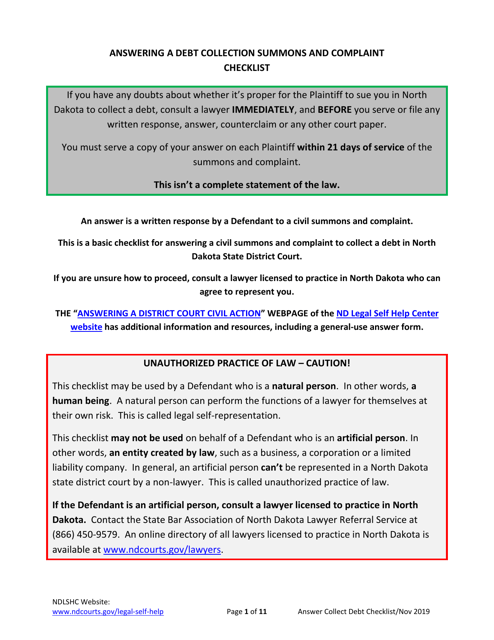

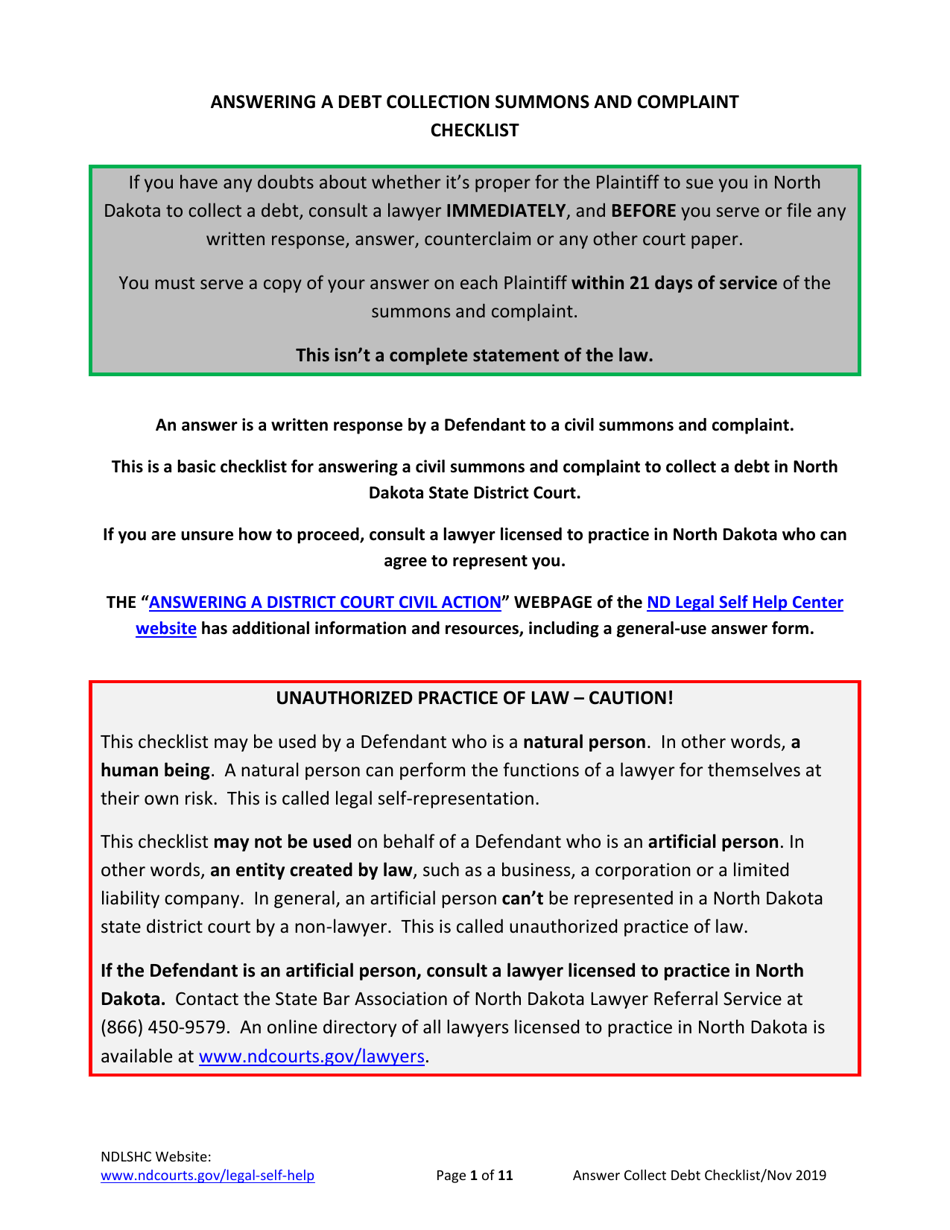

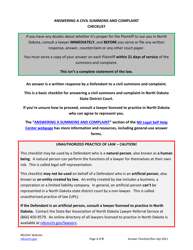

Answering a Debt Collection Summons and Complaint - Checklist - North Dakota

Answering a Debt Collection Summons and Complaint - Checklist is a legal document that was released by the North Dakota Courts - a government authority operating within North Dakota.

FAQ

Q: What is a debt collection summons and complaint?

A: A debt collection summons and complaint is a legal document that initiates a lawsuit against you for the repayment of a debt.

Q: What should I do if I receive a debt collection summons and complaint?

A: You should read the document carefully and respond within the specified time frame to avoid a default judgment.

Q: How do I respond to a debt collection summons and complaint in North Dakota?

A: You can respond by filing an answer with the court, which outlines your position and any defenses you may have.

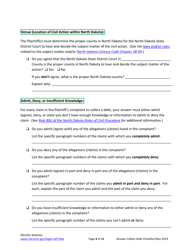

Q: What should I include in my answer to a debt collection summons and complaint?

A: Your answer should address each allegation made in the summons and complaint and present any relevant defenses or counterclaims.

Q: Do I need an attorney to respond to a debt collection summons and complaint?

A: While it's not required, having an attorney can provide valuable legal advice and assistance throughout the process.

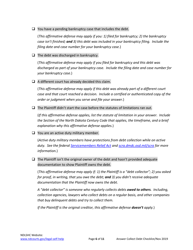

Q: What happens if I don't respond to a debt collection summons and complaint?

A: If you don't respond, the court may enter a default judgment against you, which can result in wage garnishment or bank account seizure.

Q: Can I negotiate a settlement with the debt collector?

A: Yes, you can negotiate a settlement with the debt collector to resolve the debt outside of court.

Q: What should I do if I believe the debt is not valid?

A: If you believe the debt is not valid, you can dispute it by sending a written request for validation to the debt collector.

Q: Can I challenge the debt collector's standing to sue me?

A: Yes, you can challenge the debt collector's standing to sue you if they cannot provide sufficient evidence of their ownership of the debt.

Q: What is the statute of limitations for debt collection in North Dakota?

A: The statute of limitations for debt collection in North Dakota is six years for most types of debts.

Form Details:

- Released on November 1, 2019;

- The latest edition currently provided by the North Dakota Courts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the North Dakota Courts.