This version of the form is not currently in use and is provided for reference only. Download this version of

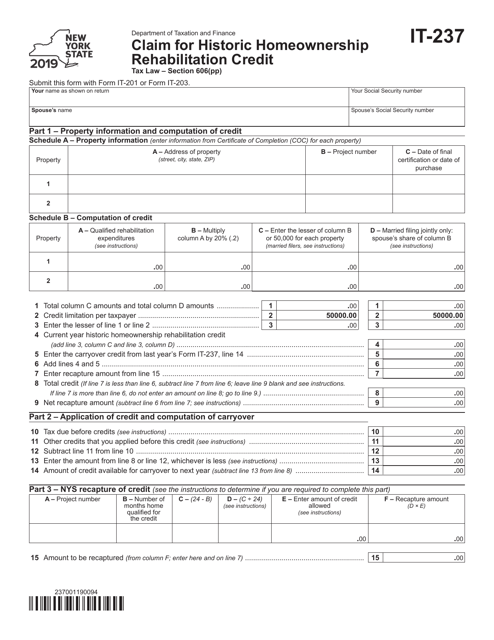

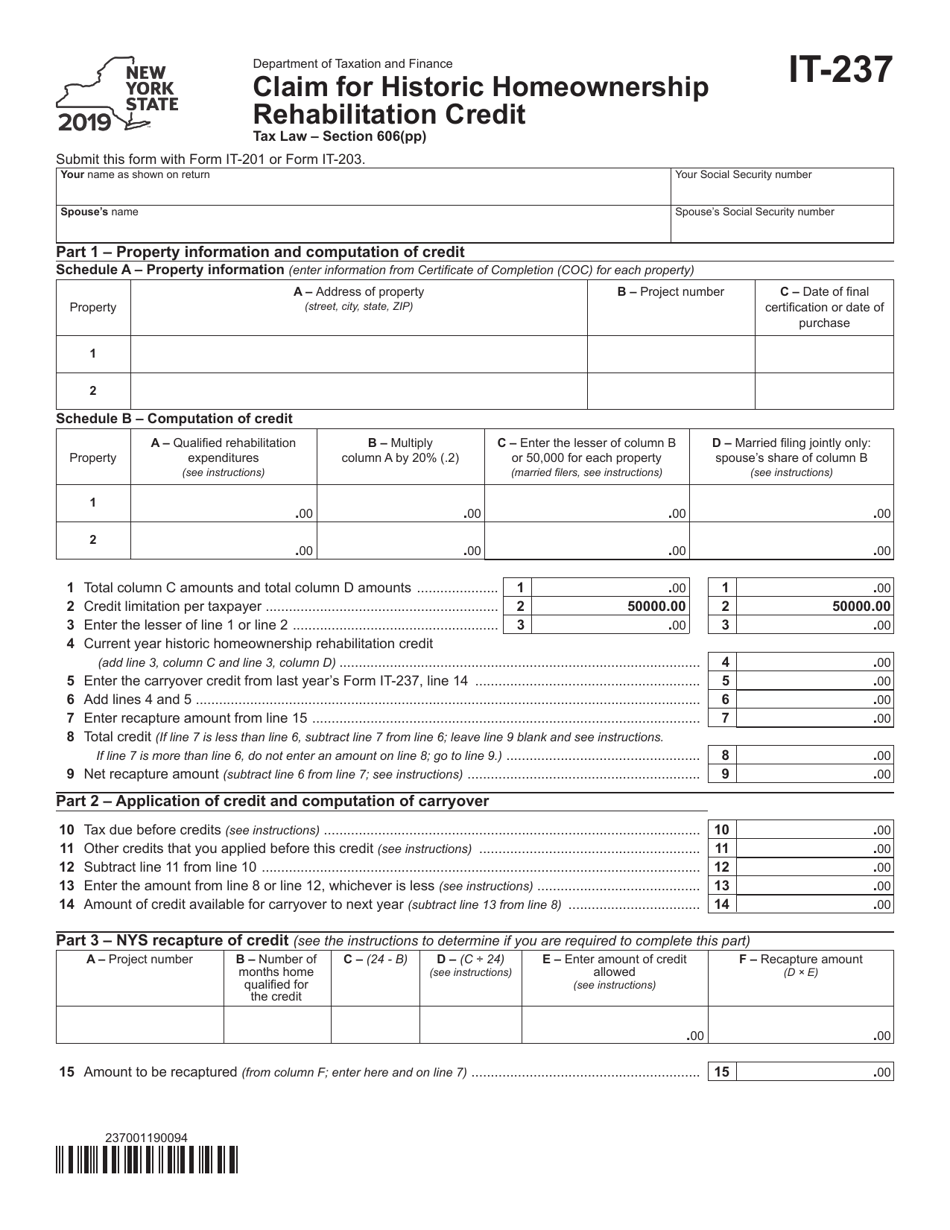

Form IT-237

for the current year.

Form IT-237 Claim for Historic Homeownership Rehabilitation Credit - New York

What Is Form IT-237?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-237?

A: Form IT-237 is a claim form used to apply for the Historic Homeownership Rehabilitation Credit in New York.

Q: What is the Historic Homeownership Rehabilitation Credit?

A: The Historic Homeownership Rehabilitation Credit is a tax credit in New York that can be claimed by eligible individuals for the rehabilitation of historic homes.

Q: Who can use Form IT-237?

A: Individuals who have incurred qualified rehabilitation expenses for a historic home in New York can use Form IT-237 to claim the Historic Homeownership Rehabilitation Credit.

Q: What are qualified rehabilitation expenses?

A: Qualified rehabilitation expenses are expenses incurred for the substantial rehabilitation of a historic home, including costs for materials, labor, and architectural services.

Q: How do I complete Form IT-237?

A: To complete Form IT-237, you need to provide your personal information, details about the historic home, information about the qualified rehabilitation expenses, and any other required supporting documentation.

Q: Is there a deadline for filing Form IT-237?

A: Yes, Form IT-237 must be filed within one year from the date the rehabilitation work is completed or the property is placed in service, whichever is later.

Q: How much is the Historic Homeownership Rehabilitation Credit?

A: The credit amount is equal to 20% of the qualified rehabilitation expenses, up to a maximum credit of $50,000 per historic home.

Q: Can the Historic Homeownership Rehabilitation Credit be carried forward?

A: No, the credit cannot be carried forward to future tax years and must be claimed in the year the rehabilitation work is completed.

Q: Are there any limitations or restrictions on claiming the credit?

A: Yes, there are several limitations and restrictions on claiming the credit, including income limitations, eligibility requirements, and compliance with historic preservation standards.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-237 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.