This version of the form is not currently in use and is provided for reference only. Download this version of

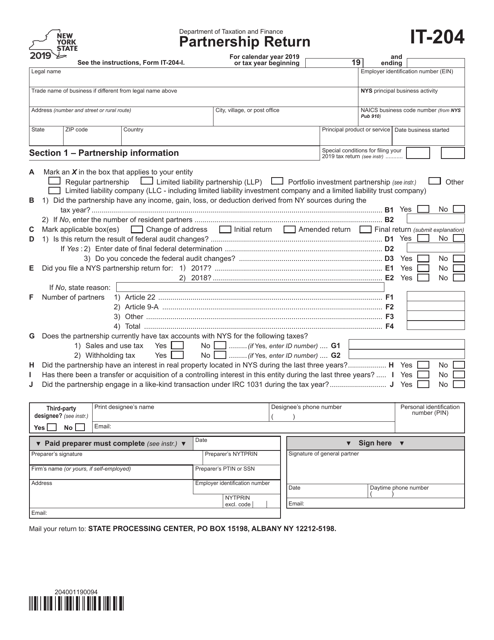

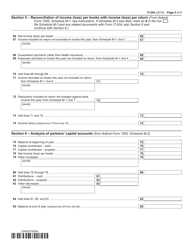

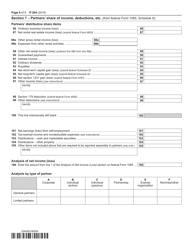

