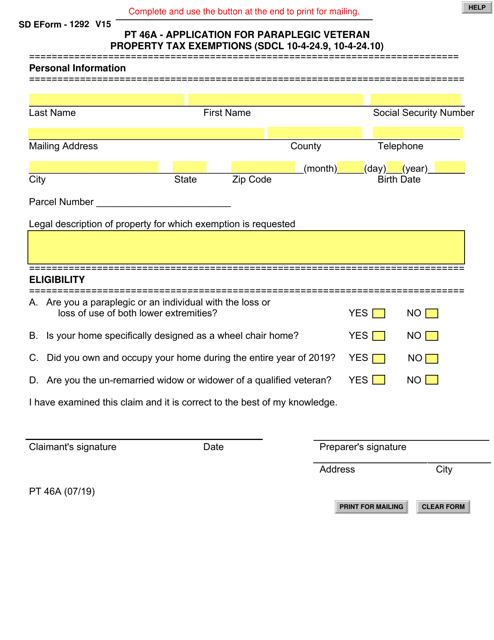

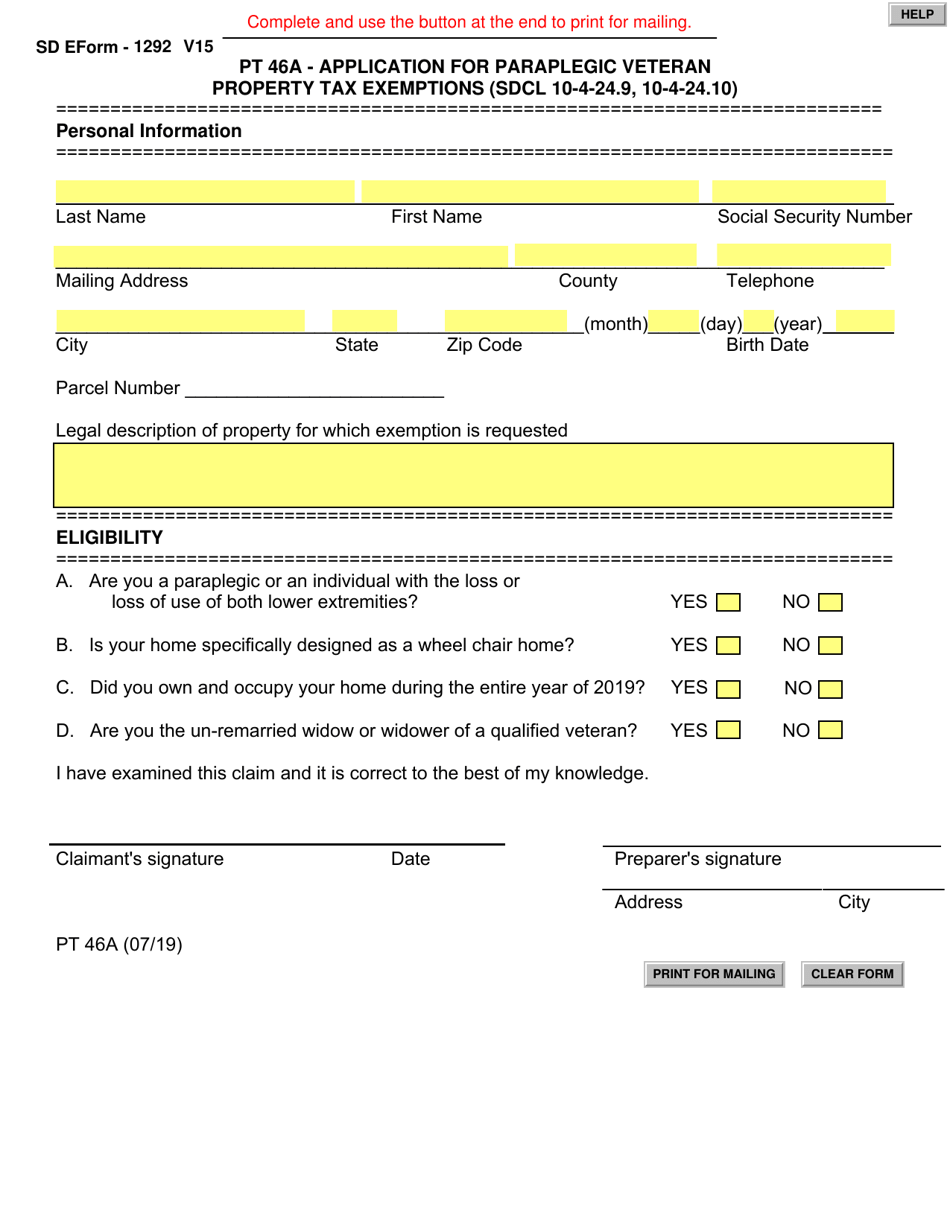

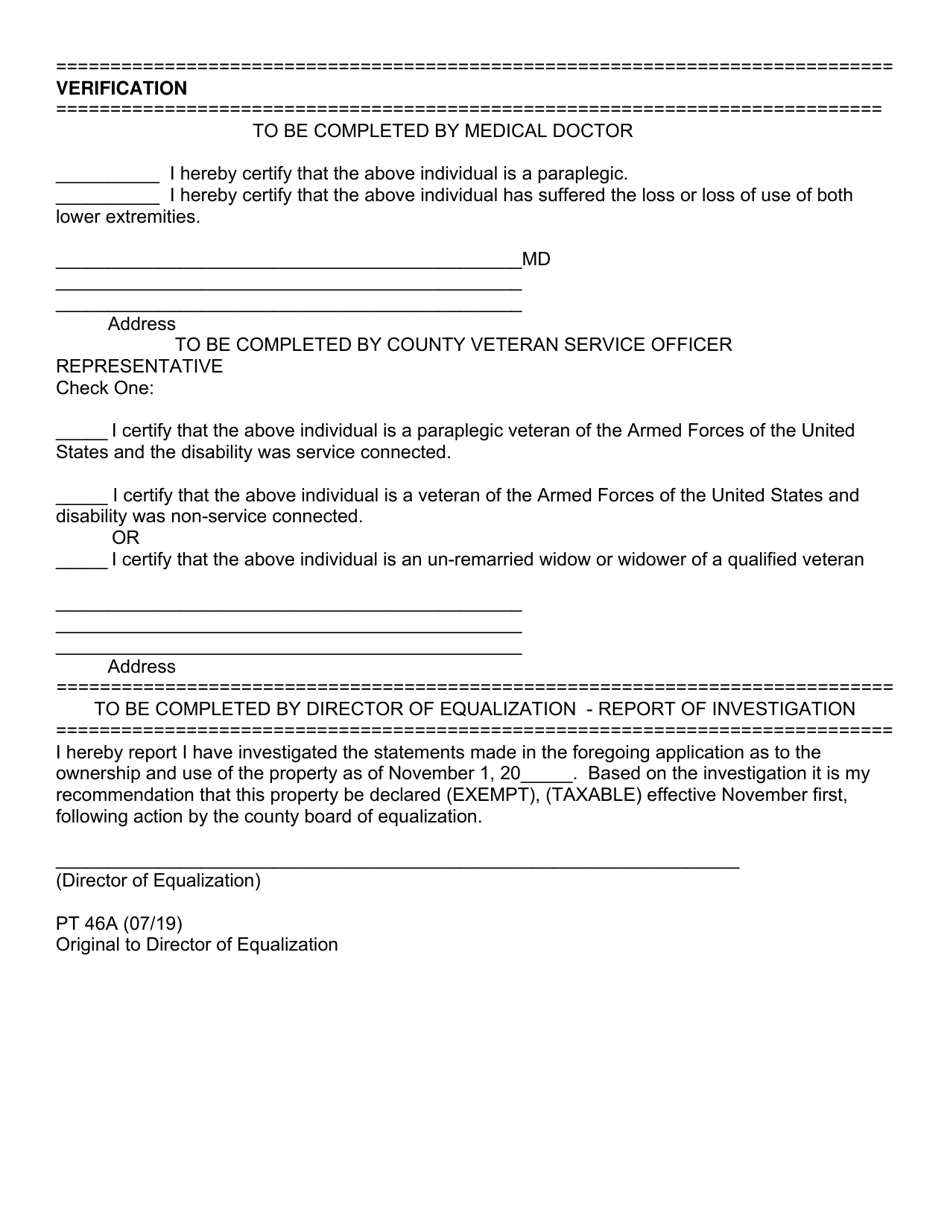

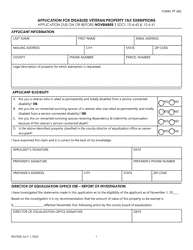

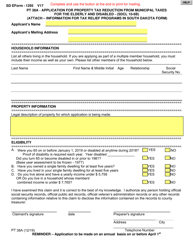

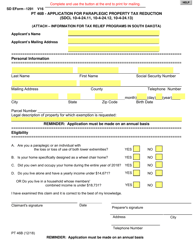

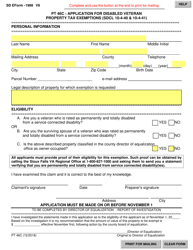

Form PT46A (SD Form 1292) Application for Paraplegic Veteran Property Tax Exemptions - South Dakota

What Is Form PT46A (SD Form 1292)?

This is a legal form that was released by the South Dakota Department of Revenue - a government authority operating within South Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT46A?

A: Form PT46A is the application for Paraplegic Veteran Property Tax Exemptions in South Dakota.

Q: What is the purpose of Form PT46A?

A: The purpose of Form PT46A is to apply for property tax exemptions for paraplegic veterans in South Dakota.

Q: Who is eligible for the property tax exemptions?

A: Paraplegic veterans who meet certain criteria are eligible for the property tax exemptions.

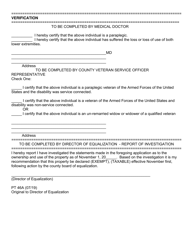

Q: What documentation do I need to submit with Form PT46A?

A: You may need to submit documentation such as proof of disability and military service.

Q: Are there any fees associated with filing Form PT46A?

A: No, there are no fees associated with filing Form PT46A.

Q: When is the deadline to file Form PT46A?

A: The deadline to file Form PT46A is typically April 1st of each year.

Q: Will I need to reapply for the property tax exemption annually?

A: In most cases, you will need to reapply for the property tax exemption annually.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the South Dakota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PT46A (SD Form 1292) by clicking the link below or browse more documents and templates provided by the South Dakota Department of Revenue.