This version of the form is not currently in use and is provided for reference only. Download this version of

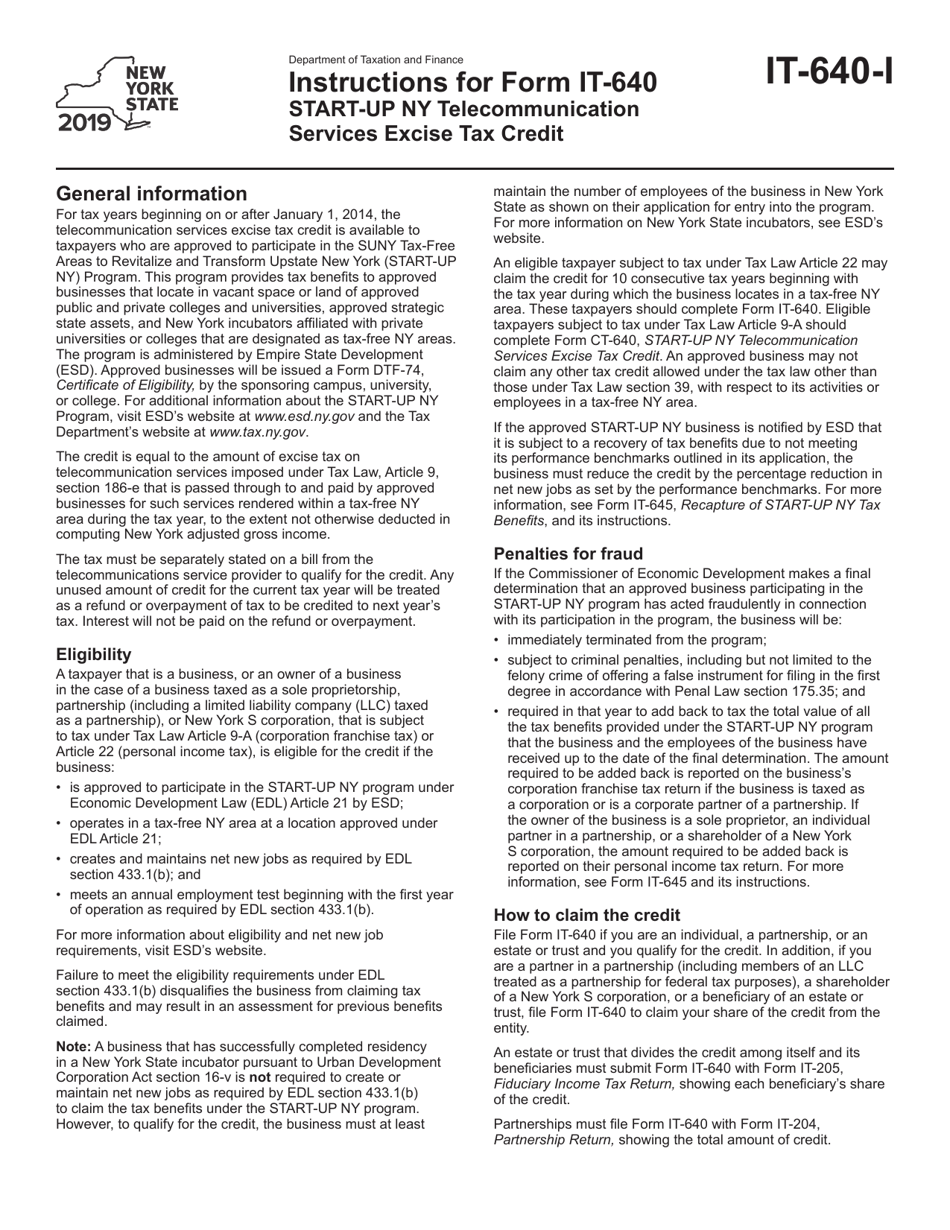

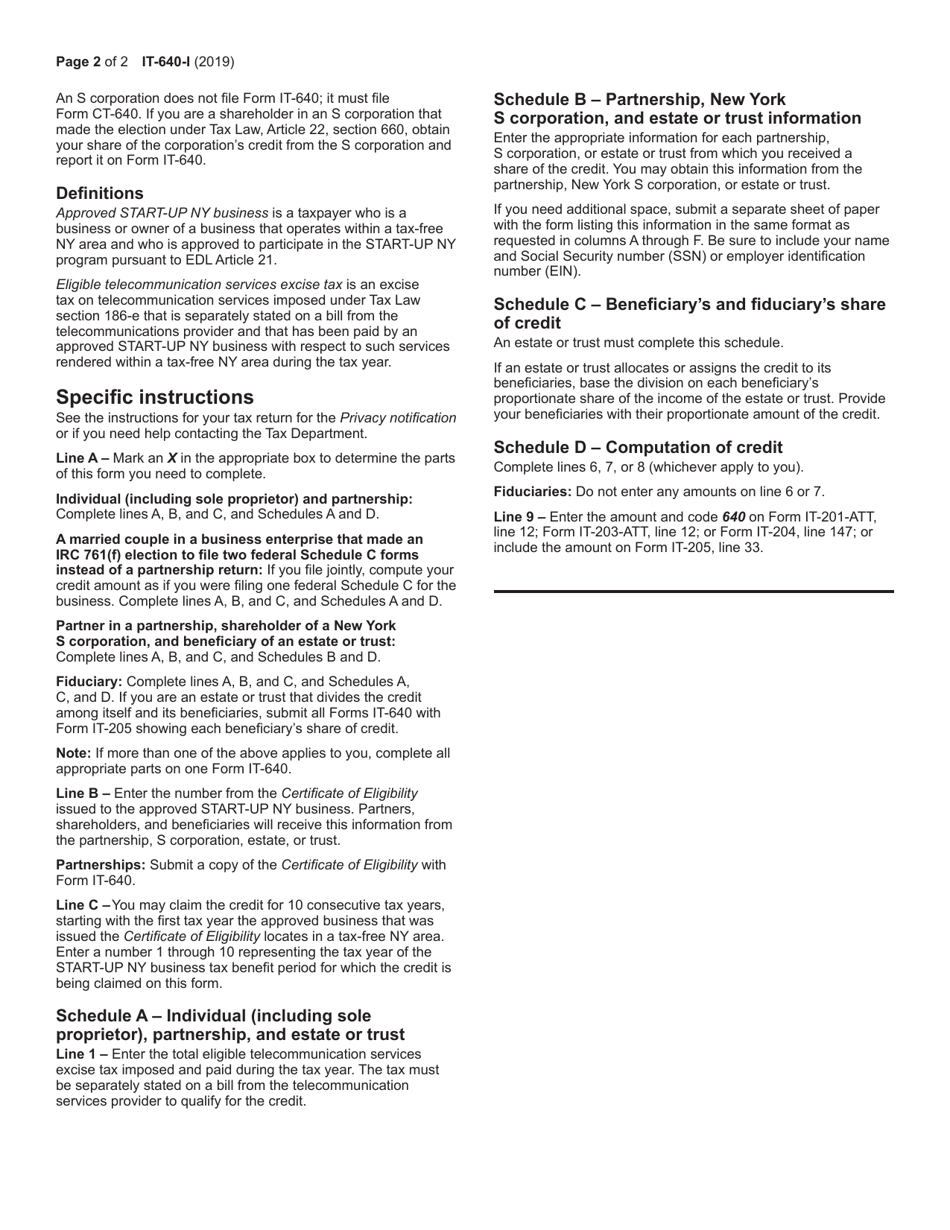

Instructions for Form IT-640

for the current year.

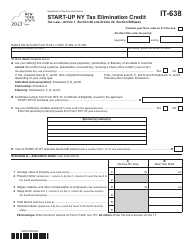

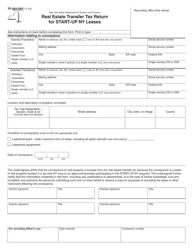

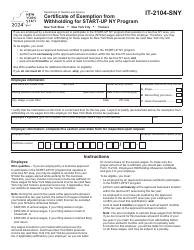

Instructions for Form IT-640 Start-Up Ny Telecommunication Services Excise Tax Credit - New York

This document contains official instructions for Form IT-640 , Start-Up Ny Telecommunication Services Excise Tax Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-640 is available for download through this link.

FAQ

Q: What is Form IT-640?

A: Form IT-640 is a tax form used to claim the Start-Up NY Telecommunication Services Excise Tax Credit in New York.

Q: What is the Start-Up NY Telecommunication Services Excise Tax Credit?

A: The Start-Up NY Telecommunication Services Excise Tax Credit is a tax credit for eligible businesses engaged in telecommunication services.

Q: Who is eligible for this tax credit?

A: Eligible businesses that are certified by the Start-Up NY program and engaged in telecommunication services may claim this tax credit.

Q: How do I claim this tax credit?

A: You need to complete and file Form IT-640 with the New York State Department of Taxation and Finance to claim the Start-Up NY Telecommunication Services Excise Tax Credit.

Q: What information is required on Form IT-640?

A: Form IT-640 requires information such as the taxpayer's identification number, the amount of the tax credit being claimed, and other details related to the business.

Q: Is there a deadline for filing Form IT-640?

A: Yes, the deadline for filing Form IT-640 is typically the same as the deadline for filing your New York State corporate franchise tax return or your New York State personal income tax return, depending on the type of taxpayer.

Q: Are there any additional requirements or documentation needed to claim this tax credit?

A: Yes, businesses claiming the Start-Up NY Telecommunication Services Excise Tax Credit may need to provide additional documentation, such as certification from the Start-Up NY program.

Q: Can I claim this tax credit if I am not certified by the Start-Up NY program?

A: No, only businesses that are certified by the Start-Up NY program are eligible to claim this tax credit.

Q: What should I do if I have more questions or need assistance with Form IT-640?

A: If you have additional questions or need assistance with Form IT-640, you can contact the New York State Department of Taxation and Finance for guidance.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.