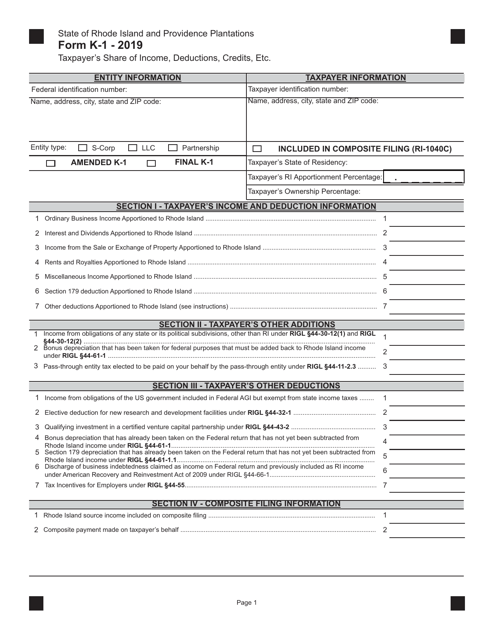

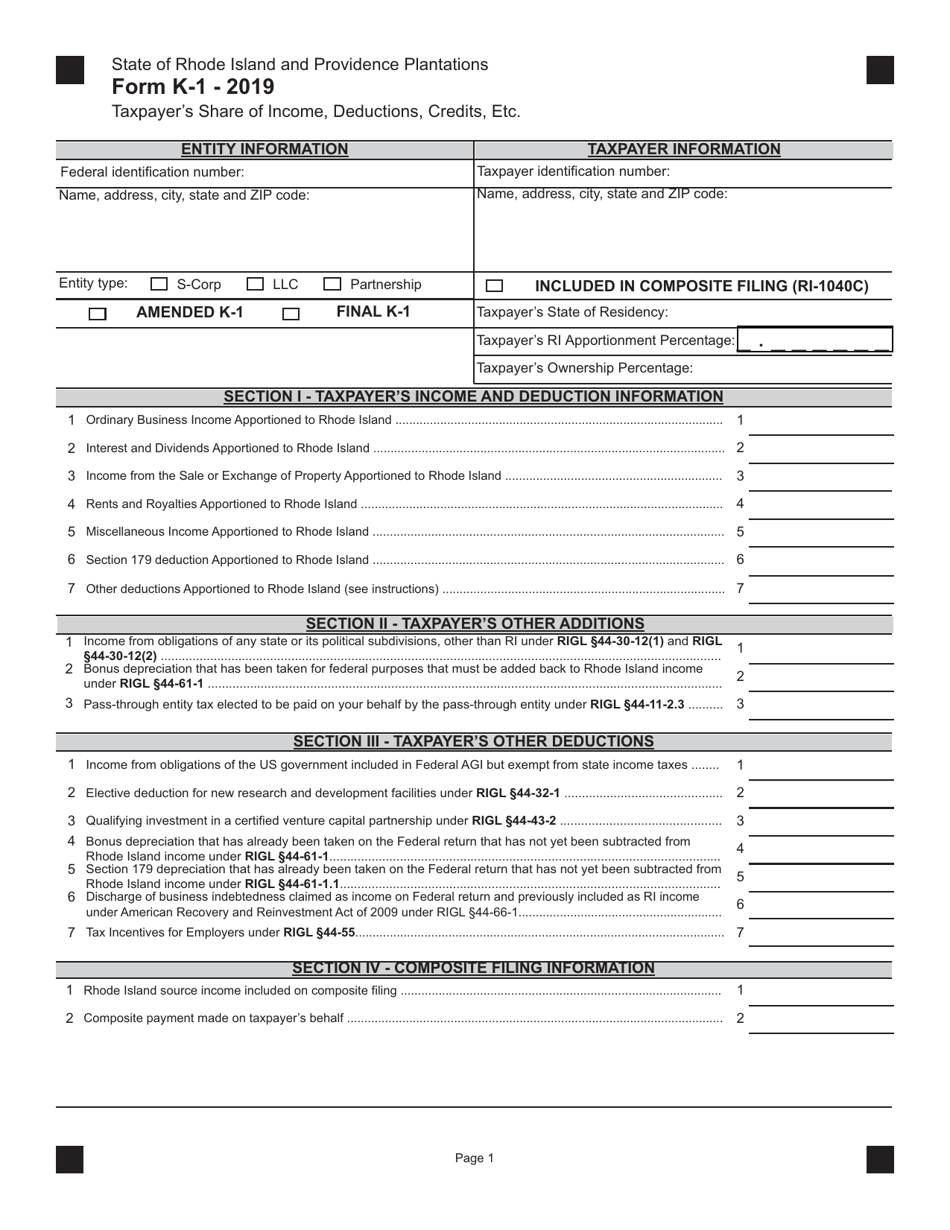

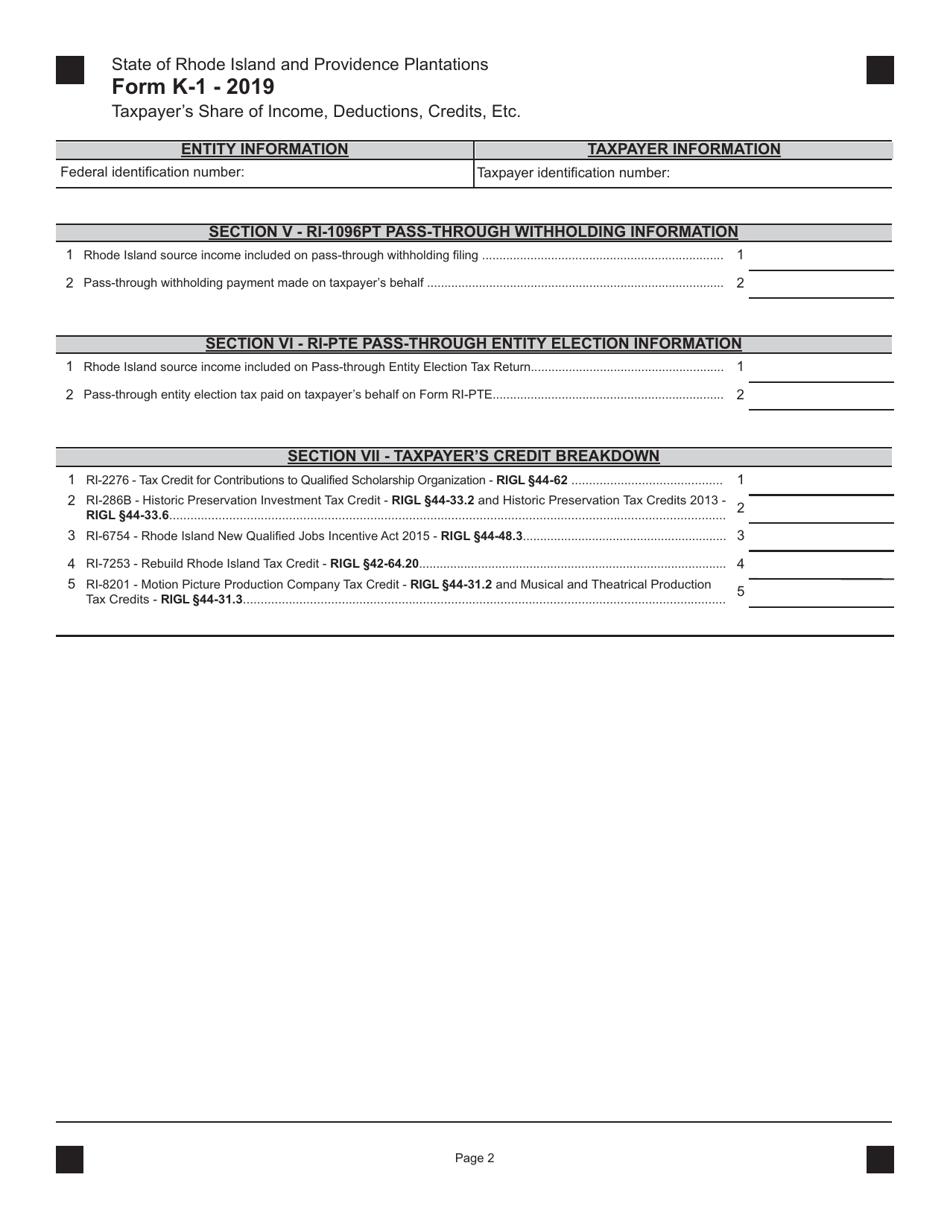

Form K-1 Taxpayer's Share of Income, Deductions, Credits, Etc. - Rhode Island

What Is Form K-1?

This is a legal form that was released by the Rhode Island Department of Revenue - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form K-1?

A: Form K-1 is a tax form used to report a taxpayer's share of income, deductions, credits, etc.

Q: What does Form K-1 show?

A: Form K-1 shows the income, deductions, and credits that a taxpayer is entitled to as a partner or shareholder in a partnership or S-corporation.

Q: Who needs to file Form K-1?

A: Partnerships and S-corporations are required to file Form K-1 to report the income, deductions, and credits to their partners or shareholders.

Q: Is Form K-1 only for Rhode Island?

A: No, Form K-1 is a federal tax form used by all states. This specific document refers to the use of Form K-1 in Rhode Island.

Q: How do I fill out Form K-1?

A: To fill out Form K-1, you'll need information about your partnership or S-corporation, as well as your share of income, deductions, and credits. Follow the instructions provided with the form.

Q: When is Form K-1 due?

A: The due date for Form K-1 depends on the type of entity. Partnerships must provide Form K-1 to their partners by March 15th, while S-corporations must provide it by March 31st.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form K-1 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue.