This version of the form is not currently in use and is provided for reference only. Download this version of

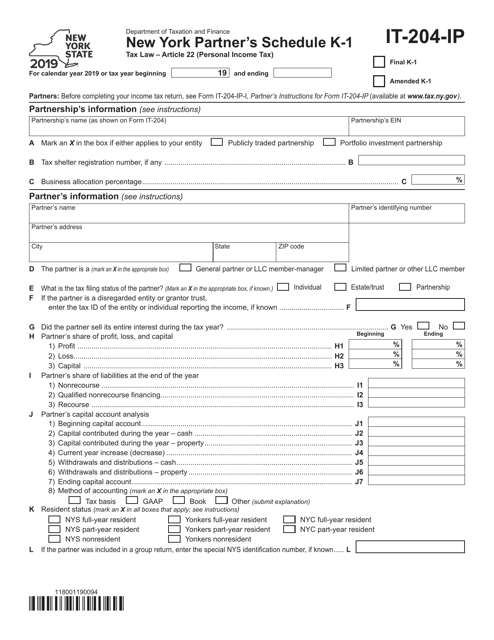

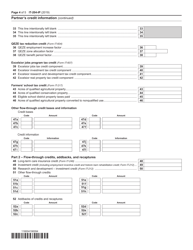

Form IT-204-IP

for the current year.

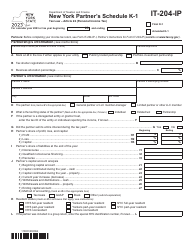

Form IT-204-IP New York Partner's Schedule - New York

What Is Form IT-204-IP?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-204-IP?

A: Form IT-204-IP is the New York Partner's Schedule for the State of New York.

Q: Who needs to file Form IT-204-IP?

A: Partners in a partnership doing business in New York and has income, gain, loss, or deduction sourced in New York are required to file Form IT-204-IP.

