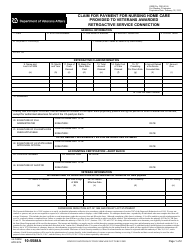

This version of the form is not currently in use and is provided for reference only. Download this version of

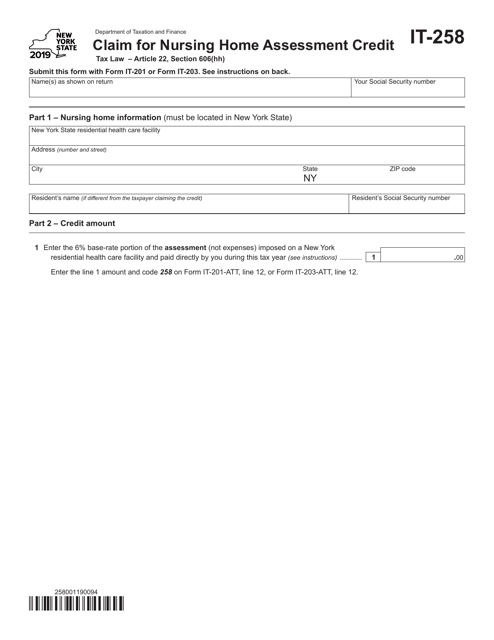

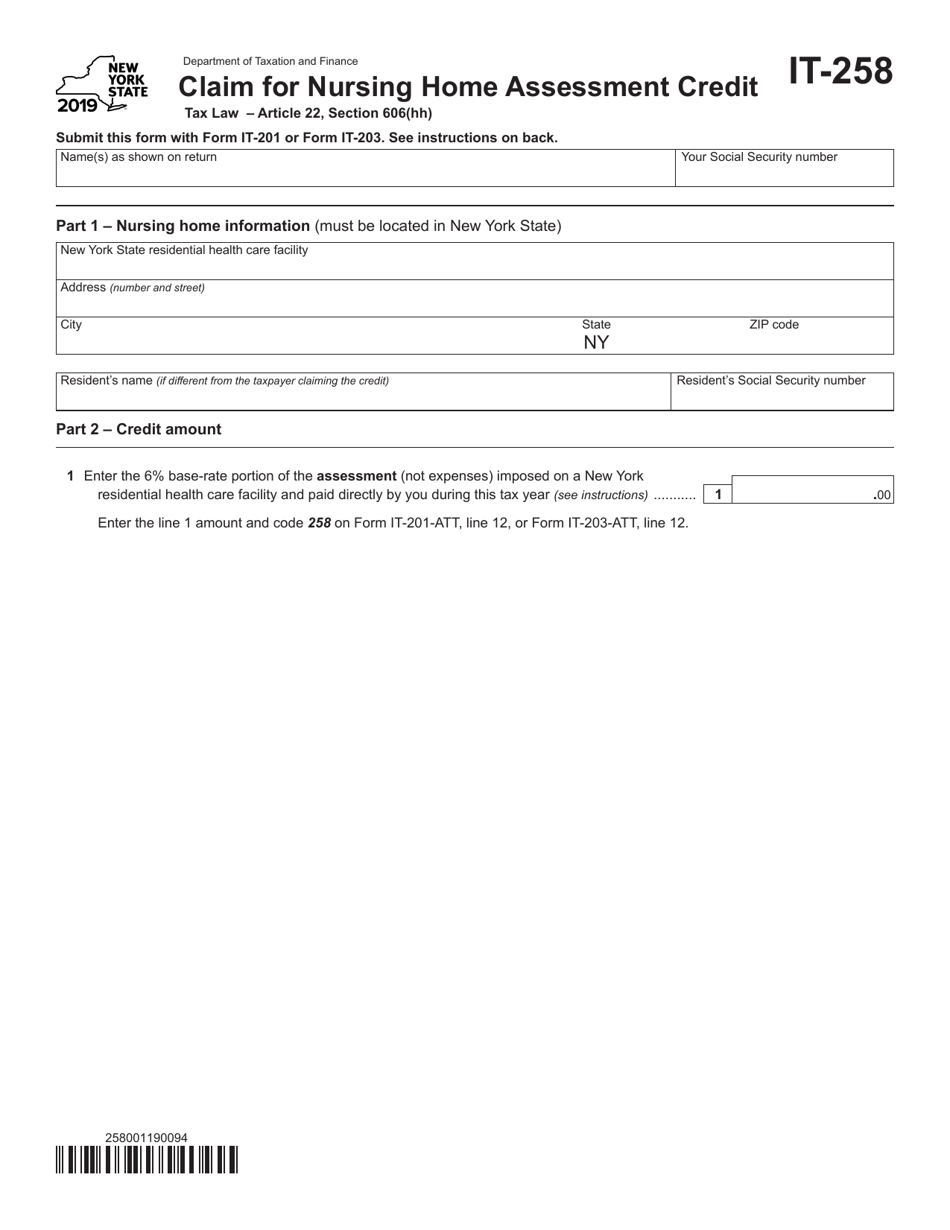

Form IT-258

for the current year.

