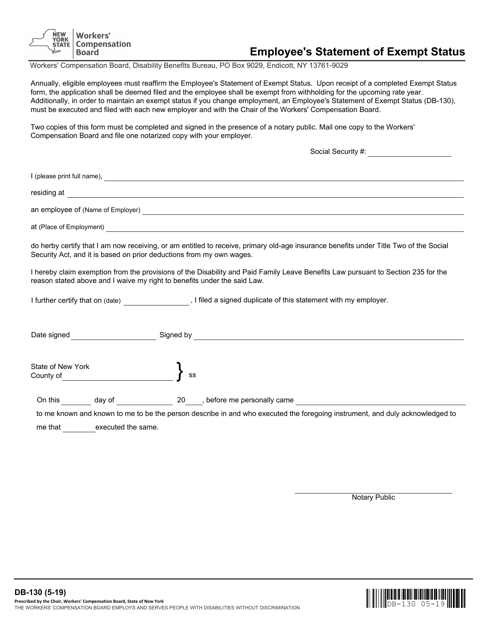

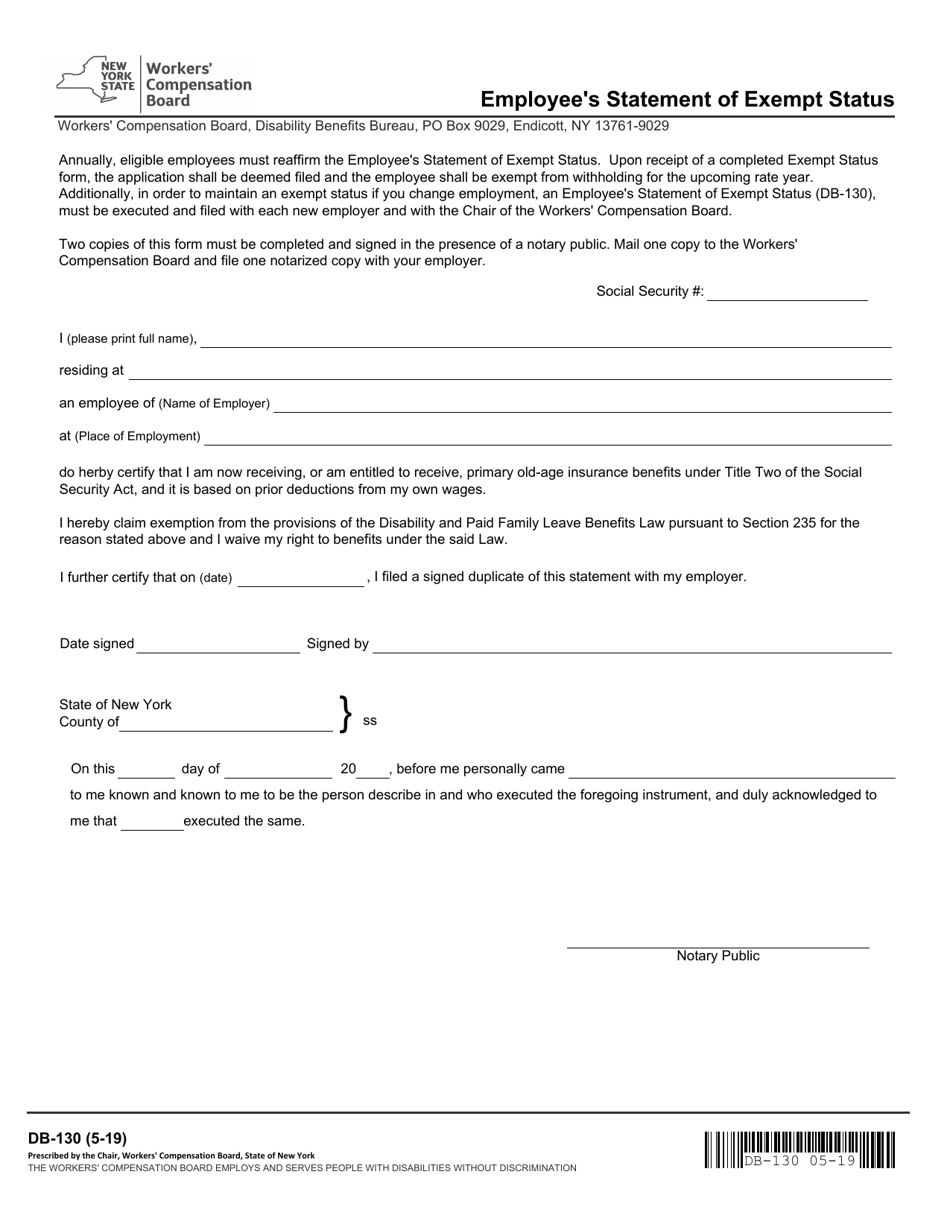

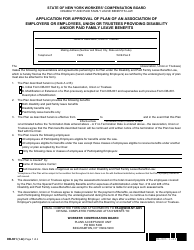

This version of the form is not currently in use and is provided for reference only. Download this version of

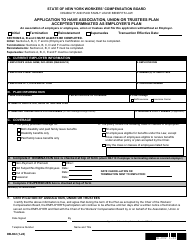

Form DB-130

for the current year.

Form DB-130 Employee's Statement of Exempt Status - New York

What Is Form DB-130?

This is a legal form that was released by the New York State Workers' Compensation Board - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

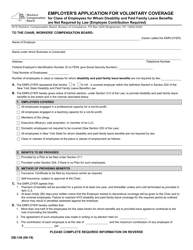

Q: What is DB-130?

A: DB-130 is the Employee's Statement of Exempt Status.

Q: Who needs to complete DB-130?

A: Employees in New York need to complete DB-130 if they want to claim exempt status from state income tax withholding.

Q: What is the purpose of DB-130?

A: The purpose of DB-130 is to allow employees to declare that they meet the criteria for exemption from state income tax withholding.

Q: How do I complete DB-130?

A: To complete DB-130, you must provide your personal information and indicate why you believe you qualify for exemption from state income tax withholding.

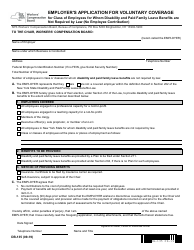

Q: Do I need to submit DB-130 every year?

A: No, you only need to submit DB-130 if you want to claim exempt status from state income tax withholding. However, you may need to submit a new form if your circumstances change.

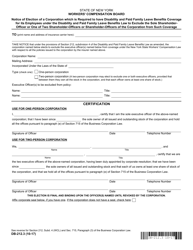

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the New York State Workers' Compensation Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DB-130 by clicking the link below or browse more documents and templates provided by the New York State Workers' Compensation Board.