This version of the form is not currently in use and is provided for reference only. Download this version of

Form 50-151

for the current year.

Form 50-151 Mine and Quarry Rendition of Taxable Property - Texas

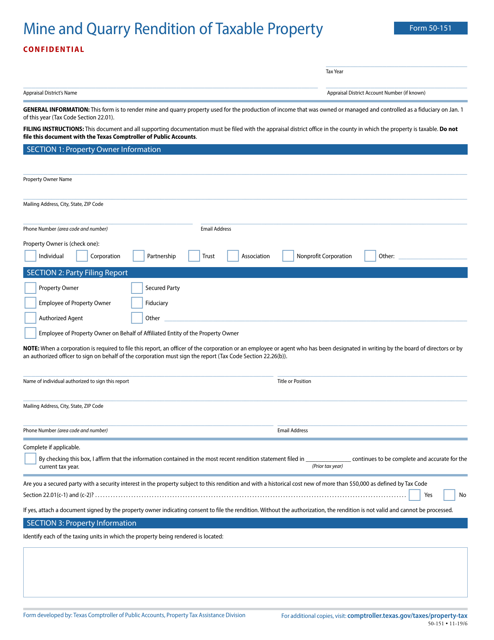

What Is Form 50-151?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-151?

A: Form 50-151 is the Mine and Quarry Rendition of Taxable Property form in Texas.

Q: Who needs to file Form 50-151?

A: Owners or operators of mines or quarries in Texas need to file Form 50-151.

Q: What is the purpose of Form 50-151?

A: Form 50-151 is used to report taxable property information for mines and quarries in Texas.

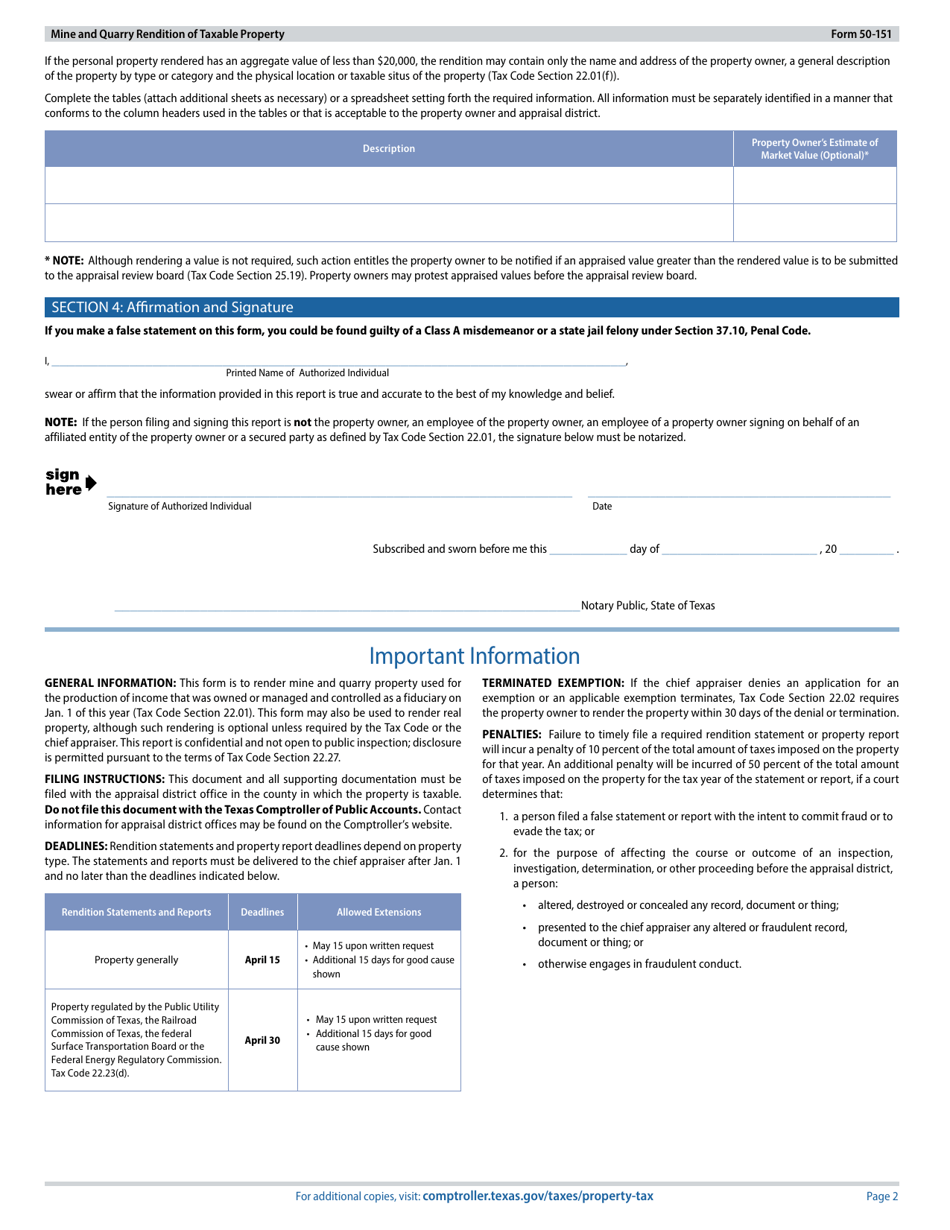

Q: When is Form 50-151 due?

