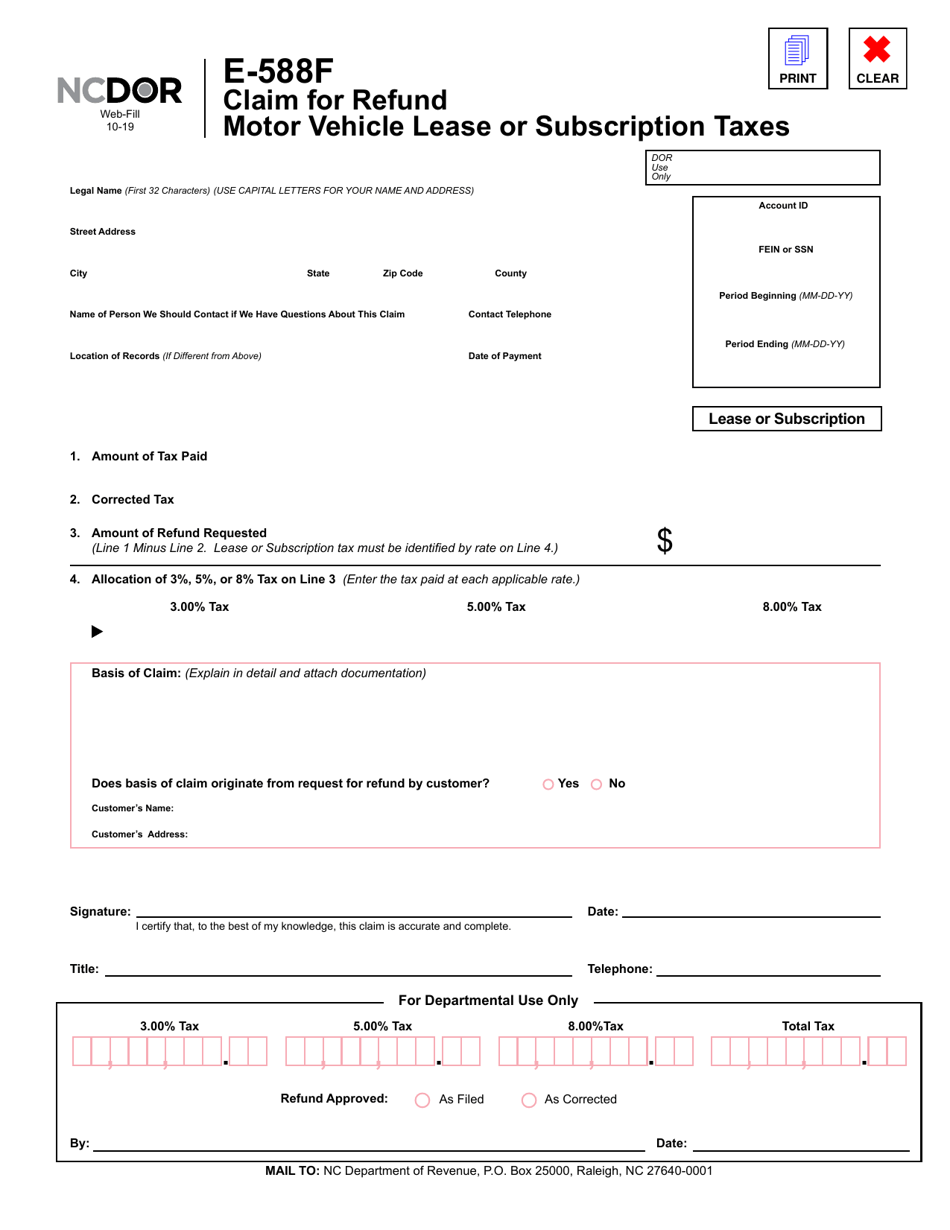

Form E-588F Claim for Refund Motor Vehicle Lease or Subscription Taxes - North Carolina

What Is Form E-588F?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

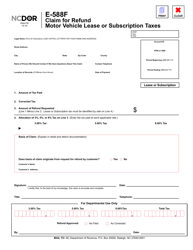

Q: What is Form E-588F?

A: Form E-588F is a claim for refund for motor vehicle lease or subscription taxes in North Carolina.

Q: Who can use Form E-588F?

A: Form E-588F can be used by individuals or businesses who have paid motor vehicle lease or subscription taxes in North Carolina.

Q: What does Form E-588F cover?

A: Form E-588F covers refund claims for motor vehicle lease or subscription taxes paid in North Carolina.

Q: What information is required on Form E-588F?

A: Form E-588F requires information such as the taxpayer's name, address, vehicle details, and supporting documents.

Q: What is the deadline for filing Form E-588F?

A: The deadline for filing Form E-588F is within three years from the due date of the original tax payment.

Q: How long does it take to process Form E-588F?

A: The processing time for Form E-588F varies, but it generally takes 4-6 weeks for a refund to be issued.

