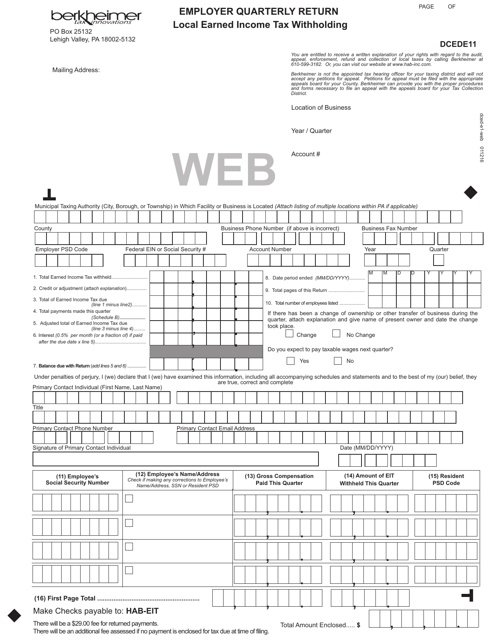

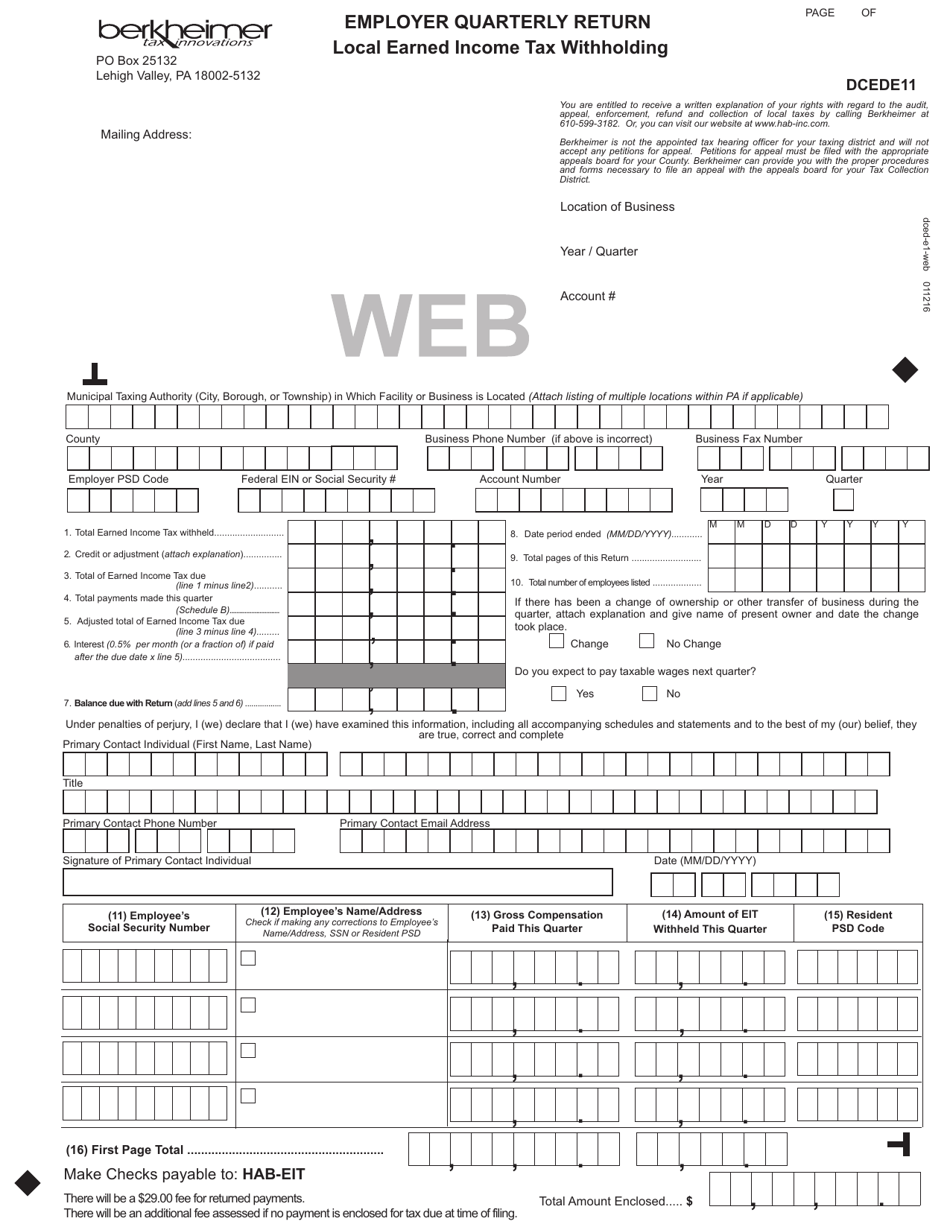

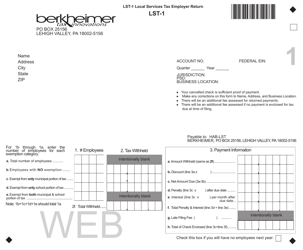

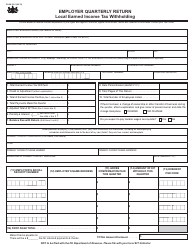

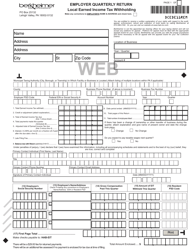

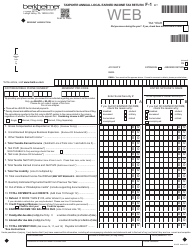

Form DCEDE11 Employer Quarterly Return Local Earned Income Tax Withholding - Pennsylvania

What Is Form DCEDE11?

This is a legal form that was released by the Berkheimer Tax Administrator - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DCEDE11?

A: Form DCEDE11 is the Employer Quarterly Return Local Earned IncomeTax Withholding form for the state of Pennsylvania.

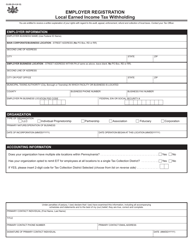

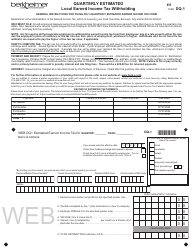

Q: Who is required to file Form DCEDE11?