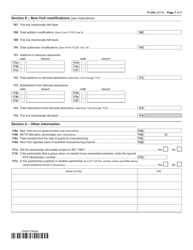

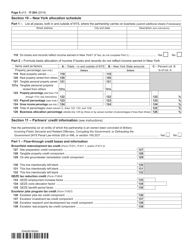

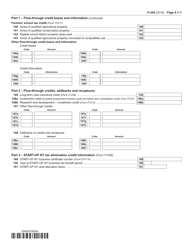

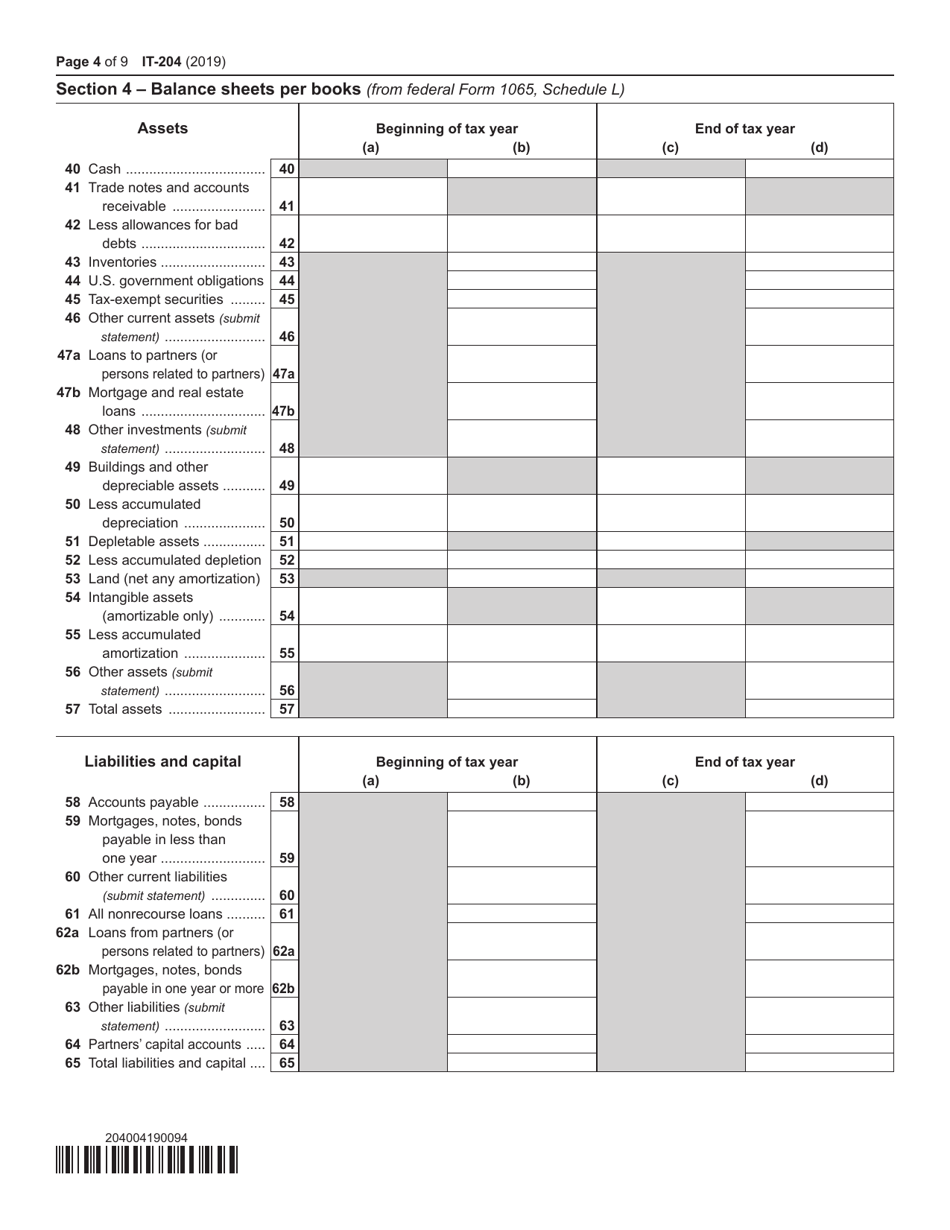

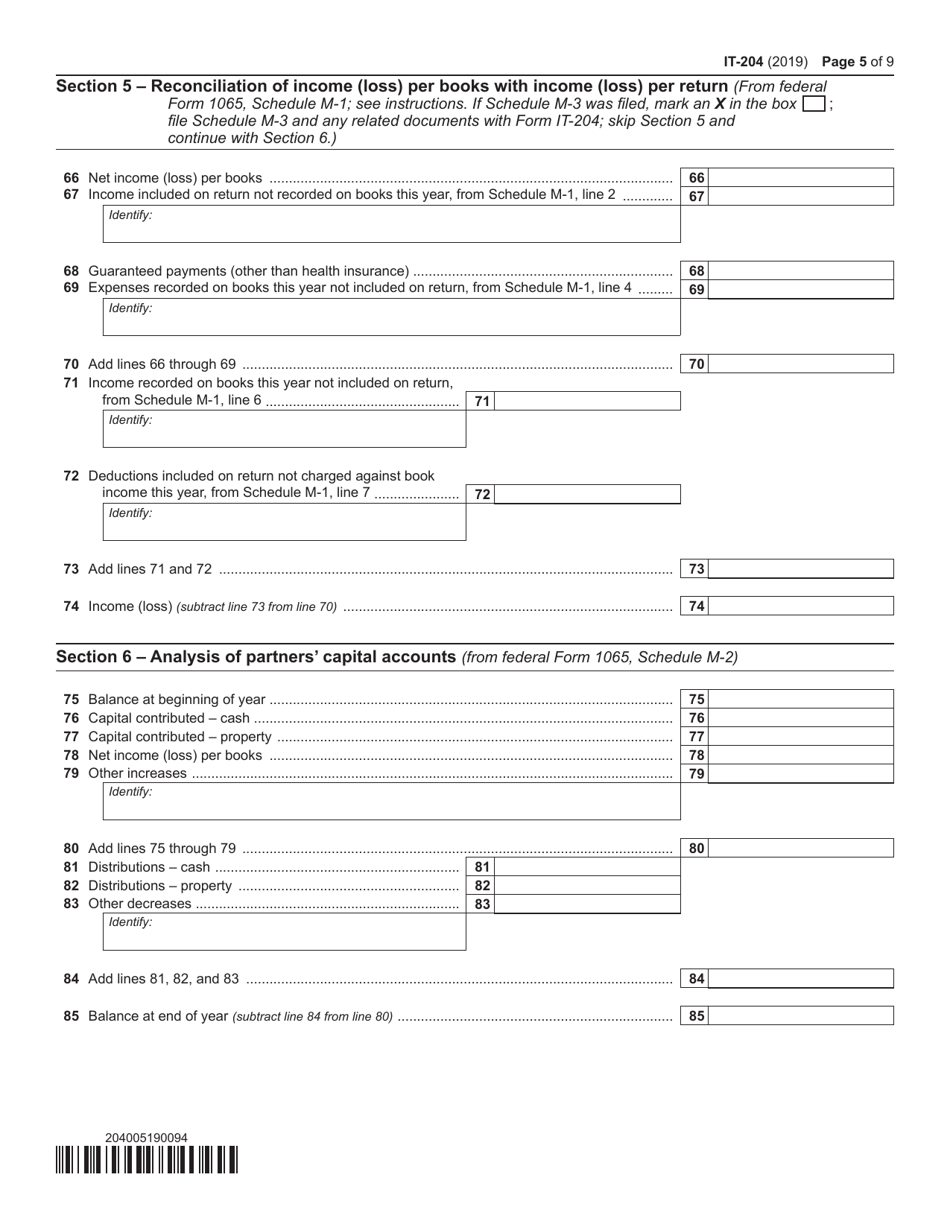

