This version of the form is not currently in use and is provided for reference only. Download this version of

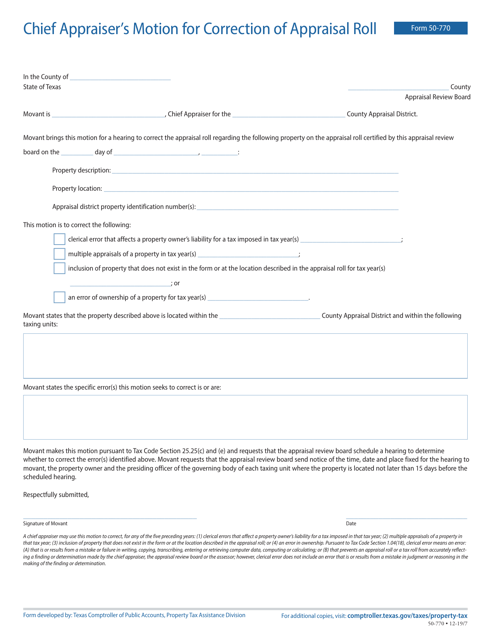

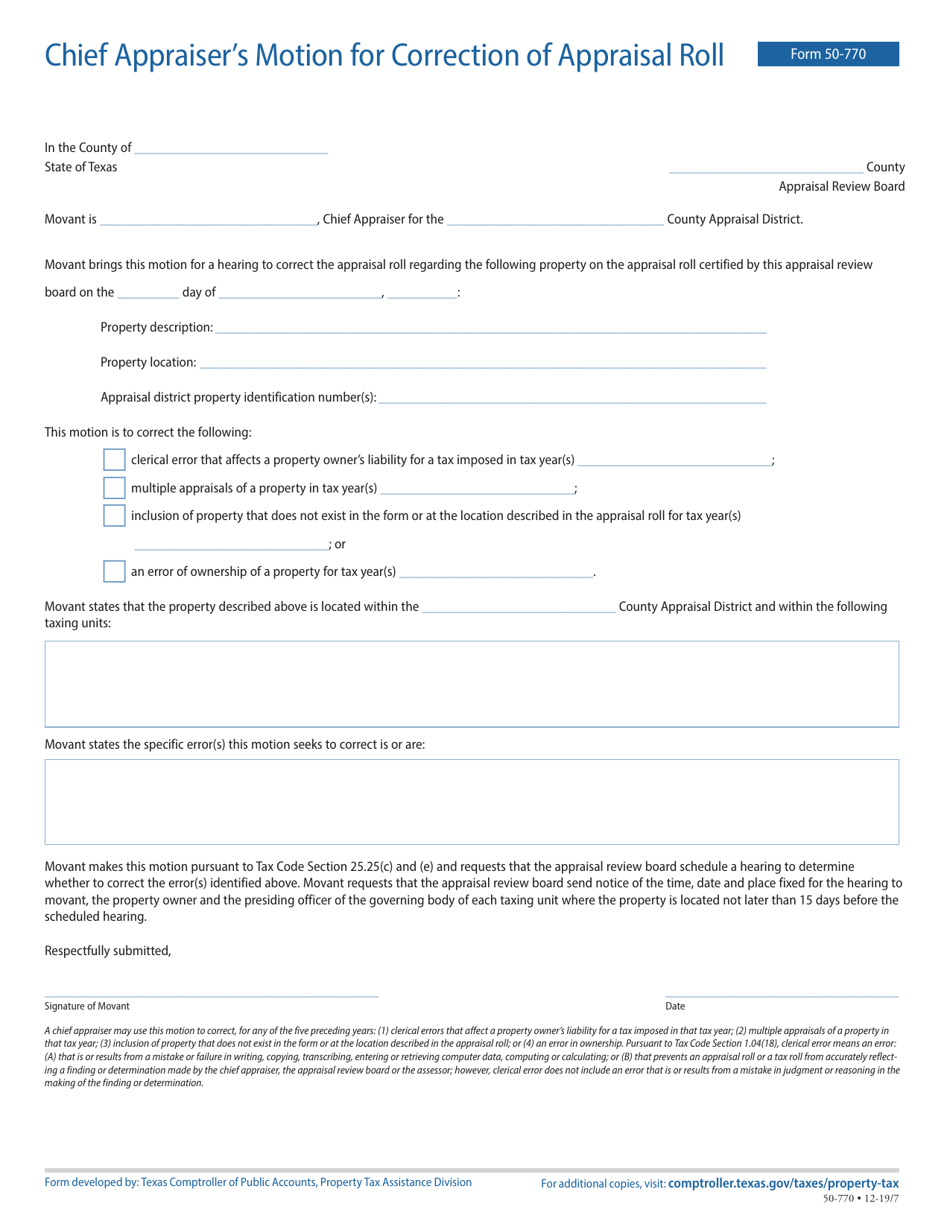

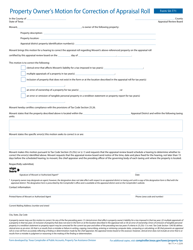

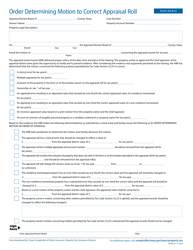

Form 50-770

for the current year.

Form 50-770 Chief Appraiser's Motion for Correction of Appraisal Roll - Texas

What Is Form 50-770?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-770?

A: Form 50-770 is the Chief Appraiser's Motion for Correction of Appraisal Roll in Texas.

Q: Who can file Form 50-770?

A: Only the Chief Appraiser can file Form 50-770.

Q: What is the purpose of Form 50-770?

A: The purpose of Form 50-770 is to request corrections to the appraisal roll.

Q: What kind of corrections can be requested with Form 50-770?

A: Form 50-770 can be used to request corrections to errors or changes in property value, ownership, or other relevant information on the appraisal roll.

Q: What is the deadline for filing Form 50-770?

A: The deadline for filing Form 50-770 is typically May 31st of the year following the tax year in which the appraisal roll was certified.

Q: Is there a fee for filing Form 50-770?

A: No, there is no fee for filing Form 50-770.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-770 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.