This version of the form is not currently in use and is provided for reference only. Download this version of

Form NC-478L

for the current year.

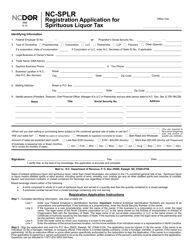

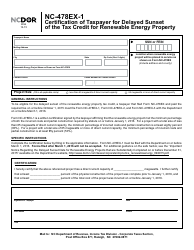

Form NC-478L Tax Credit for Investing in Real Property - North Carolina

What Is Form NC-478L?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form NC-478L?

A: Form NC-478L is a tax form specifically designed for individuals or entities in North Carolina who have invested in real property and are eligible for a tax credit.

Q: What is the purpose of Form NC-478L?

A: The purpose of Form NC-478L is to report and claim any tax credits that you may be eligible for as a result of investing in real property in North Carolina.

Q: Who is eligible to use Form NC-478L?

A: Individuals or entities who have made qualified investments in real property in North Carolina may be eligible to use Form NC-478L to claim tax credits.

Q: What type of tax credit does Form NC-478L provide?

A: Form NC-478L provides a tax credit for investments made in real property in North Carolina, specifically targeted towards low-income housing projects.

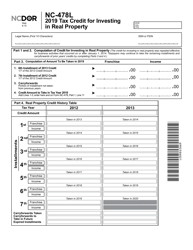

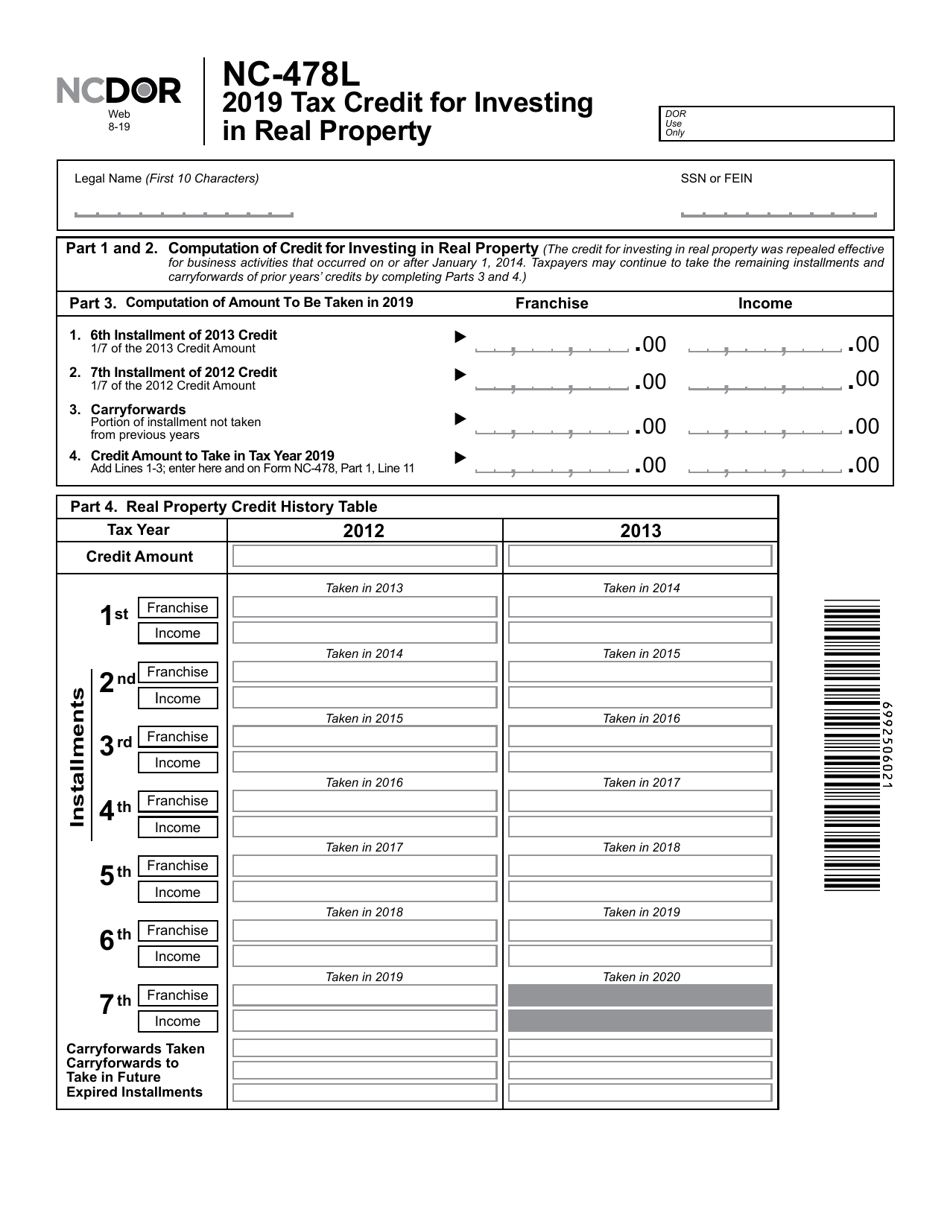

Q: How do I fill out Form NC-478L?