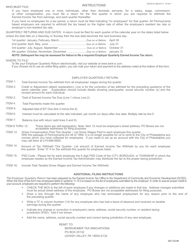

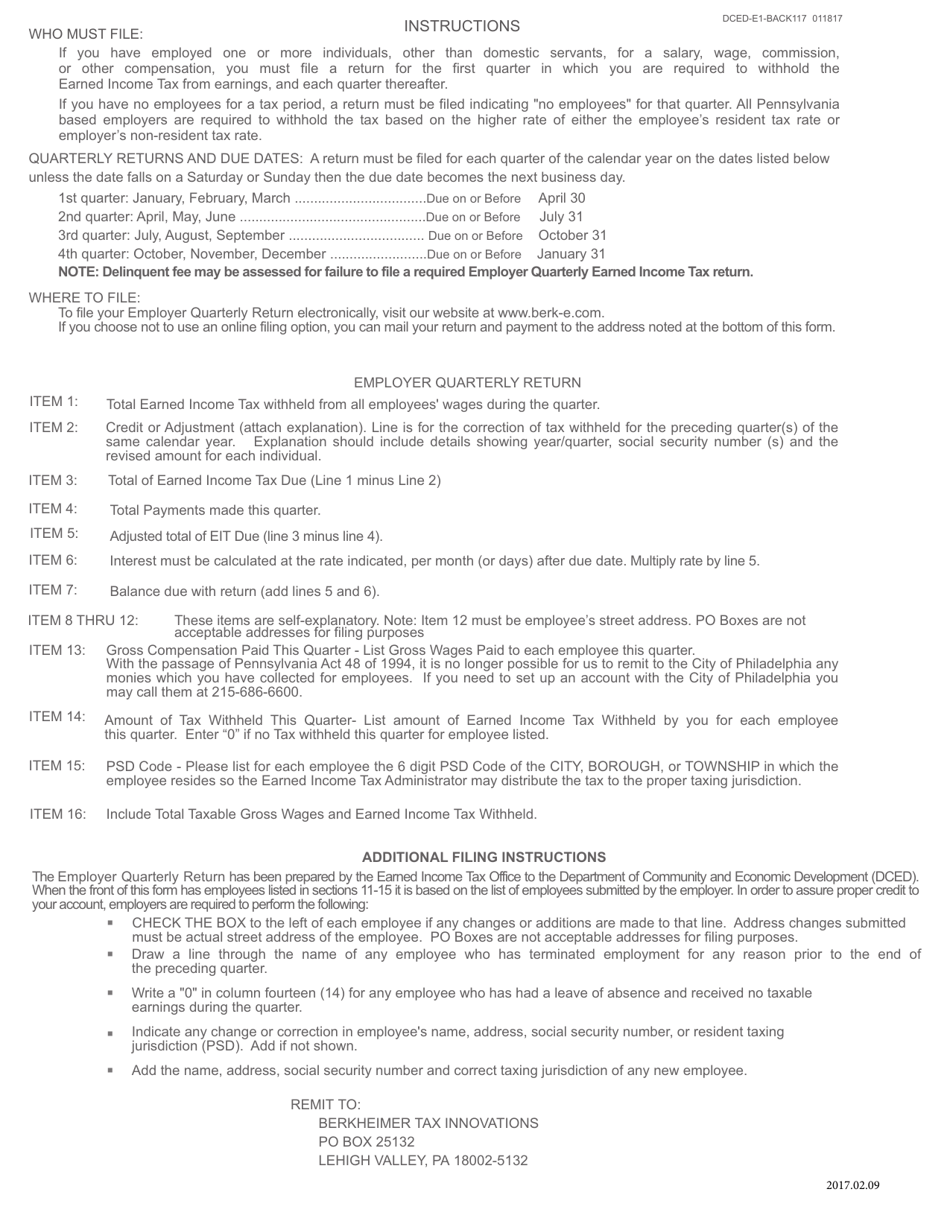

A: Employers in Pennsylvania are required to file Form DCEDE11 if they withhold local earned income tax from their employees.

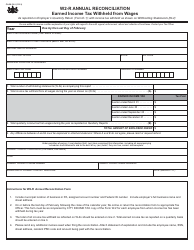

Q: What is the purpose of Form DCEDE11?

A: The purpose of Form DCEDE11 is to report and remit the local earned income tax withheld from employees' wages.

Q: How often should Form DCEDE11 be filed?

A: Form DCEDE11 should be filed quarterly by employers in Pennsylvania.

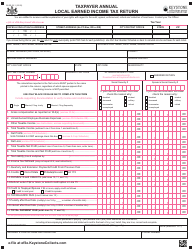

Q: Are there any penalties for not filing Form DCEDE11?

A: Yes, there may be penalties for not filing Form DCEDE11 or for filing it late. It is important to file the form on time to avoid penalties.

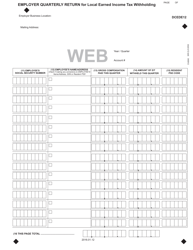

Q: What information is required to complete Form DCEDE11?