Q: Are there any fees associated with filing Form E-588F?

A: No, there are no fees associated with filing Form E-588F.

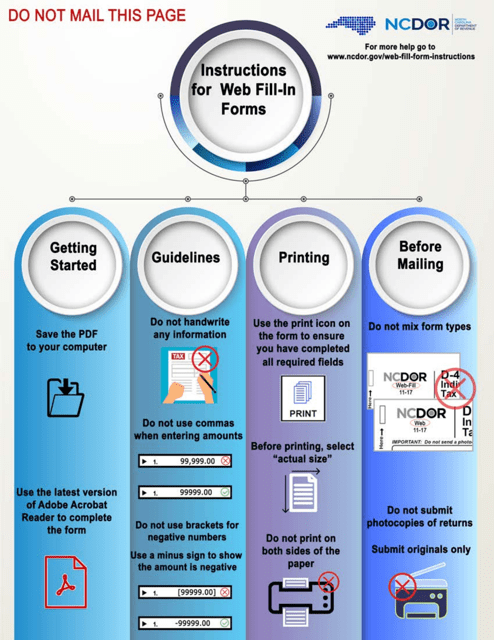

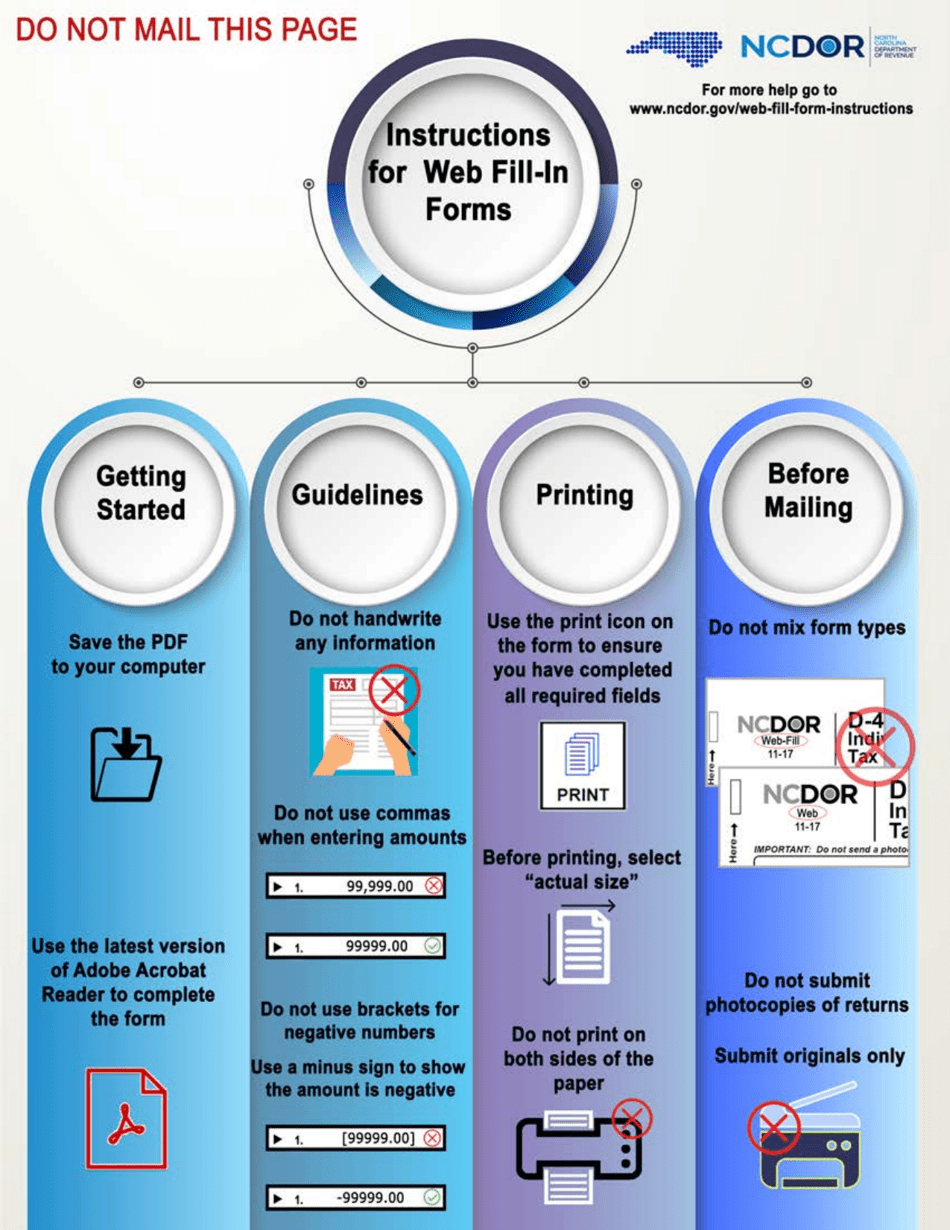

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form E-588F by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.