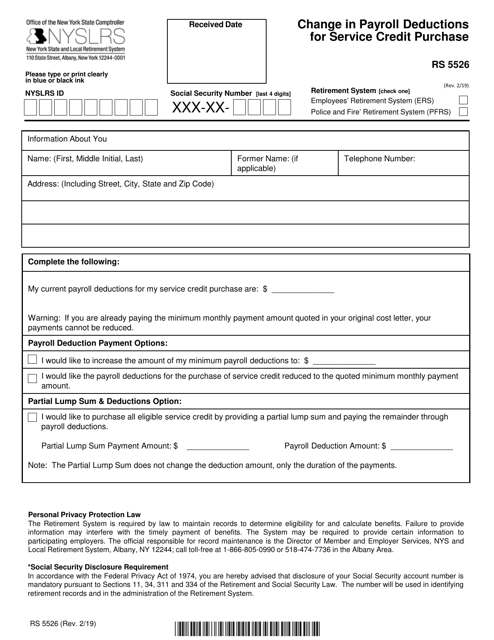

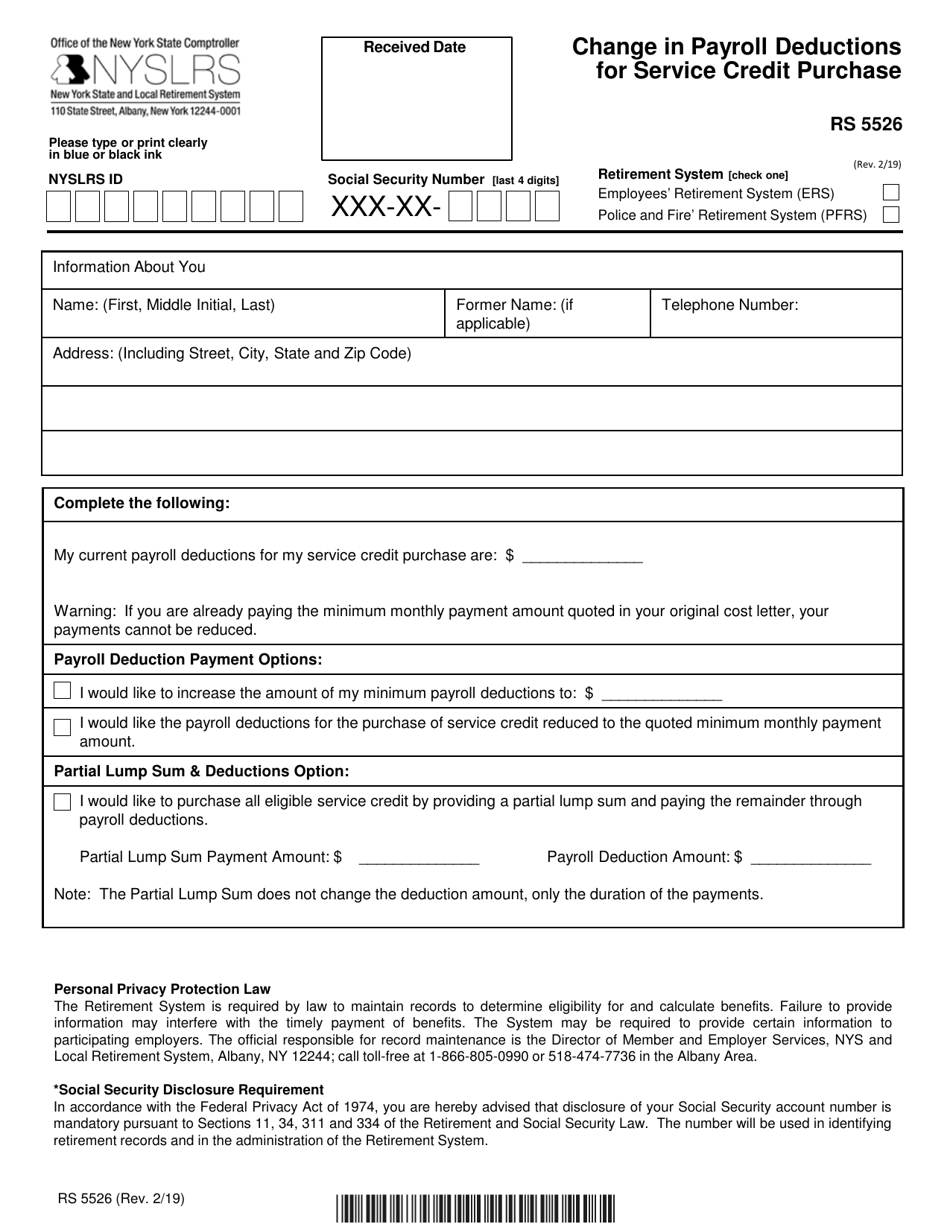

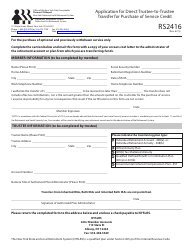

Form RS5526 Change in Payroll Deductions for Service Credit Purchase - New York

What Is Form RS5526?

This is a legal form that was released by the Office of the New York State Comptroller - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form RS5526?

A: Form RS5526 is used to request a change in payroll deductions for service credit purchase in New York.

Q: What is a service credit purchase?

A: A service credit purchase is a way for employees in New York to increase the amount of credited service towards their pension or retirement benefits.

Q: How do I use form RS5526?

A: To use form RS5526, you must fill out the necessary information regarding your payroll deductions for service credit purchase and submit it to the appropriate authority in New York.

Q: Can I change my payroll deductions for service credit purchase using this form?

A: Yes, you can request a change in your payroll deductions for service credit purchase by submitting form RS5526.

Form Details:

- Released on February 1, 2019;

- The latest edition provided by the Office of the New York State Comptroller;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RS5526 by clicking the link below or browse more documents and templates provided by the Office of the New York State Comptroller.