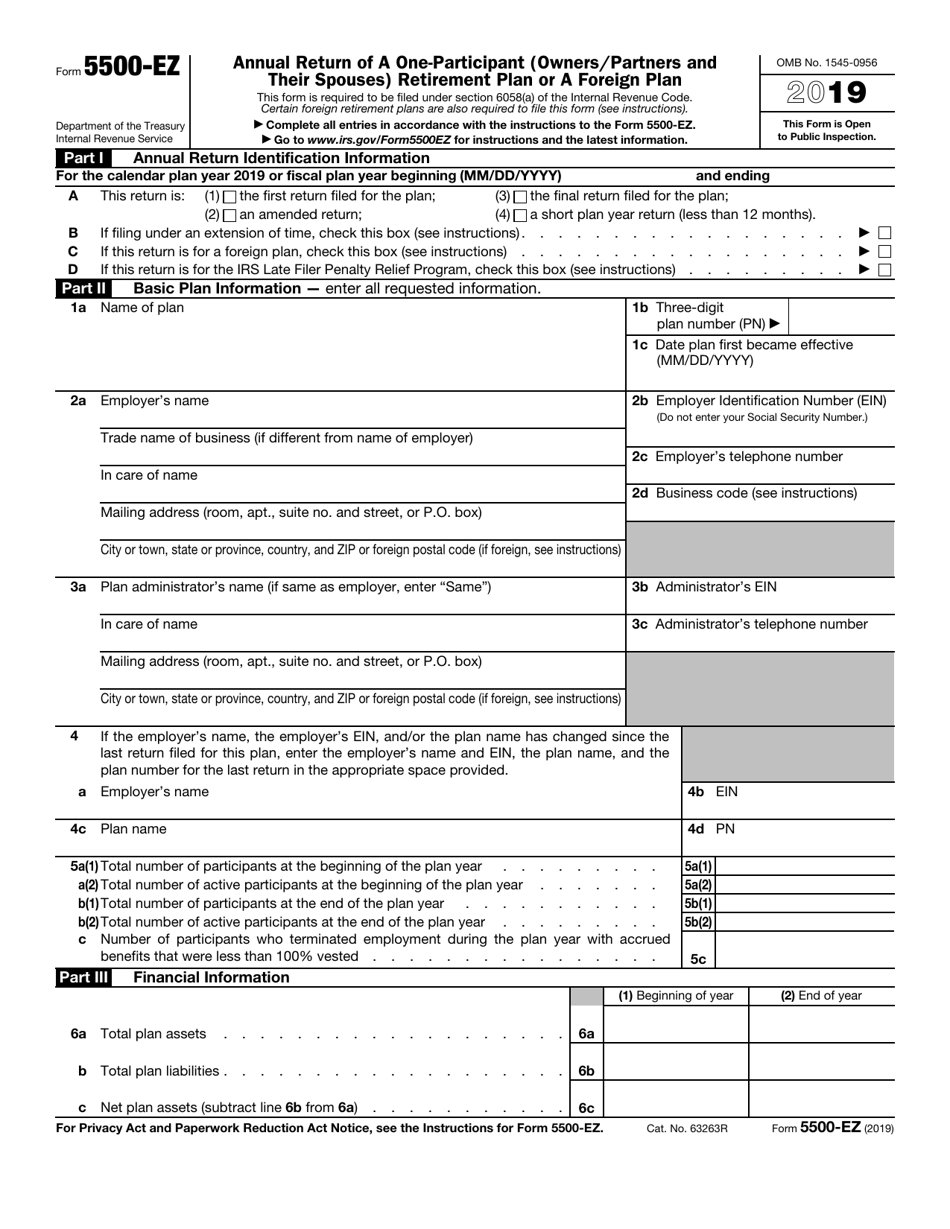

IRS Form 5500-EZ Annual Return of a One-Participant (Owners / Partners and Their Spouses) Retirement Plan or a Foreign Plan

What Is Form 5500-EZ?

IRS Form 5500-EZ, Annual Return of a One-Participant (Owners/Partners and Their Spouses) Retirement Plan or a Foreign Plan , is a document used by one-participant plans (retirement plans that cover only you and your spouse/partner and do not provide benefits to anyone except you and your spouse/partner) and by foreign plans (pension plans maintained outside the United States) that have to file an annual return and do not file it electronically on a related Form 5500-SF.

The latest version of the form was issued by the Internal Revenue Service (IRS) in 2019 with all previous editions obsolete. A fillable Form 5500-EZ is available for download below.

If you are required to file at least 250 forms, you must use Form 5500-SF, Short Form Annual Return/Report of Small Employee Benefit Plan, instead, since electronic filing for the IRS Form 5500-EZ is not available.

You are not required to file the form with attachments or schedules; however, you must retain completed Schedule MB (Multiemployer Defined Benefit Plan and Certain Money Purchase Plan Actuarial Information) for your records and completed and signed Schedule SB (Single-Employer Defined Benefit Plan Actuarial Information), if either of them is applicable because you have to perform an annual valuation and keep the funding records that are associated with plan funding.

IRS Form 5500-EZ Instructions

- Part I - Annual Return Identification Information. Describe the plan and state if you are filing under an extension of time.

- Part II - Basic Plan Information. Enter the name of the plan, provide the employer and plan administrator information, including employer identification numbers. Indicate the number of participants at the beginning and at the end of the plan year.

