This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1120-IC-DISC

for the current year.

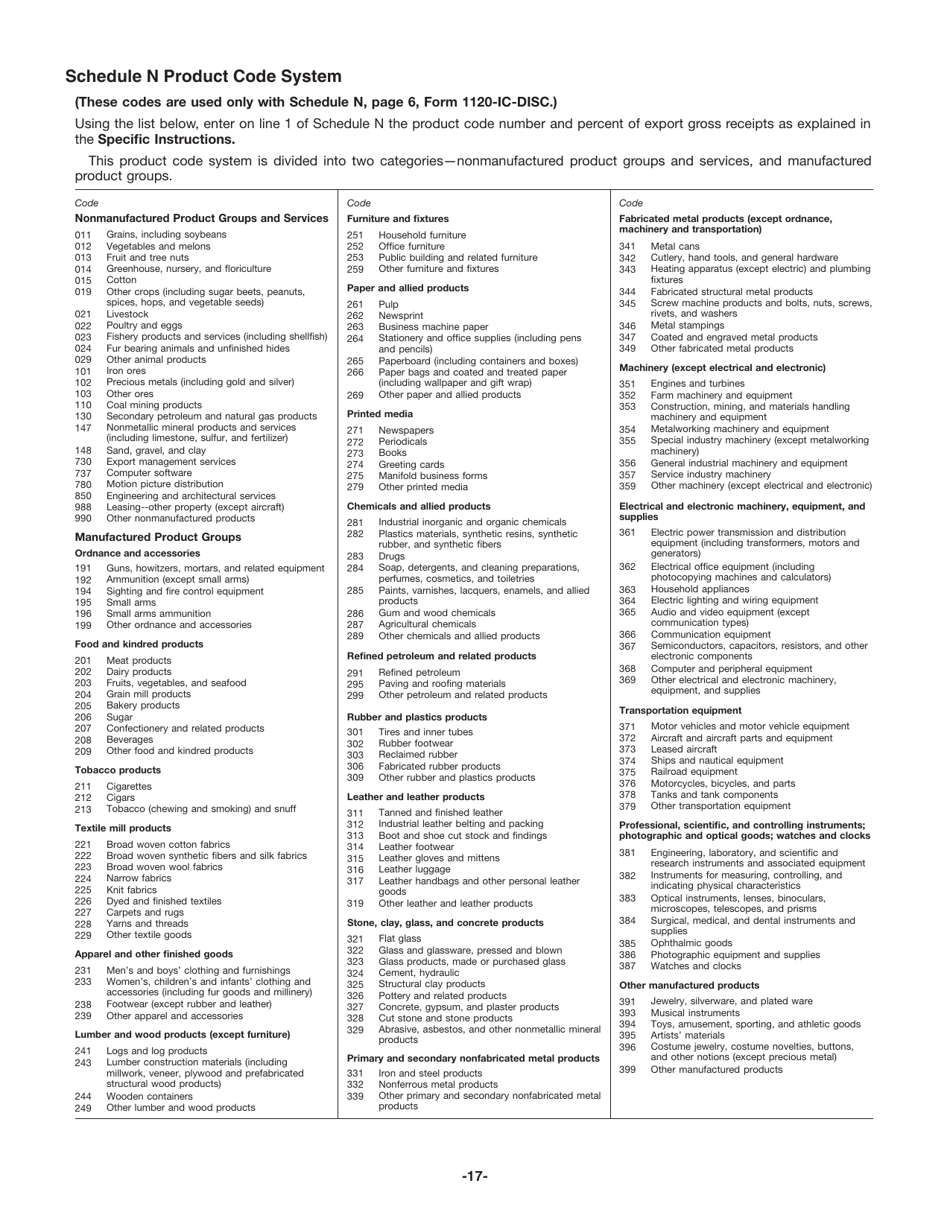

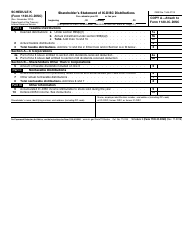

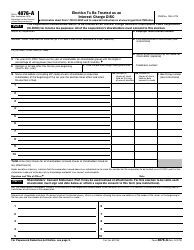

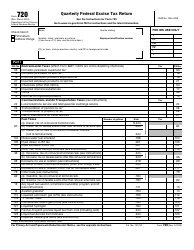

Instructions for IRS Form 1120-IC-DISC Interest Charge Domestic International Sales Corporation Return

