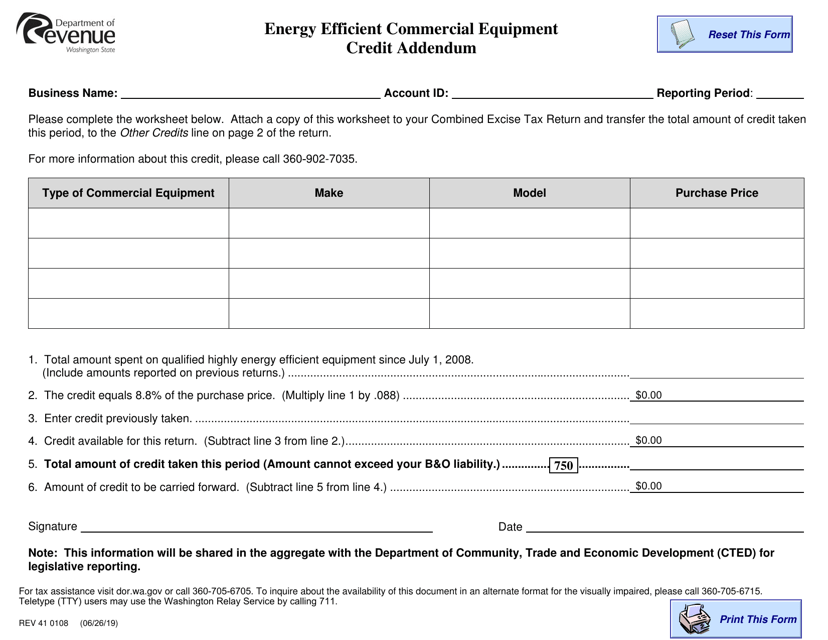

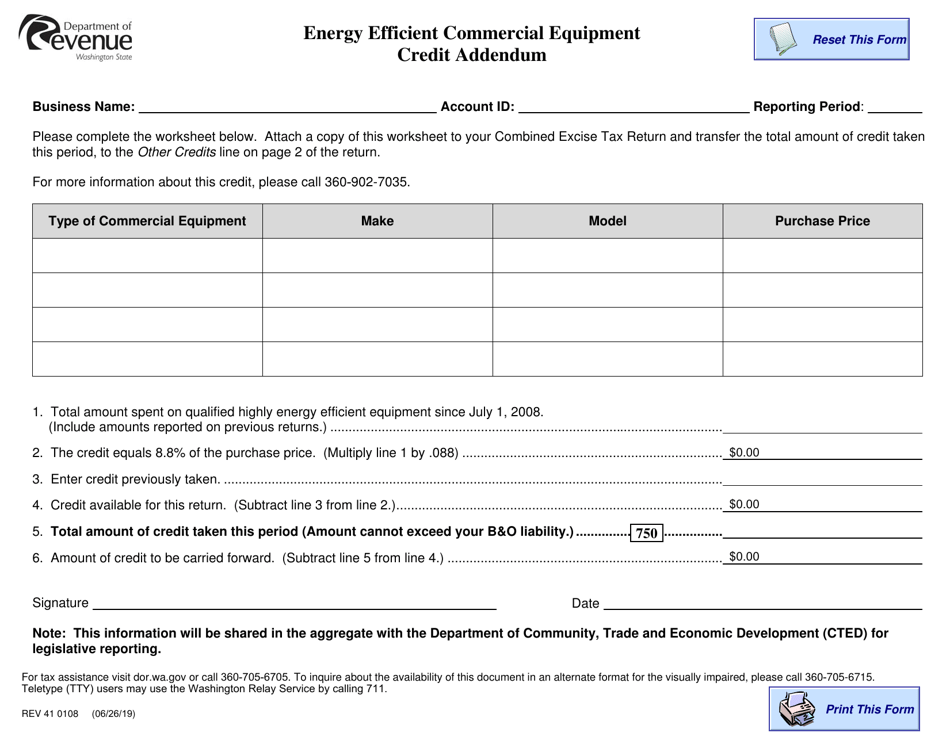

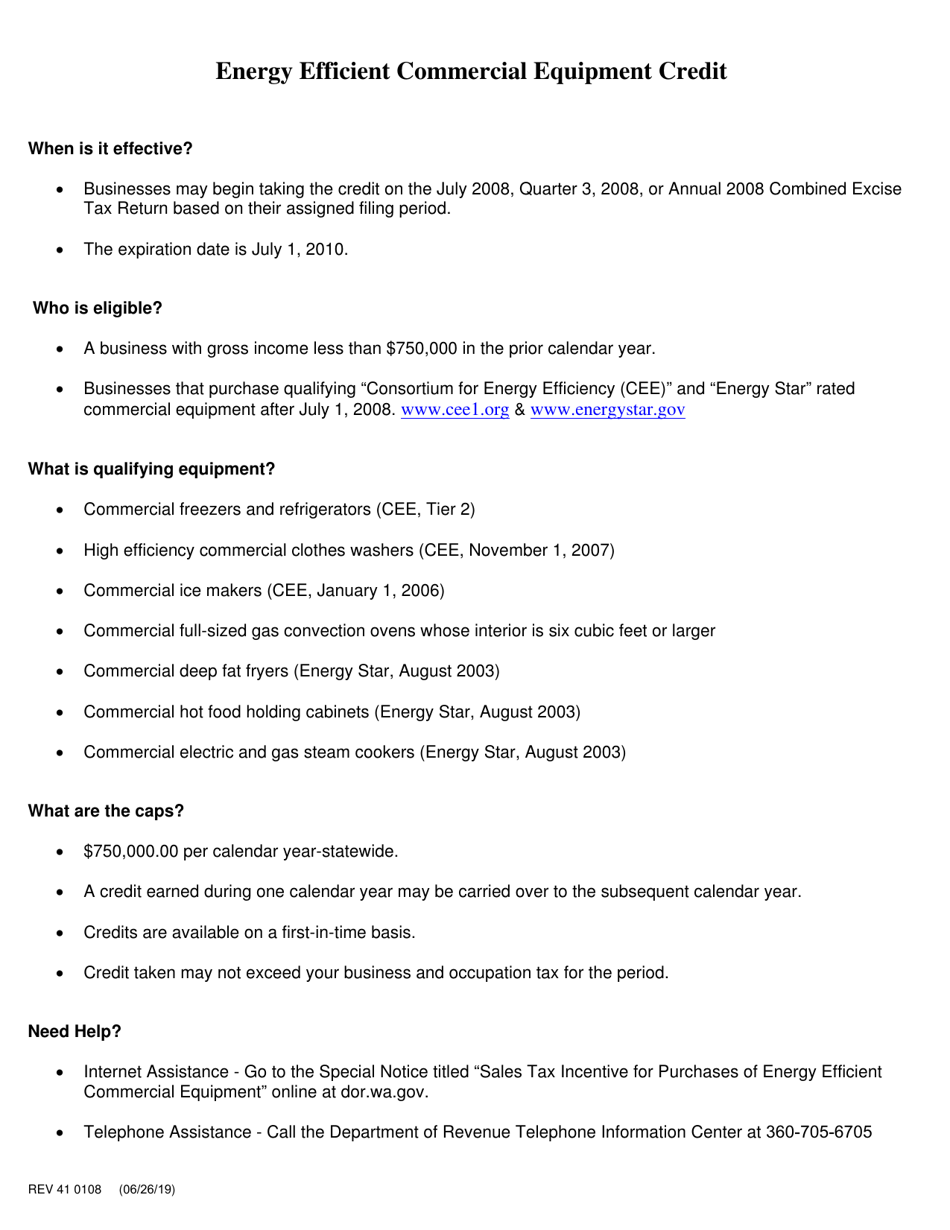

Form REV41 0108 Energy Efficient Commercial Equipment Credit Addendum - Washington

What Is Form REV41 0108?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV41 0108?

A: Form REV41 0108 is an addendum to claim the Energy Efficient Commercial Equipment Credit in Washington.

Q: What is the Energy Efficient Commercial Equipment Credit?

A: The Energy Efficient Commercial Equipment Credit is a tax credit offered in Washington for businesses that purchase energy-efficient equipment.

Q: Who can claim the Energy Efficient Commercial Equipment Credit?

A: Businesses in Washington that purchase eligible energy-efficient equipment can claim the credit.

Q: What is the purpose of the addendum?

A: The addendum, Form REV41 0108, provides additional information and documentation required to claim the Energy Efficient Commercial Equipment Credit.

Q: Are there any eligibility requirements for the credit?

A: Yes, there are specific eligibility requirements that must be met in order to claim the Energy Efficient Commercial Equipment Credit. These requirements are outlined in the instructions for Form REV41 0108.

Q: Is the credit available only for new equipment purchases?

A: No, the credit is also available for the purchase of used equipment, as long as it meets the eligibility requirements.

Q: How much is the credit?

A: The amount of the credit varies depending on the type of equipment and its energy efficiency. The specific credit amount can be calculated using the instructions provided with Form REV41 0108.

Q: When is the deadline to claim the credit?

A: The deadline to claim the Energy Efficient Commercial Equipment Credit in Washington is typically April 15th of the year following the purchase of the equipment.

Q: Can I claim this credit if I already claimed a federal tax credit for the same equipment?

A: Yes, you can still claim the Energy Efficient Commercial Equipment Credit in Washington even if you already claimed a federal tax credit for the same equipment.

Form Details:

- Released on June 26, 2019;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV41 0108 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.