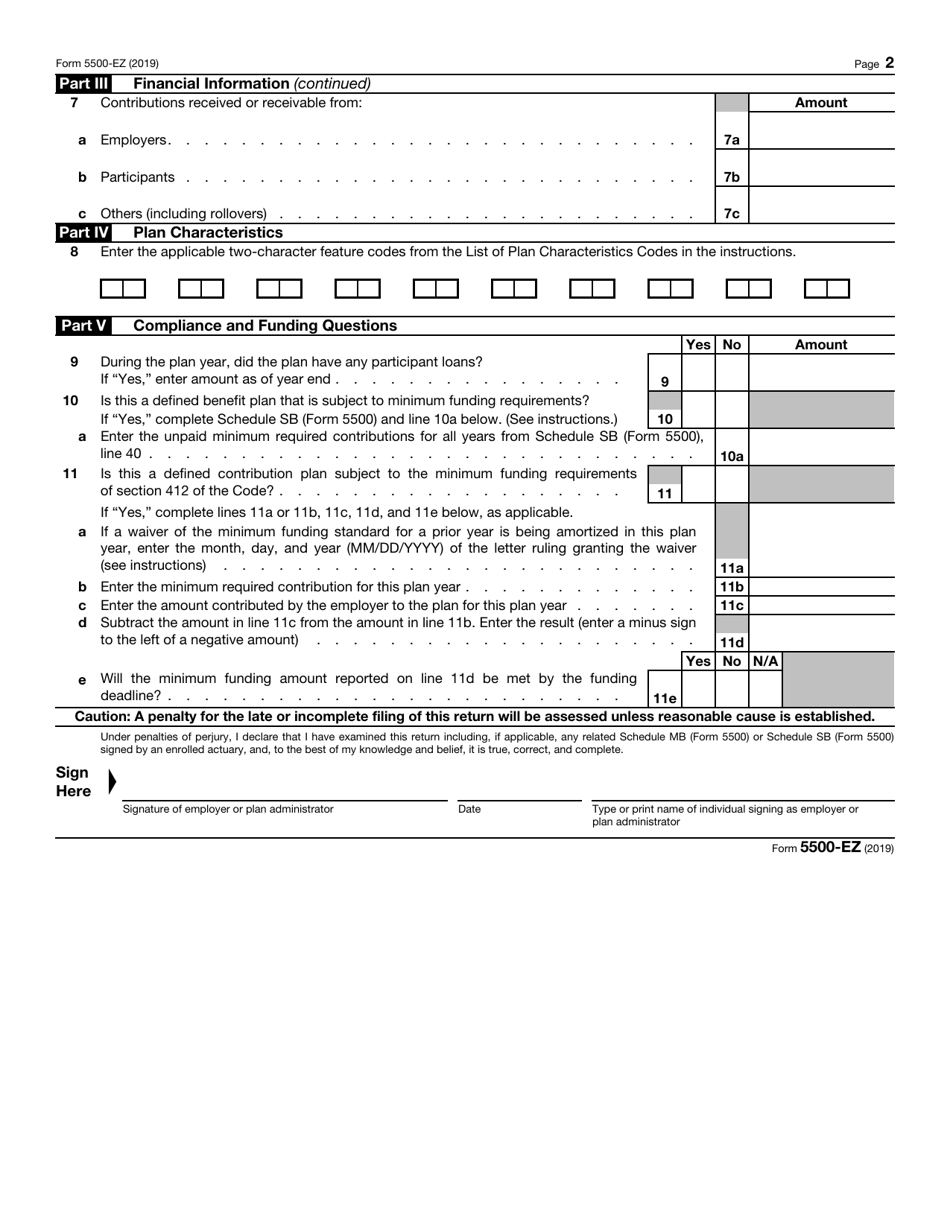

- Part III - Financial Information. Write down the plan assets, liabilities, contributions.

- Part IV - Plan Characteristics. Enter two-character feature codes from the official instructions for the form issued by the IRS.

- Part V - Compliance and Funding Questions. State if the plan had any participant loans, if it is a defined benefit/defined contribution plan subject to minimum funding requirements.

The IRS 5500-EZ form must be signed and dated by the employer (owner) or the plan administrator.

When Is Form 5500-EZ due?

The Form 5500-EZ due date is the last day of the seventh calendar month after the end of the plan year. The form must be filed on paper. The mailing address for the form is at the Department of Treasury, Internal Revenue Service, Ogden, UT 84201-0020. The IRS imposes a penalty of $25 per day for not filing this return.

IRS 5500-EZ Related Forms:

- IRS Form 5500, Annual Return/Report of Employee Benefit Plan, is a document used to report information about Direct Filing Entities, or DFEs (investment arrangements that manage funds from various plans), and employee benefit plans. Each sponsor or administrator of an employee benefit plan subject to the Employee Retirement Income Security Act of 1974 (ERISA) has to report information about benefit plans every year.

- IRS Form 5500-SF, Short Form Annual Return/Report of Small Employee Benefit Plan, is a related simplified form used by certain small welfare and pension benefit plans. The plan must be small, it cannot be a multiemployer plan or hold employer securities, 100% of its assets must be invested in secure investments with a determinable fair value, and it has to be exempt from the audit by the independent qualified public accountant.