Instructions for IRS Form 1040, 1040-SR Schedule F Profit or Loss From Farming

This document contains official instructions for IRS Form 1040 Schedule F and IRS Form 1040-SR Schedule F . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040 (1040-SR) Schedule F is available for download through this link.

FAQ

Q: What is IRS Form 1040?

A: IRS Form 1040 is the standard individual tax return form used by U.S. taxpayers.

Q: What is IRS Form 1040-SR?

A: IRS Form 1040-SR is a simplified version of Form 1040 for taxpayers who are 65 or older.

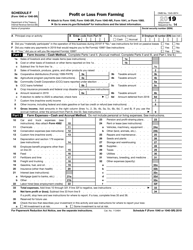

Q: What is Schedule F?

A: Schedule F is a tax form used to report profit or loss from farming activities.

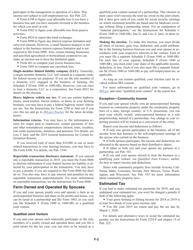

Q: Who should file Schedule F?

A: Farmers who have a profit or loss from their farming activities should file Schedule F.

Q: What types of farming activities are covered by Schedule F?

A: Schedule F covers a wide range of farming activities, including crops, livestock, and dairy farming.

Q: What information is required on Schedule F?

A: Schedule F requires information such as income from sales of agricultural products, deductible farm expenses, and depreciation of farm assets.

Q: Can I file Schedule F if I have a hobby farm?

A: No, Schedule F is only for taxpayers who engage in farming activities for profit, not for hobby farmers.

Q: Is Schedule F mandatory for all farmers?

A: Farmers who have a profit or loss from their farming activities are generally required to file Schedule F, but there may be exceptions.

Instruction Details:

- This 12-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.