This version of the form is not currently in use and is provided for reference only. Download this version of

Form WPF GARN01.0200

for the current year.

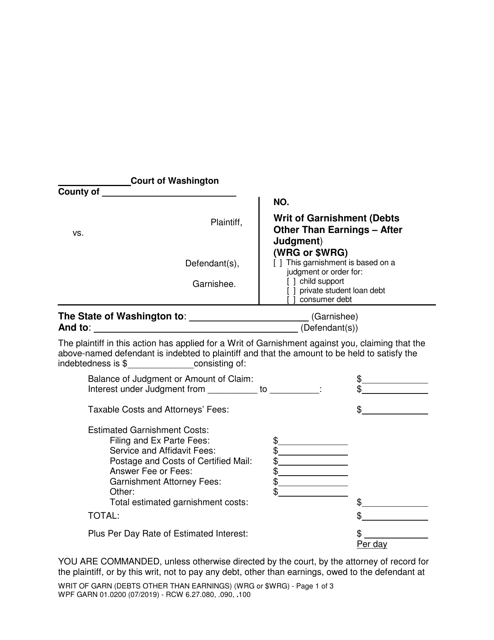

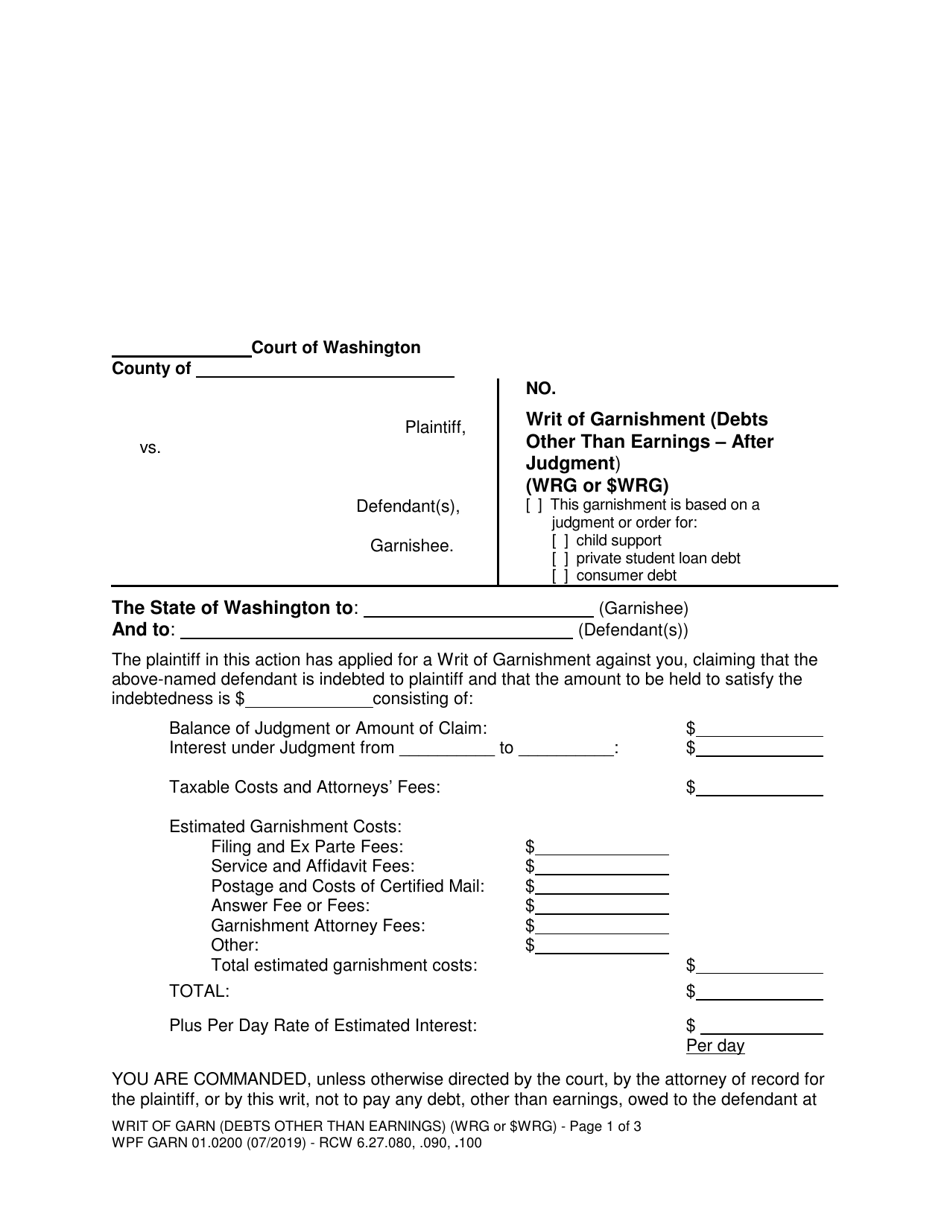

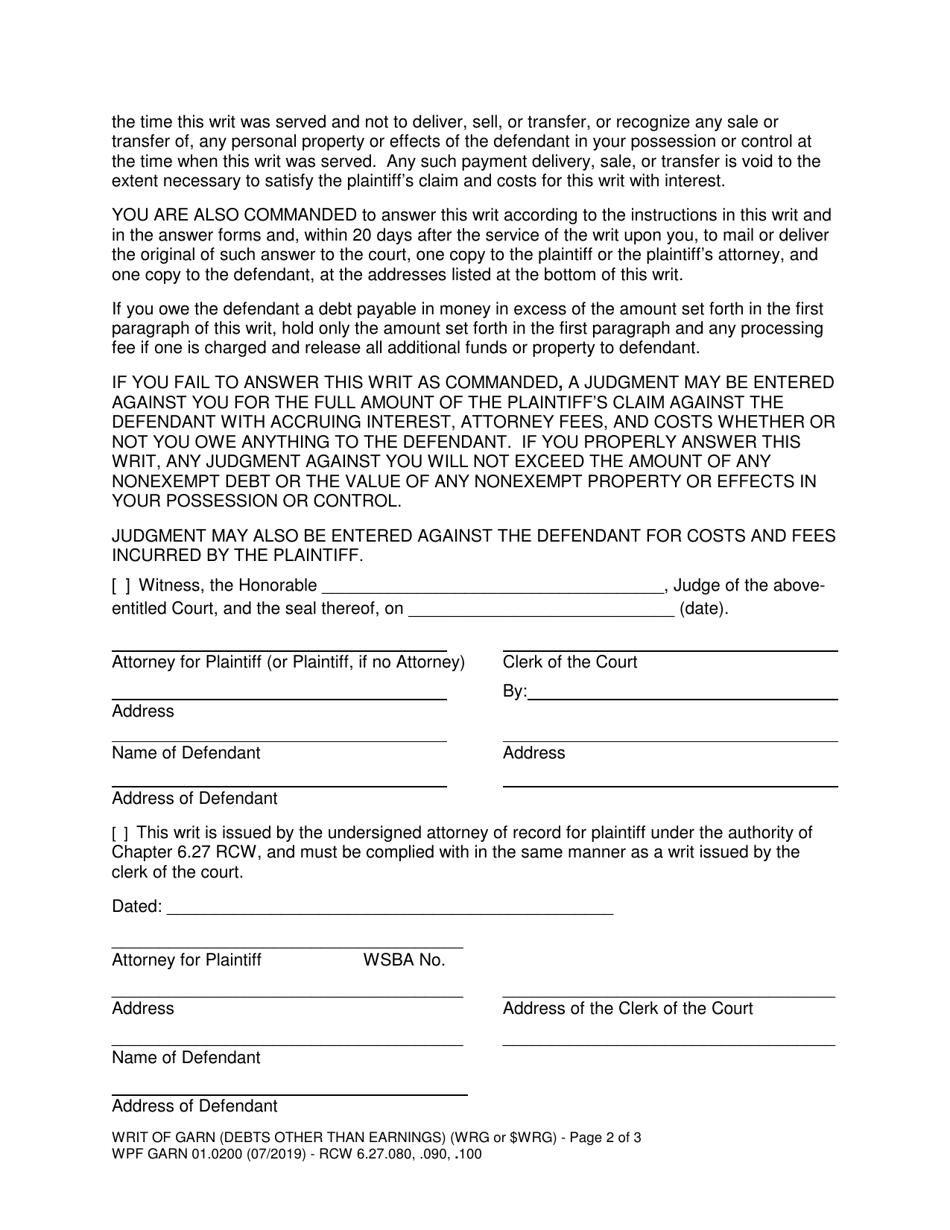

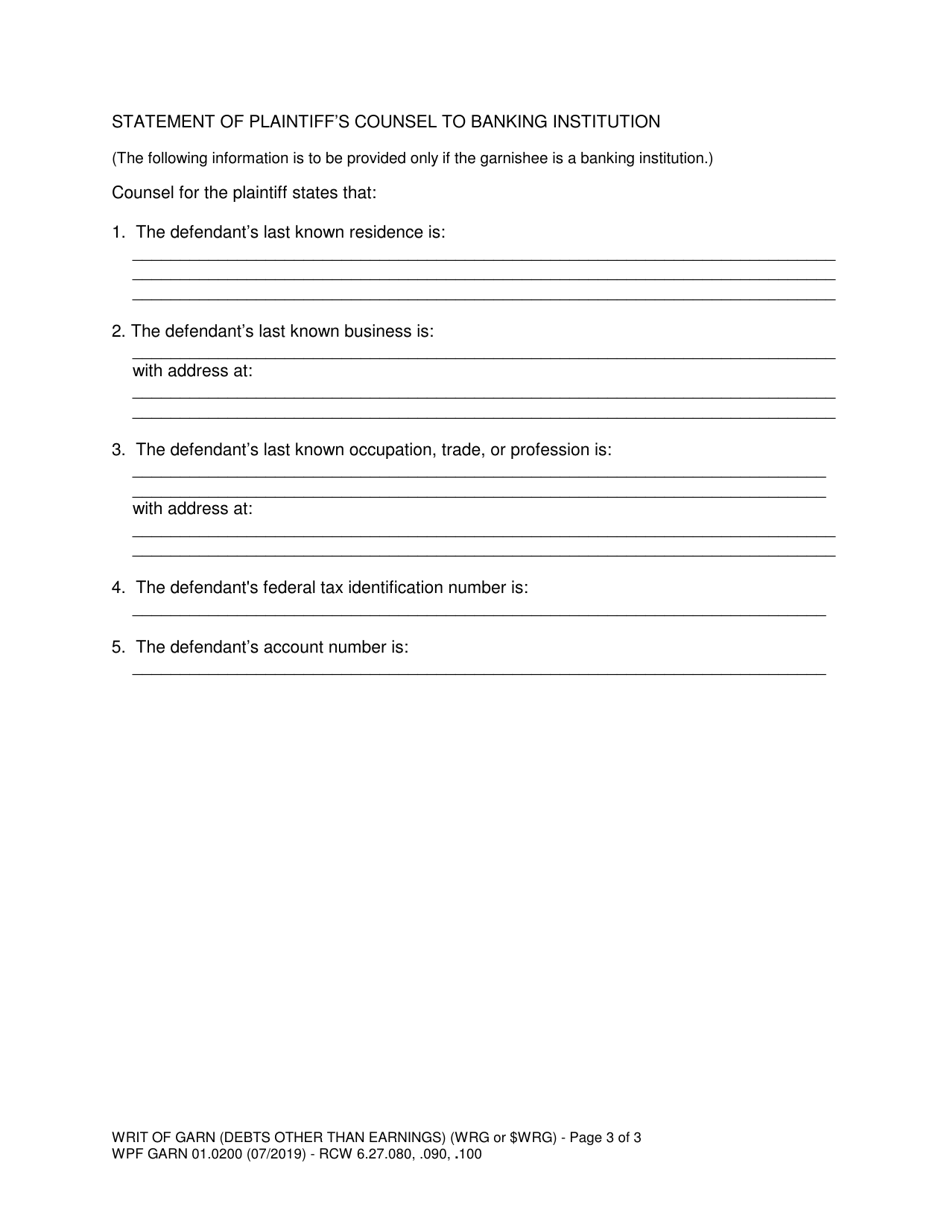

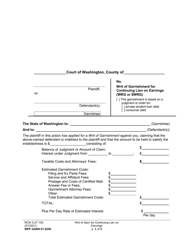

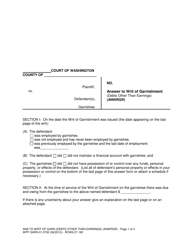

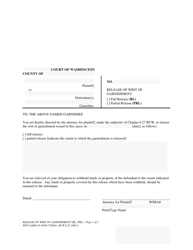

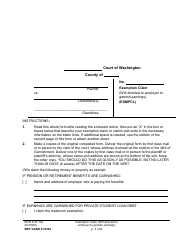

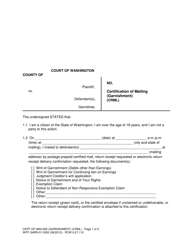

Form WPF GARN01.0200 Writ of Garnishment (Debts Other Than Earnings - After Judgment) - Washington