A: To fill out Form NC-478L, you will need to provide information such as your name, address, investment details, and other required information. The form also requires supporting documentation to be attached.

Q: When is the deadline to file Form NC-478L?

A: The deadline to file Form NC-478L is typically the same as the deadline for filing your North Carolina state tax return, which is April 15th of each year.

Q: What should I do if I have questions or need assistance with Form NC-478L?

A: If you have questions or need assistance with Form NC-478L, you should reach out to the North Carolina Department of Revenue or consult with a tax professional.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the North Carolina Department of Revenue;

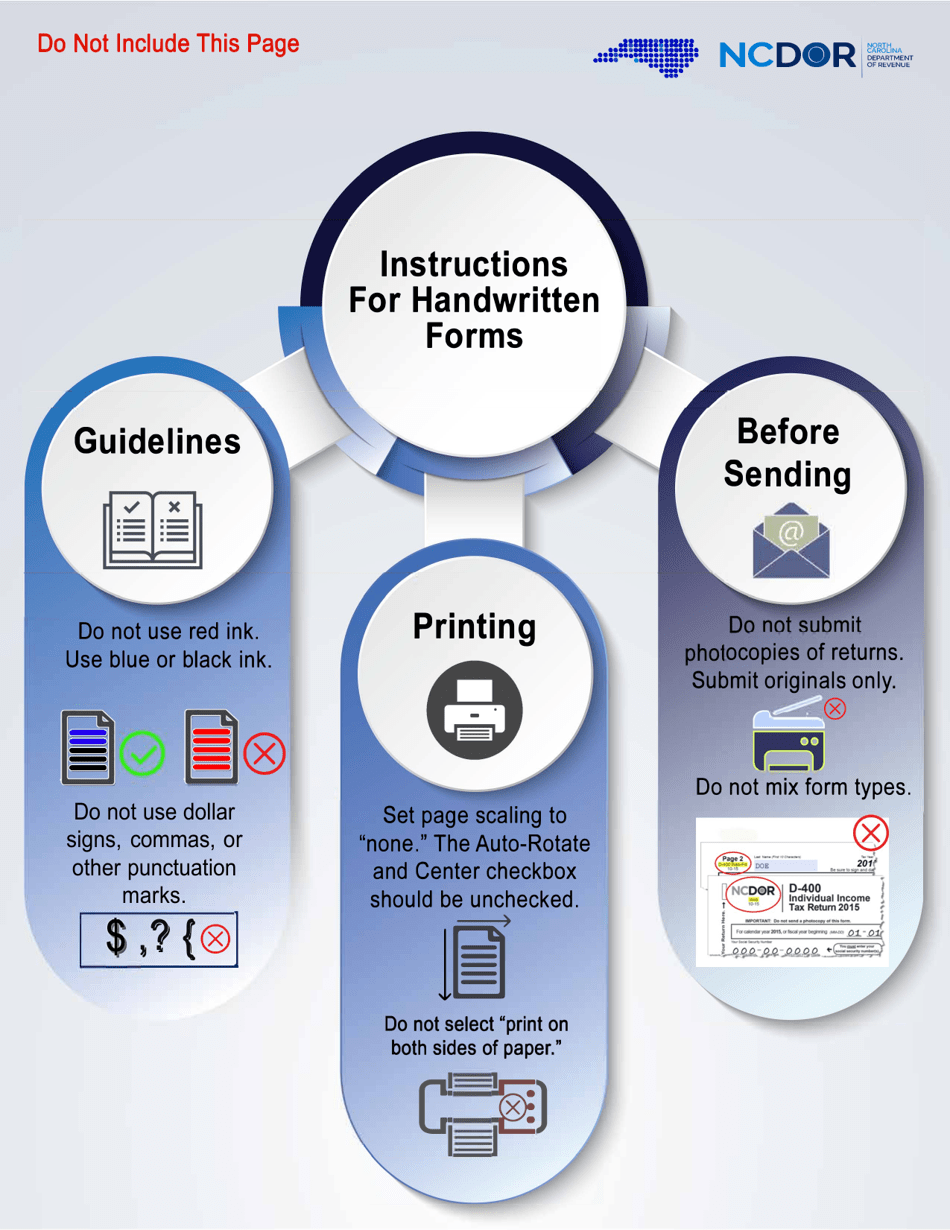

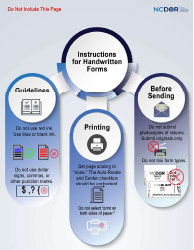

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NC-478L by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.