This version of the form is not currently in use and is provided for reference only. Download this version of

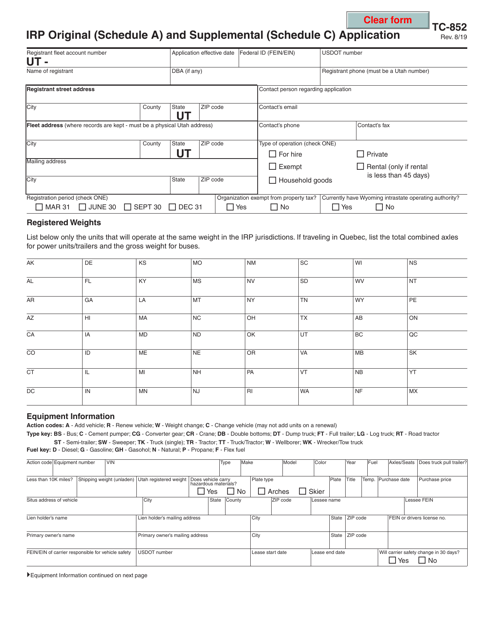

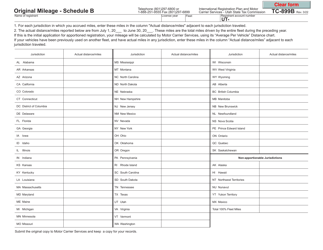

Form TC-852

for the current year.