Form IT-258 Claim for Nursing Home Assessment Credit - New York

What Is Form IT-258?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

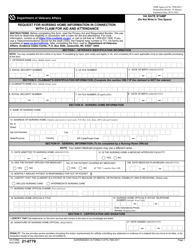

Q: What is Form IT-258?

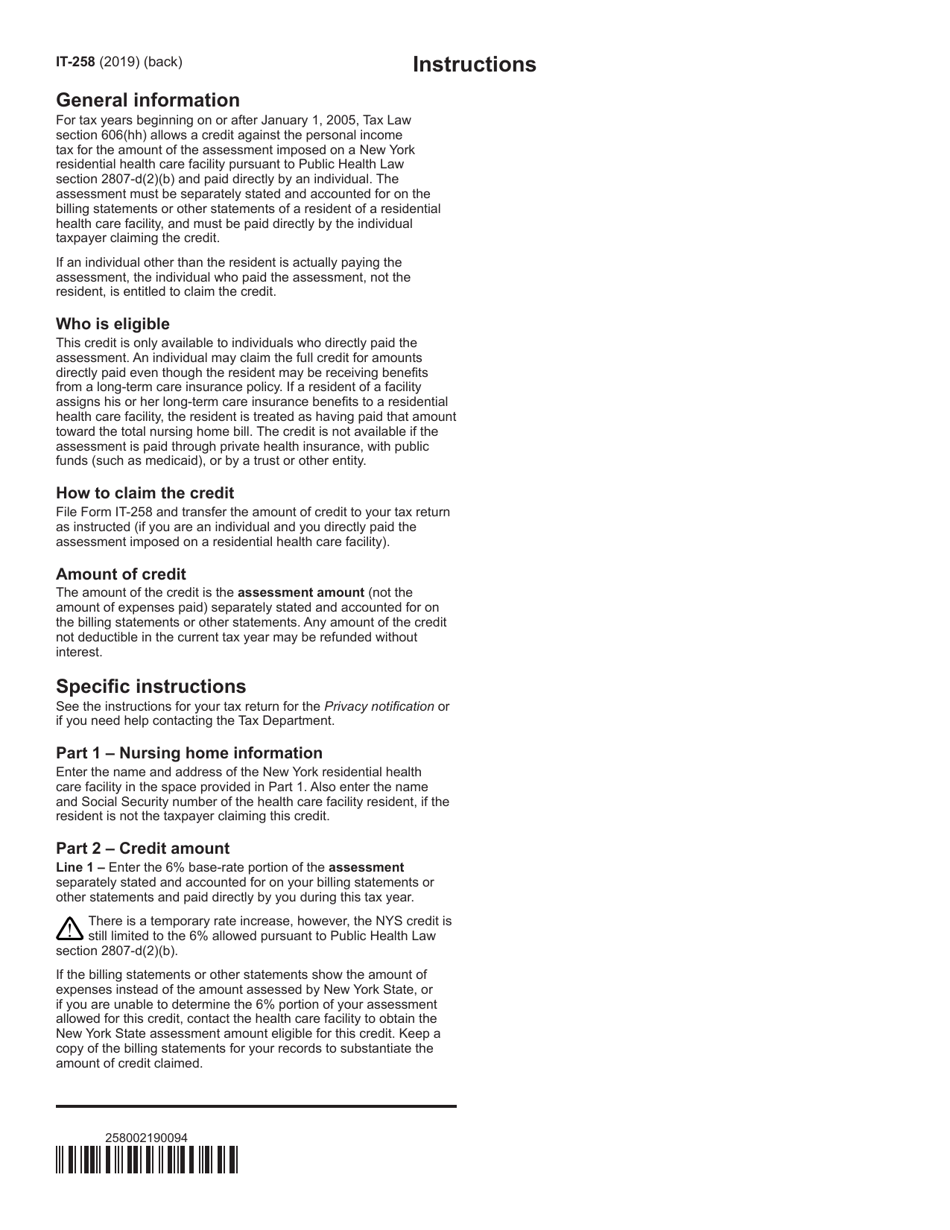

A: Form IT-258 is the Claim for Nursing HomeAssessment Credit specifically for residents of New York.

Q: Who is eligible to file Form IT-258?

A: New York residents who are eligible for the Nursing Home Assessment Credit may file Form IT-258.

Q: What is the Nursing Home Assessment Credit?

A: The Nursing Home Assessment Credit is a tax credit available to qualified individuals in New York who reside in a nursing home or who received care from a long-term care facility.

Q: How do I claim the Nursing Home Assessment Credit?

A: You can claim the Nursing Home Assessment Credit by completing Form IT-258 and including it with your New York state tax return.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-258 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.