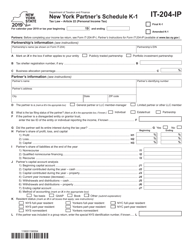

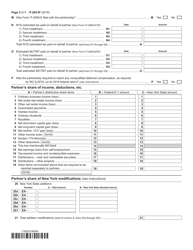

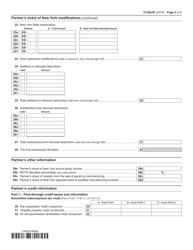

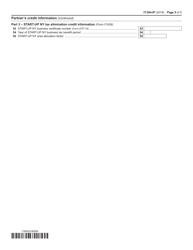

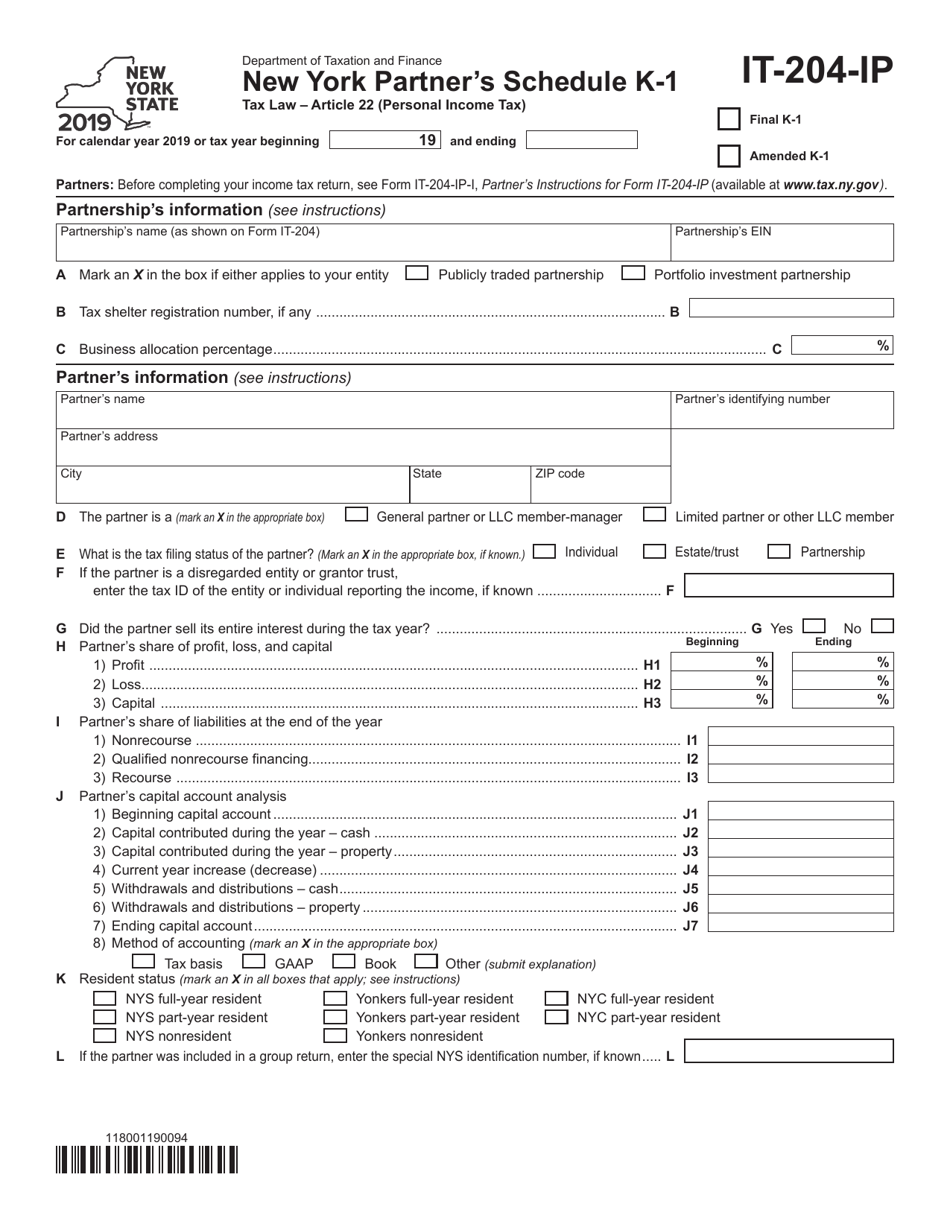

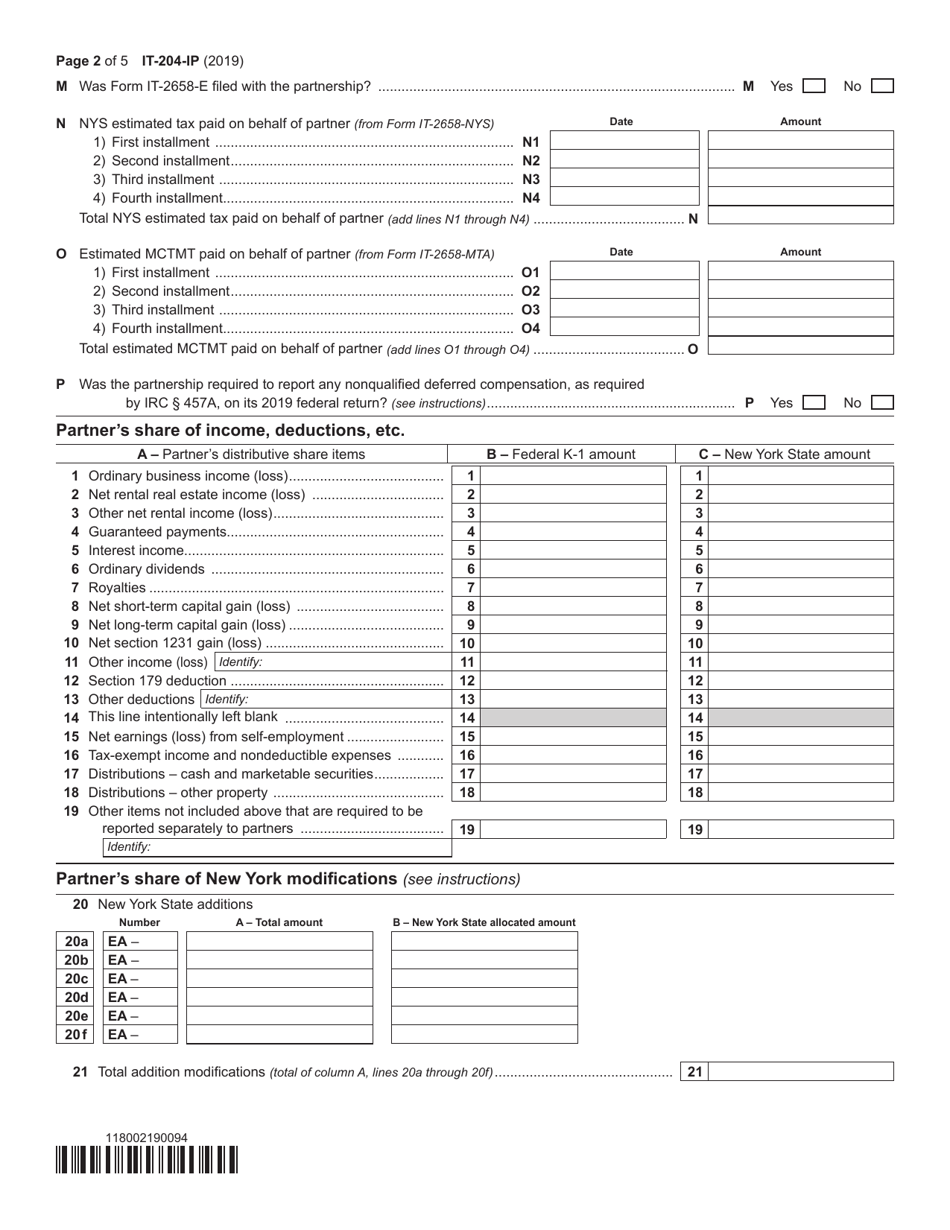

