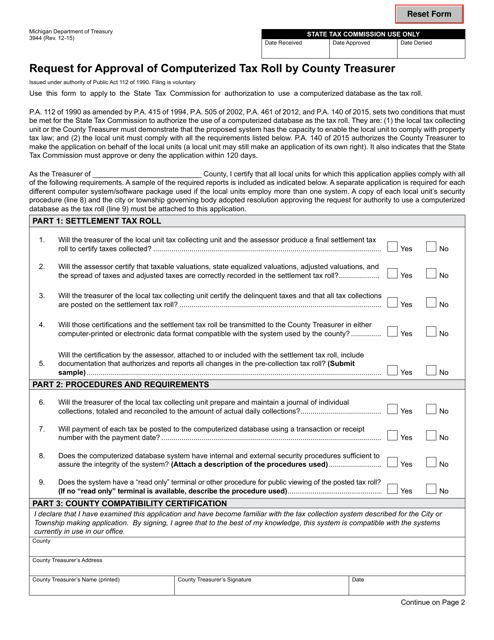

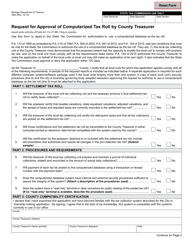

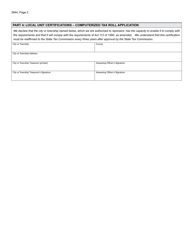

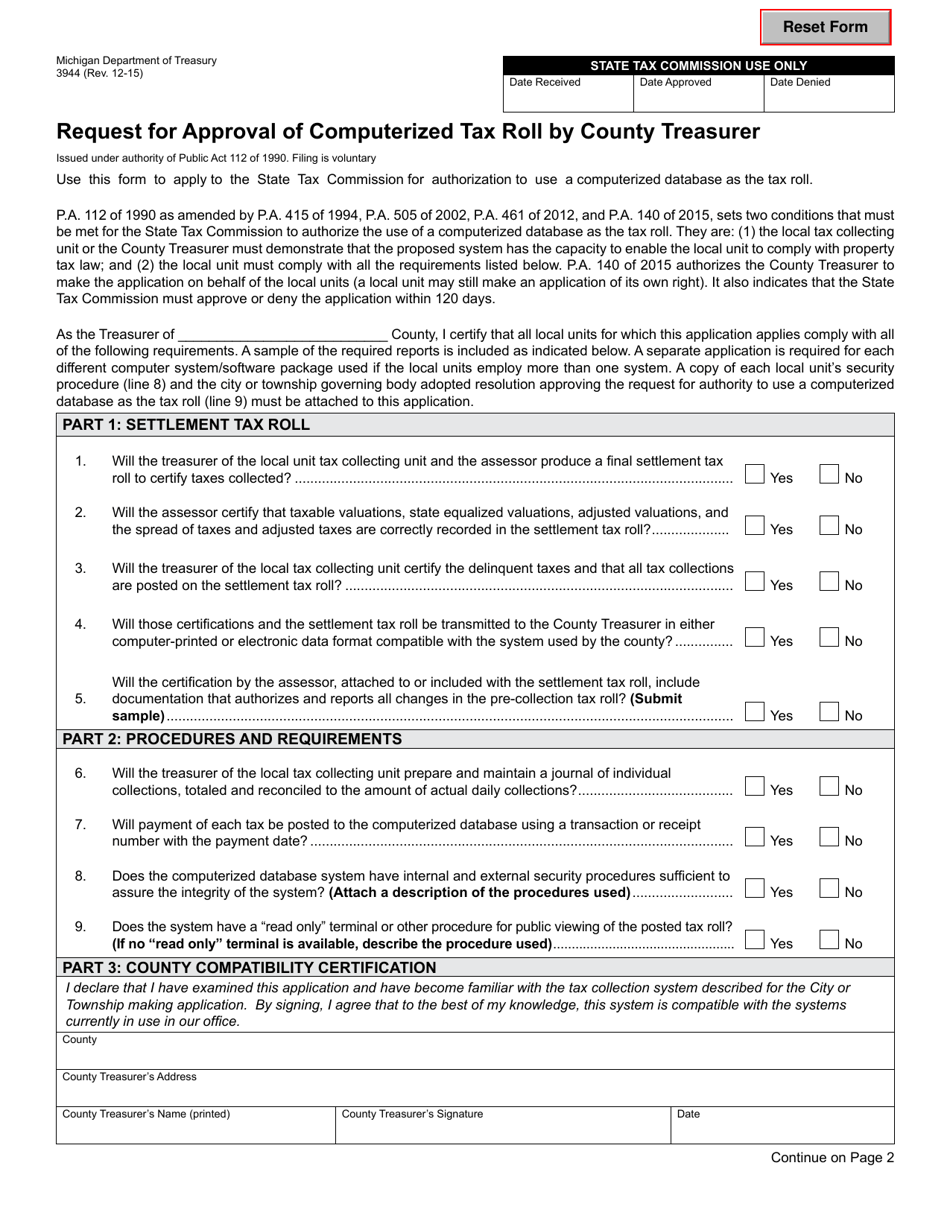

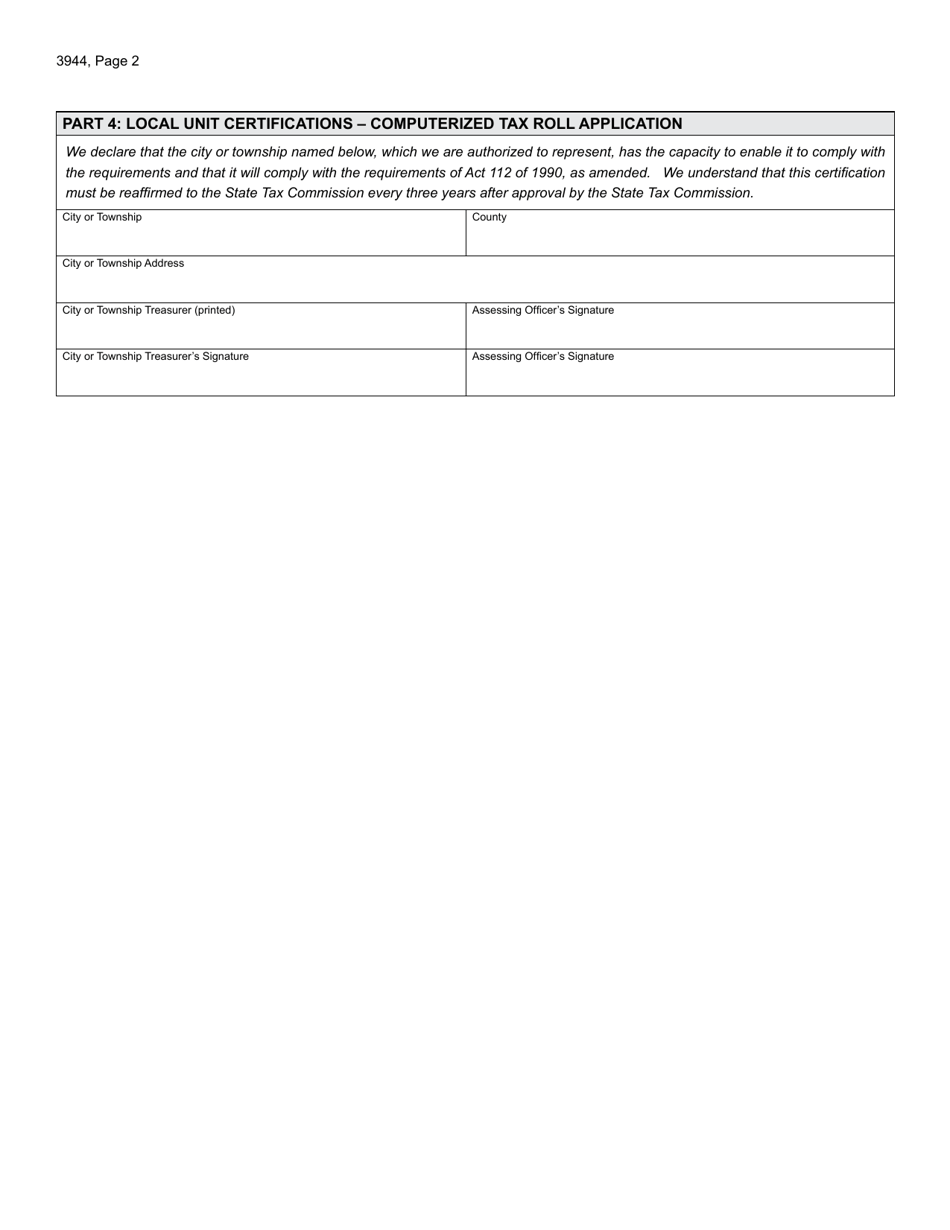

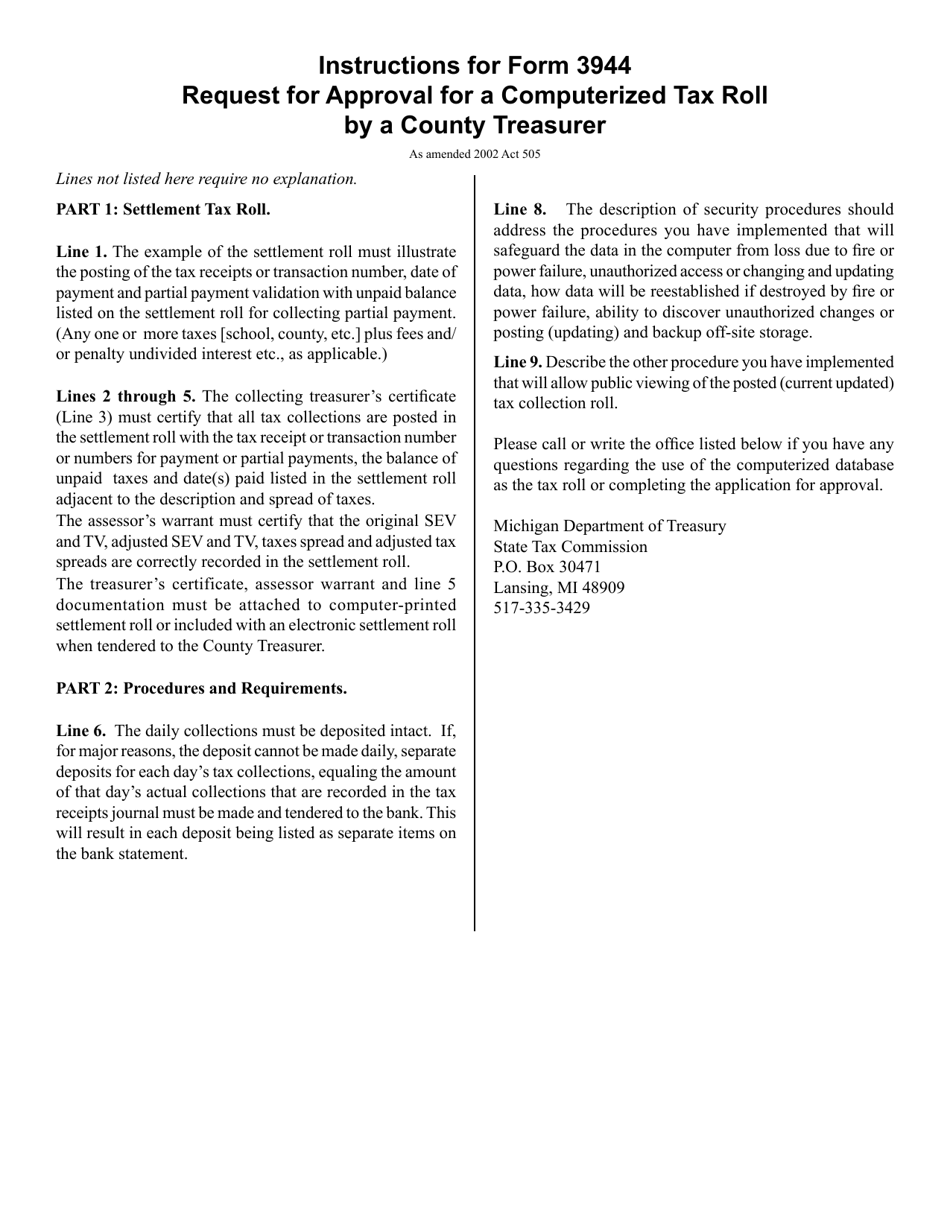

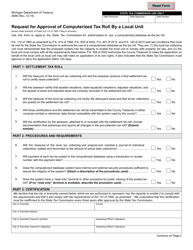

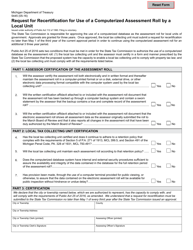

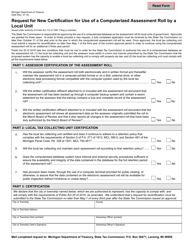

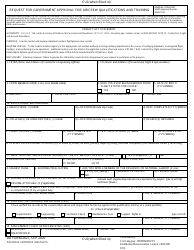

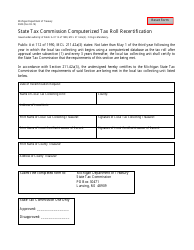

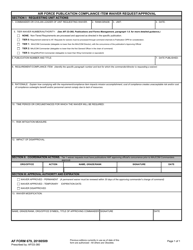

Form 3944 Request for Approval of Computerized Tax Roll by County Treasurer - Michigan

