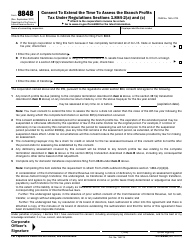

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8615

for the current year.

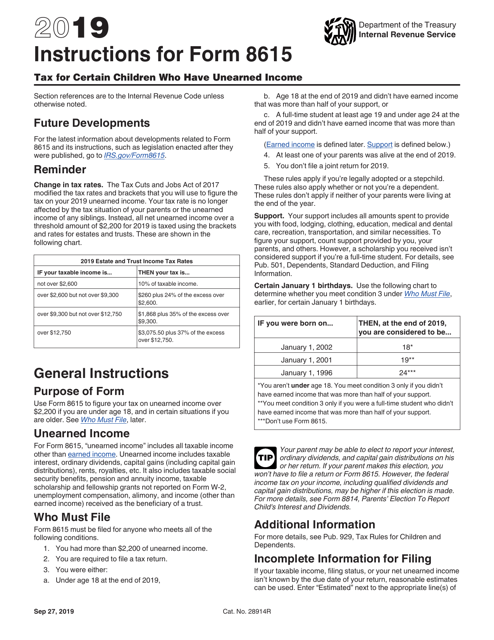

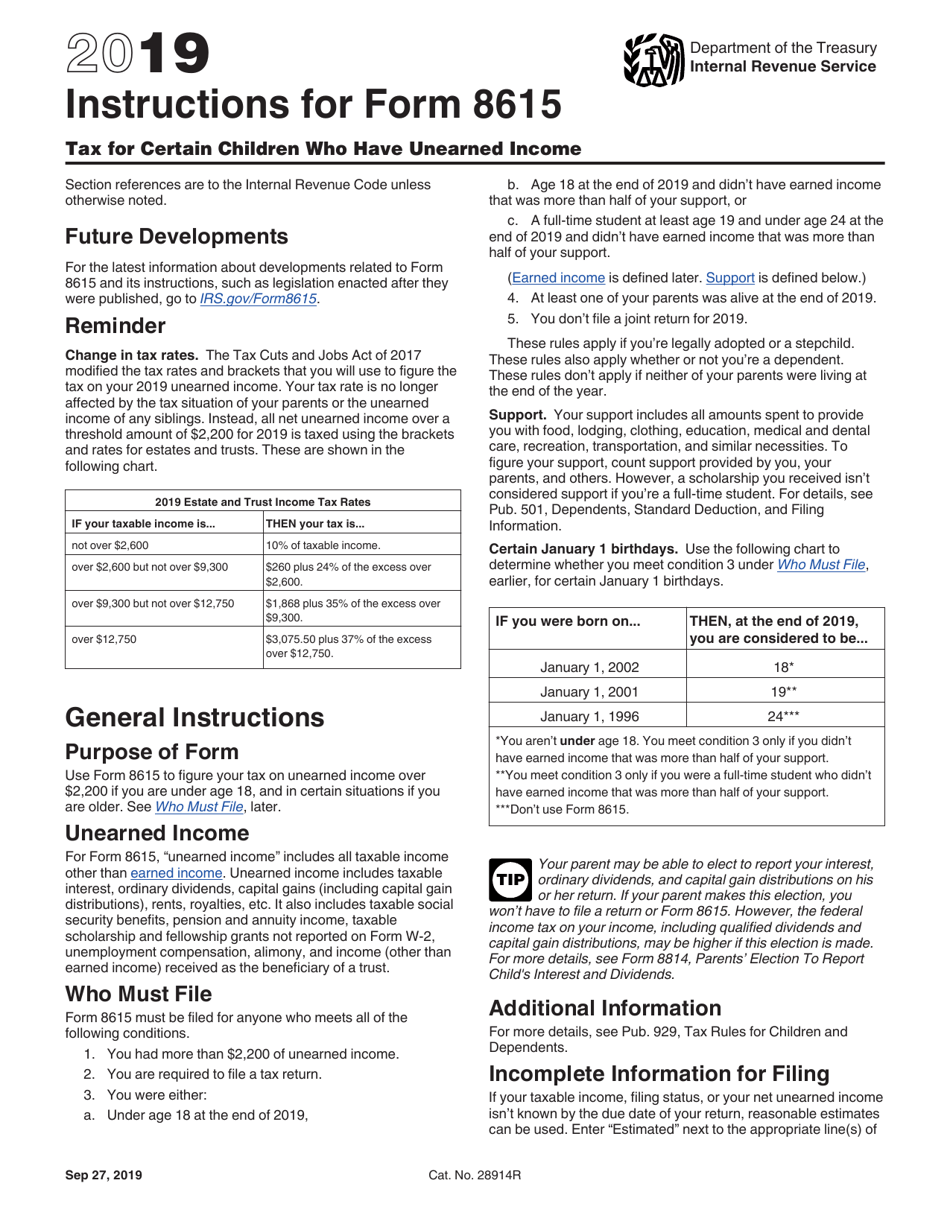

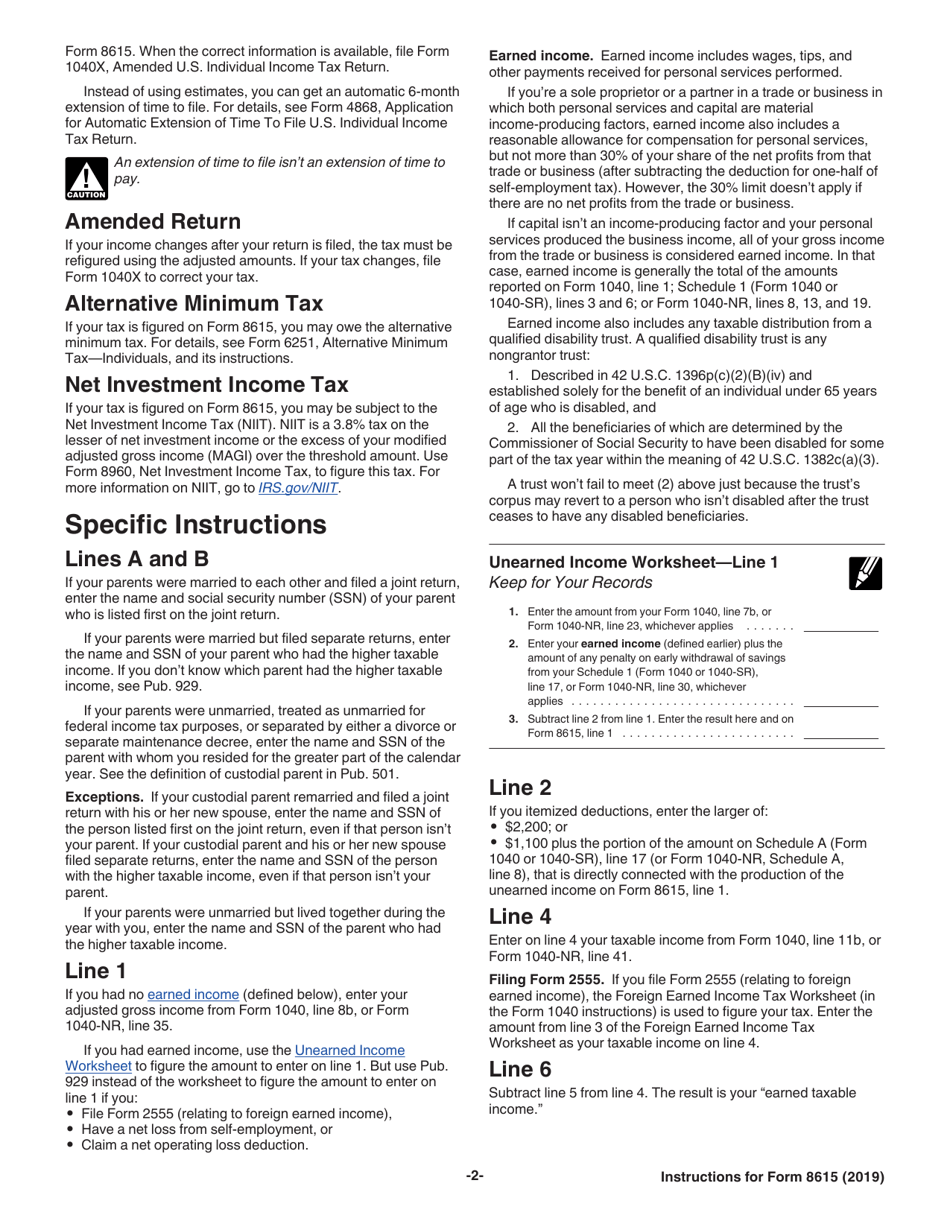

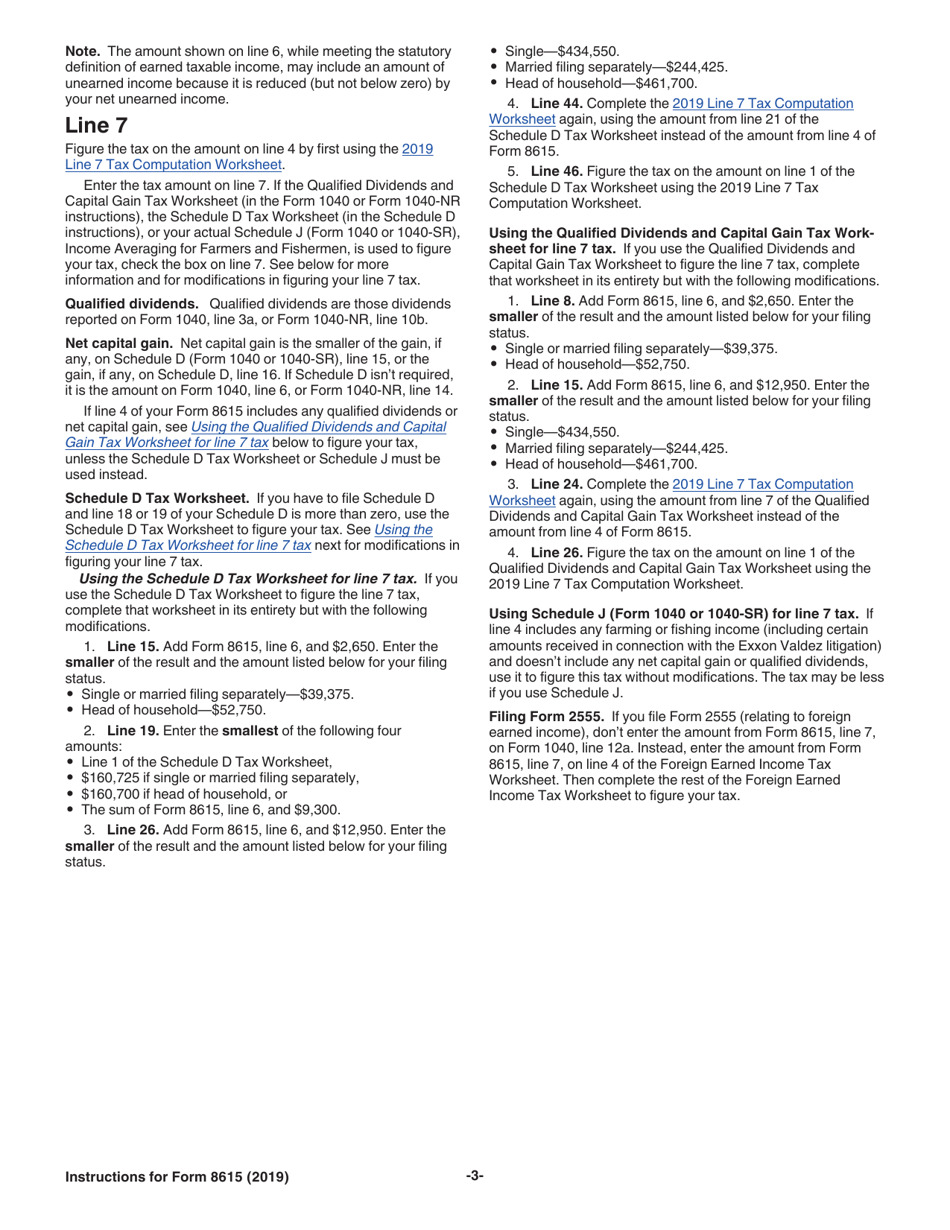

Instructions for IRS Form 8615 Tax for Certain Children Who Have Unearned Income

This document contains official instructions for IRS Form 8615 , Tax for Certain Children Who Have Unearned Income - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8615 is available for download through this link.

FAQ

Q: What is IRS Form 8615?

A: IRS Form 8615 is a tax form used to calculate the tax liability for children who have unearned income.

Q: Who is eligible to file IRS Form 8615?

A: Children who have unearned income and meet certain criteria specified by the IRS are eligible to file Form 8615.

Q: What is considered unearned income?

A: Unearned income includes investment income, such as dividends, interest, and capital gains, as well as other types of income like taxable social security benefits.

Q: What are the criteria for filing IRS Form 8615?

