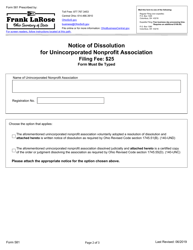

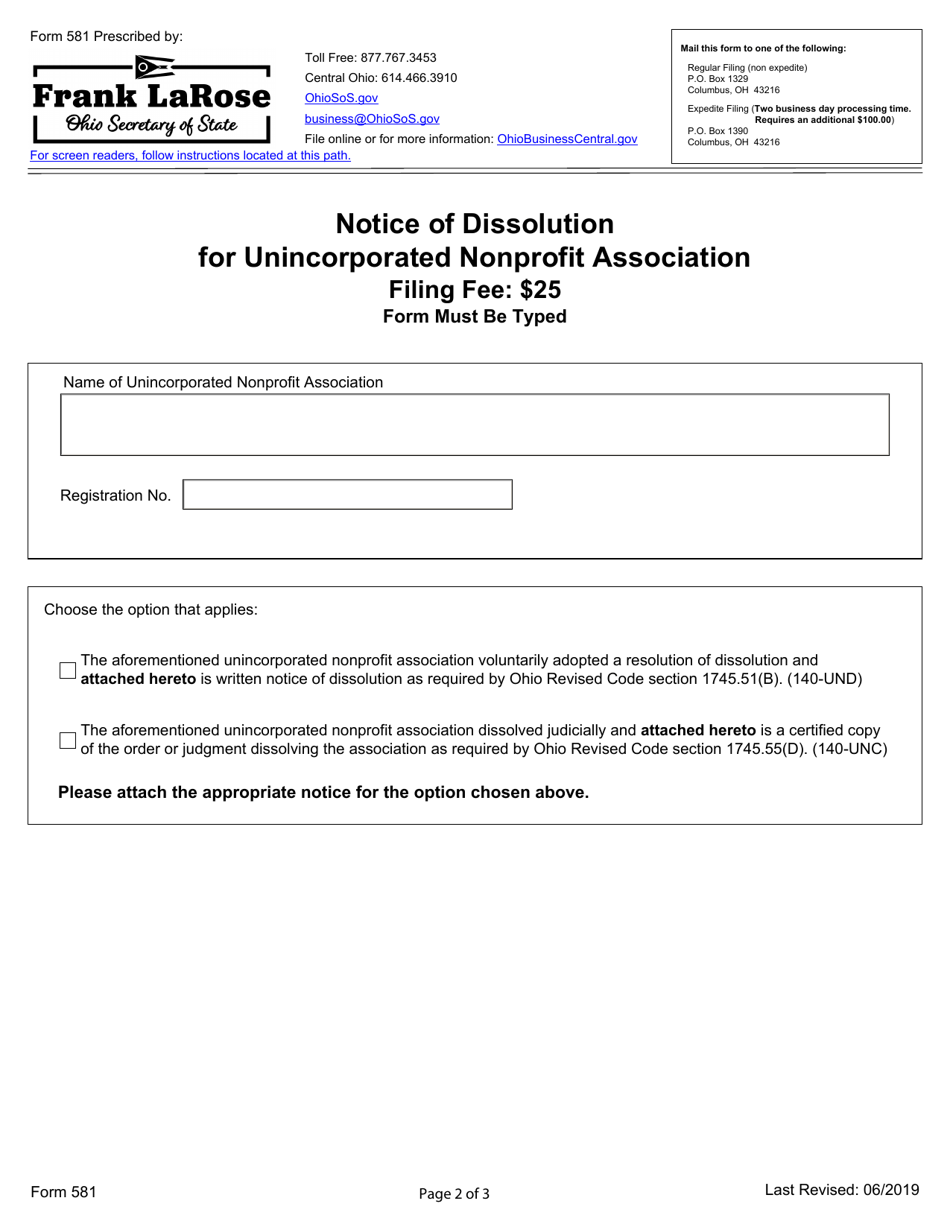

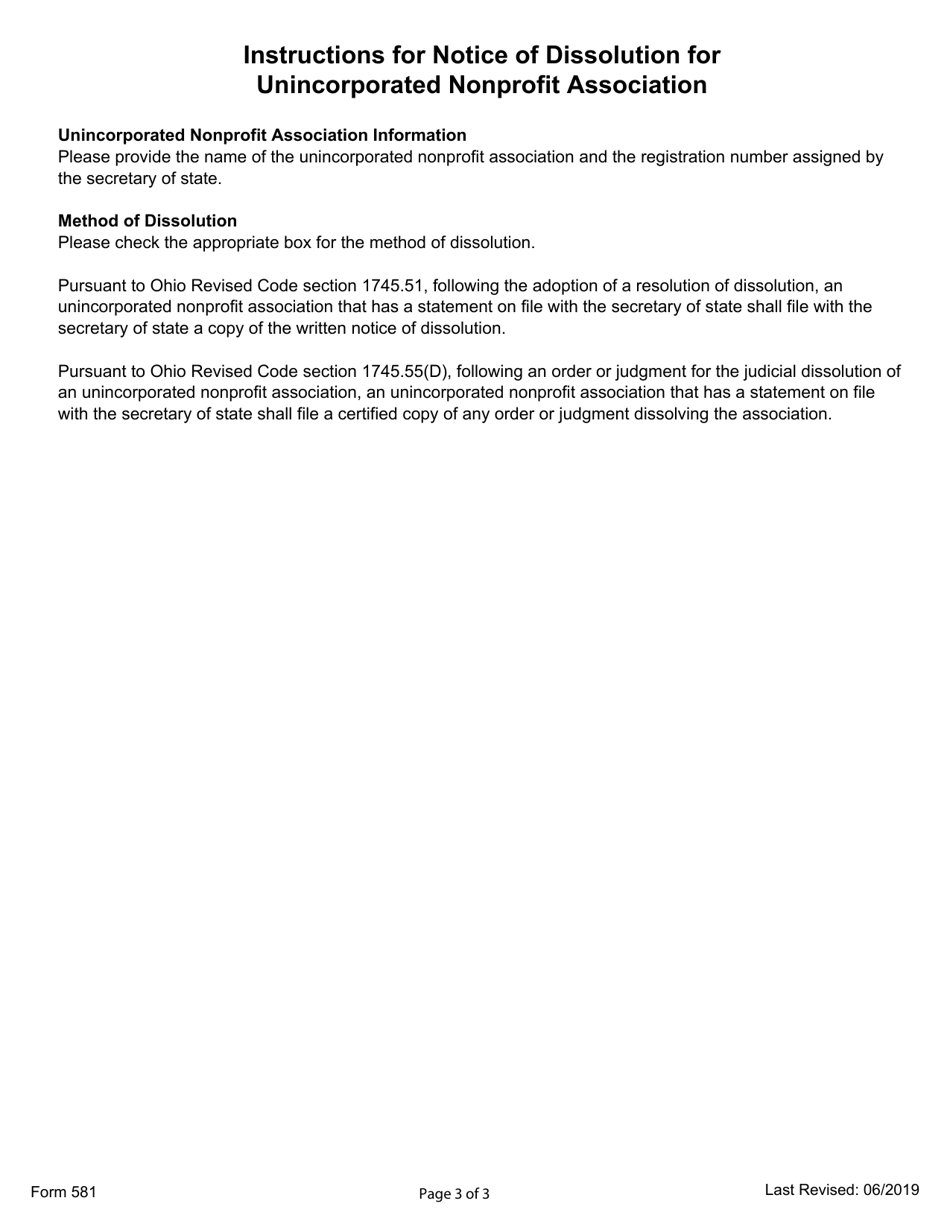

Form 581 Notice of Dissolution for Unincorporated Nonprofit Association - Ohio

What Is Form 581?

This is a legal form that was released by the Ohio Secretary of State - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 581?

A: Form 581 is a Notice of Dissolution for Unincorporated Nonprofit Association in Ohio.

Q: What is an unincorporated nonprofit association?

A: An unincorporated nonprofit association is a group of individuals or organizations that come together for a common nonprofit purpose.

Q: Why would an unincorporated nonprofit association need to file Form 581?

A: An unincorporated nonprofit association needs to file Form 581 to notify the state of Ohio that it is dissolving and ceasing its operations.

Q: Who can file Form 581?

