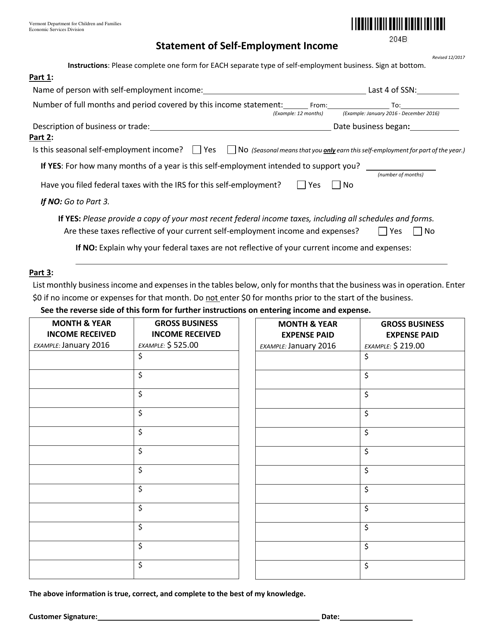

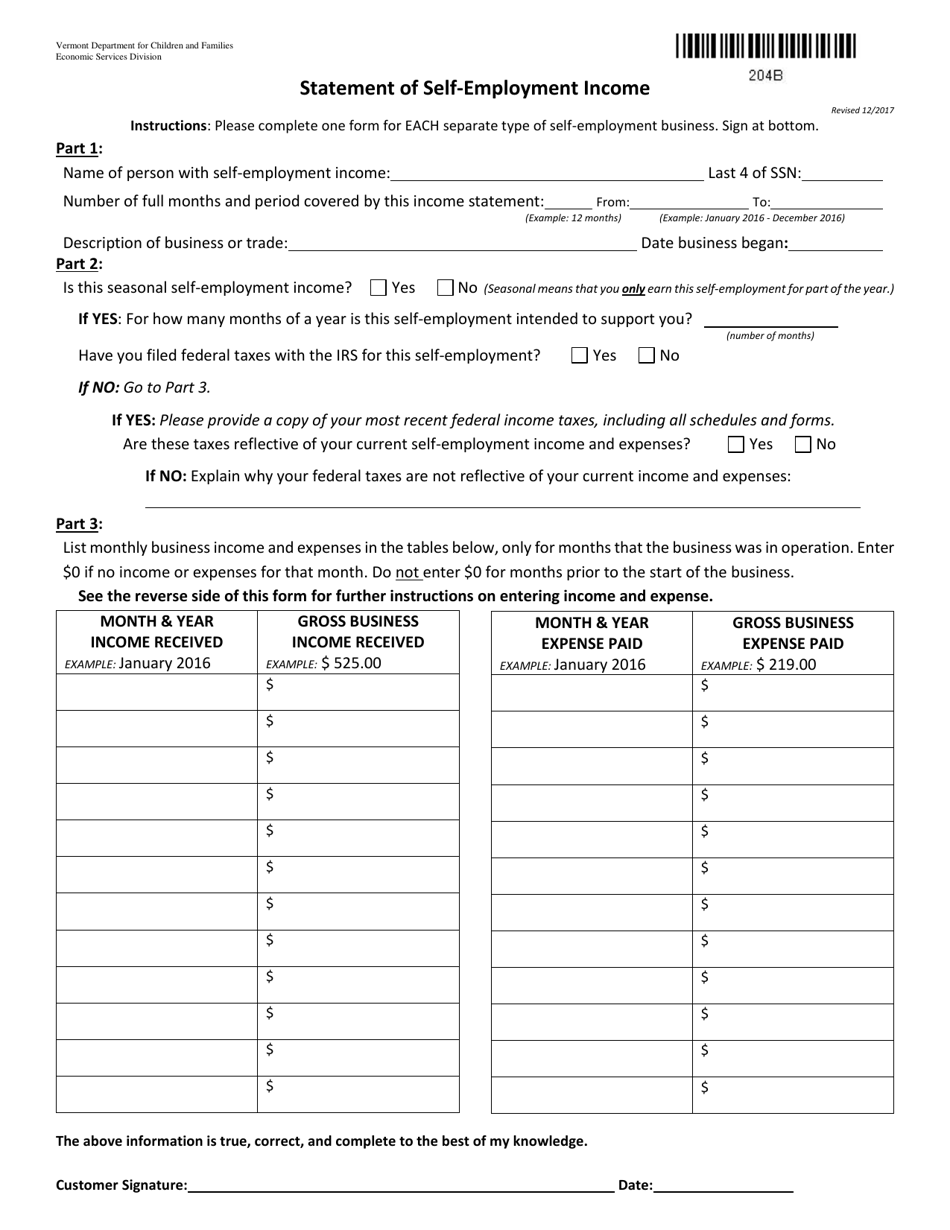

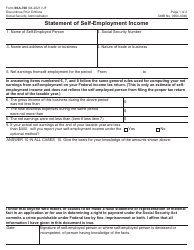

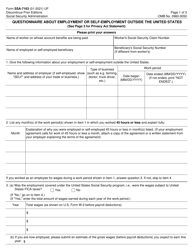

Form 204B Statement of Self-employment Income - Vermont

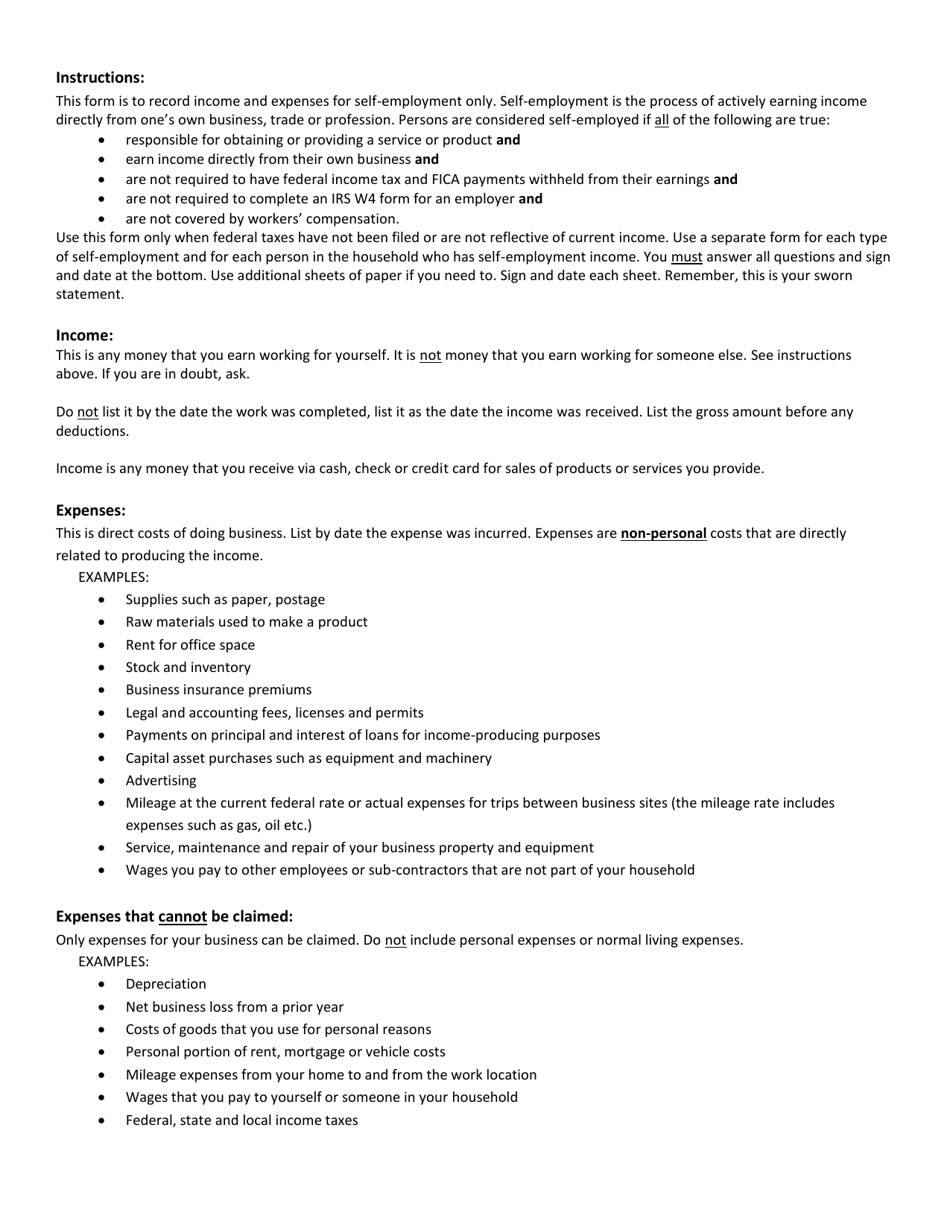

What Is Form 204B?

This is a legal form that was released by the Vermont Department of Children and Families - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 204B?

A: Form 204B is the Statement of Self-employment Income specifically for Vermont.

Q: Who needs to fill out Form 204B?

A: Individuals who are self-employed in Vermont need to fill out Form 204B.

Q: What is the purpose of Form 204B?

A: Form 204B is used to report self-employment income earned in Vermont.

Q: Are there any income limits for filling out Form 204B?

A: No, there are no specific income limits for filling out Form 204B.

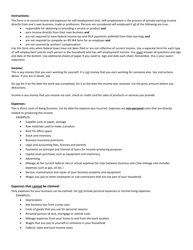

Q: What documents do I need to fill out Form 204B?

A: You will need your records of self-employment income earned in Vermont.

Q: When is the deadline to file Form 204B?

A: The deadline to file Form 204B is the same as the deadline for filing your Vermont state income tax return.

Q: Are there any penalties for not filing Form 204B?

A: Yes, there may be penalties for not filing Form 204B or for underreporting your self-employment income.

Q: Can I get an extension to file Form 204B?

A: Yes, you can request an extension to file Form 204B, but you must still pay any taxes owed by the original deadline.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Vermont Department of Children and Families;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 204B by clicking the link below or browse more documents and templates provided by the Vermont Department of Children and Families.