A: Children must meet age, income, and dependency requirements as set by the IRS to be eligible for filing Form 8615.

Q: How do I calculate the tax liability using IRS Form 8615?

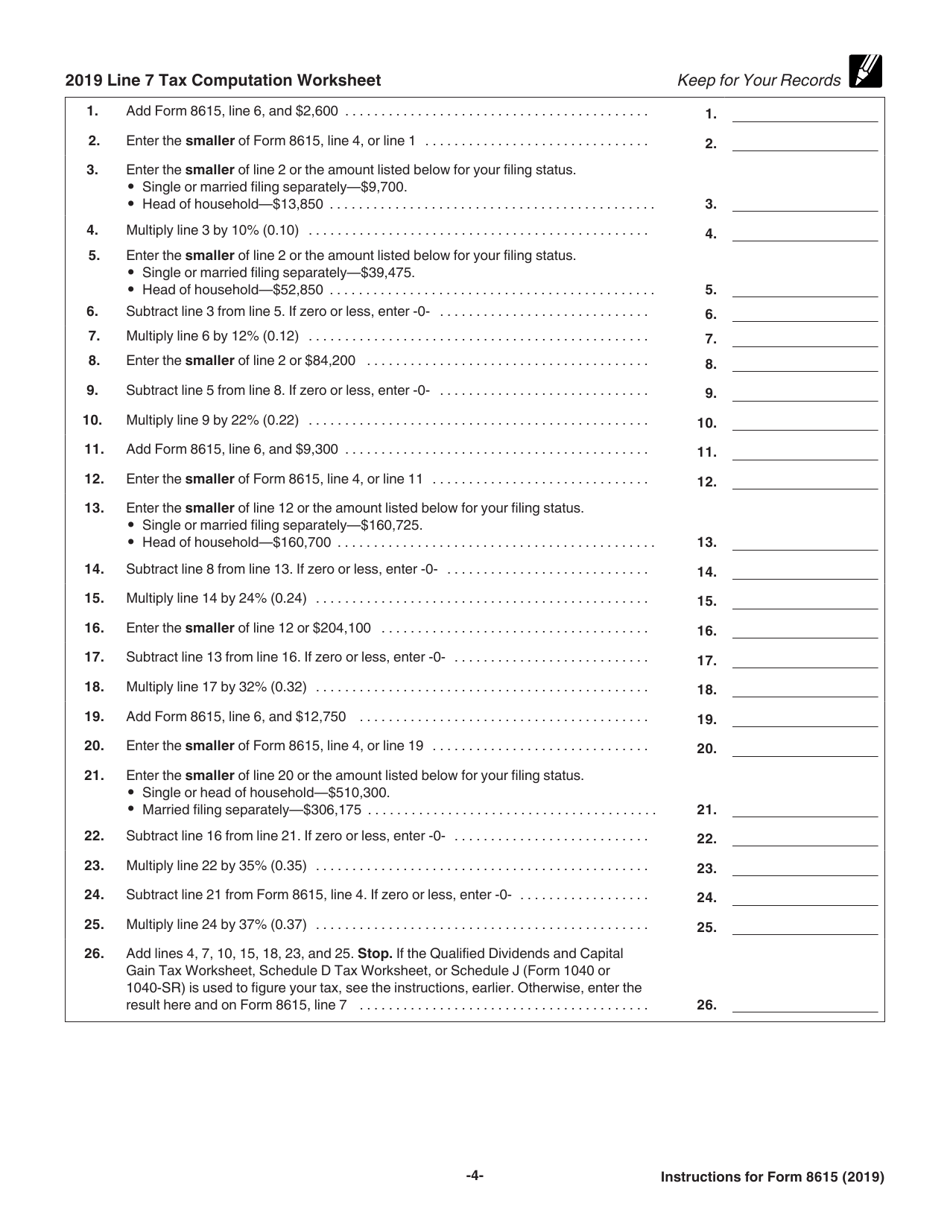

A: IRS Form 8615 provides a step-by-step calculation to determine the taxable amount of unearned income and the corresponding tax liability.

Q: Can I use IRS Form 8615 if my child only has earned income?

A: No, IRS Form 8615 is specifically for children who have unearned income. If your child only has earned income, other tax forms may be appropriate.

Q: When is the deadline for filing IRS Form 8615?

A: The deadline for filing IRS Form 8615 is usually the same as the regular tax filing deadline, which is April 15th of the following year.

Instruction Details:

- This 4-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.