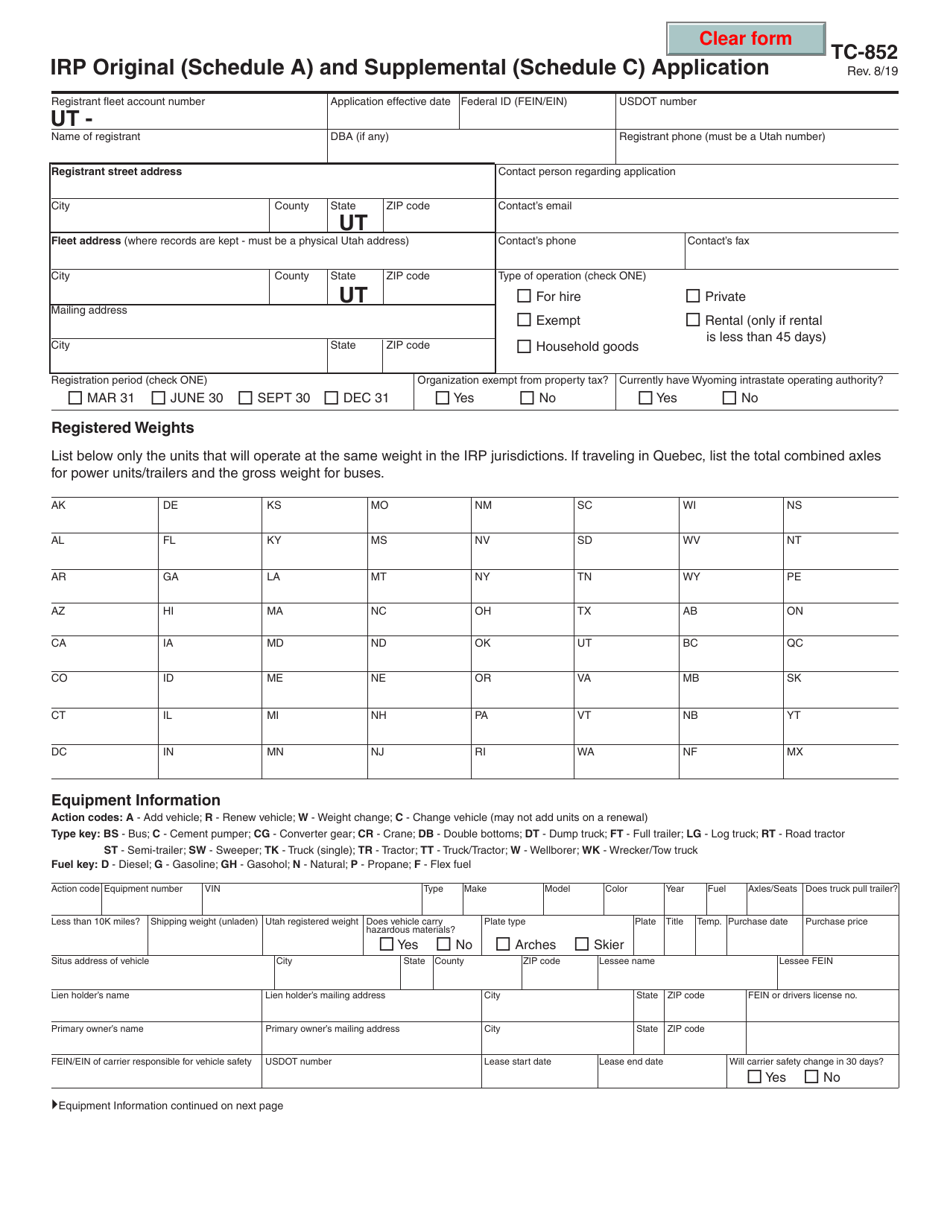

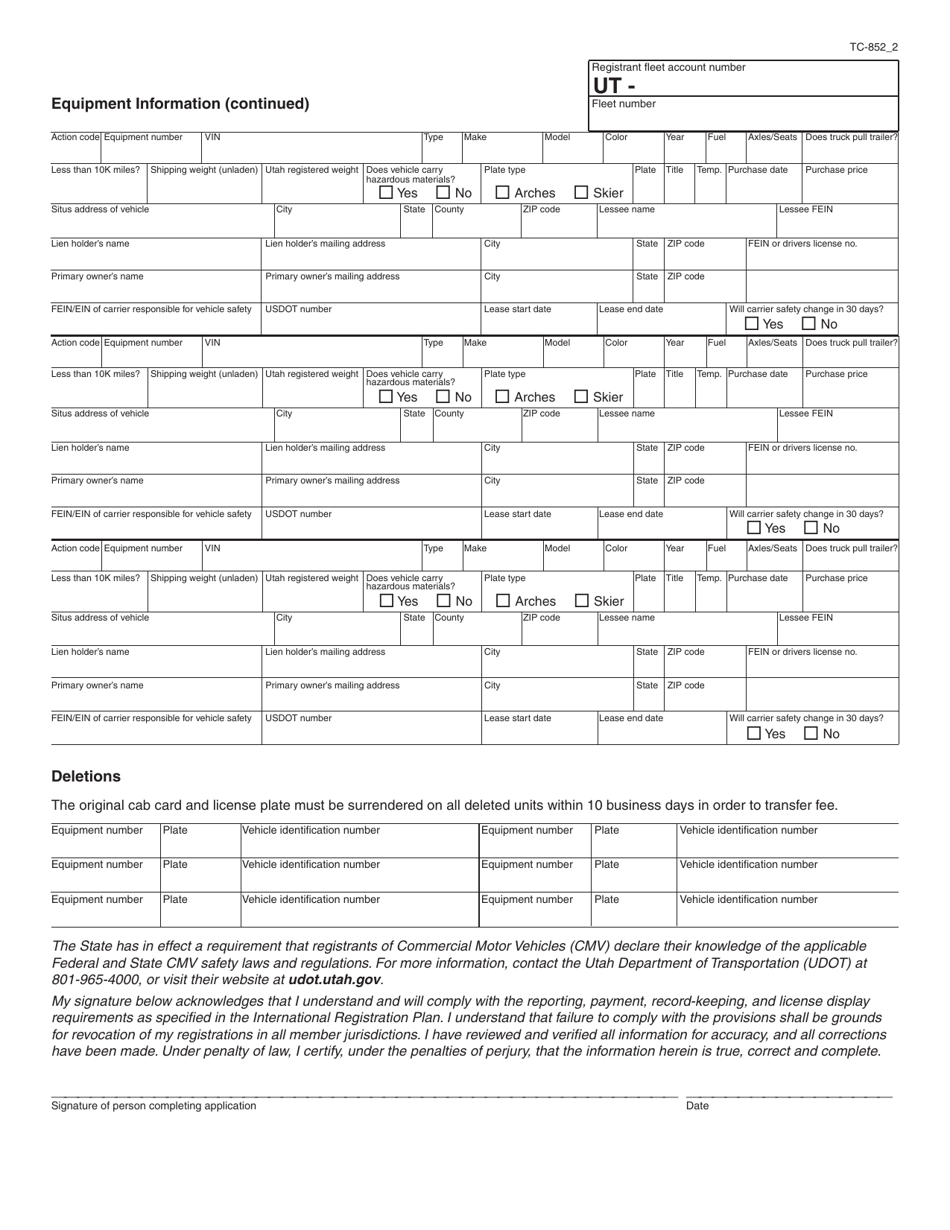

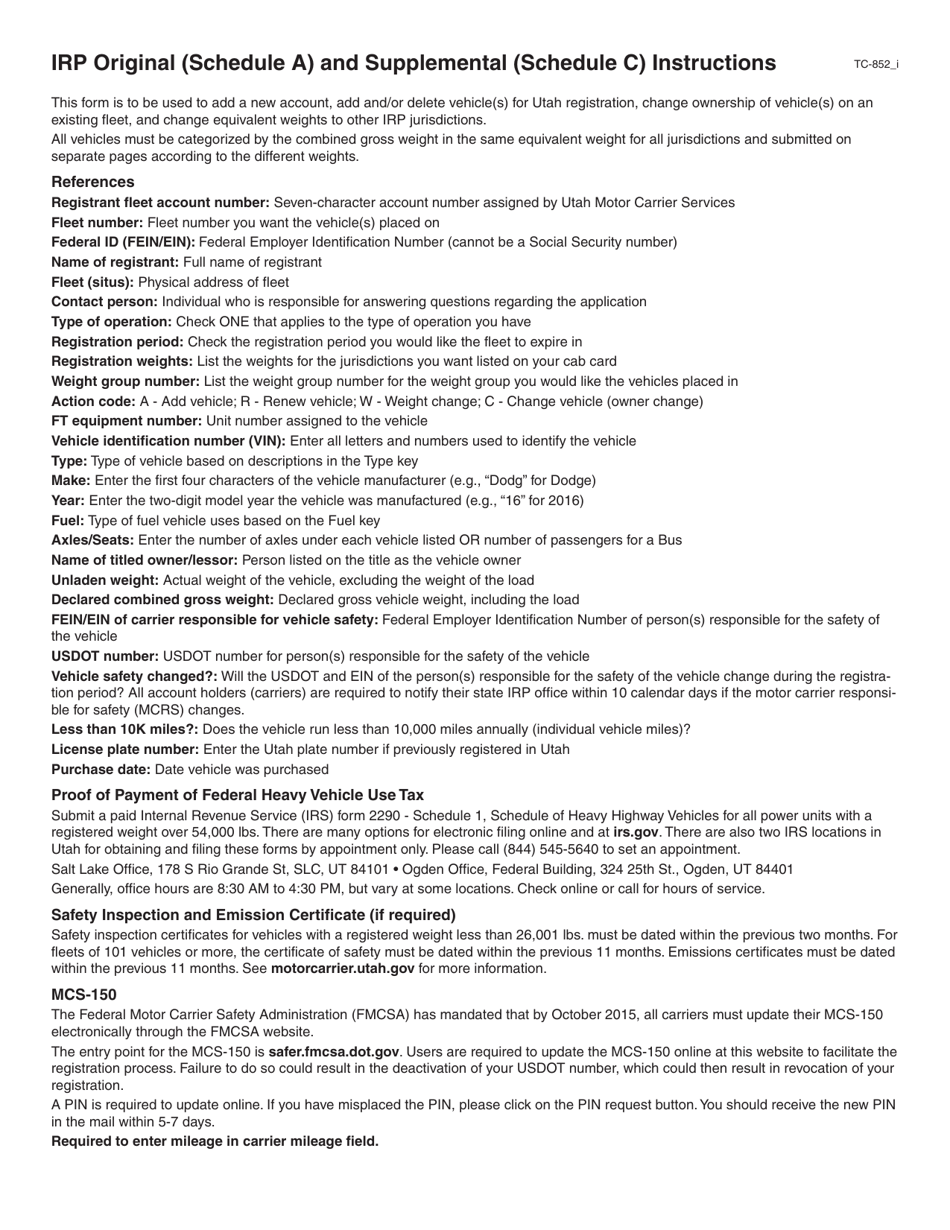

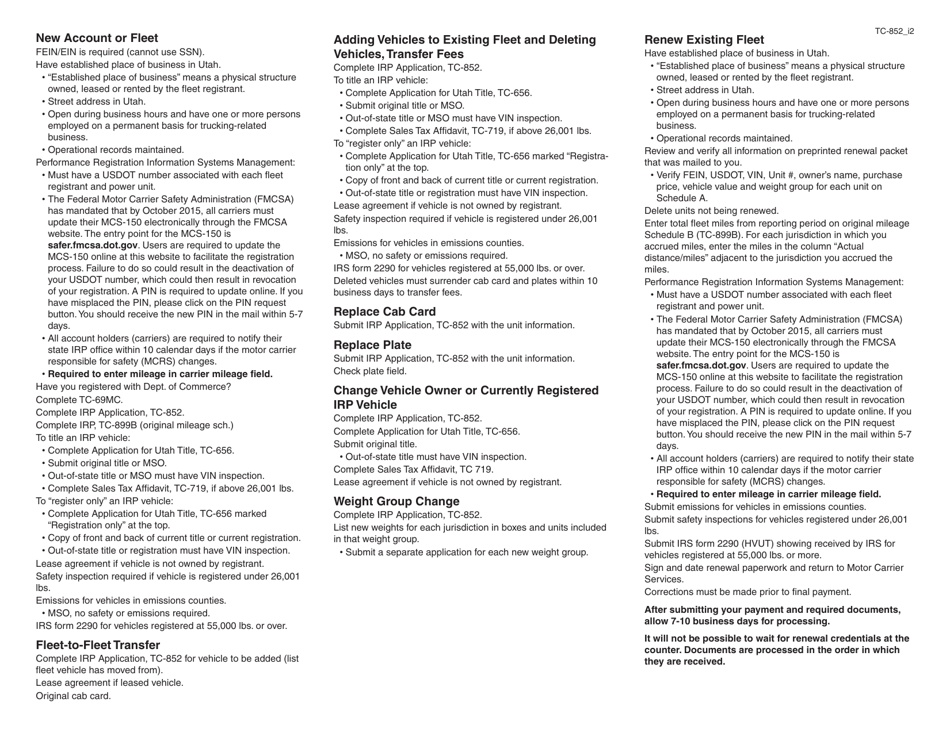

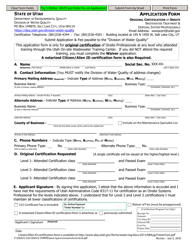

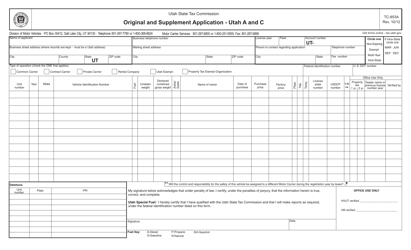

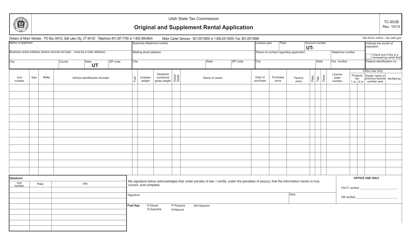

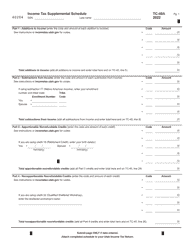

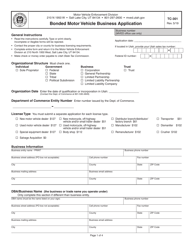

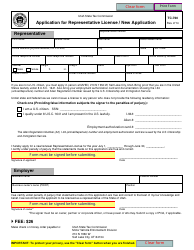

Form TC-852 Irp Original (Schedule a) and Supplemental (Schedule C) Application - Utah

What Is Form TC-852?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the TC-852 IRP Original (Schedule A) and Supplemental (Schedule C) Application form in Utah?

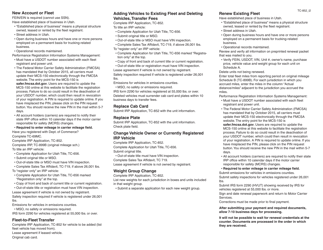

A: The TC-852 form is used to apply for International Registration Plan (IRP) in Utah and consists of Schedule A and Schedule C.

Q: What is International Registration Plan (IRP)?

