This version of the form is not currently in use and is provided for reference only. Download this version of

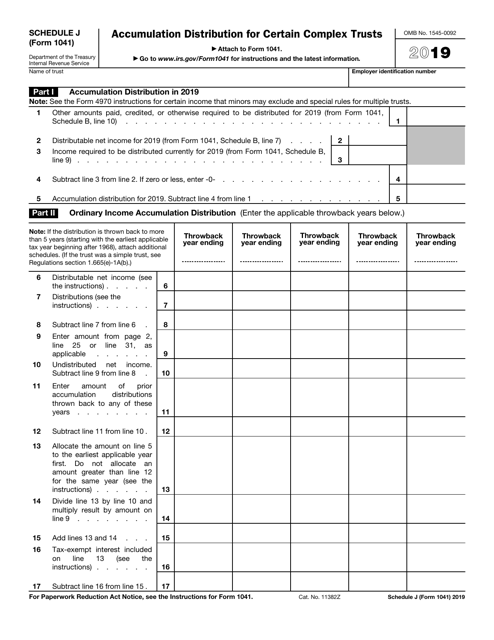

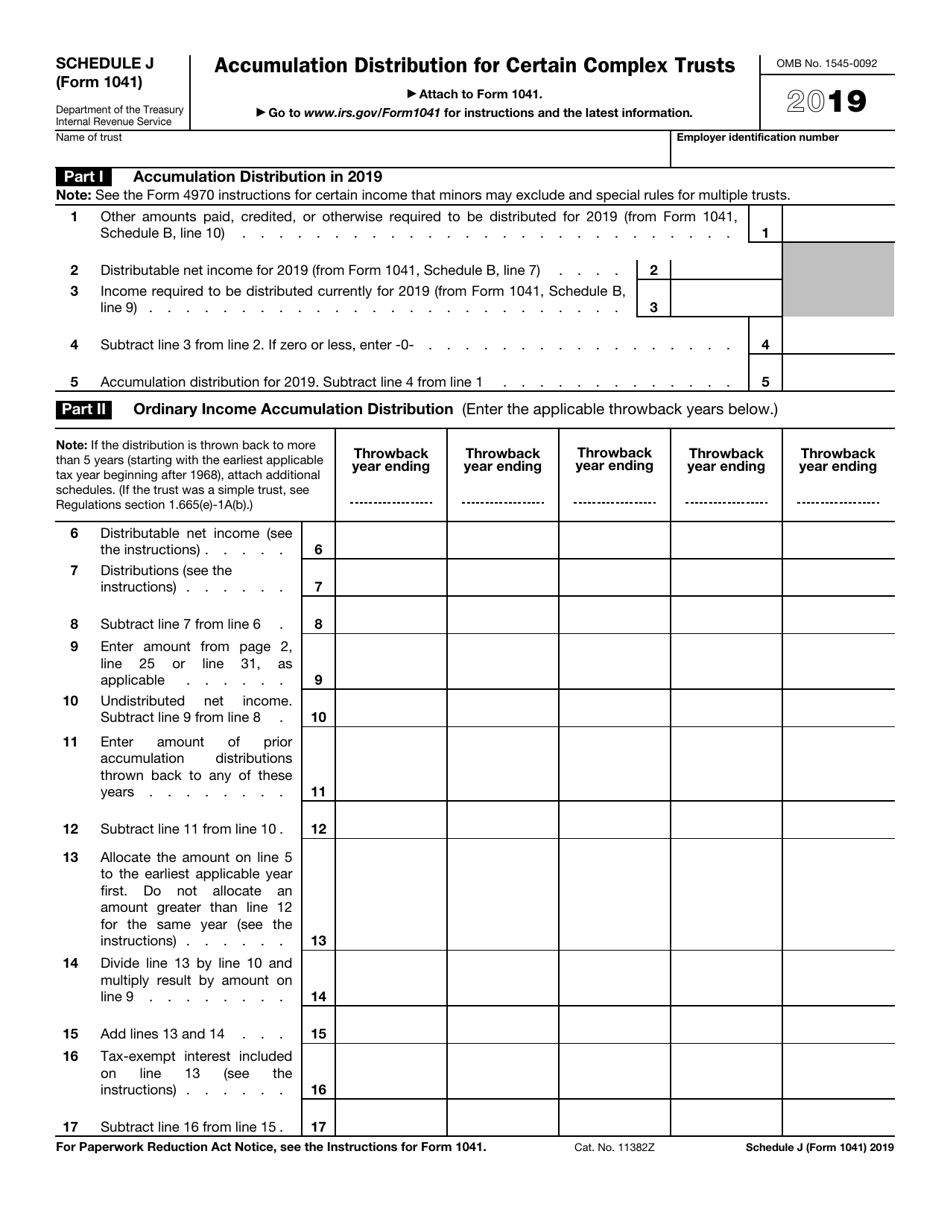

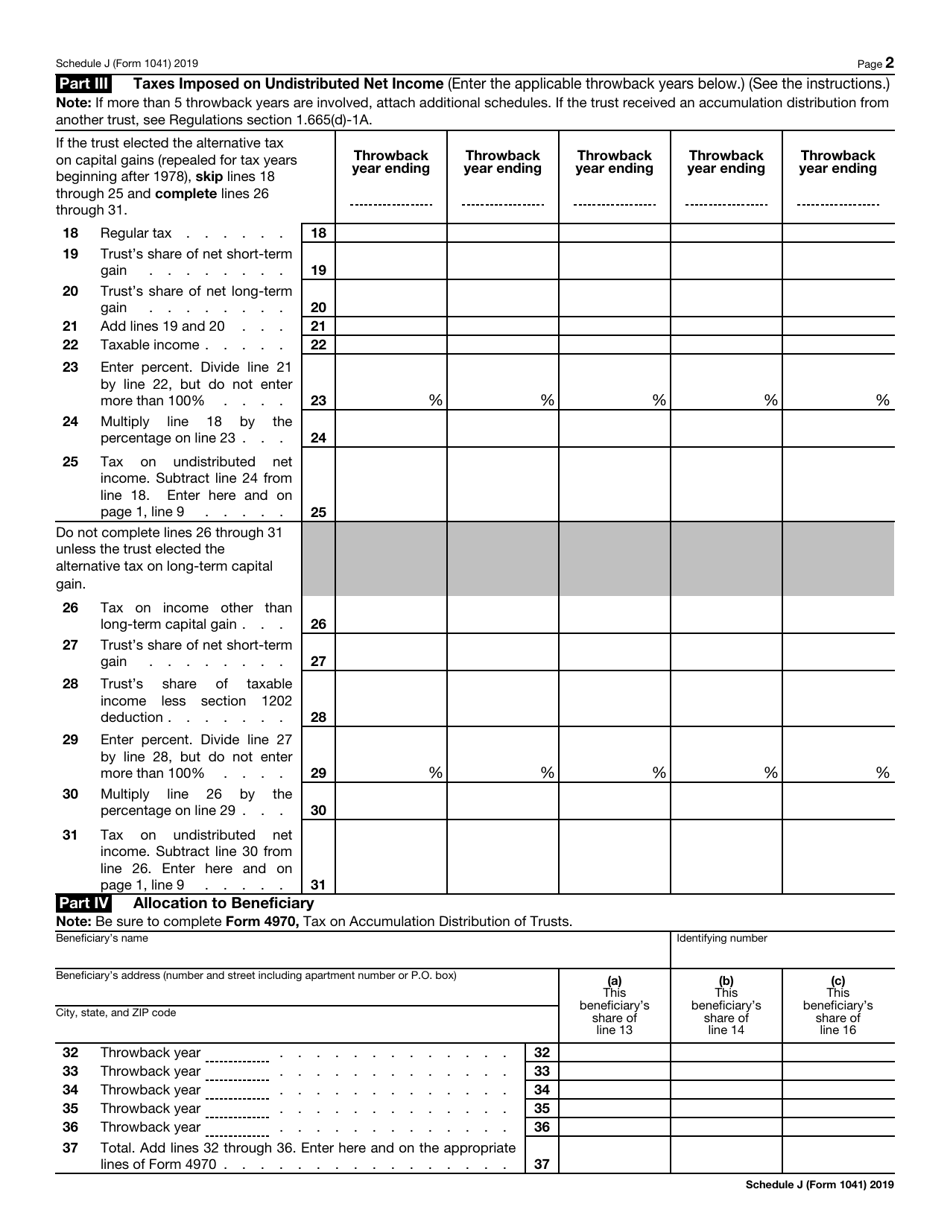

IRS Form 1041 Schedule J

for the current year.

IRS Form 1041 Schedule J Accumulation Distribution for Certain Complex Trusts

What Is IRS Form 1041 Schedule J?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1041, U.S. Income Tax Return for Estates and Trusts. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1041 Schedule J?

A: IRS Form 1041 Schedule J is a form used to report accumulation distribution for certain complex trusts.

Q: What is an accumulation distribution?

A: An accumulation distribution is the distribution of income that has been accumulated by a trust rather than distributed to beneficiaries.

Q: What are complex trusts?

A: Complex trusts are trusts that have certain characteristics or provisions that make them different from simple trusts.

Q: Who is required to file Form 1041 Schedule J?

A: Trusts that hold income and accumulated earnings beyond the current tax year and have complex tax situations are required to file Form 1041 Schedule J.

Q: What information is required to be reported on Form 1041 Schedule J?

A: Form 1041 Schedule J requires the reporting of the trust's income, deductions, and credits, as well as any accumulated income that is being distributed.

Q: When is the deadline to file Form 1041 Schedule J?

A: The deadline to file Form 1041 Schedule J is the same as the deadline for filing Form 1040, which is typically April 15th of the following year.

Q: Is there a penalty for not filing Form 1041 Schedule J?

A: Yes, there may be penalties for failing to file Form 1041 Schedule J or for filing it late. It is important to meet all tax filing requirements to avoid potential penalties or interest charges.

Q: Can I file Form 1041 Schedule J electronically?

A: Yes, Form 1041 Schedule J can be filed electronically using tax software or through a tax professional.

Q: Do I need to attach any additional documentation with Form 1041 Schedule J?

A: Yes, you may need to attach additional documentation, such as schedules detailing the trust's income and deductions, with Form 1041 Schedule J. The specific requirements will depend on the trust's circumstances.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1041 Schedule J through the link below or browse more documents in our library of IRS Forms.