What Is Form 3944?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. Check the official instructions before completing and submitting the form.

FAQ

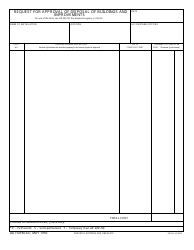

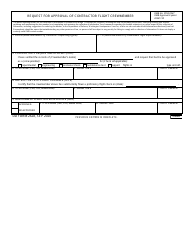

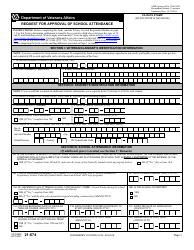

Q: What is Form 3944?

A: Form 3944 is a request for approval of a computerized tax roll by the county treasurer in Michigan.

Q: Who needs to fill out Form 3944?

A: County treasurers in Michigan need to fill out Form 3944.

Q: What is the purpose of Form 3944?

A: The purpose of Form 3944 is to request approval of a computerized tax roll by the county treasurer in Michigan.

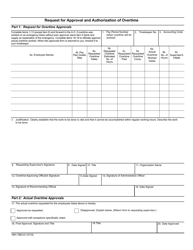

Q: Is there a fee associated with filing Form 3944?

A: No, there is no fee associated with filing Form 3944.

Q: Are there any specific requirements for completing Form 3944?

A: Yes, there are specific requirements for completing Form 3944, such as providing accurate and detailed information about the computerized tax roll.

Q: What is the deadline for filing Form 3944?

A: The deadline for filing Form 3944 may vary, so it is important to check with the county treasurer for the specific deadline.

Q: What happens after submitting Form 3944?

A: After submitting Form 3944, the county treasurer will review the request and approve or deny it based on the provided information.

Q: Can I make changes to the computerized tax roll after it has been approved?

A: Yes, changes can be made to the computerized tax roll after it has been approved, but they may require additional approval.

Q: What should I do if my Form 3944 is denied?

A: If your Form 3944 is denied, you should contact the county treasurer to understand the reason for the denial and to address any issues.

Form Details:

- Released on December 1, 2015;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3944 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.