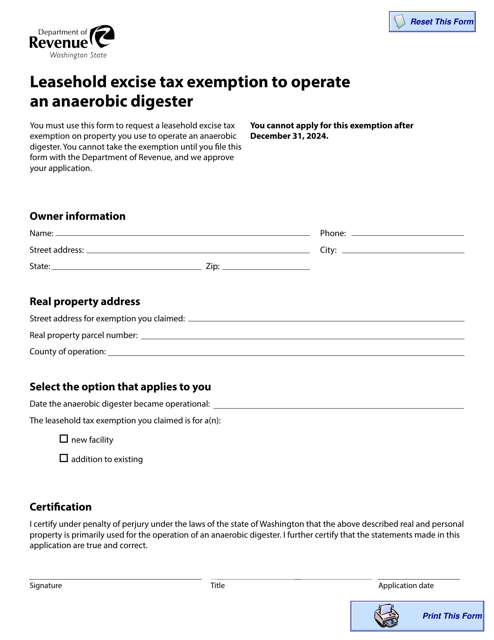

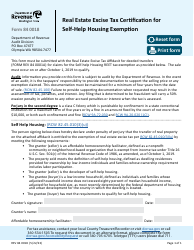

Form REV63 0034 Leasehold Excise Tax Exemption to Operate an Anaerobic Digester - Washington

What Is Form REV63 0034?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV63 0034?

A: Form REV63 0034 is a Leasehold Excise Tax Exemption to Operate an Anaerobic Digester form in the state of Washington.

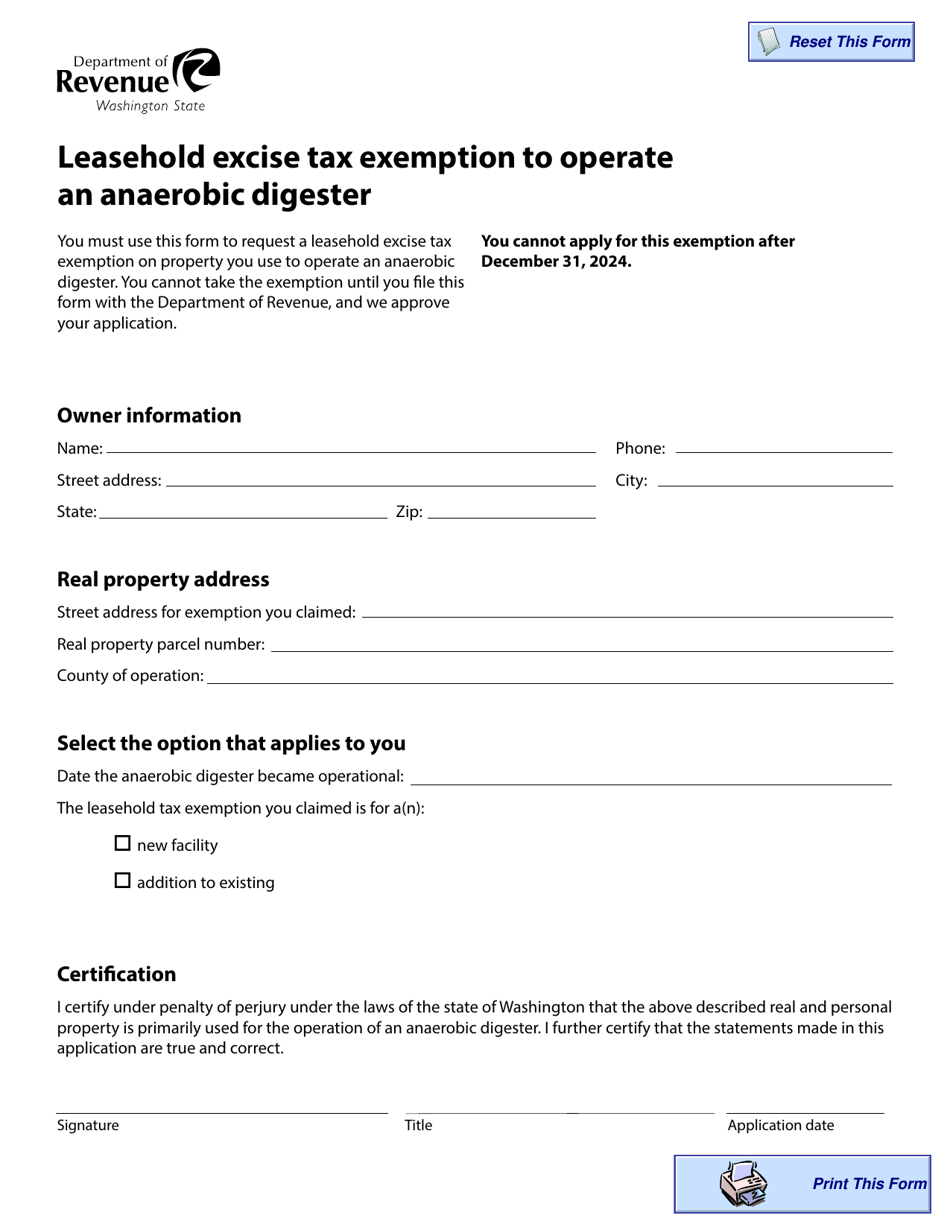

Q: What is the purpose of Form REV63 0034?

A: The purpose of Form REV63 0034 is to apply for an exemption from leasehold excise tax for operating an anaerobic digester.

Q: Who needs to file Form REV63 0034?

A: Anyone in Washington state operating an anaerobic digester and seeking an exemption from leasehold excise tax needs to file Form REV63 0034.

Q: What is an anaerobic digester?

A: An anaerobic digester is a system that breaks down organic materials in the absence of oxygen to produce biogas and nutrient-rich digestate.

Q: What is leasehold excise tax?

A: Leasehold excise tax is a tax imposed on the transfer of certain leasehold interests in real property in Washington state.

Form Details:

- Released on June 27, 2019;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV63 0034 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.