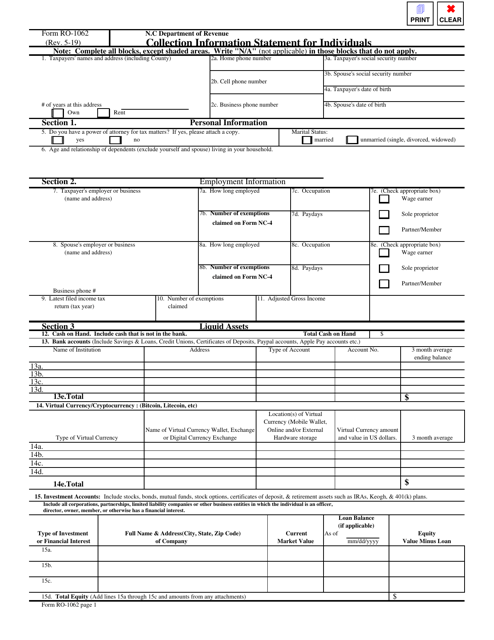

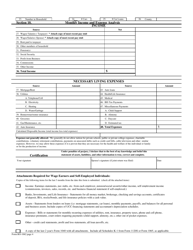

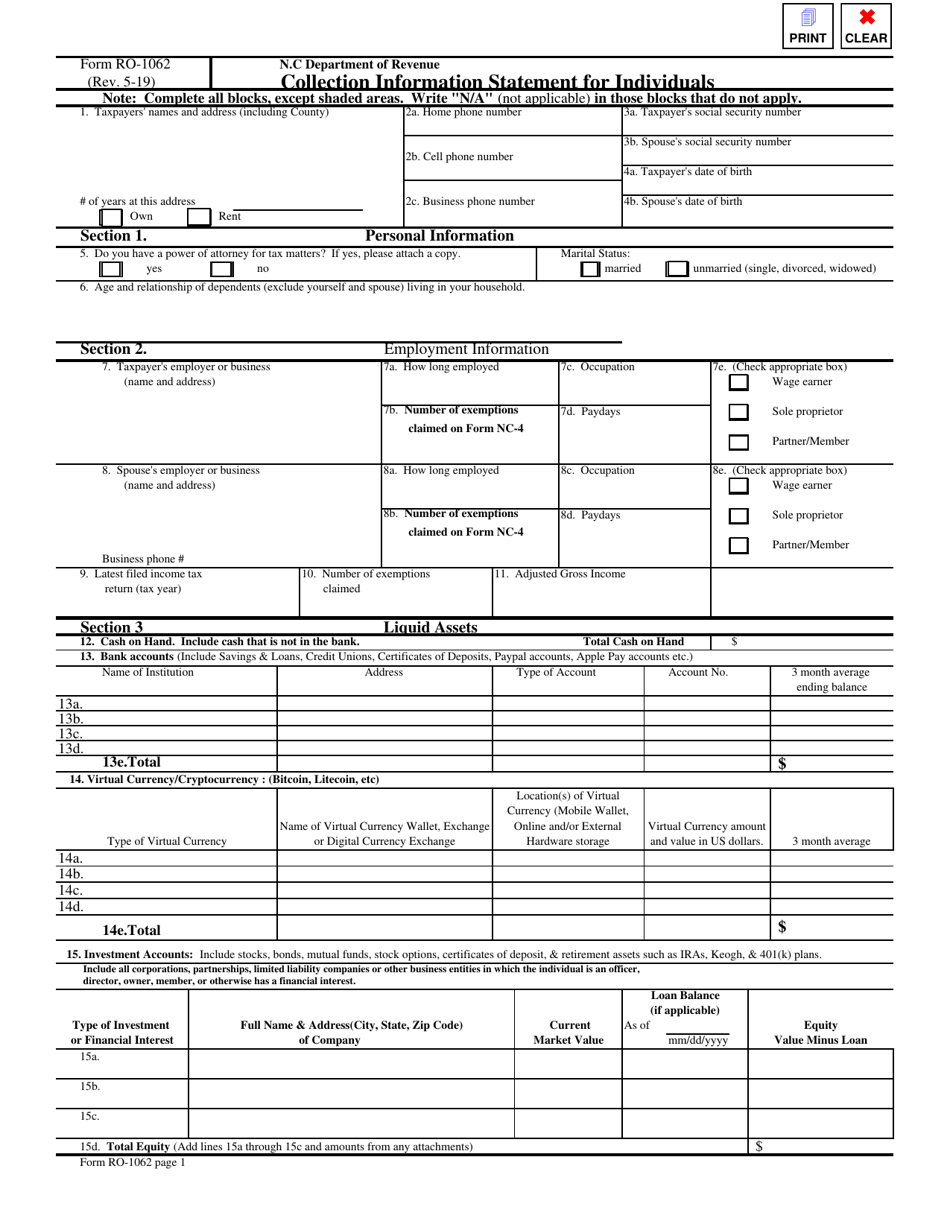

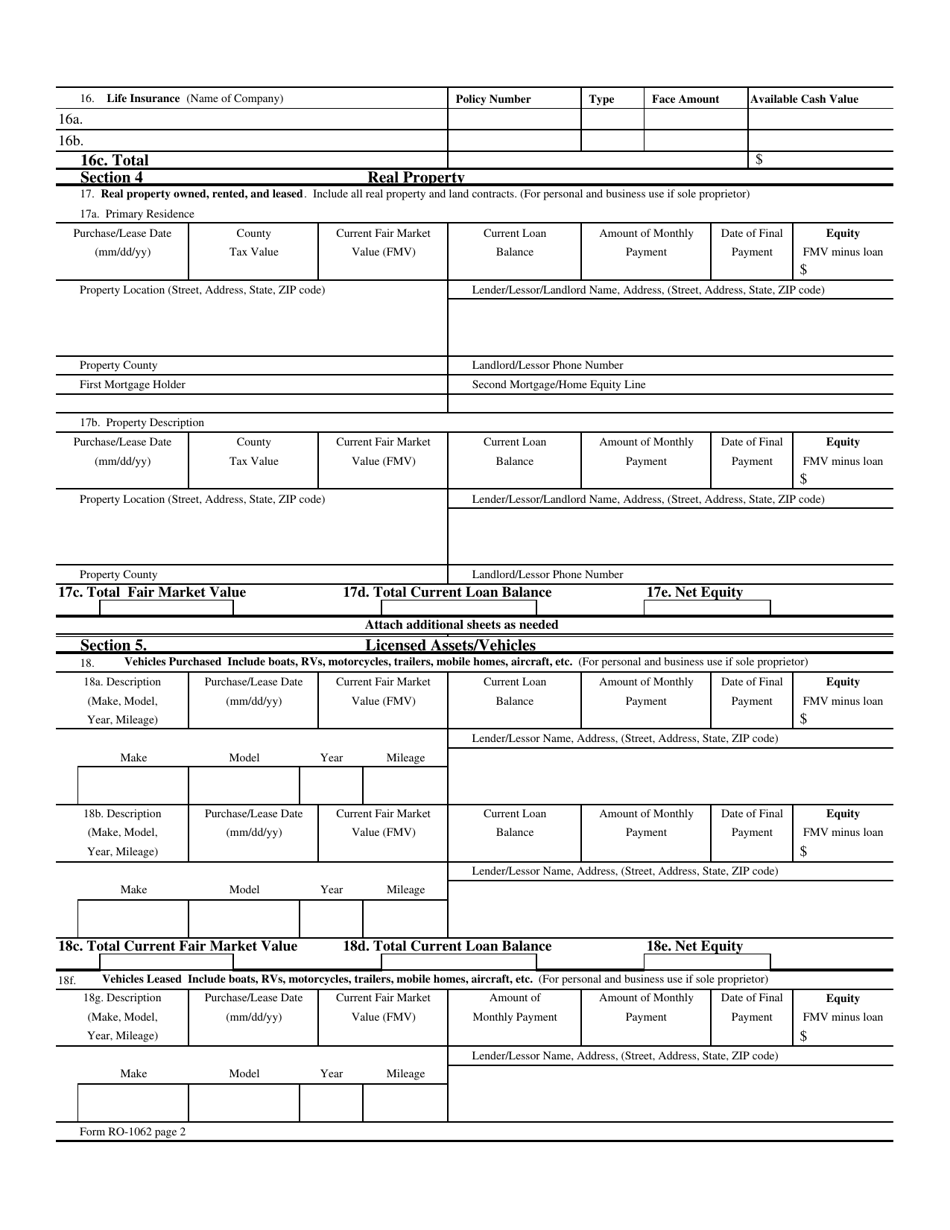

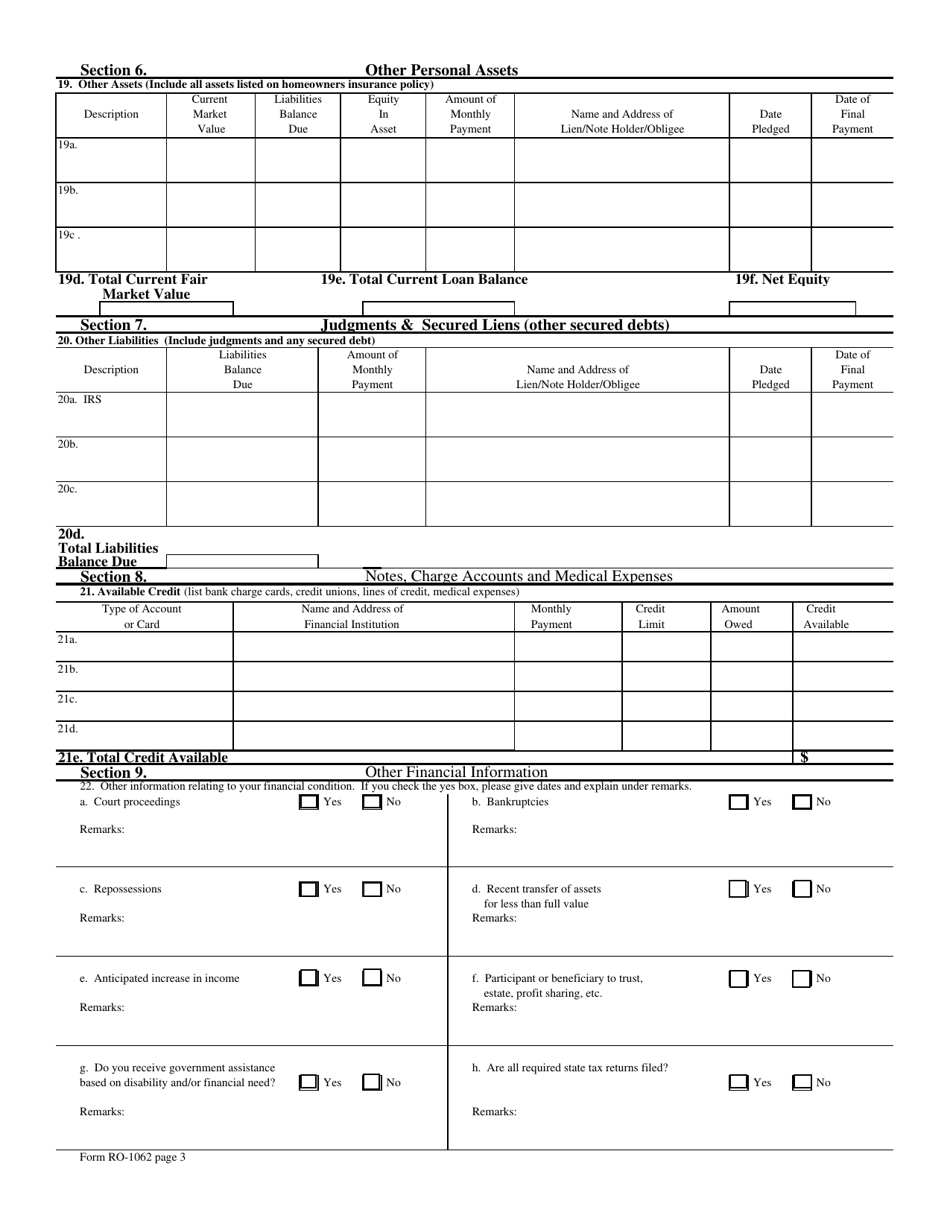

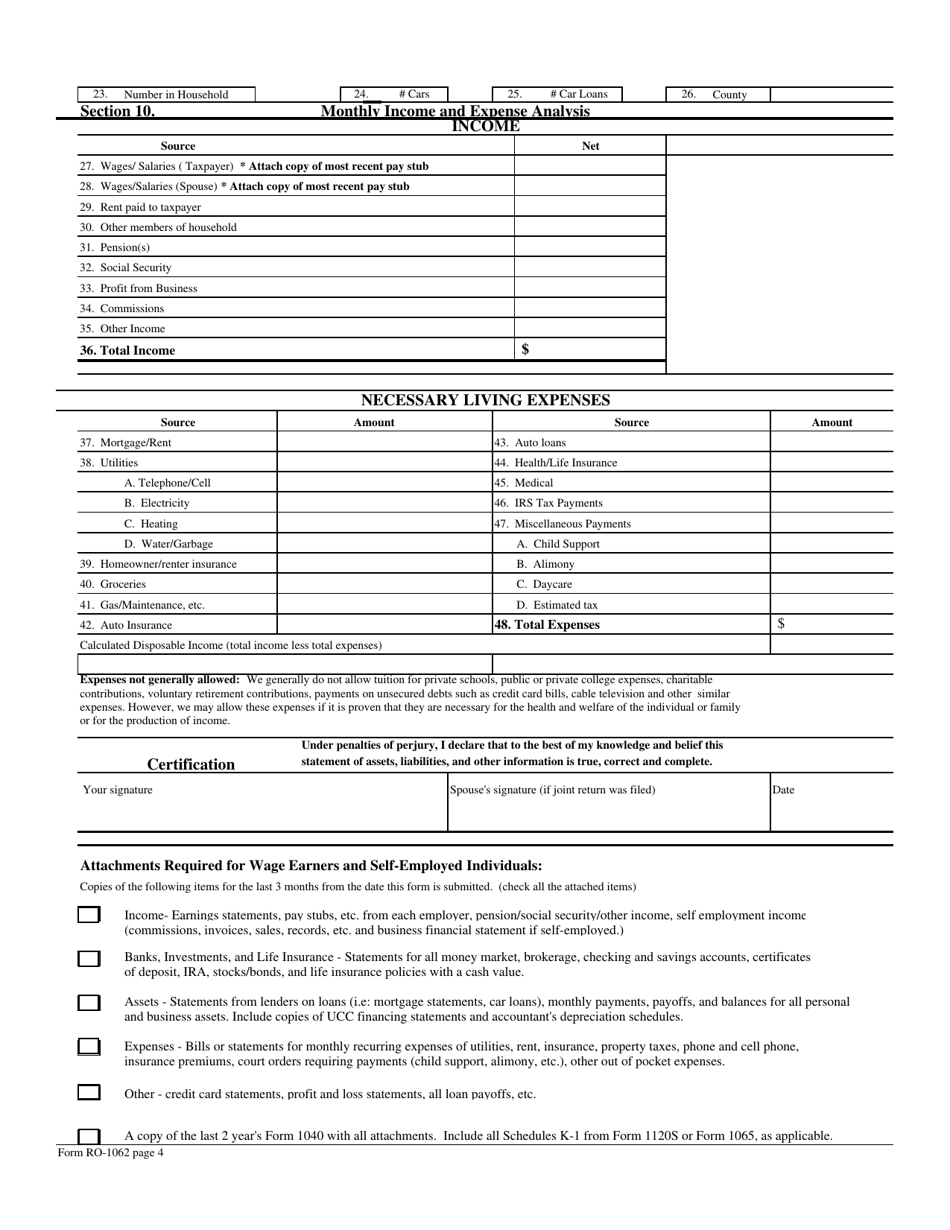

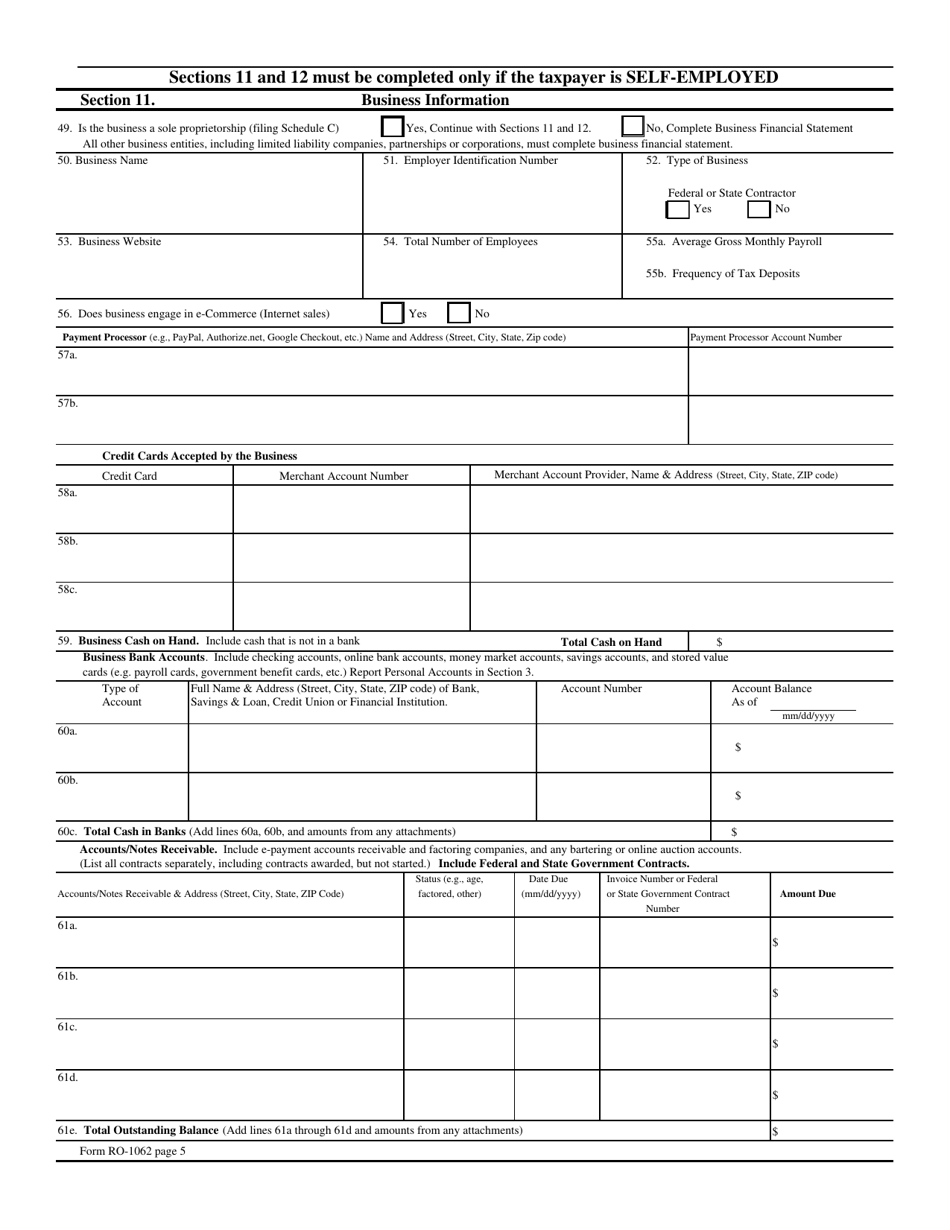

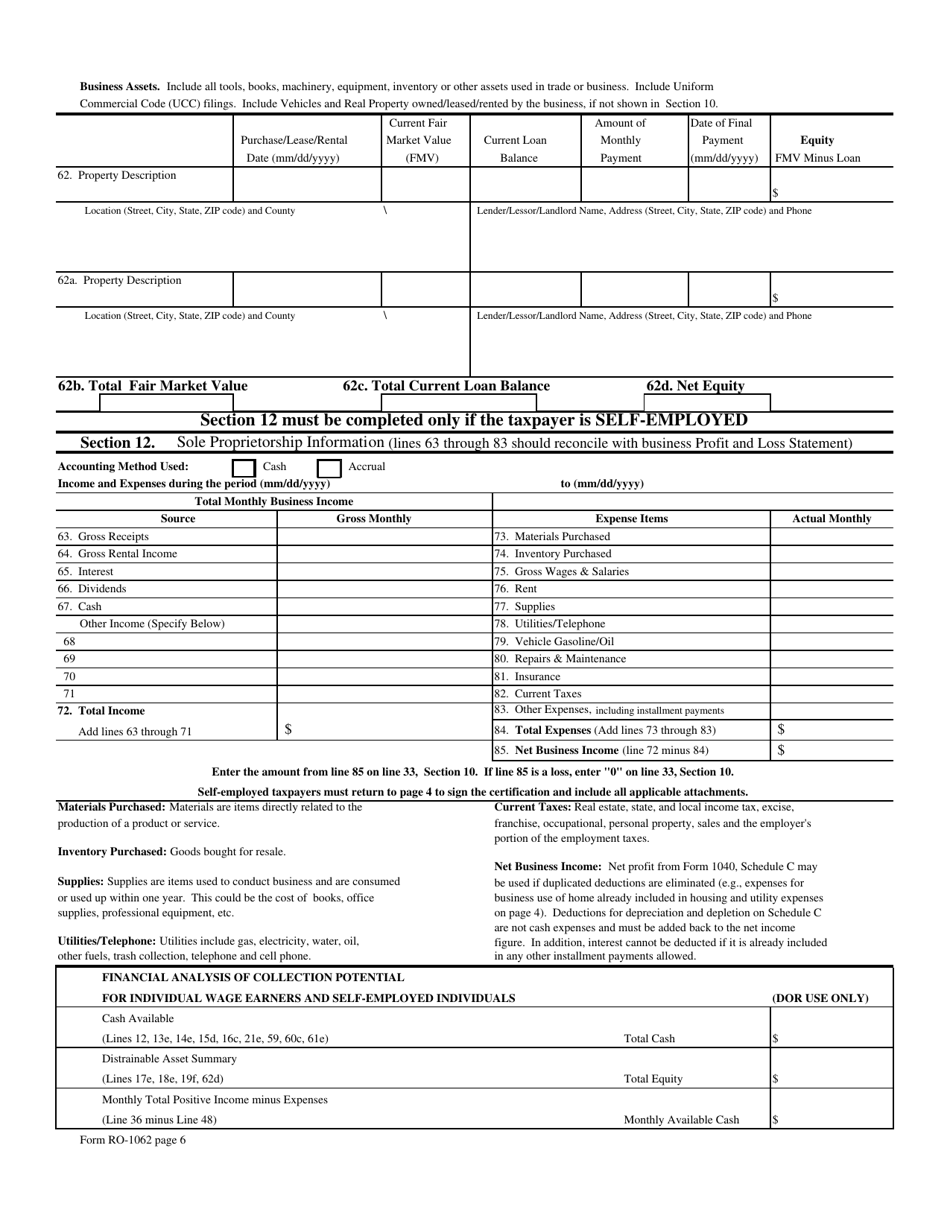

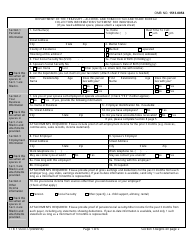

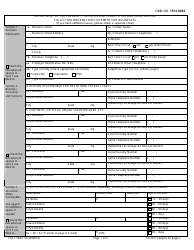