A: Form 50-151 is due on April 15th each year.

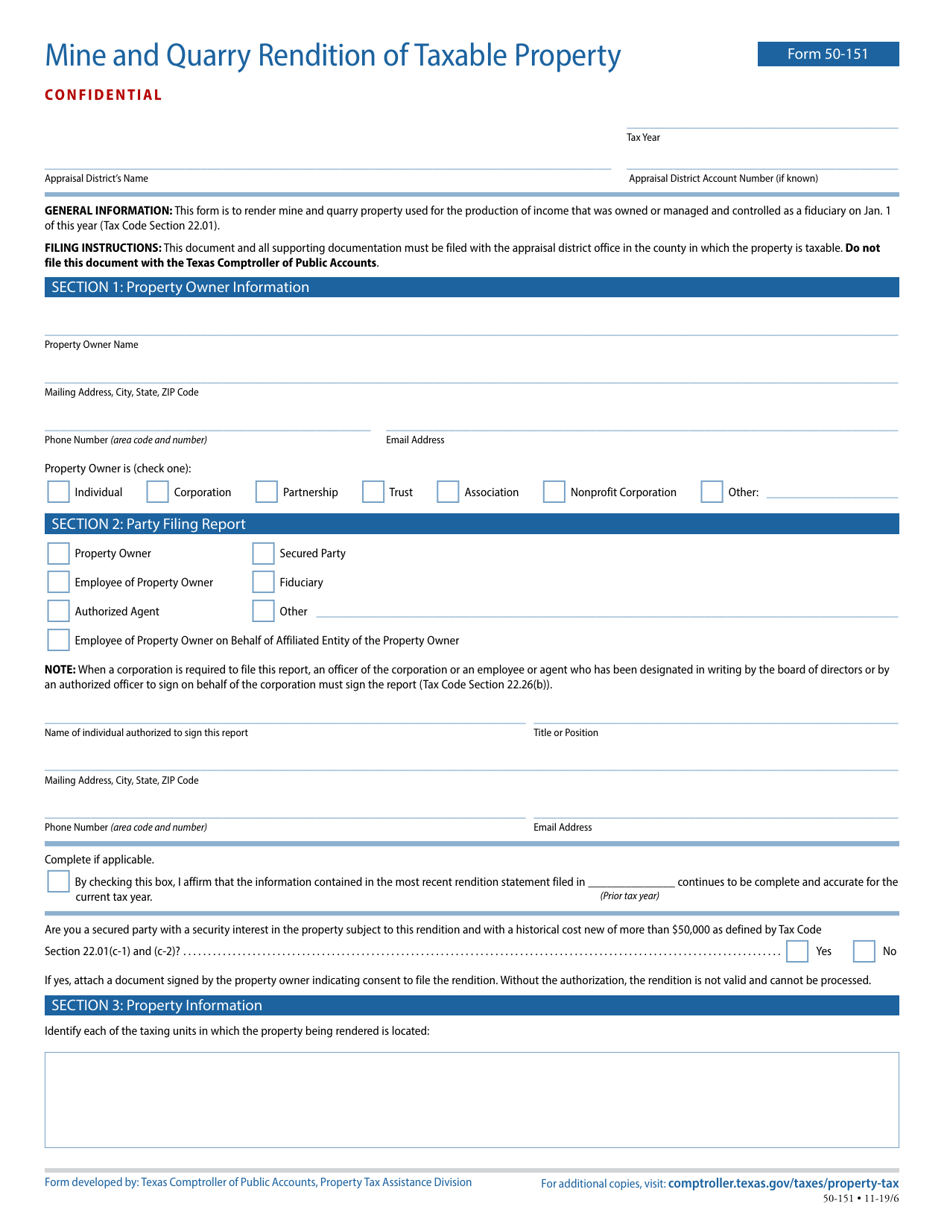

Q: What information is required on Form 50-151?

A: Form 50-151 requires information such as property description, production information, and the value of the property.

Q: Are there any penalties for not filing Form 50-151?

A: Yes, there are penalties for not filing Form 50-151, including late filing penalties and interest charges.

Q: Is Form 50-151 only for mines and quarries?

A: Yes, Form 50-151 is specifically for mines and quarries in Texas.

Q: What other forms may be required for property tax reporting in Texas?

A: Other forms that may be required for property tax reporting in Texas include Form 50-144 for property rendition and Form 50-114 for business personal property rendition.

Form Details:

- Released on November 6, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-151 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.