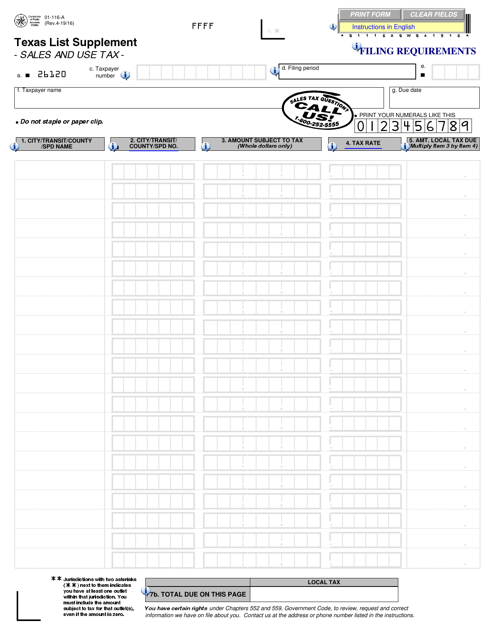

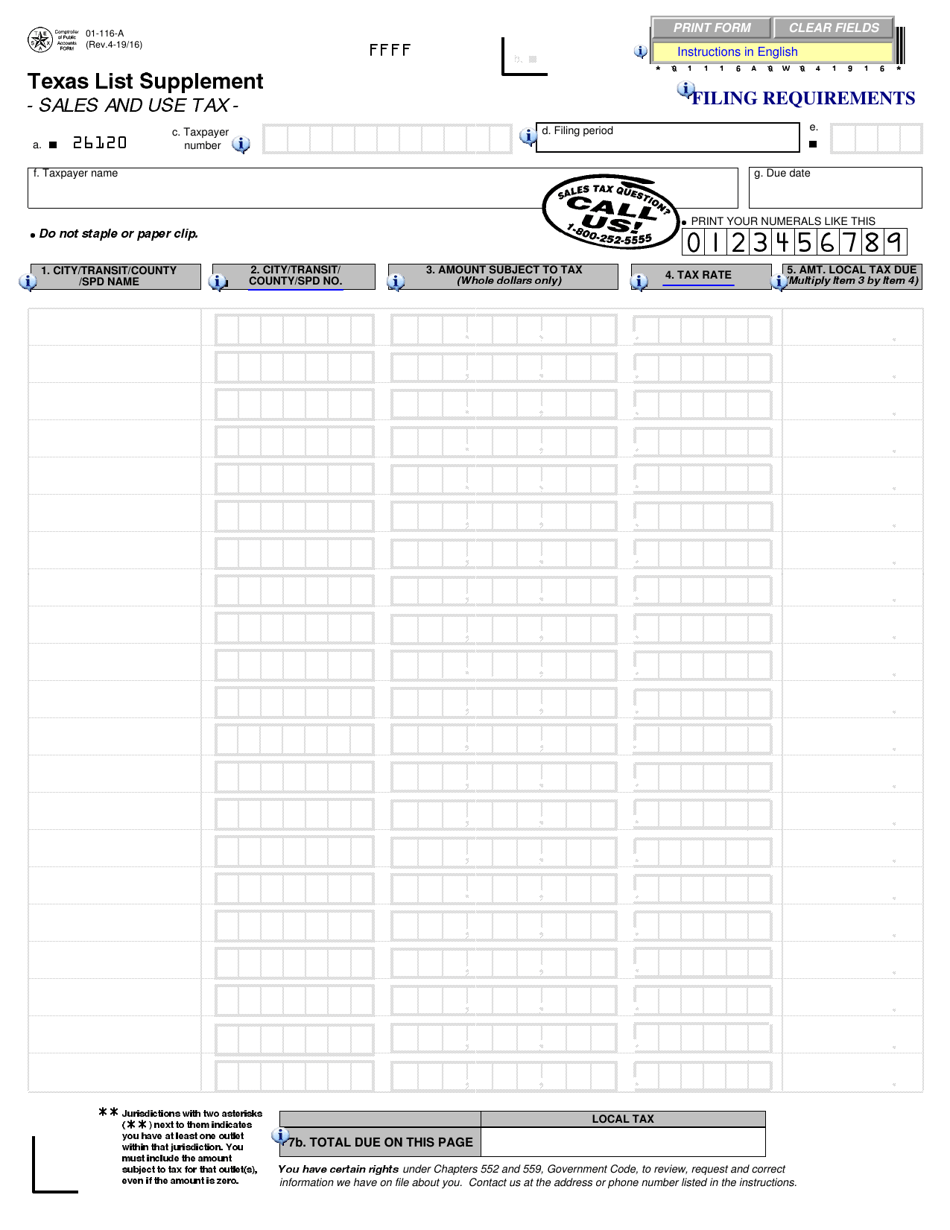

Form 01-116-A Texas List Supplement - Texas

What Is Form 01-116-A?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 01-116-A?

A: Form 01-116-A is the Texas List Supplement.

Q: Who uses Form 01-116-A?

A: Form 01-116-A is used by residents of Texas.

Q: What is the purpose of Form 01-116-A?

A: The purpose of Form 01-116-A is to provide a list of items eligible for exemption from property taxes in Texas.

Q: What information is included in Form 01-116-A?

A: Form 01-116-A includes a list of items such as agricultural land, residential property, and certain types of personal property that may be exempt from property taxes.

Q: Do I need to submit Form 01-116-A every year?

A: You may be required to submit Form 01-116-A annually if you own property that is eligible for exemption from property taxes.

Q: Are all items listed in Form 01-116-A automatically exempt from property taxes?

A: No, not all items listed in Form 01-116-A are automatically exempt from property taxes. Some items may require additional documentation or approval from the appropriate authorities.

Q: What should I do if I have questions about Form 01-116-A or property tax exemptions in Texas?

A: If you have questions about Form 01-116-A or property tax exemptions in Texas, you should contact your local appraisal district or the Texas Comptroller's office for assistance.

Form Details:

- Released on April 1, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 01-116-A by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.