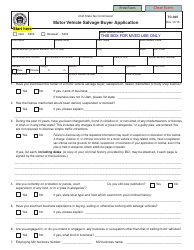

A: The IRP is an agreement among US states and Canadian provinces that simplifies the registration and licensing of commercial vehicles traveling across jurisdictions.

Q: What is Schedule A and Schedule C of the TC-852 form?

A: Schedule A in TC-852 form is the original application for registration under the IRP, while Schedule C is used for supplemental information like additional jurisdictions or vehicles.

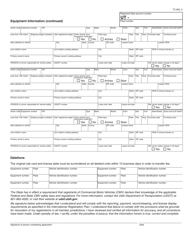

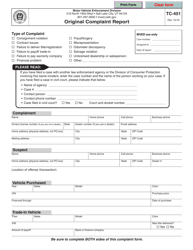

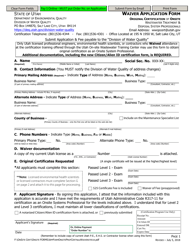

Q: What information is required in the TC-852 form?

A: The form requires information about the registrant, vehicle details, jurisdictional information, and supporting documentation for the vehicles being registered.

Q: Who should use the TC-852 form?

A: The TC-852 form should be used by owners and operators of commercial vehicles that travel across multiple jurisdictions and need to obtain IRP registration in Utah.

Q: Is there a fee to submit the TC-852 form?

A: Yes, there is a registration fee associated with the TC-852 form. The fee varies depending on the weight and number of vehicles being registered.

Q: What is the deadline for submitting the TC-852 form?

A: The TC-852 form should be submitted at least 45 days before the desired effective registration date or before the expiration of the current registration, whichever is earlier.

Q: What if I need to make changes or corrections to my TC-852 form after submission?

A: You can submit a corrected TC-852 form with the necessary changes or corrections to the Utah State Tax Commission.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-852 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.