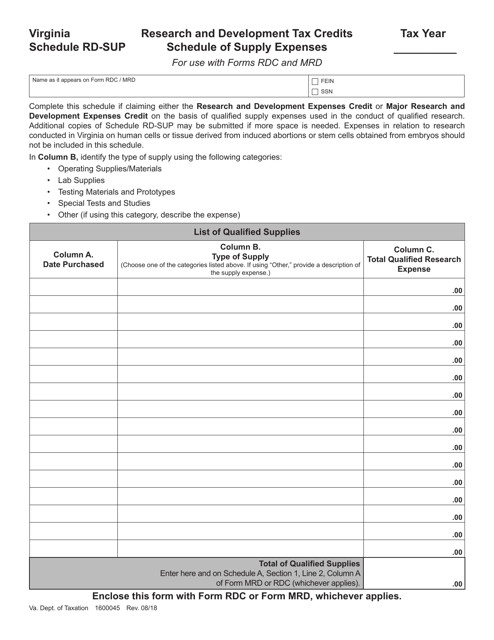

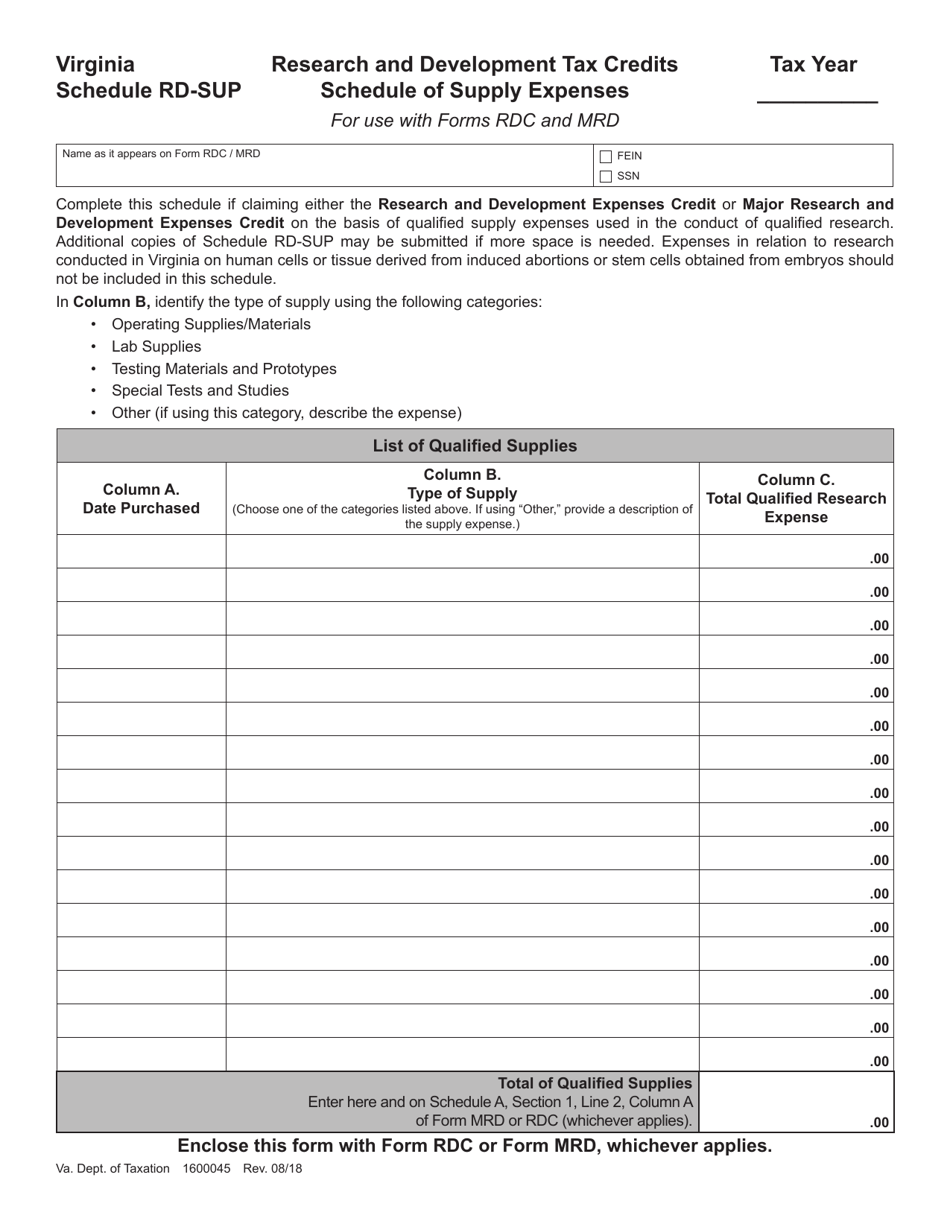

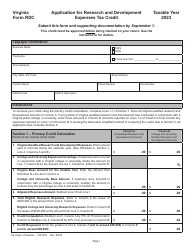

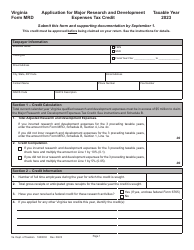

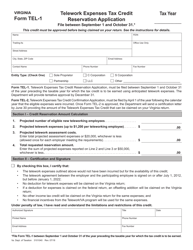

Schedule RD-SUP Research and Development Tax Credits Schedule of Supply Expenses - Virginia

What Is Schedule RD-SUP?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is RD-SUP?

A: RD-SUP stands for Schedule of Supply Expenses - Virginia.

Q: What is the purpose of RD-SUP?

A: The purpose of RD-SUP is to claim Research and Development Tax Credits.

Q: What expenses are included in RD-SUP?

A: RD-SUP includes supply expenses related to research and development activities.

Q: Is RD-SUP specific to Virginia?

A: Yes, RD-SUP is specific to Virginia.

Q: Who can claim RD-SUP?

A: Businesses engaged in research and development activities in Virginia can claim RD-SUP.

Q: How do I schedule RD-SUP?

A: You need to complete the provided Schedule of Supply Expenses form to schedule RD-SUP.

Q: What is the benefit of claiming RD-SUP?

A: Claiming RD-SUP allows businesses to receive tax credits for their research and development expenses in Virginia.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule RD-SUP by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.