This version of the form is not currently in use and is provided for reference only. Download this version of

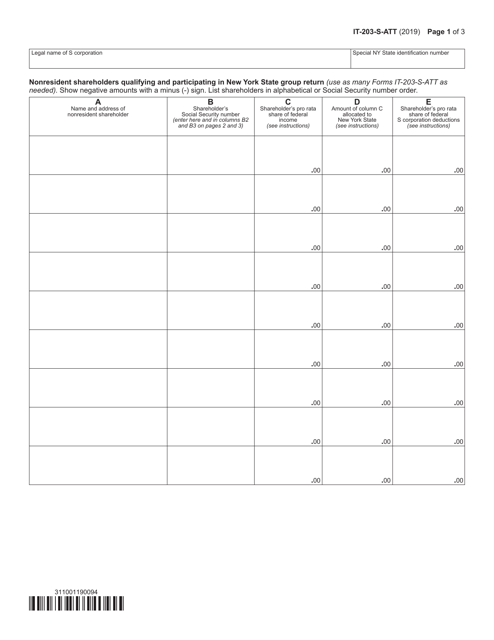

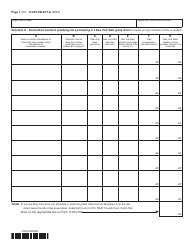

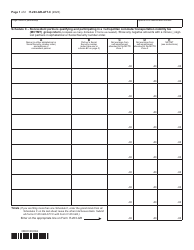

Form IT-203-S-ATT

for the current year.

