This version of the form is not currently in use and is provided for reference only. Download this version of

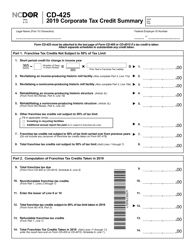

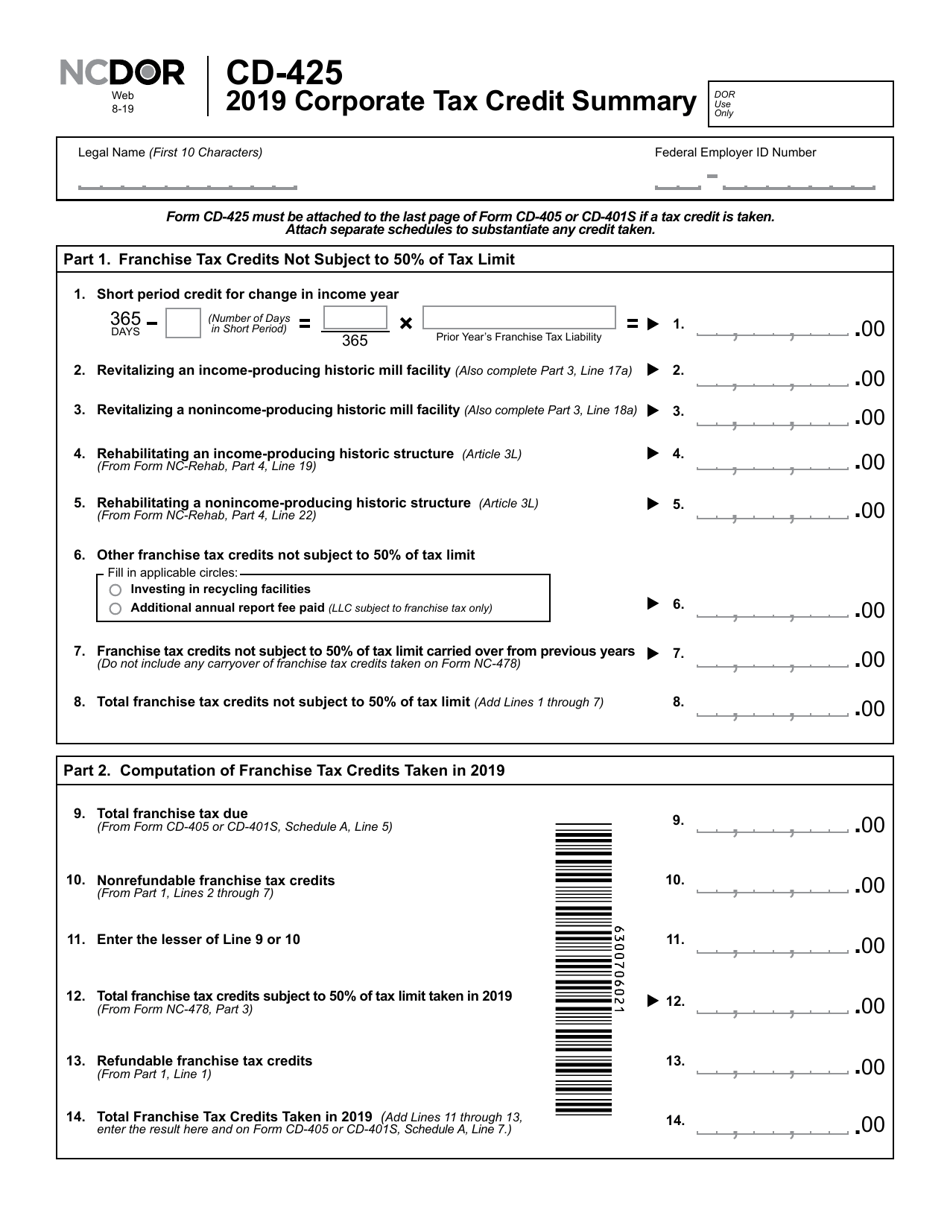

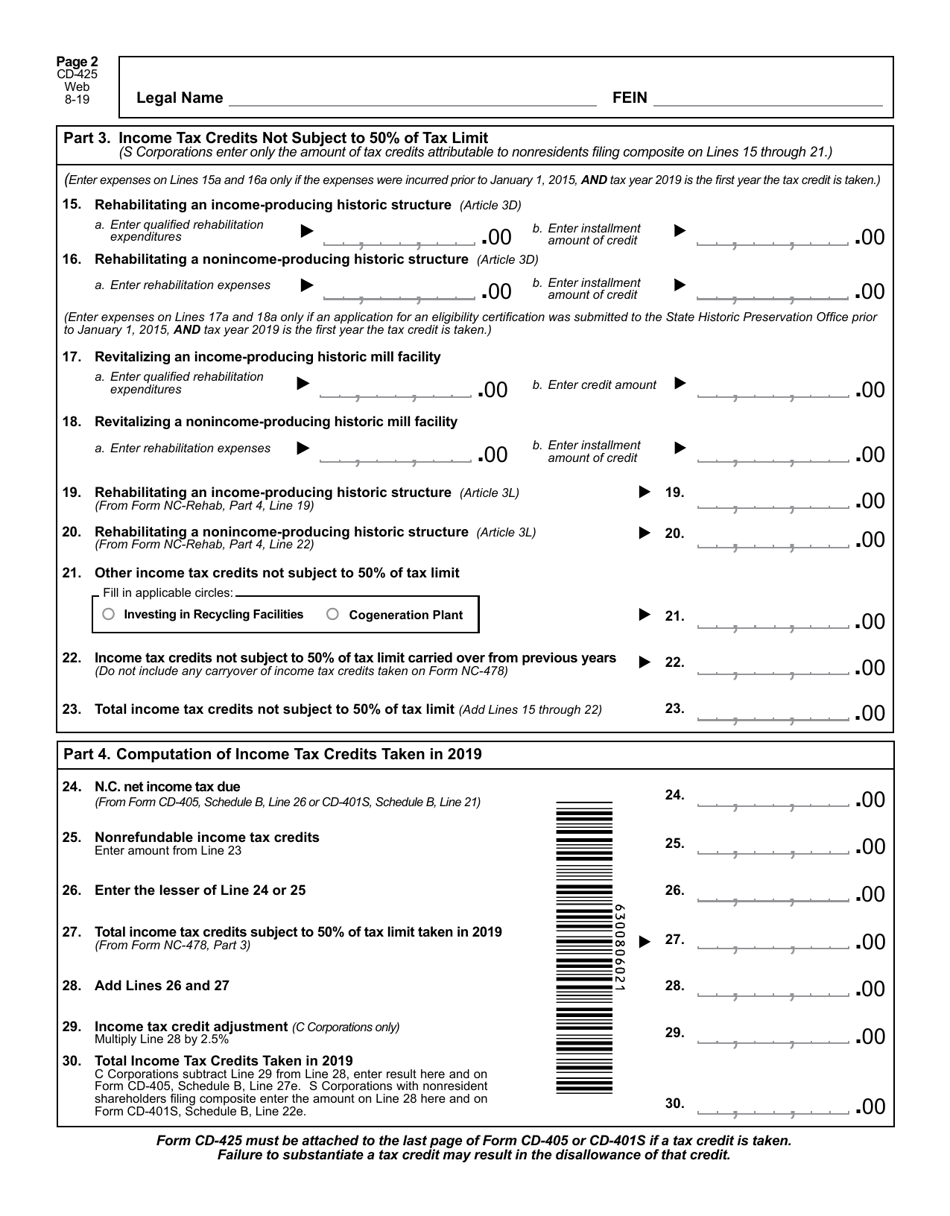

Form CD-425

for the current year.

Form CD-425 Corporate Tax Credit Summary - North Carolina

What Is Form CD-425?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CD-425?

A: Form CD-425 is the Corporate Tax Credit Summary for North Carolina.

Q: Who needs to file Form CD-425?

A: Corporate taxpayers in North Carolina need to file Form CD-425.

Q: What is the purpose of Form CD-425?

A: Form CD-425 is used to summarize corporate tax credits in North Carolina.

Q: When is the deadline to file Form CD-425?

A: The deadline to file Form CD-425 is the same as the corporate tax returnfiling deadline in North Carolina.

Q: Are there any penalties for late filing of Form CD-425?

A: Yes, there may be penalties for late filing of Form CD-425. It is important to file it on time.

Q: Are there any instructions for completing Form CD-425?

A: Yes, detailed instructions for completing Form CD-425 are provided on the form itself.

Q: Can I file Form CD-425 electronically?

A: Yes, you can file Form CD-425 electronically if you use the North Carolina e-File system.

Q: What should I do if I have questions about Form CD-425?

A: If you have questions about Form CD-425, you can contact the North Carolina Department of Revenue for assistance.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CD-425 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.