This version of the form is not currently in use and is provided for reference only. Download this version of

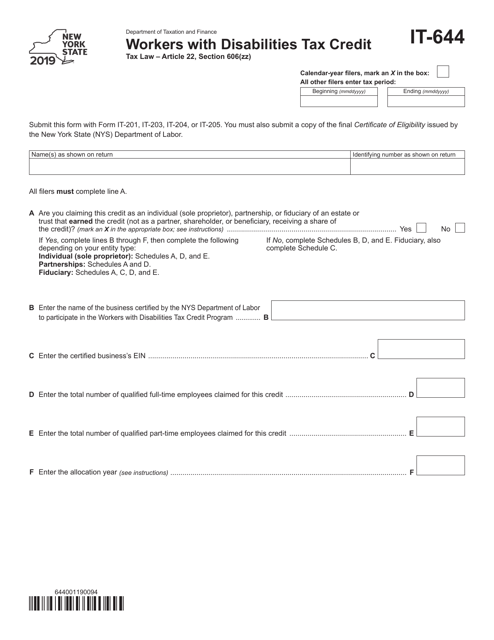

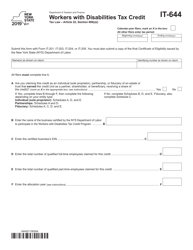

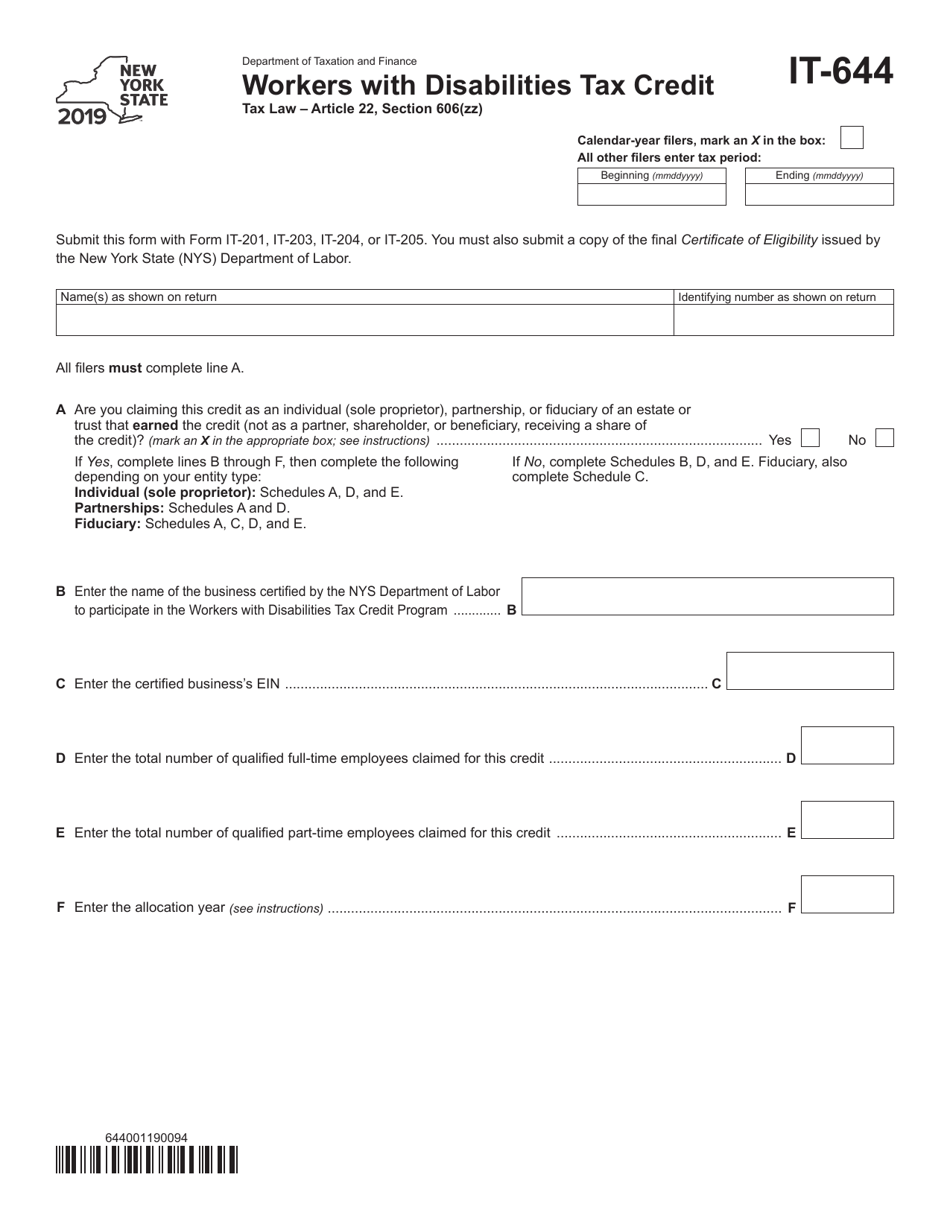

Form IT-644

for the current year.

