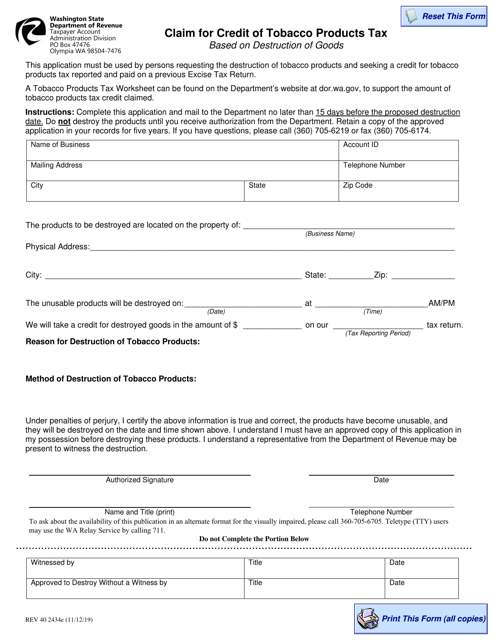

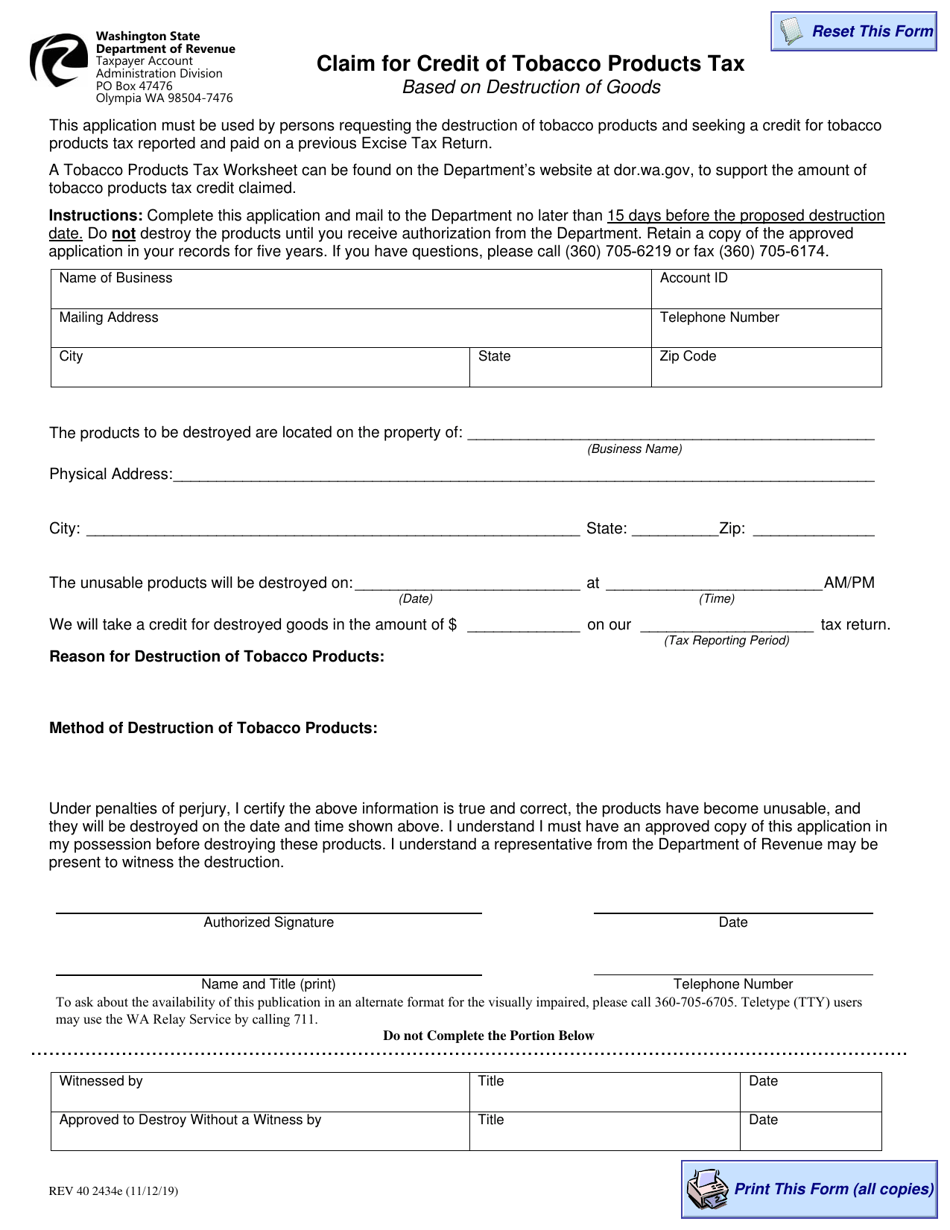

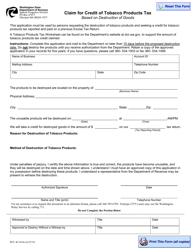

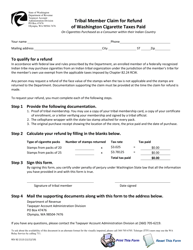

Form REV40 2434E Claim for Credit of Tobacco Products Tax - Washington

What Is Form REV40 2434E?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV40 2434E?

A: Form REV40 2434E is a claim form used to request a credit of tobacco products tax in Washington.

Q: Who can use Form REV40 2434E?

A: Anyone who has paid tobacco products tax in Washington and is eligible for a credit can use this form.

Q: How do I file Form REV40 2434E?

A: You can file Form REV40 2434E by completing the form with your relevant information and submitting it to the appropriate authority.

Q: What is the purpose of filing Form REV40 2434E?

A: The purpose of filing Form REV40 2434E is to claim a credit for tobacco products tax paid in Washington.

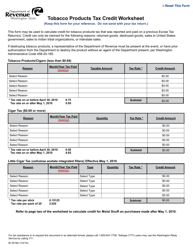

Q: What information do I need to provide on Form REV40 2434E?

A: You will need to provide your personal information, details about the tobacco products tax paid, and any supporting documentation.

Q: Is there a deadline for filing Form REV40 2434E?

A: Yes, there is a deadline for filing Form REV40 2434E. It is important to check the instructions on the form or contact the Washington State Department of Revenue for the specific deadline.

Q: Are there any fees associated with filing Form REV40 2434E?

A: No, there are no fees associated with filing Form REV40 2434E.

Q: What happens after I file Form REV40 2434E?

A: After you file Form REV40 2434E, the Washington State Department of Revenue will review your claim and notify you of the outcome.

Form Details:

- Released on November 12, 2019;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV40 2434E by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.