A: Form 581 can be filed by a representative of the unincorporated nonprofit association or by an attorney authorized to act on their behalf.

Q: What information is required on Form 581?

A: Form 581 requires information such as the name of the association, its principal office address, the date of dissolution, and the name and address of the person filing the form.

Q: Are there any other requirements or forms that need to be filed when dissolving an unincorporated nonprofit association?

A: It is recommended to consult with an attorney or the Ohio Secretary of State's office for any additional requirements or forms that may need to be filed.

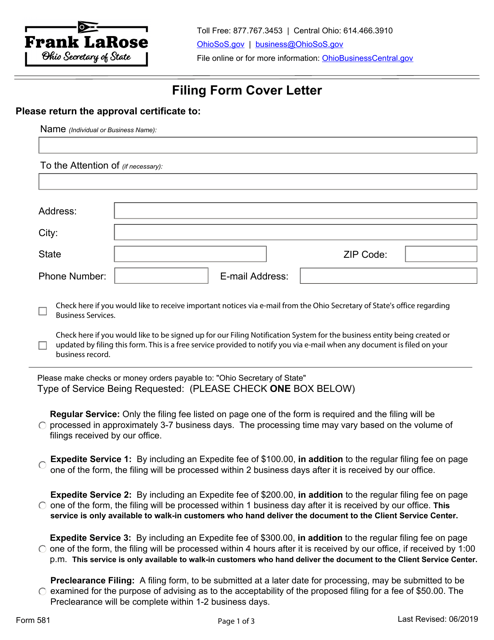

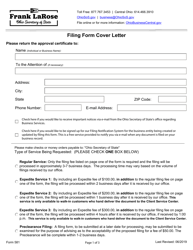

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Ohio Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 581 by clicking the link below or browse more documents and templates provided by the Ohio Secretary of State.