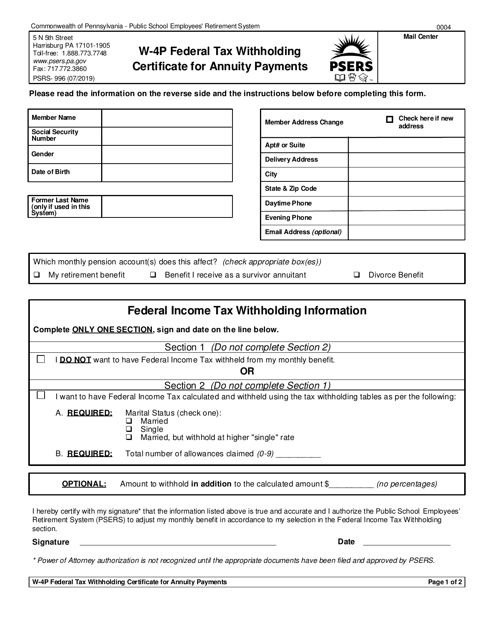

Form PSRS-996 W-4p Federal Tax Withholding Certificate for Pension or Annuity Payments - Pennsylvania

What Is Form PSRS-996?

This is a legal form that was released by the Pennsylvania Public School Employees' Retirement System - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PSRS-996 W-4p?

A: Form PSRS-996 W-4p is a Federal Tax Withholding Certificate for Pension or Annuity Payments for Pennsylvania residents.

Q: Who should use Form PSRS-996 W-4p?

A: Form PSRS-996 W-4p should be used by Pennsylvania residents who receive pension or annuity payments and want to adjust their federal tax withholding.

Q: What is the purpose of Form PSRS-996 W-4p?

A: The purpose of Form PSRS-996 W-4p is to allow Pennsylvania residents to specify their federal tax withholding preferences for their pension or annuity payments.

Q: How do I fill out Form PSRS-996 W-4p?

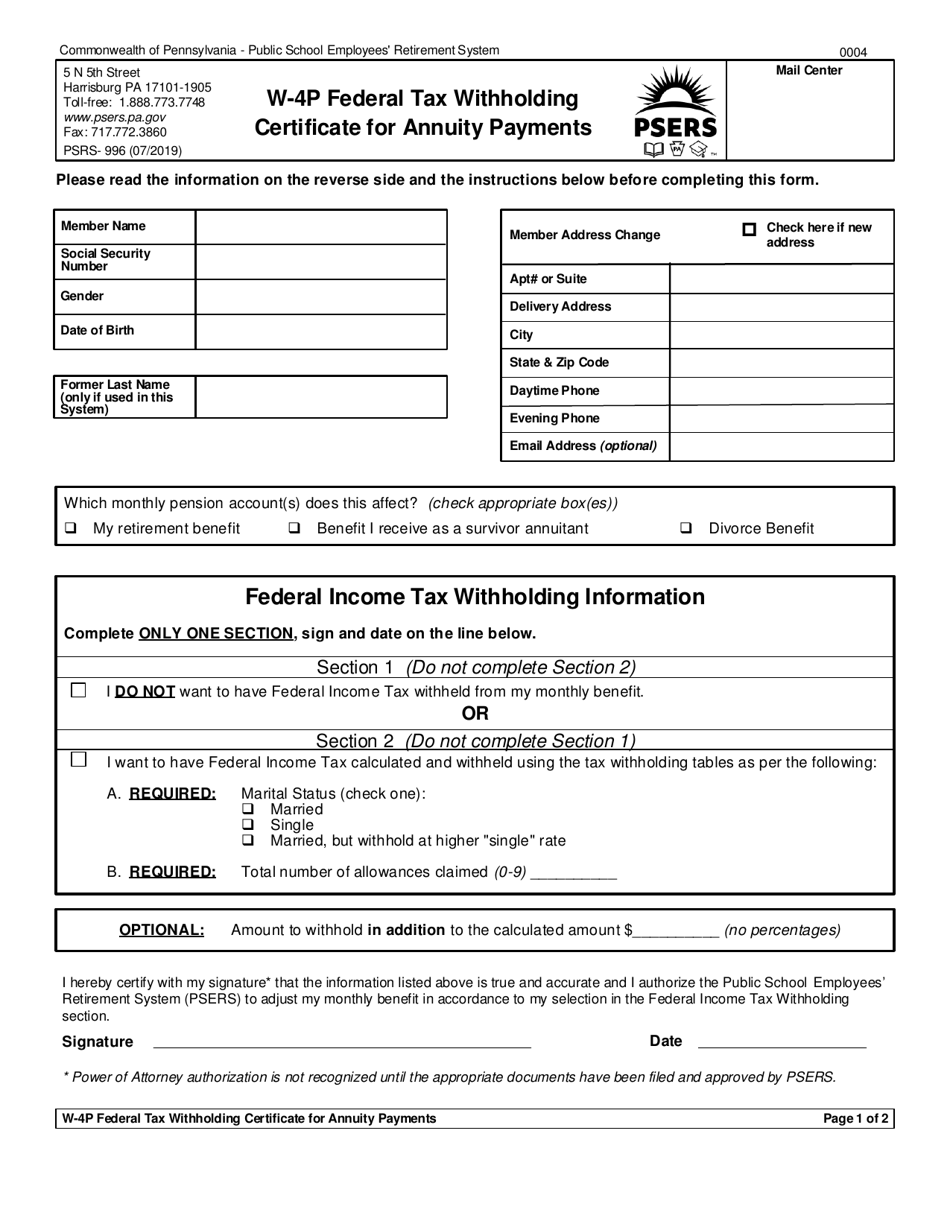

A: To fill out Form PSRS-996 W-4p, you will need to provide your personal information, including your name, address, and Social Security number, as well as indicate your federal tax withholding preferences.

Q: When should I submit Form PSRS-996 W-4p?

A: You should submit Form PSRS-996 W-4p to PSERS as soon as possible after any changes in your federal tax withholding preferences for your pension or annuity payments.

Q: Are there any specific instructions for submitting Form PSRS-996 W-4p?

A: Yes, there are specific instructions provided on the form itself, which should be followed carefully.

Q: Is Form PSRS-996 W-4p only applicable for Pennsylvania residents?

A: Yes, Form PSRS-996 W-4p is specifically designed for Pennsylvania residents who receive pension or annuity payments.

Q: Do I need to submit Form PSRS-996 W-4p every year?

A: No, you do not need to submit Form PSRS-996 W-4p every year. However, you should review your federal tax withholding preferences regularly and submit an updated form if necessary.

Q: Can I make changes to my federal tax withholding after submitting Form PSRS-996 W-4p?

A: Yes, you can make changes to your federal tax withholding by submitting a new Form PSRS-996 W-4p with the updated information.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Pennsylvania Public School Employees' Retirement System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PSRS-996 by clicking the link below or browse more documents and templates provided by the Pennsylvania Public School Employees' Retirement System.