Form RO-1062 Collection Information Statement for Individuals - North Carolina

What Is Form RO-1062?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RO-1062?

A: Form RO-1062 is the Collection Information Statement for Individuals.

Q: Who is required to complete Form RO-1062?

A: Individuals in North Carolina who owe taxes and are subject to collection actions may be required to complete this form.

Q: What is the purpose of Form RO-1062?

A: The purpose of Form RO-1062 is to provide detailed financial information to the North Carolina Department of Revenue for the assessment of an individual's ability to pay their outstanding tax liability.

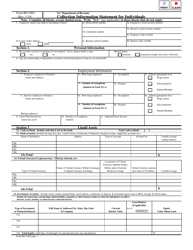

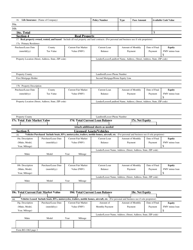

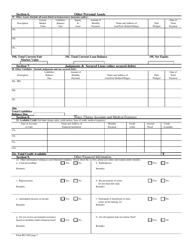

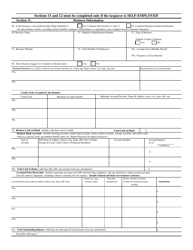

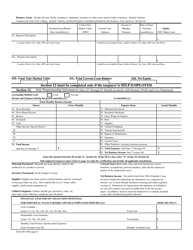

Q: What information is required on Form RO-1062?

A: Form RO-1062 requires information about the individual's income, assets, expenses, liabilities, and other financial details.

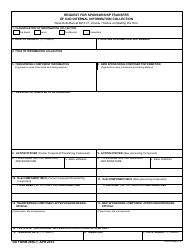

Q: Is Form RO-1062 confidential?

A: Yes, the information provided on Form RO-1062 is confidential and protected by law.

Q: What happens after I submit Form RO-1062?

A: After submitting Form RO-1062, the North Carolina Department of Revenue will review the information provided to determine the individual's ability to pay their tax liability and may take appropriate collection actions.

Q: Can I request an installment payment plan based on the information provided on Form RO-1062?

A: Yes, if you are unable to pay your tax liability in full, you may request an installment payment plan based on the financial information provided on Form RO-1062.

Q: What should I do if I have questions about completing Form RO-1062?

A: If you have questions about completing Form RO-1062, you should contact the North Carolina Department of Revenue for assistance.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RO-1062 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.