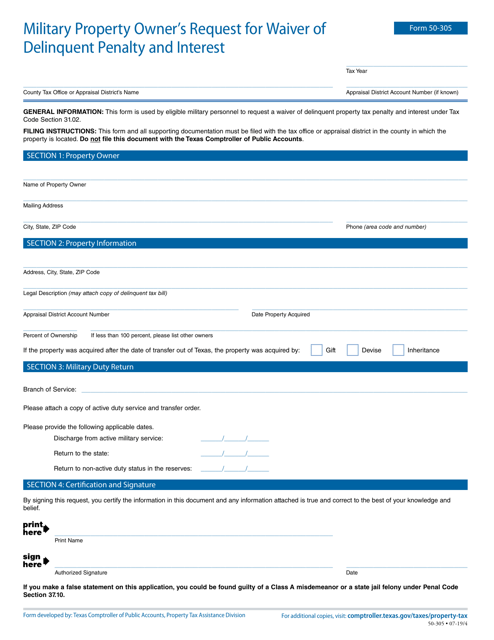

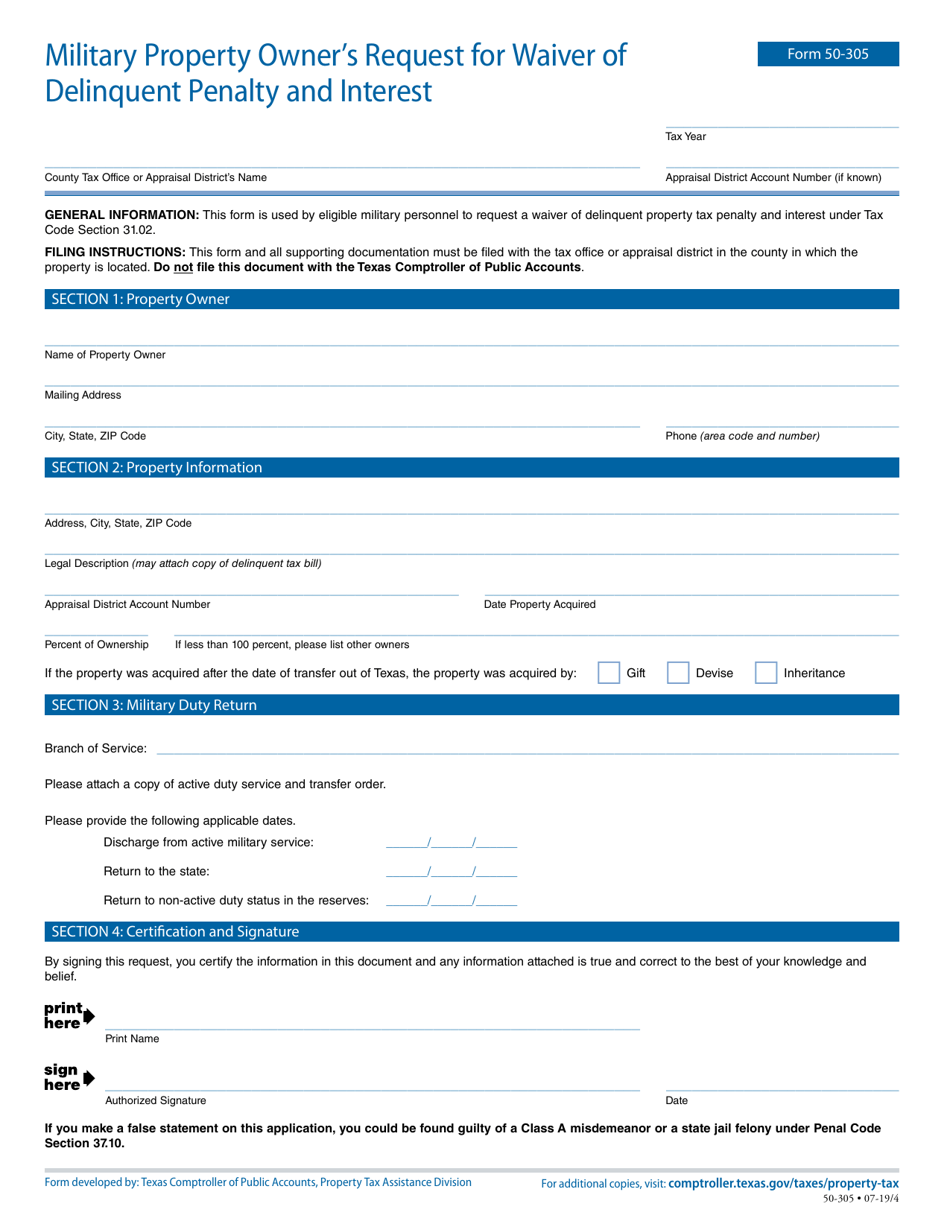

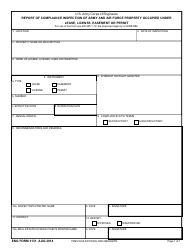

Form 50-305 Military Property Owner's Request for Waiver of Delinquent Penalty and Interest - Texas

What Is Form 50-305?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-305?

A: Form 50-305 is a document used in Texas for military property owners to request a waiver of delinquent penalty and interest.

Q: Who can use Form 50-305?

A: This form is specifically for military property owners in Texas who are seeking a waiver of delinquent penalty and interest.

Q: What is the purpose of Form 50-305?

A: The purpose of Form 50-305 is to allow military property owners in Texas to request a waiver of delinquent penalty and interest on their property taxes.

Q: What should I do if I am a military property owner in Texas and want to request a waiver of delinquent penalty and interest?

A: If you are a military property owner in Texas and want to request a waiver of delinquent penalty and interest, you should fill out Form 50-305 and submit it to the appropriate tax office.

Q: What happens after I submit Form 50-305?

A: After you submit Form 50-305, the tax office will review your request and determine whether to approve or deny the waiver of delinquent penalty and interest.

Q: Is there a deadline for submitting Form 50-305?

A: Yes, there is a deadline for submitting Form 50-305. You should submit the form within two years from the delinquency date of the taxes.

Q: Are there any fees associated with submitting Form 50-305?

A: No, there are no fees associated with submitting Form 50-305.

Form Details:

- Released on July 4, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-305 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.