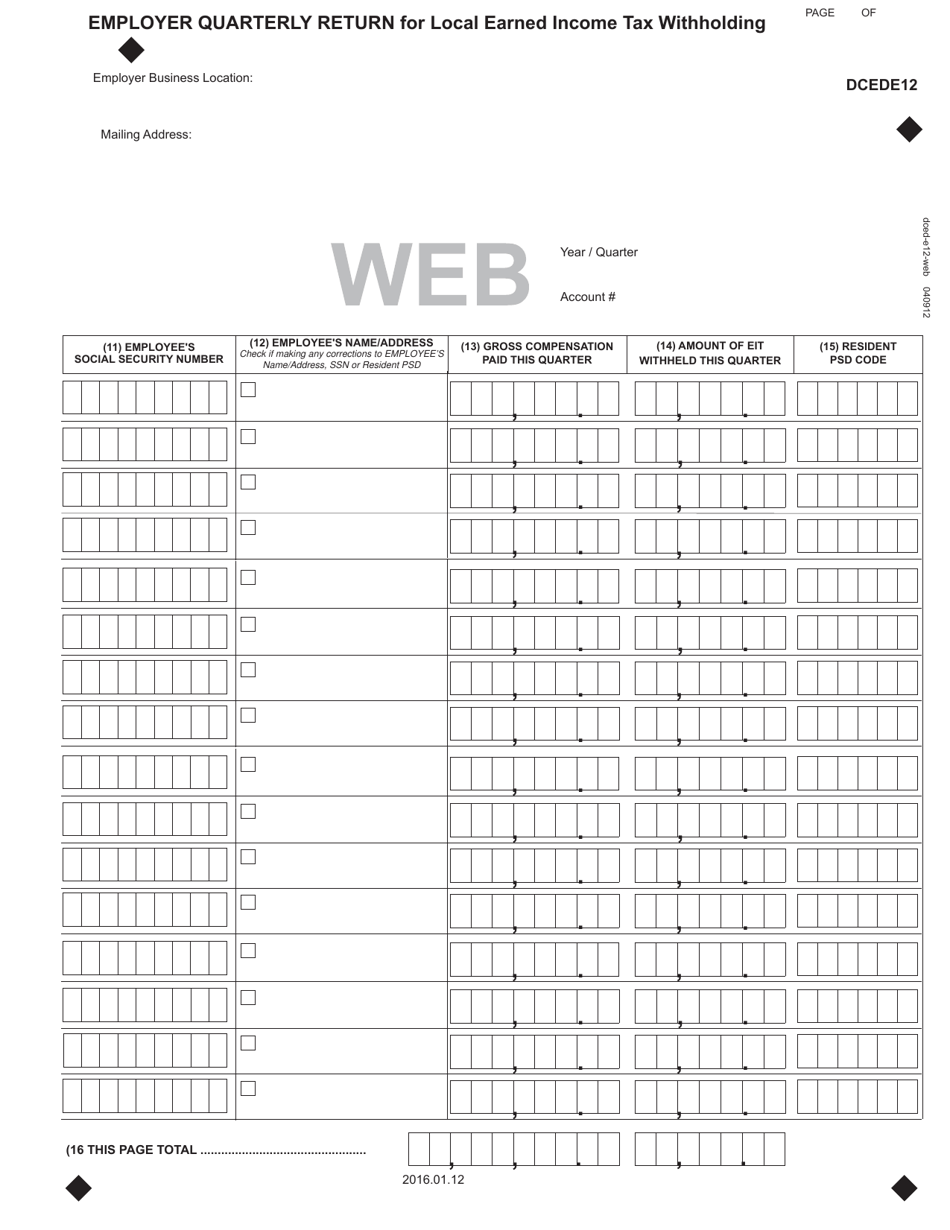

A: Some of the information required to complete Form DCEDE11 includes the employer's name and contact information, employee information, and the amount of local earned income tax withheld.

Q: Can Form DCEDE11 be filed electronically?

A: Yes, Form DCEDE11 can be filed electronically through the Pennsylvania Department of Revenue's e-filing system.

Q: Is Form DCEDE11 only for employers in Pennsylvania?

A: Yes, Form DCEDE11 is specifically for employers in Pennsylvania who withhold local earned income tax.

Q: Is there a deadline for filing Form DCEDE11?

A: Yes, Form DCEDE11 must be filed by the last day of the month following the end of each quarter (e.g., April 30 for the first quarter).

Form Details:

- Released on February 9, 2017;

- The latest edition provided by the Berkheimer Tax Administrator;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DCEDE11 by clicking the link below or browse more documents and templates provided by the Berkheimer Tax Administrator.