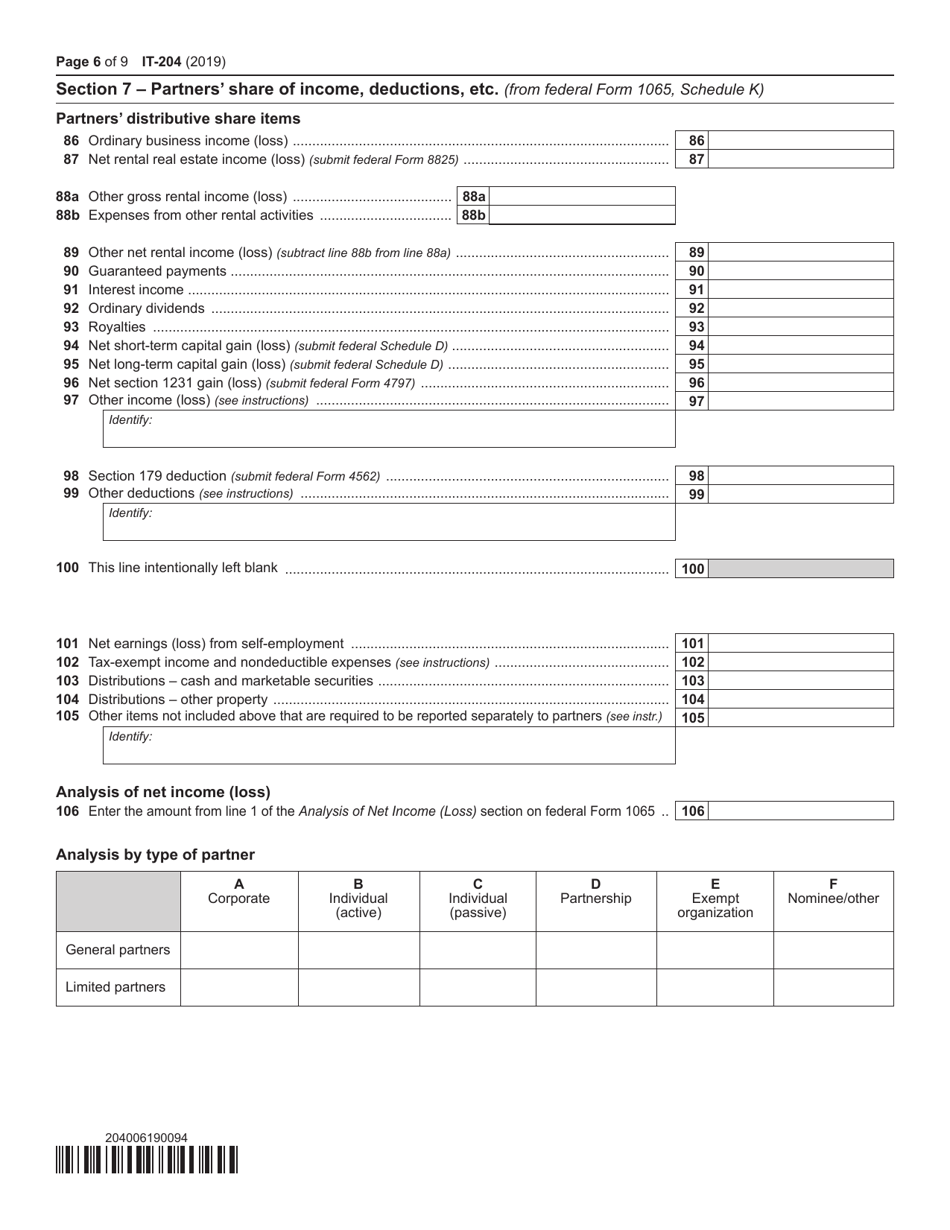

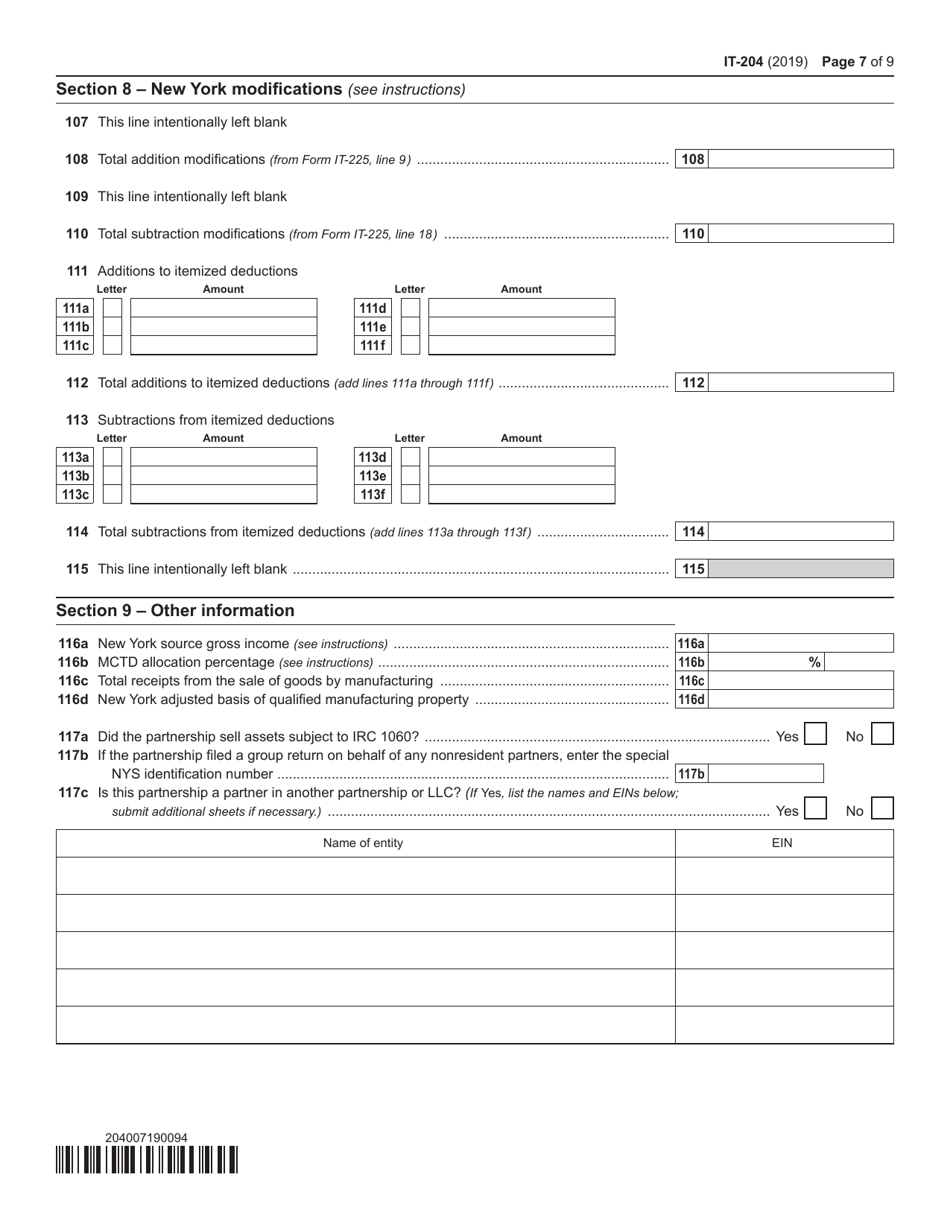

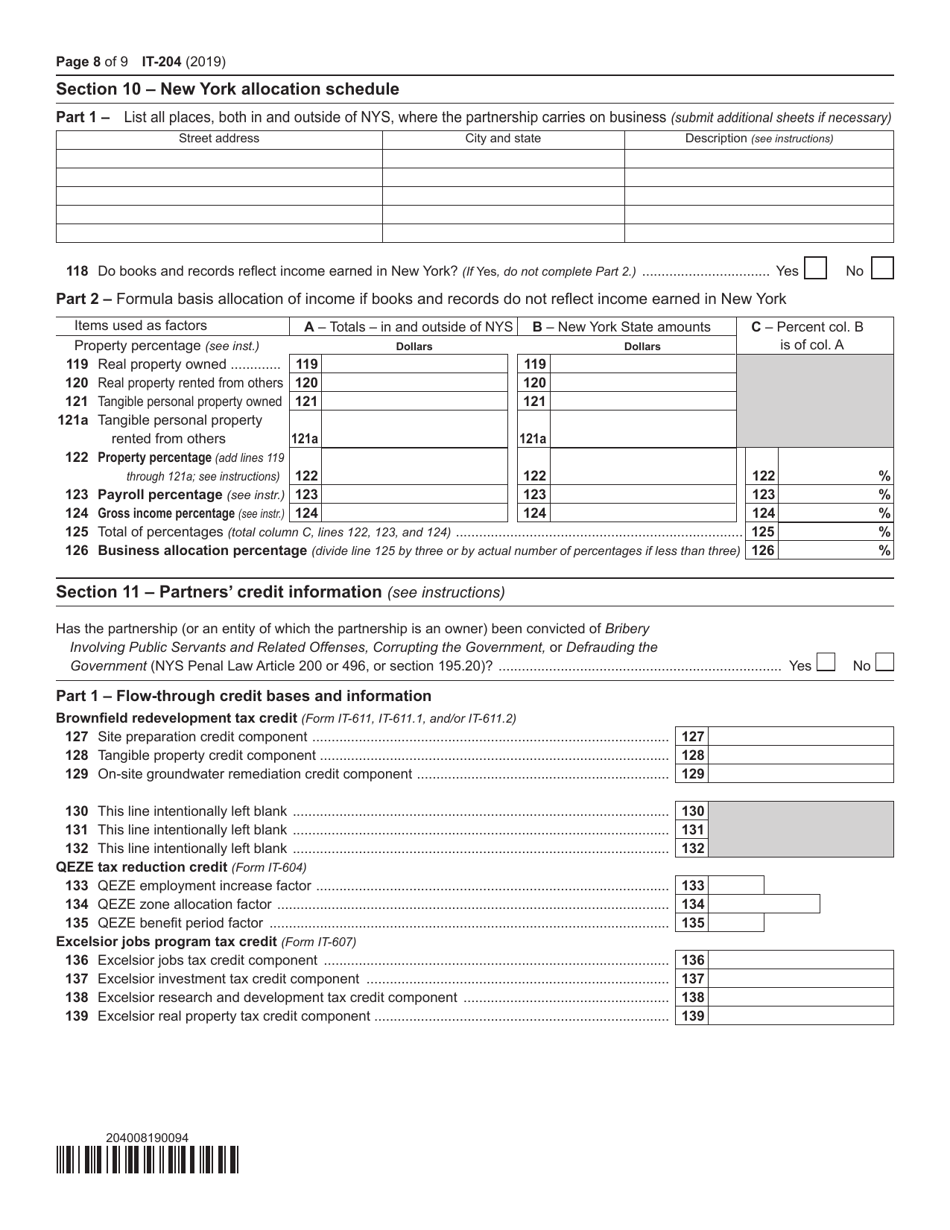

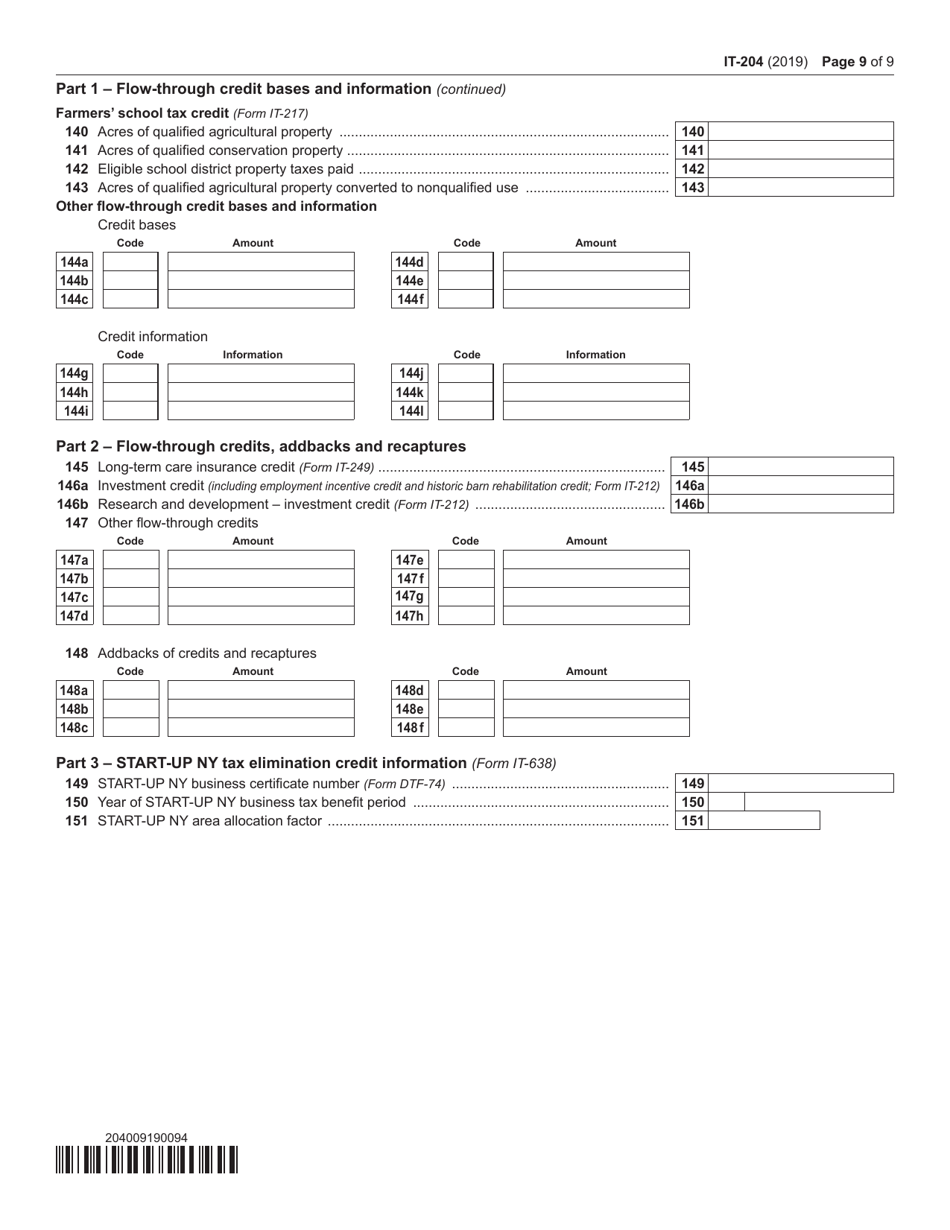

Form IT-204

for the current year.

Form IT-204 Partnership Return - New York

What Is Form IT-204?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-204?

A: Form IT-204 is the Partnership Return form used in New York.

Q: Who needs to file Form IT-204?

A: Partnerships that have income from New York sources or have New York partners need to file Form IT-204.

Q: How do I file Form IT-204?

A: You can file Form IT-204 electronically or by mail. Check the instructions for detailed information.

