This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 4797

for the current year.

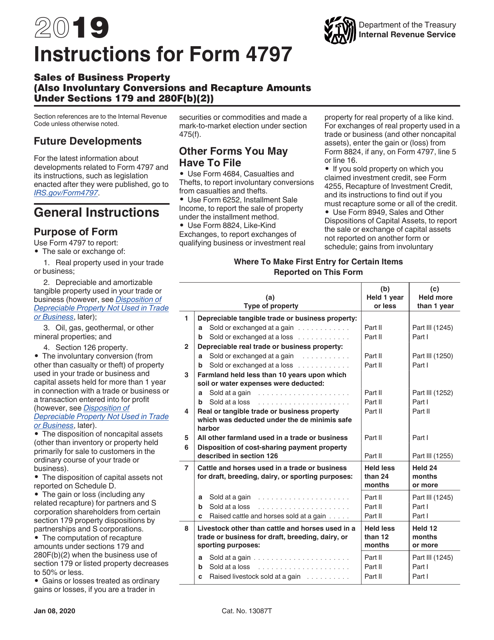

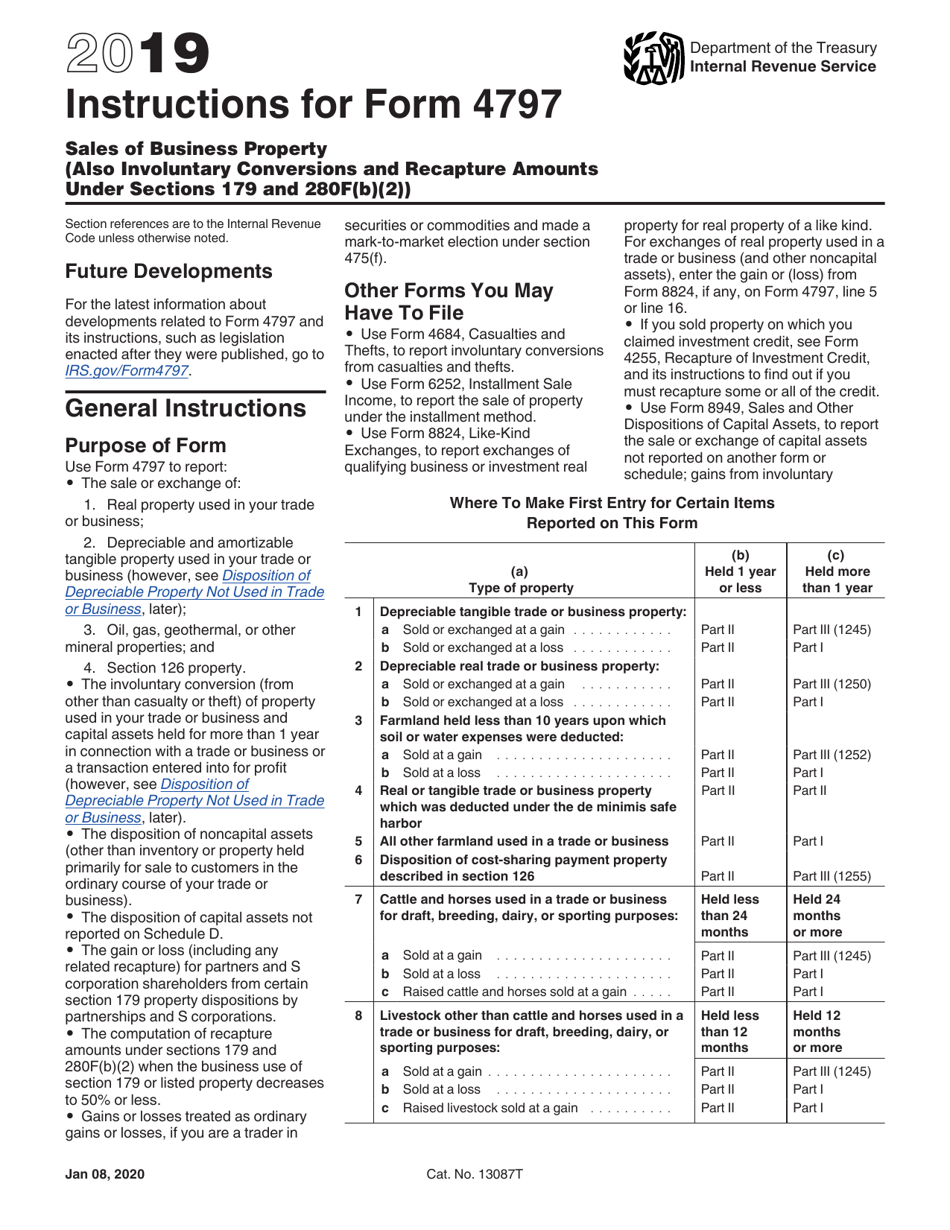

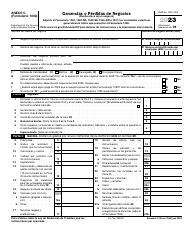

Instructions for IRS Form 4797 Sales of Business Property (Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280f(B)(2))

This document contains official instructions for IRS Form 4797 , Sales of Involuntary Conversions and Recapture Amounts Under Sections 179 and 280f(B)(2)) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 4797 is available for download through this link.

FAQ

Q: What is IRS Form 4797?

A: IRS Form 4797 is used to report the sales of business property.

Q: What other transactions does Form 4797 cover?

A: Form 4797 also covers involuntary conversions and recapture amounts under Sections 179 and 280F(b)(2).

Q: What is an involuntary conversion?

A: An involuntary conversion is when property is taken or destroyed without your consent, and you receive compensation for it.

Q: What is meant by recapture amounts?

A: Recapture amounts refer to the amount of depreciation that needs to be reported and recaptured as ordinary income.

Q: When should I file Form 4797?

A: You should file Form 4797 when you've had sales of business property or when you need to report an involuntary conversion or recapture amounts.

Instruction Details:

- This 12-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.