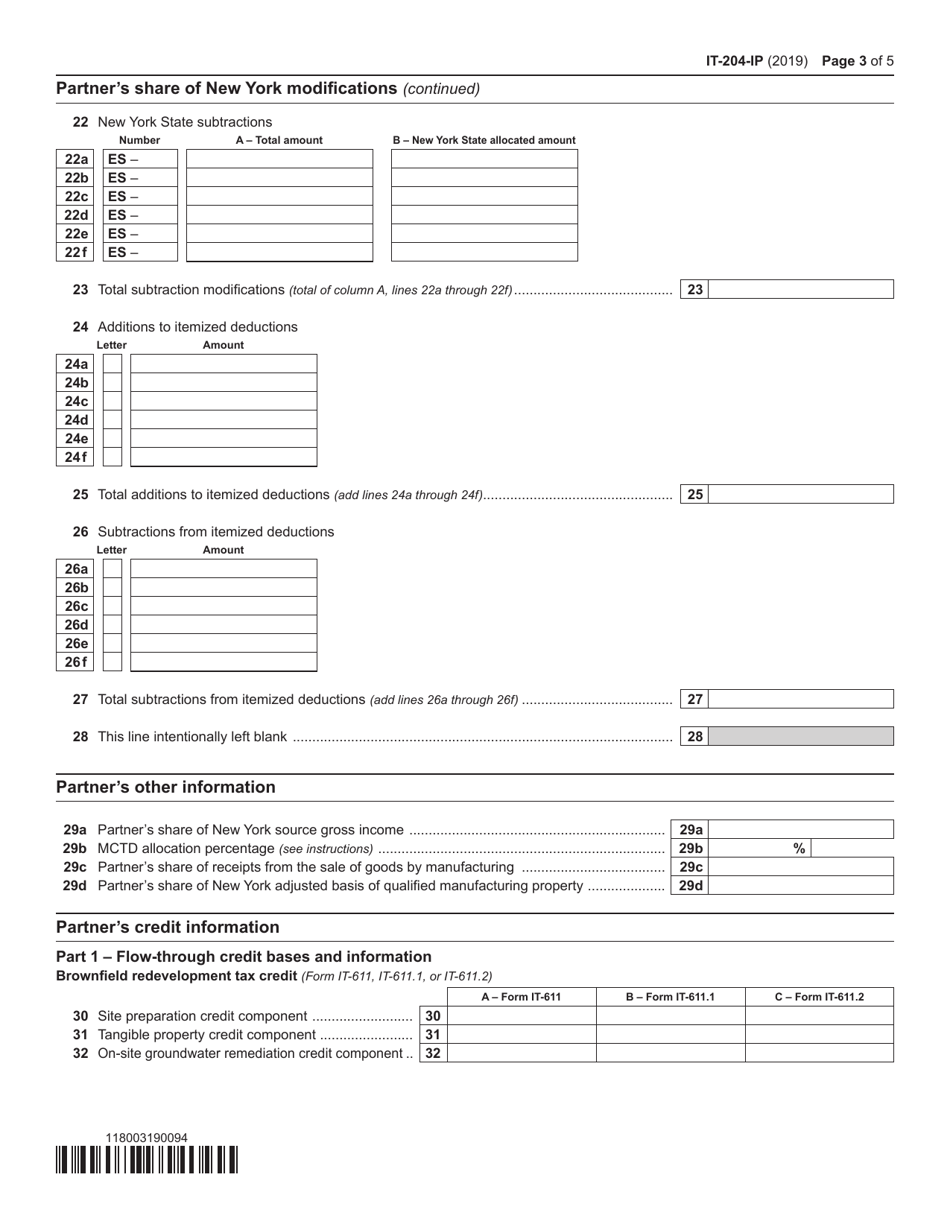

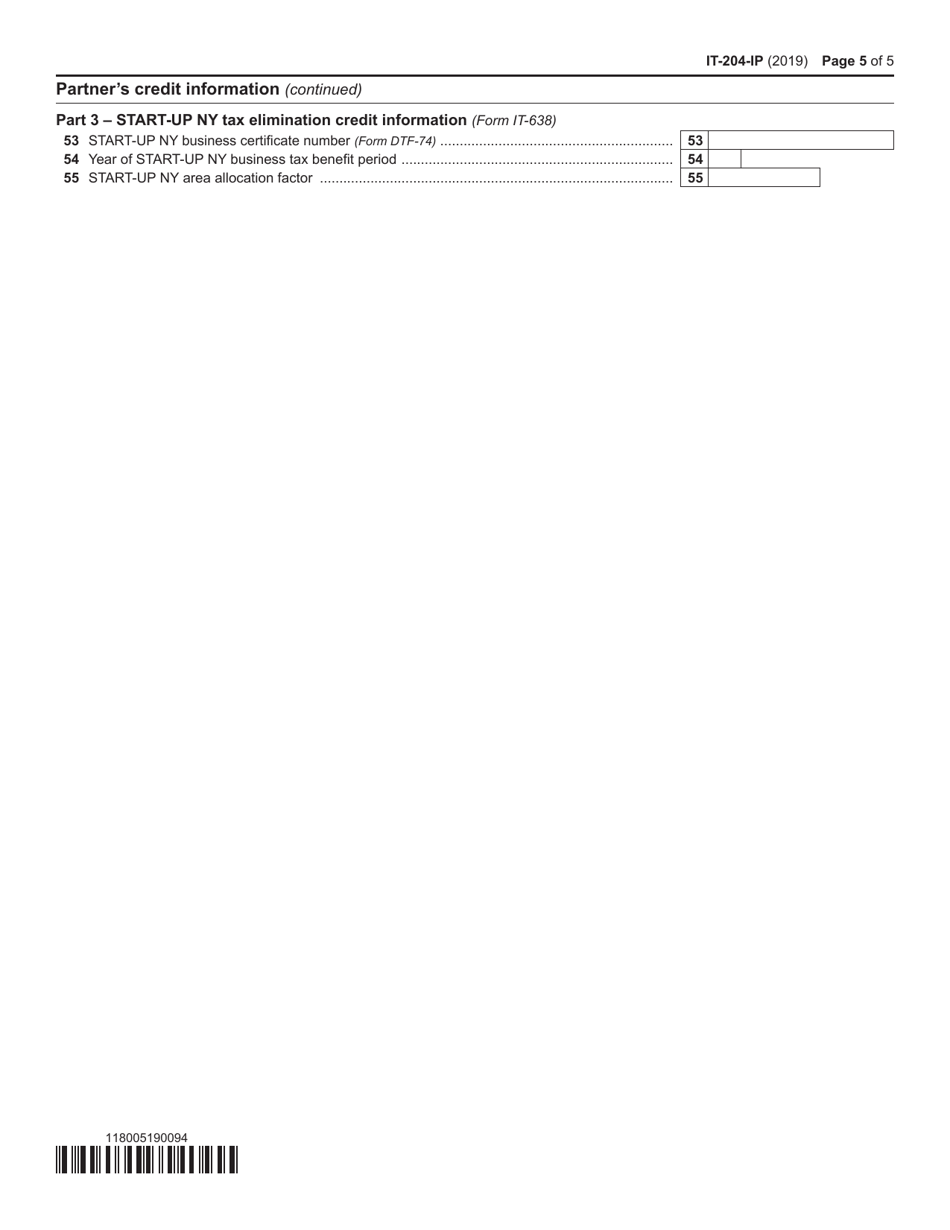

Q: What information is required on Form IT-204-IP?

A: Form IT-204-IP requires the partner's identifying information, share of partnership income, and New York additions, deductions, and modifications.

Q: When is the deadline to file Form IT-204-IP?

A: Form IT-204-IP is due on the same date as the partnership return, which is generally on or before March 15th.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-204-IP by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.