What Is Form WPF GARN01.0200?

This is a legal form that was released by the Washington State Courts - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WPF GARN01.0200?

A: Form WPF GARN01.0200 is a Writ of Garnishment (Debts Other Than Earnings - After Judgment) form used in Washington.

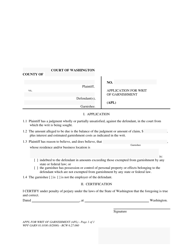

Q: When is Form WPF GARN01.0200 used?

A: Form WPF GARN01.0200 is used to request a garnishment of non-earnings debts after a judgment has been obtained.

Q: What is a Writ of Garnishment?

A: A Writ of Garnishment is a legal order that allows a creditor to collect money owed by a debtor directly from a third party, such as a bank or employer.

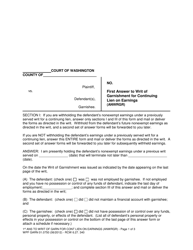

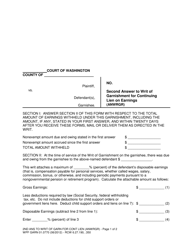

Q: What are non-earnings debts?

A: Non-earnings debts are debts owed by a judgment debtor that are not related to their earnings, such as bank accounts or property.

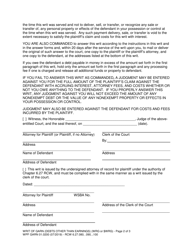

Q: What happens after I file Form WPF GARN01.0200?

A: After you file Form WPF GARN01.0200, the court will issue a Writ of Garnishment, which will be served on the third party holding the debtor's assets.

Q: How long does a garnishment last?

A: A garnishment can last until the debt is paid in full or until the court orders it to be terminated.

Q: Can the debtor stop a garnishment?

A: The debtor may be able to stop a garnishment by paying the debt in full or by negotiating a settlement with the creditor.

Q: What if I have more questions about Form WPF GARN01.0200?

A: If you have more questions about Form WPF GARN01.0200 or the garnishment process, you should consult with an attorney or seek legal advice.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Washington State Courts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WPF GARN01.0200 by clicking the link below or browse more documents and templates provided by the Washington State Courts.