This version of the form is not currently in use and is provided for reference only. Download this version of

Form DTF-664

for the current year.

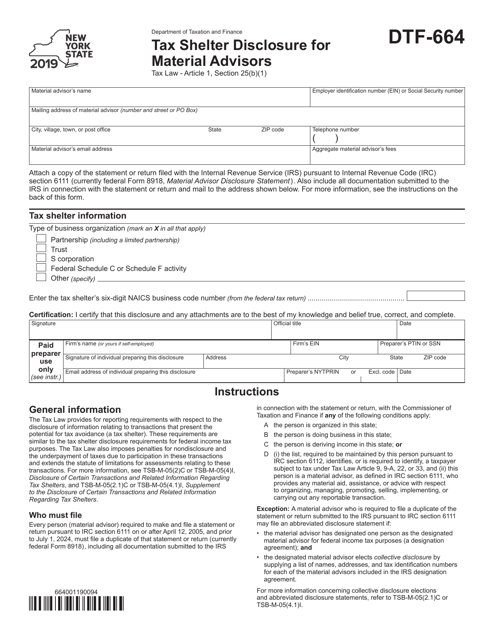

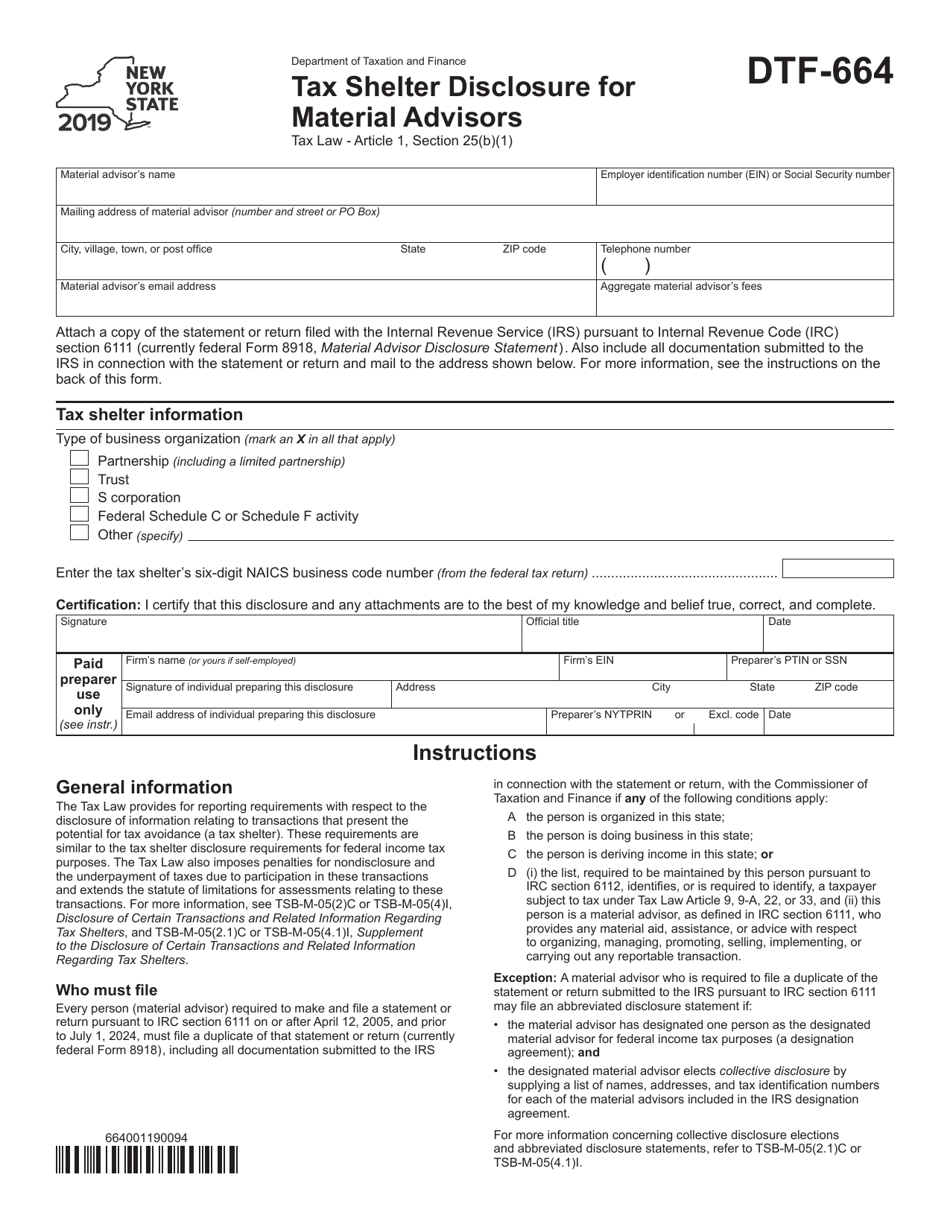

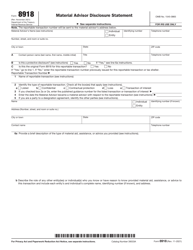

Form DTF-664 Tax Shelter Disclosure for Material Advisors - New York

What Is Form DTF-664?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTF-664?

