This version of the form is not currently in use and is provided for reference only. Download this version of

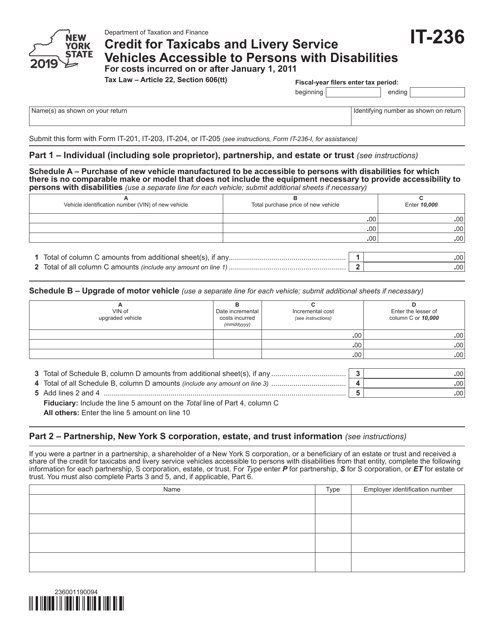

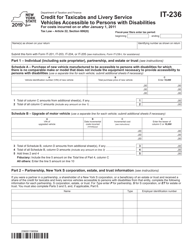

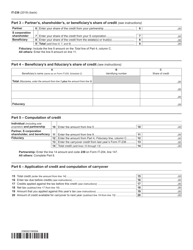

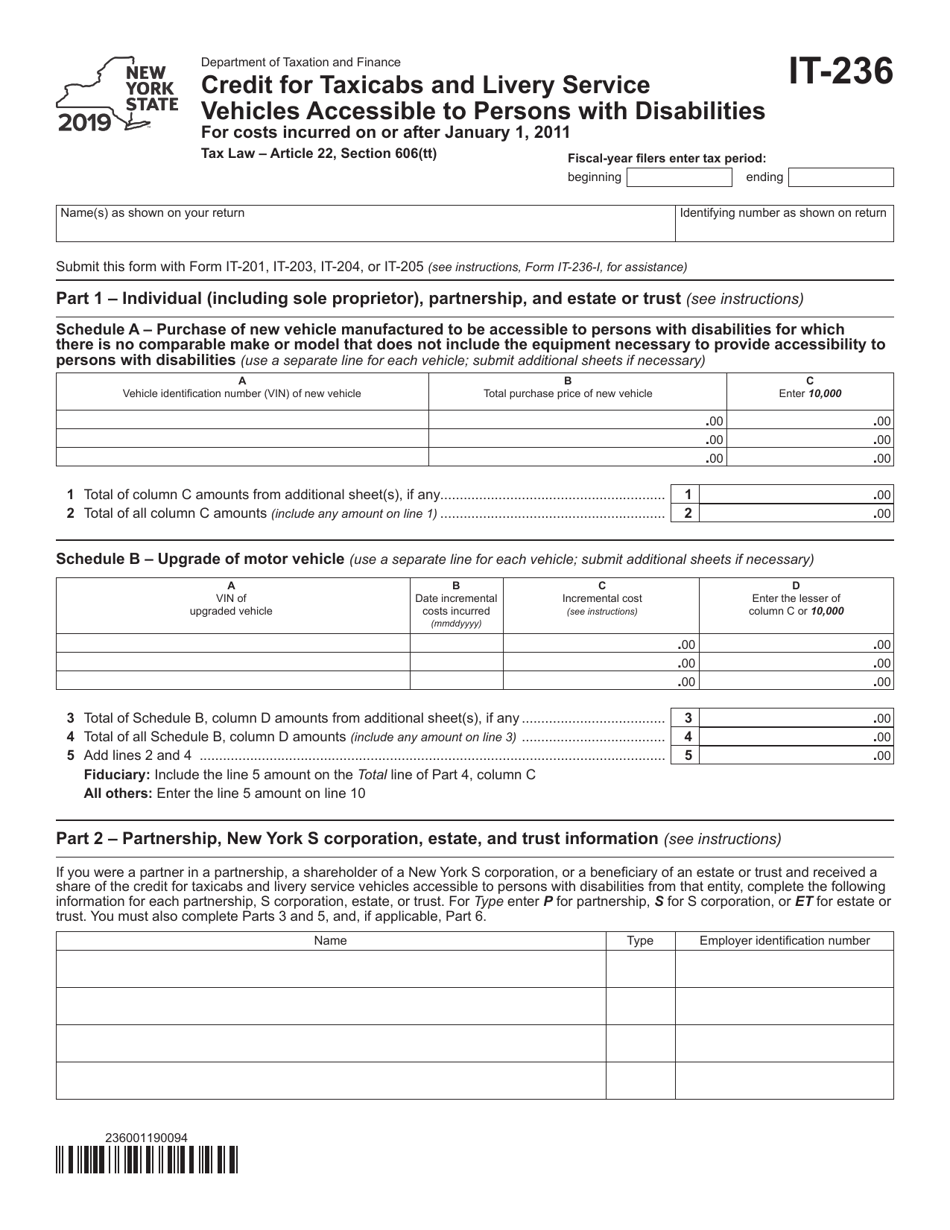

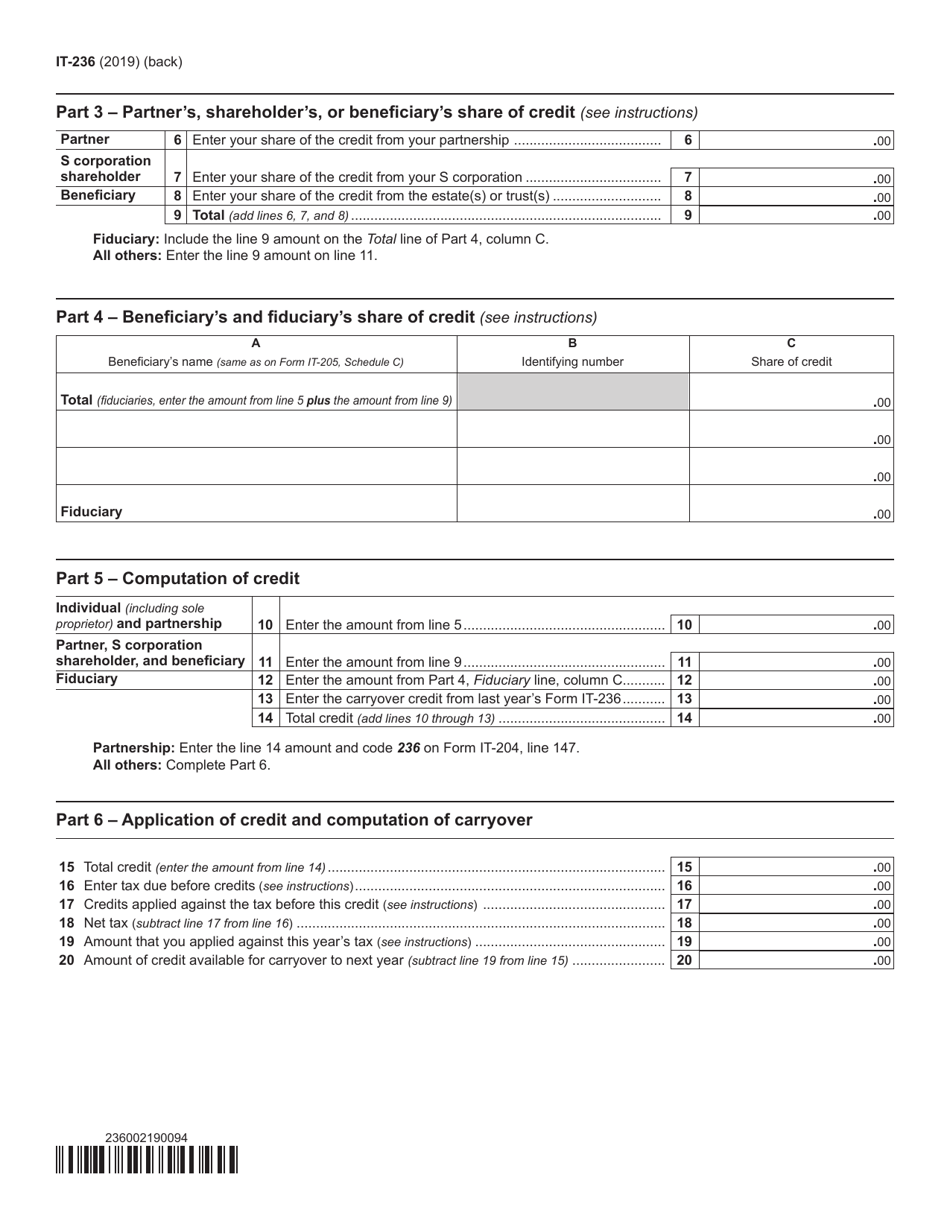

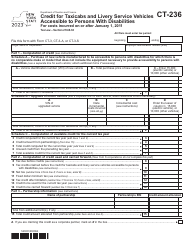

Form IT-236

for the current year.

Form IT-236 Credit for Taxicabs and Livery Service Vehicles Accessible to Persons With Disabilities - New York

What Is Form IT-236?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-236?

A: Form IT-236 is a tax form used in New York to claim the Credit for Taxicabs and Livery Service Vehicles Accessible to Persons With Disabilities.

Q: Who can use Form IT-236?

A: This form can be used by individuals or businesses who operate taxicabs or livery service vehicles in New York and provide services to persons with disabilities.

Q: What is the purpose of the form?

A: The purpose of Form IT-236 is to claim a credit for the costs associated with making taxicabs or livery service vehicles accessible to persons with disabilities.

Q: What expenses can be claimed on Form IT-236?

A: You can claim expenses related to the purchase or lease of accessible vehicles, modifications to existing vehicles, and costs associated with training drivers to assist persons with disabilities.

Q: How much is the credit?

A: The credit is 50% of the eligible expenses, up to a maximum of $10,000 per vehicle.

Q: How can I file Form IT-236?

A: Form IT-236 can be filed electronically or by mail with the New York State Department of Taxation and Finance.

Q: Are there any deadlines for filing Form IT-236?

A: Yes, the form must be filed by the due date of the tax return for the year in which the expenses were incurred.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-236 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.