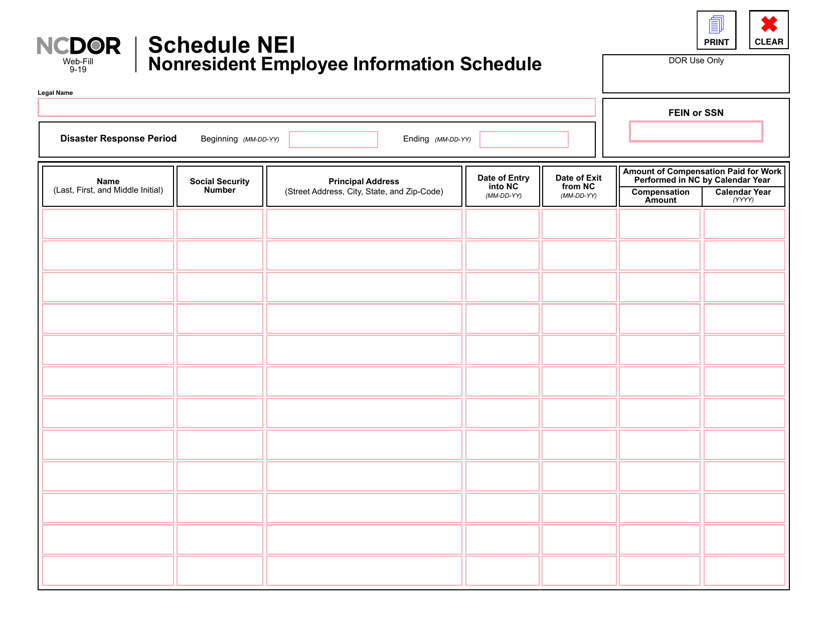

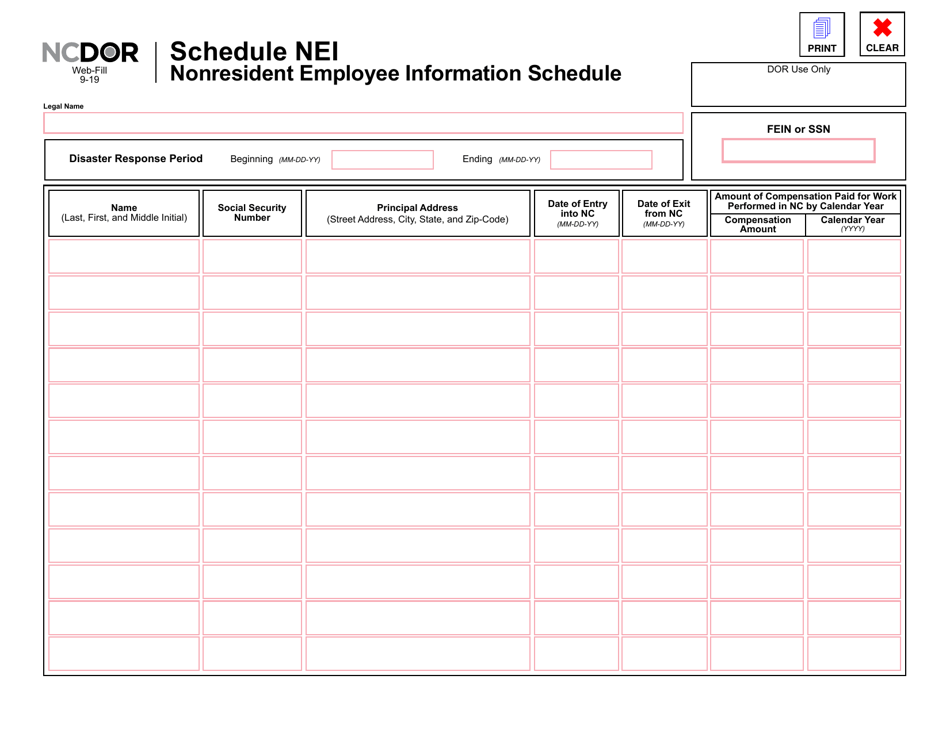

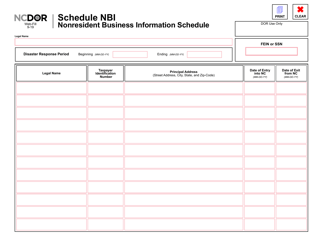

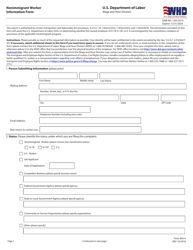

Schedule NEI Nonresident Employee Information Schedule - North Carolina

What Is Schedule NEI?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule NEI?

A: Schedule NEI is the Nonresident Employee Information Schedule.

Q: Who needs to file Schedule NEI?

A: North Carolina nonresident employees who work in North Carolina but live in another state need to file Schedule NEI.

Q: What information is required on Schedule NEI?

A: Schedule NEI requires information about the nonresident employee, including their name, address, employer's name and address, wages earned in North Carolina, and any taxes withheld.

Q: When is Schedule NEI due?

A: Schedule NEI is due on the same date as the employee's North Carolina income tax return, which is typically April 15th.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule NEI by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.