A: Form DTF-664 is the Tax Shelter Disclosure for Material Advisors form in New York.

Q: Who needs to file Form DTF-664?

A: Material Advisors in New York who provide tax shelter services need to file Form DTF-664.

Q: What is a tax shelter?

A: A tax shelter is a legal way to reduce a person's or business's taxable income.

Q: What is a Material Advisor?

A: A Material Advisor is a person or entity who provides tax shelter services for a fee or other consideration.

Q: Why do Material Advisors need to file Form DTF-664?

A: Material Advisors in New York need to file Form DTF-664 to disclose certain information about tax shelters they are involved with.

Q: What information is required on Form DTF-664?

A: Form DTF-664 requires Material Advisors to disclose information about the tax shelter, including its description, the tax benefits claimed, and the clients involved.

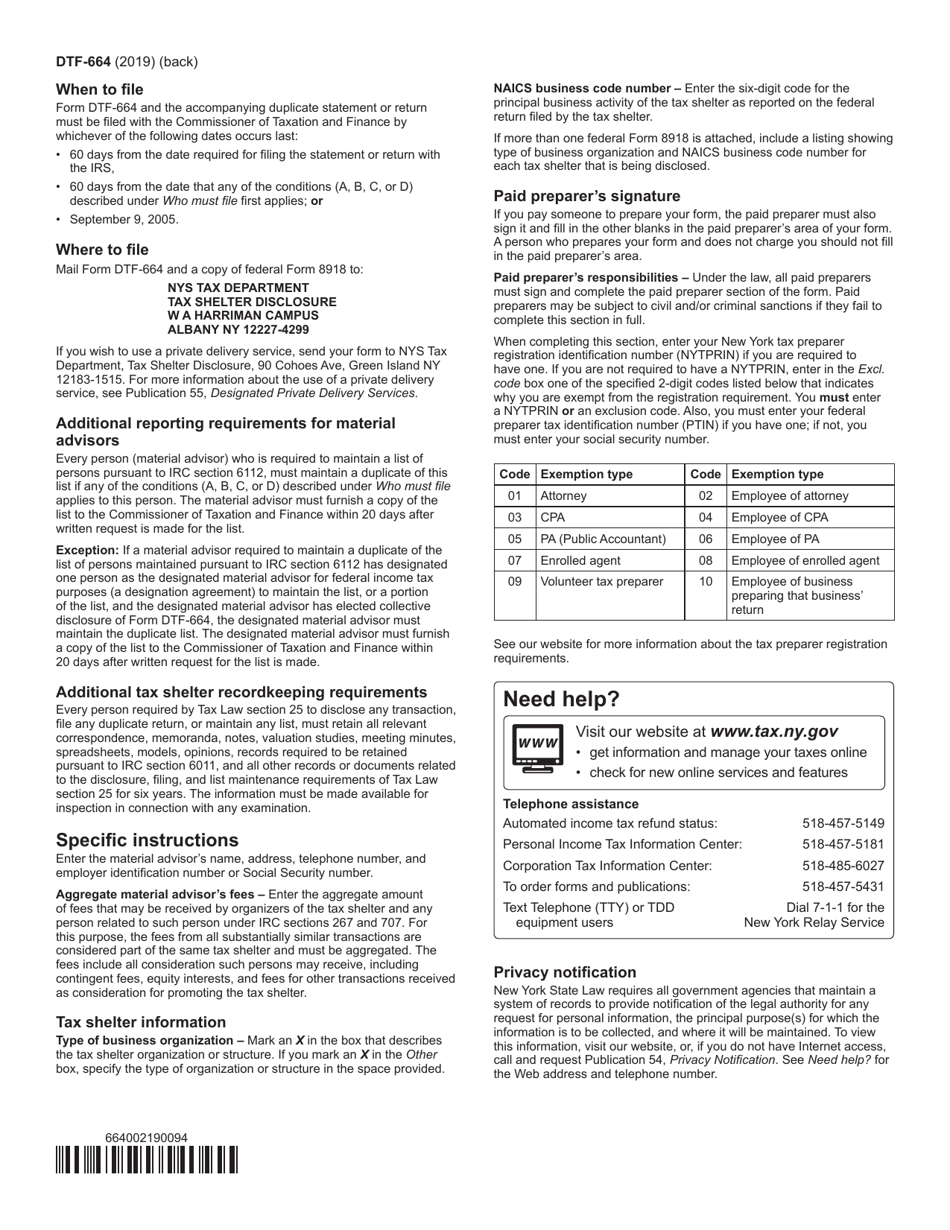

Q: When is Form DTF-664 due?

A: Form DTF-664 is typically due by the last day of the month following the end of the material advisor's tax year.

Q: Are there any penalties for not filing Form DTF-664?

A: Yes, failure to file Form DTF-664 or filing an incomplete or inaccurate form can result in penalties and other enforcement actions.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DTF-664 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.