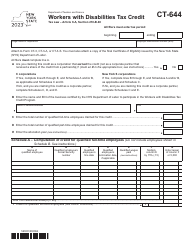

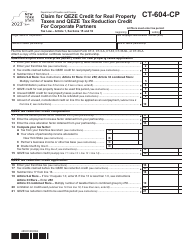

Form IT-644 Workers With Disabilities Tax Credit - New York

What Is Form IT-644?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-644?

A: Form IT-644 is a tax form in New York used for claiming the Workers With Disabilities Tax Credit.

Q: Who is eligible for the Workers With Disabilities Tax Credit?

A: Individuals and businesses in New York who employ individuals with disabilities are eligible for this tax credit.

Q: What is the purpose of the Workers With Disabilities Tax Credit?

A: The purpose of this tax credit is to encourage businesses to hire and retain individuals with disabilities.

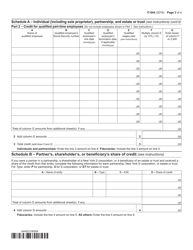

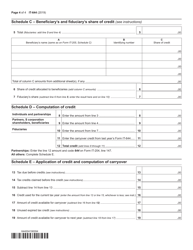

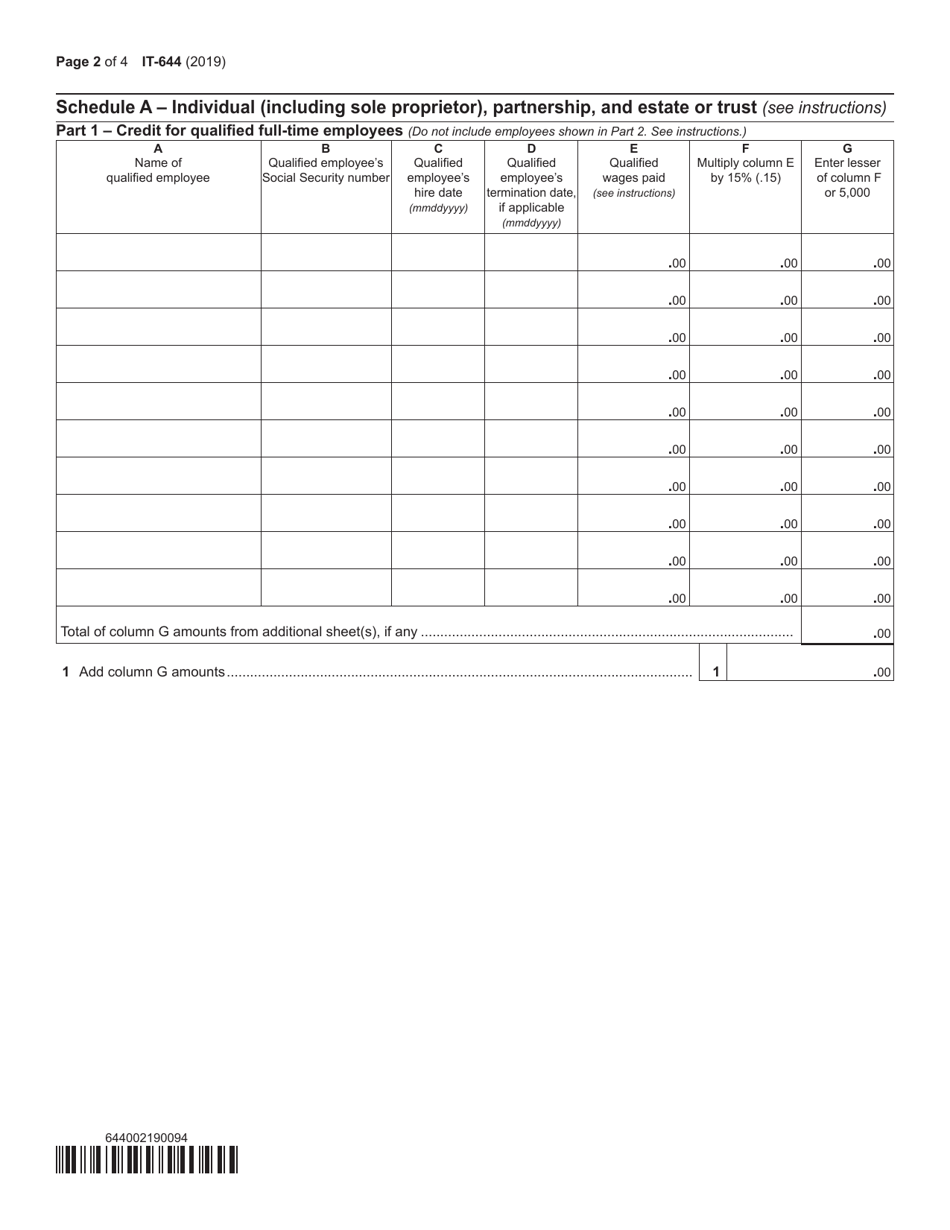

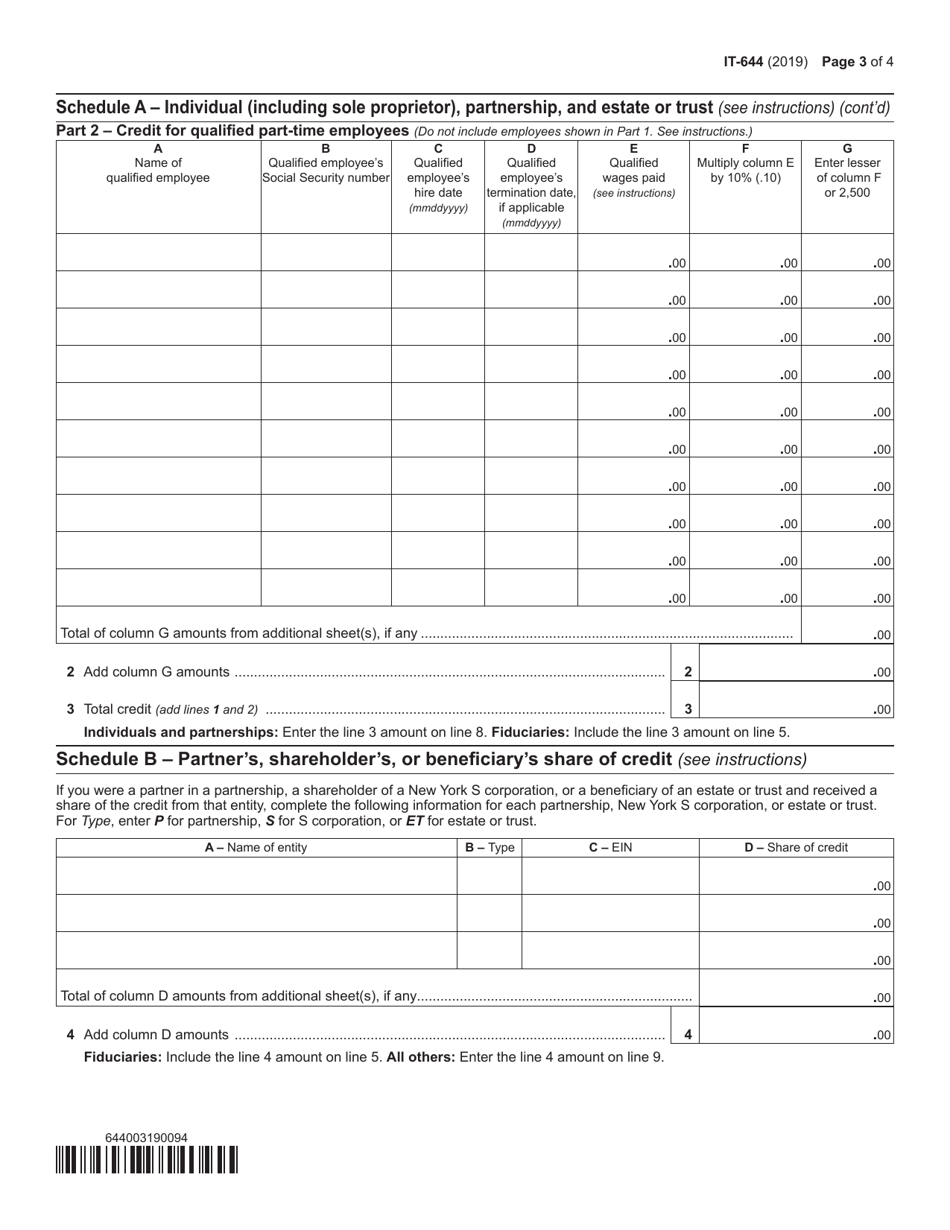

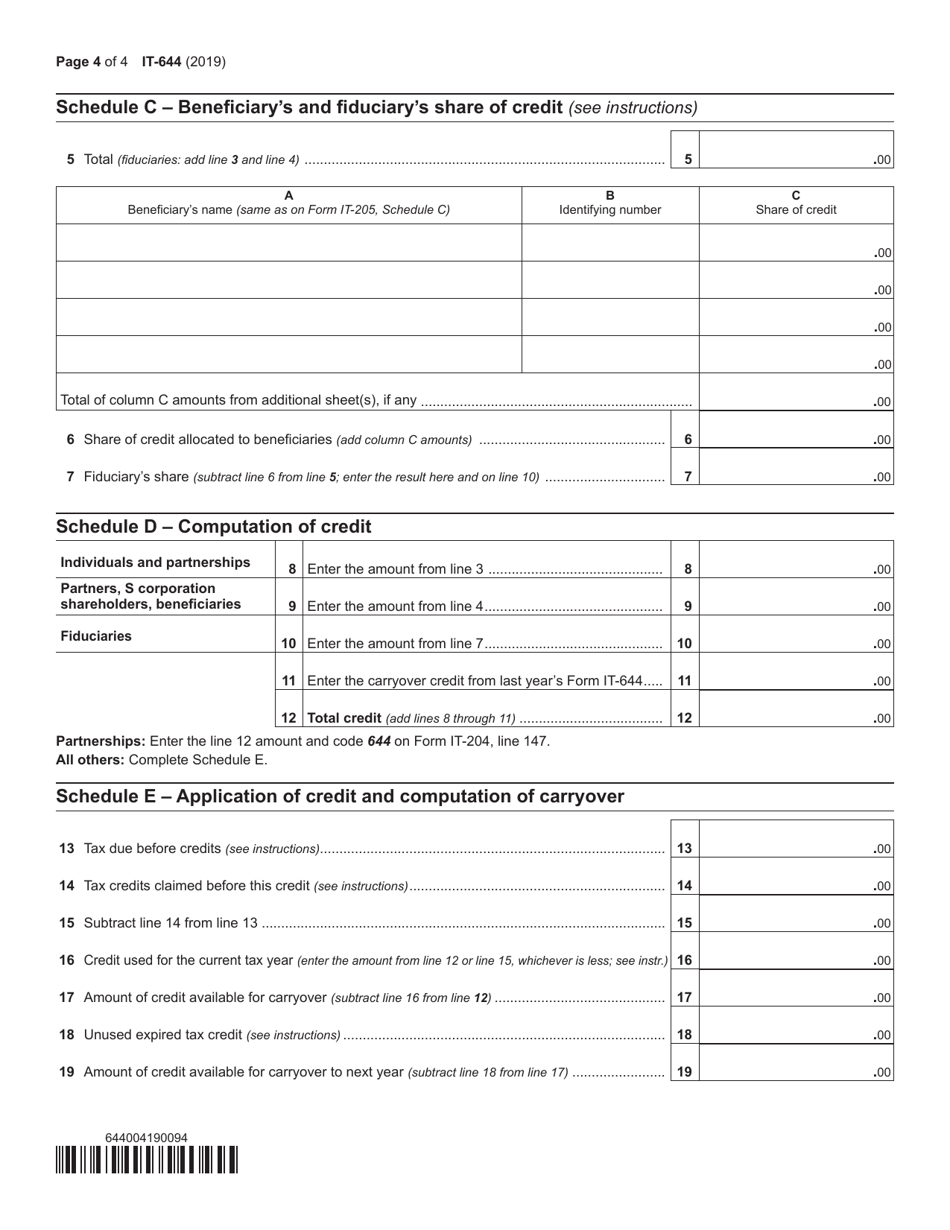

Q: How much is the Workers With Disabilities Tax Credit?

A: The tax credit amount depends on factors such as the wages paid to individuals with disabilities and the number of hours worked.

Q: When is the deadline to file Form IT-644?

A: Form IT-644 must be filed with your annual tax return by the due date for that tax year.

Q: Can I claim the tax credit for multiple employees with disabilities?

A: Yes, you can claim the tax credit for each eligible employee with disabilities that you employ.

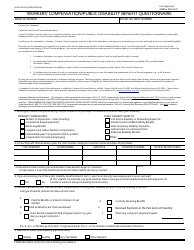

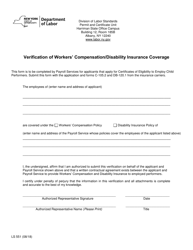

Q: Do I need to provide any supporting documentation with Form IT-644?

A: Yes, you may need to provide documentation such as a certification letter or Form IT-643 with your application.

Q: Is the tax credit refundable?

A: Yes, the Workers With Disabilities Tax Credit is refundable, which means that if the credit exceeds your tax liability, you may receive a refund of the remaining amount.

Q: What if I have additional questions about Form IT-644?

A: If you have additional questions, you can contact the New York State Department of Taxation and Finance for assistance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-644 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.