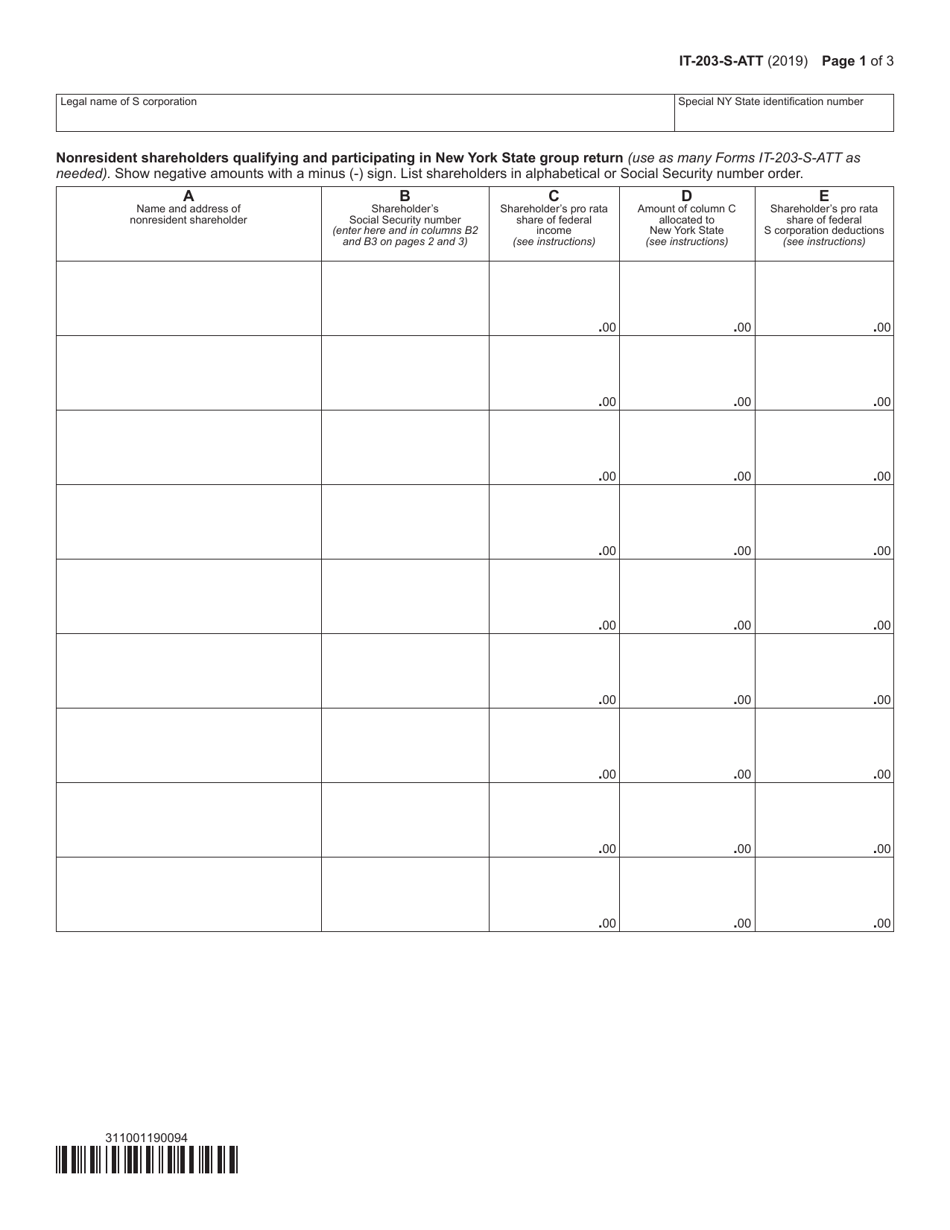

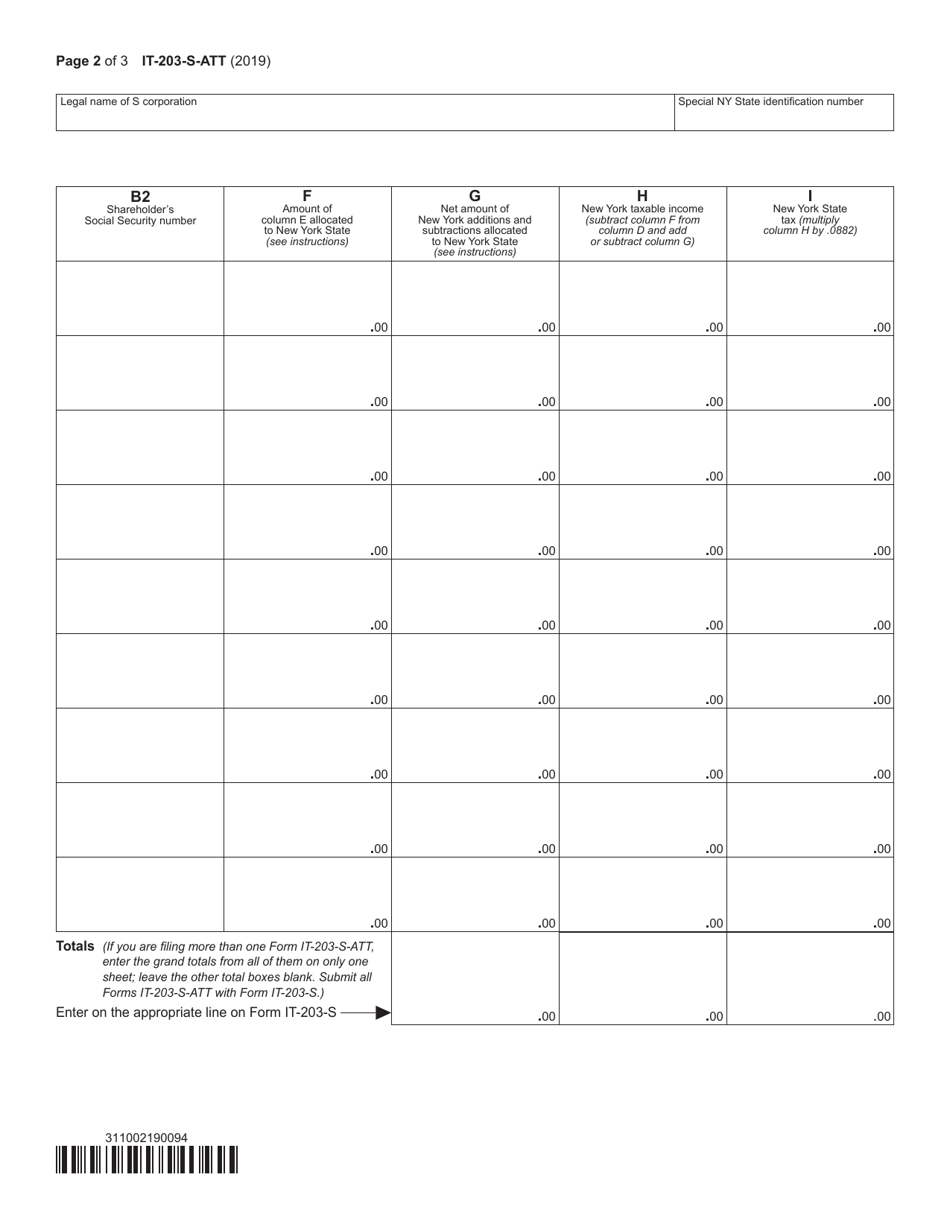

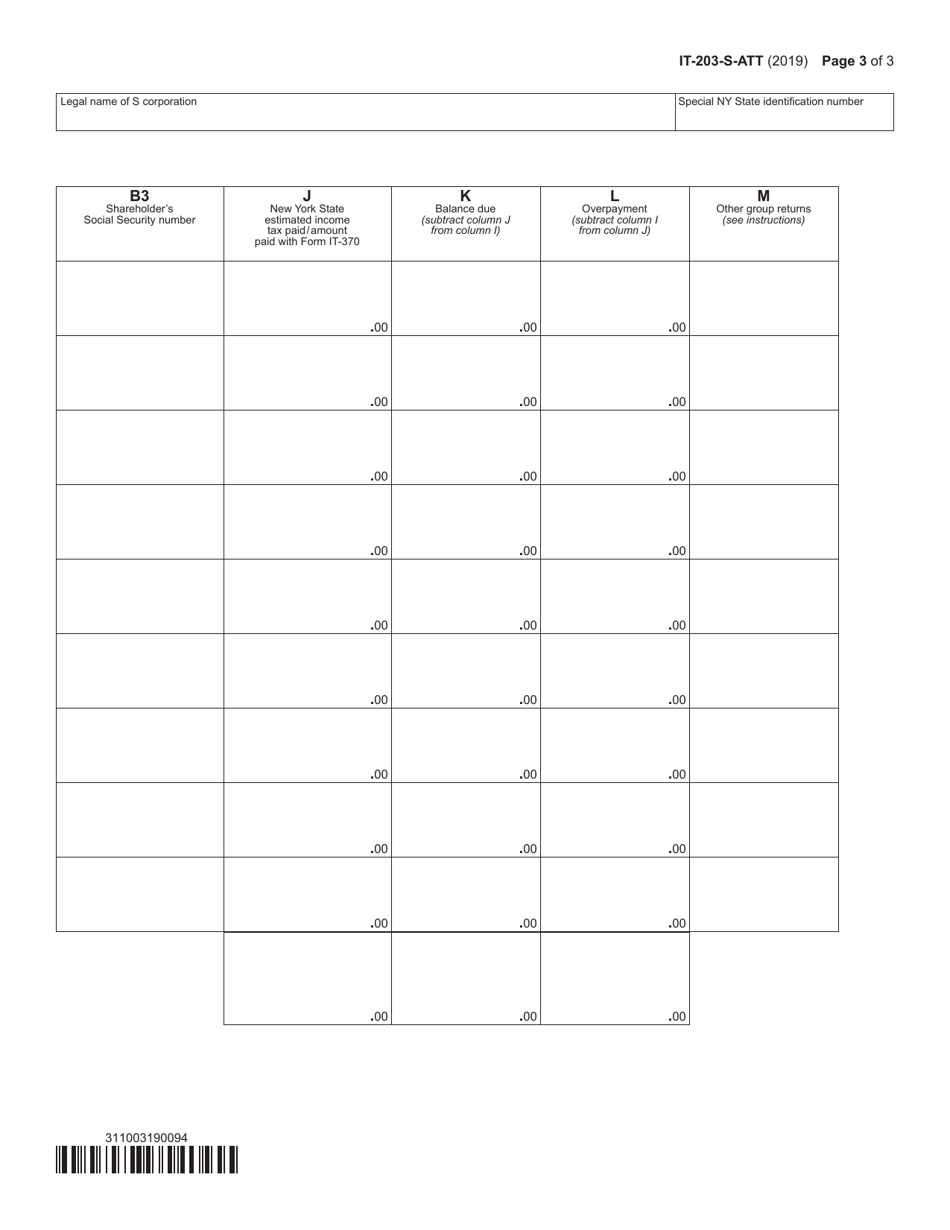

Form IT-203-S-ATT Nonresident Shareholders Qualifying and Participating in New York State Group Return - New York

What Is Form IT-203-S-ATT?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-203-S-ATT?

A: Form IT-203-S-ATT is a tax form used by nonresident shareholders to report their participation in a New York State group return.

Q: Who needs to use Form IT-203-S-ATT?

A: Nonresident shareholders who are qualifying and participating in a New York State group return need to use Form IT-203-S-ATT.

Q: What is a New York State group return?

A: A New York State group return is a tax return filed by an entity on behalf of multiple nonresident shareholders.

Q: What does it mean to qualify and participate in a New York State group return?

A: Qualifying and participating in a New York State group return means that a nonresident shareholder meets certain requirements and has elected to be included in the group return.

Q: How do I complete Form IT-203-S-ATT?

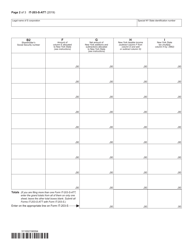

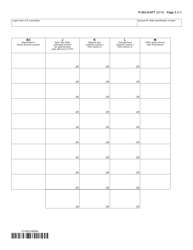

A: Form IT-203-S-ATT requires you to provide information about the New York State group return in which you are participating, as well as your personal details and income information.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-203-S-ATT by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.