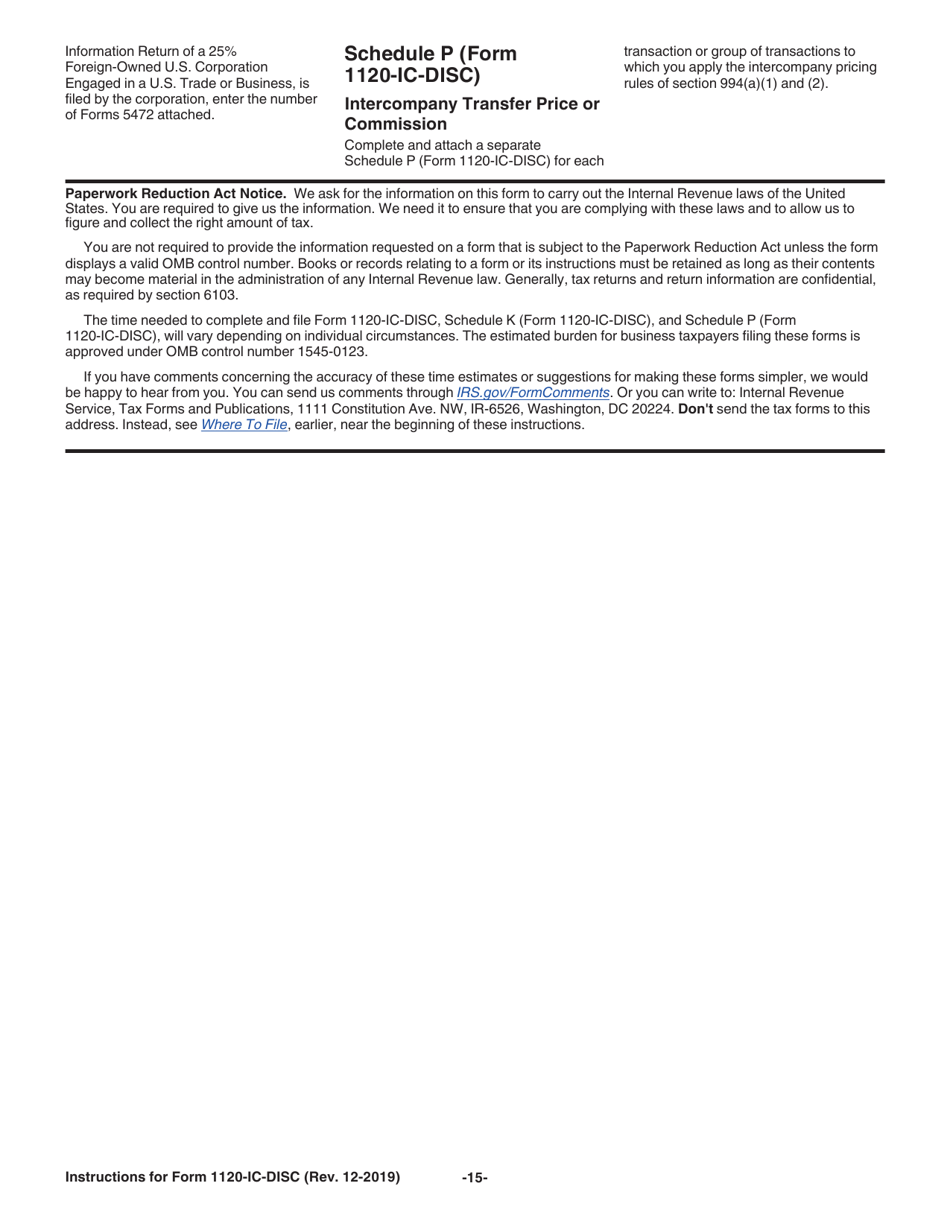

This document contains official instructions for IRS Form 1120-IC-DISC , Interest Charge Domestic International Sales Corporation Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120-IC-DISC Schedule P is available for download through this link.

FAQ

Q: What is IRS Form 1120-IC-DISC?

A: IRS Form 1120-IC-DISC is a tax form used by Interest Charge Domestic International Sales Corporations (IC-DISCs) to report their income and calculate the interest charge on certain deferred tax liabilities.

Q: Who needs to file IRS Form 1120-IC-DISC?

A: Any IC-DISC that had gross receipts from qualified exports during the tax year must file Form 1120-IC-DISC.

Q: What is an IC-DISC?

A: An Interest Charge Domestic International Sales Corporation (IC-DISC) is a domestic corporation that meets certain requirements and elects to be treated as an IC-DISC for federal income tax purposes.

Q: What are qualified exports?

A: Qualified exports refer to the sale, lease, rental, or license of qualifying export property to a foreign person for use outside the United States.

Q: What is the purpose of Form 1120-IC-DISC?

A: Form 1120-IC-DISC is used to report IC-DISC's income and calculate the interest charge on certain deferred tax liabilities related to the IC-DISC's export transactions.

Q: When is Form 1120-IC-DISC due?

A: Form 1120-IC-DISC is generally due on the 15th day of the 9th month after the end of the IC-DISC's tax year.

Q: Are there any penalties for not filing Form 1120-IC-DISC?

A: Yes, there are penalties for not filing Form 1120-IC-DISC or for filing it late. It is important to file the form accurately and on time to avoid penalties.

Instruction Details:

- This 17-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.