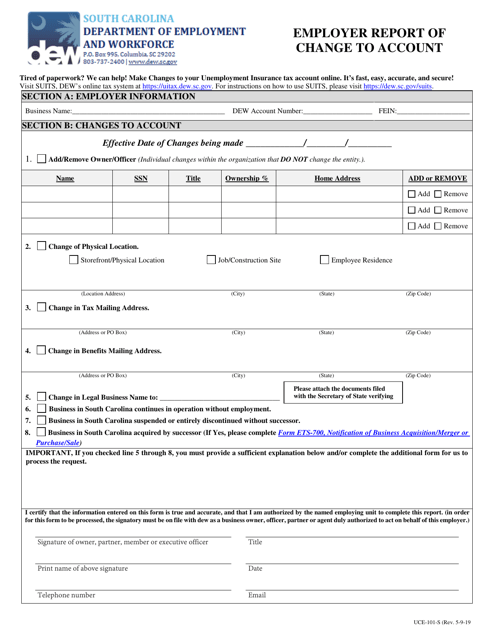

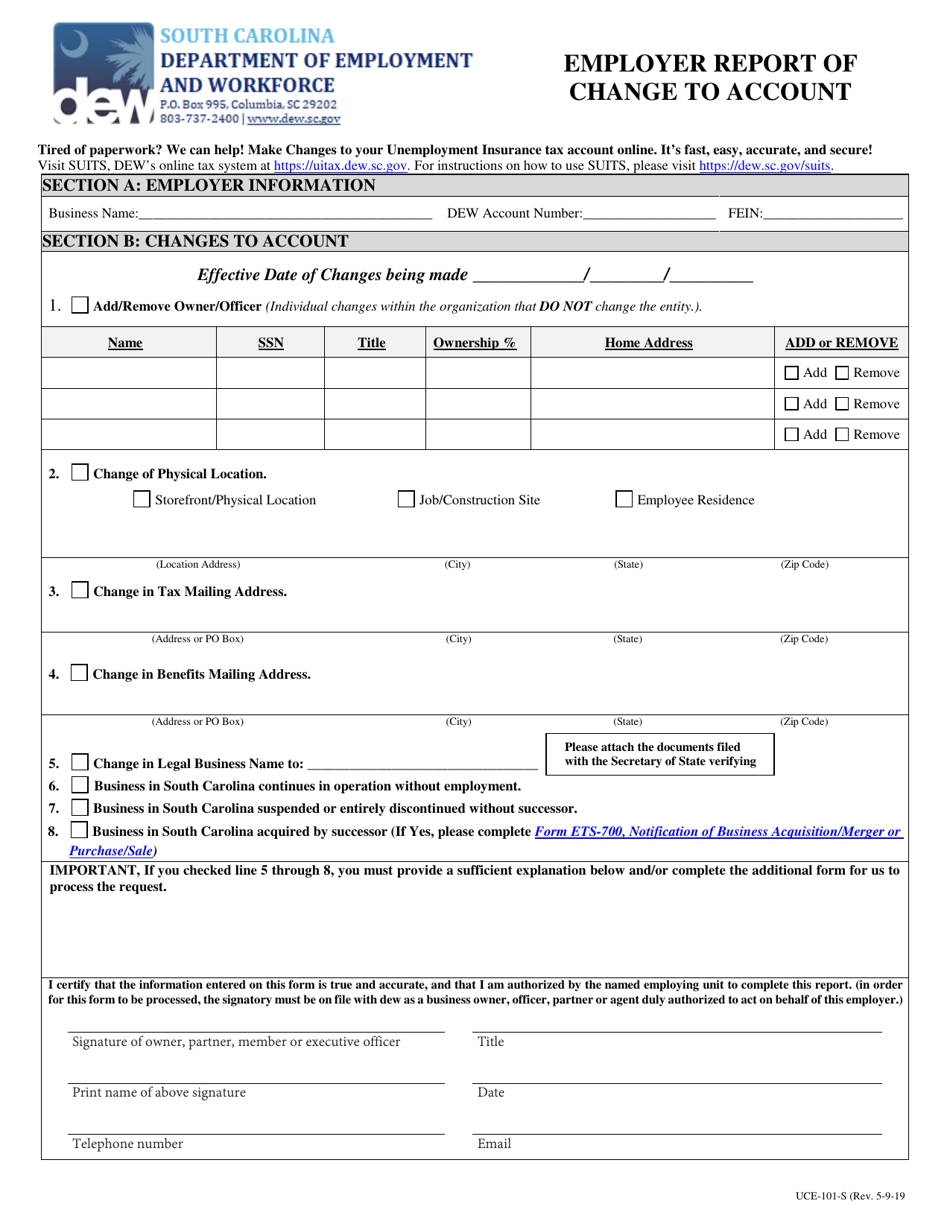

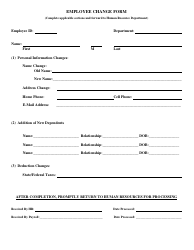

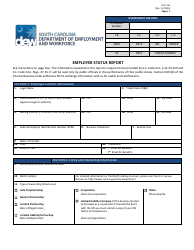

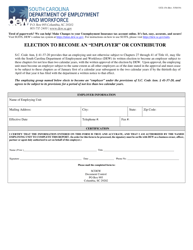

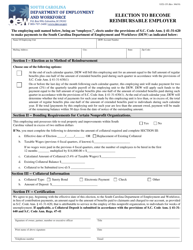

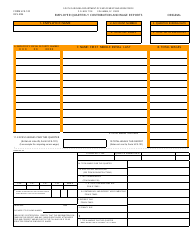

Form UCE-101-S Employer Report of Change to Account - South Carolina

What Is Form UCE-101-S?

This is a legal form that was released by the South Carolina Department of Employment & Workforce - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form UCE-101-S?

A: Form UCE-101-S is the Employer Report of Change to Account used in South Carolina.

Q: Who is required to file Form UCE-101-S?

A: Employers in South Carolina are required to file Form UCE-101-S when there is a change to their account information.

Q: What is the purpose of Form UCE-101-S?

A: The purpose of Form UCE-101-S is to report changes to employer account information in South Carolina.

Q: When should I file Form UCE-101-S?

A: Form UCE-101-S should be filed as soon as there is a change to employer account information in South Carolina.

Q: What information do I need to provide on Form UCE-101-S?

A: You need to provide updated employer account information such as business name, address, contact information, and any other changes relevant to your account.

Q: Are there any fees associated with filing Form UCE-101-S?

A: No, there are no fees associated with filing Form UCE-101-S.

Q: What happens after I file Form UCE-101-S?

A: After you file Form UCE-101-S, the South Carolina Department of Employment and Workforce will update your account information accordingly.

Q: What do I do if I have additional questions about Form UCE-101-S?

A: If you have additional questions about Form UCE-101-S, you can contact the South Carolina Department of Employment and Workforce for assistance.

Form Details:

- Released on May 9, 2019;

- The latest edition provided by the South Carolina Department of Employment & Workforce;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UCE-101-S by clicking the link below or browse more documents and templates provided by the South Carolina Department of Employment & Workforce.