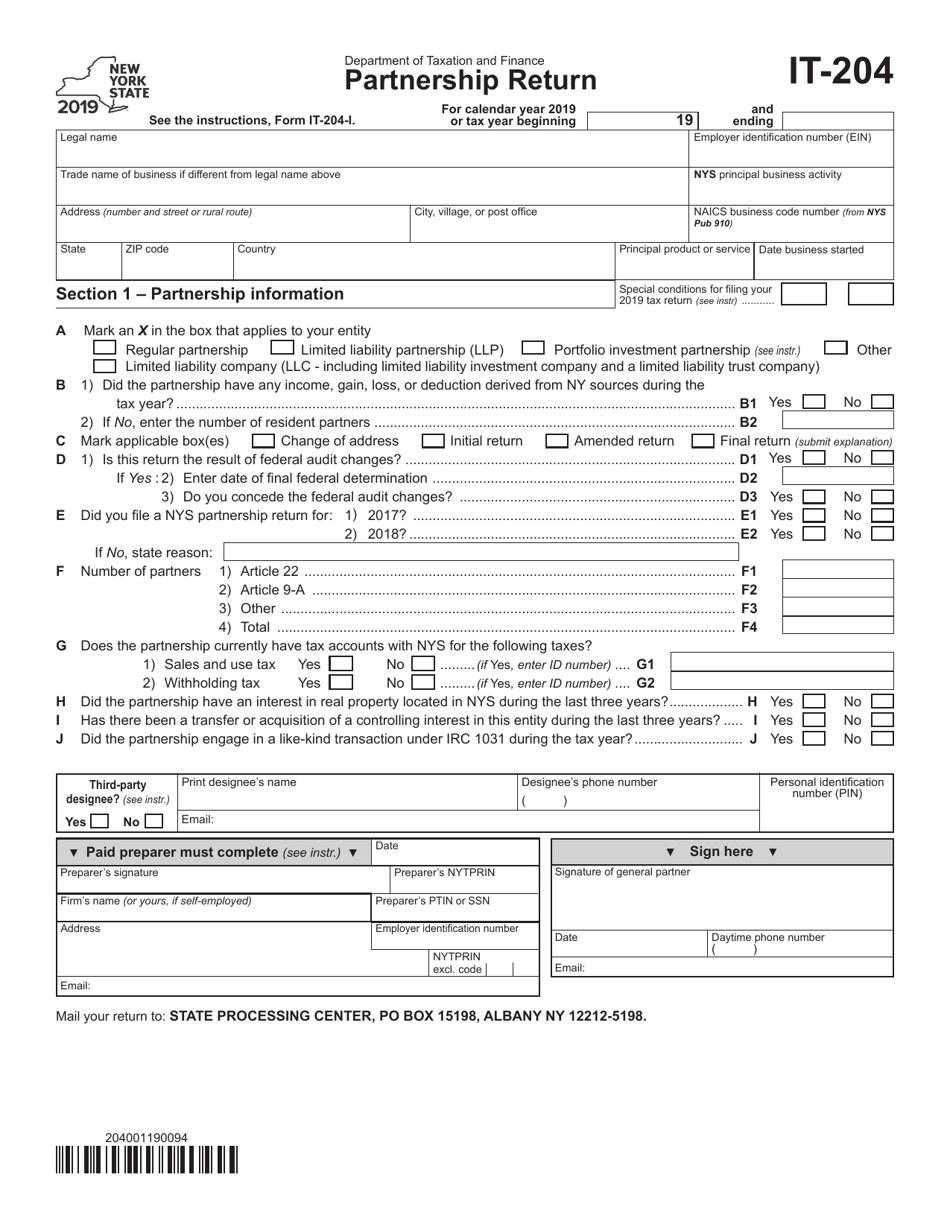

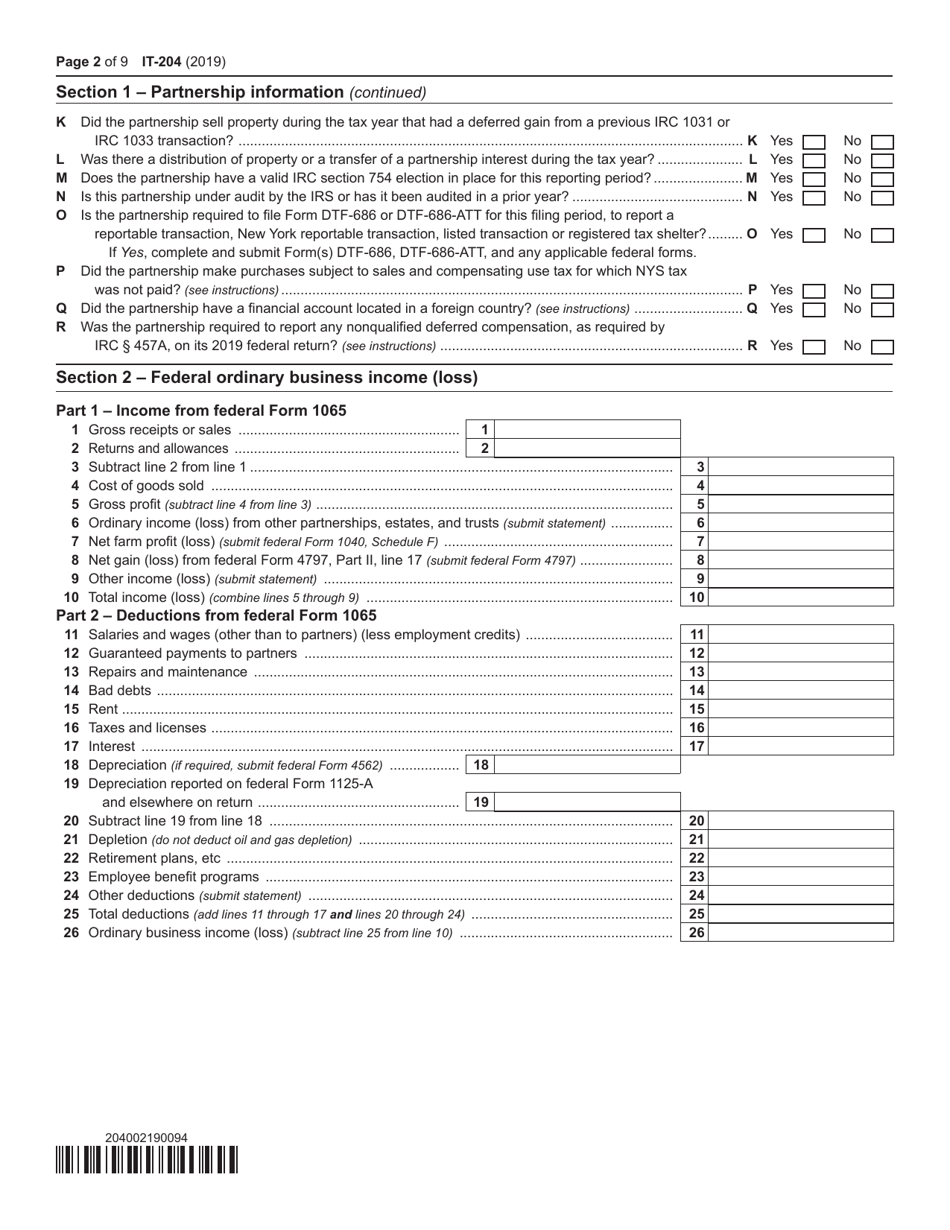

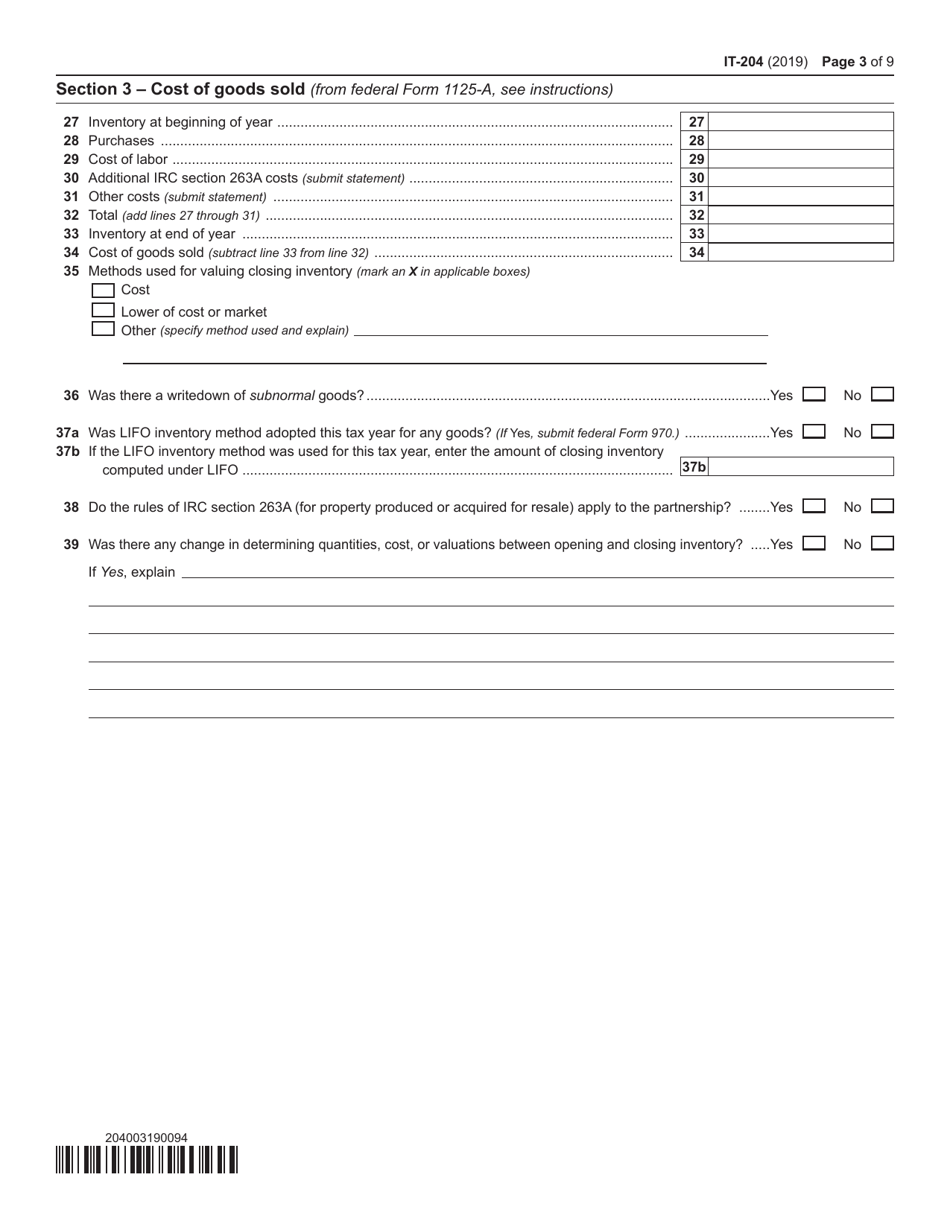

Q: What information do I need to complete Form IT-204?

A: You will need information about the partnership's income, deductions, credits, and partners.

Q: When is the deadline to file Form IT-204?

A: The deadline to file Form IT-204 is usually the 15th day of the third month after the end of the partnership's tax year.

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing. It's important to file by the deadline to avoid penalties.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-204 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.