This version of the form is not currently in use and is provided for reference only. Download this version of

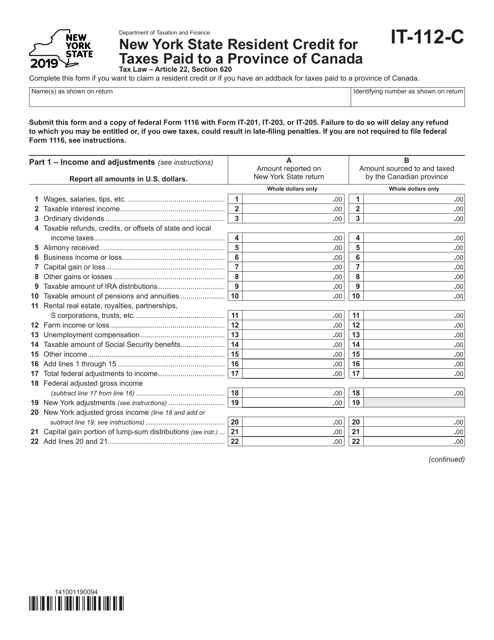

Form IT-112-C

for the current year.

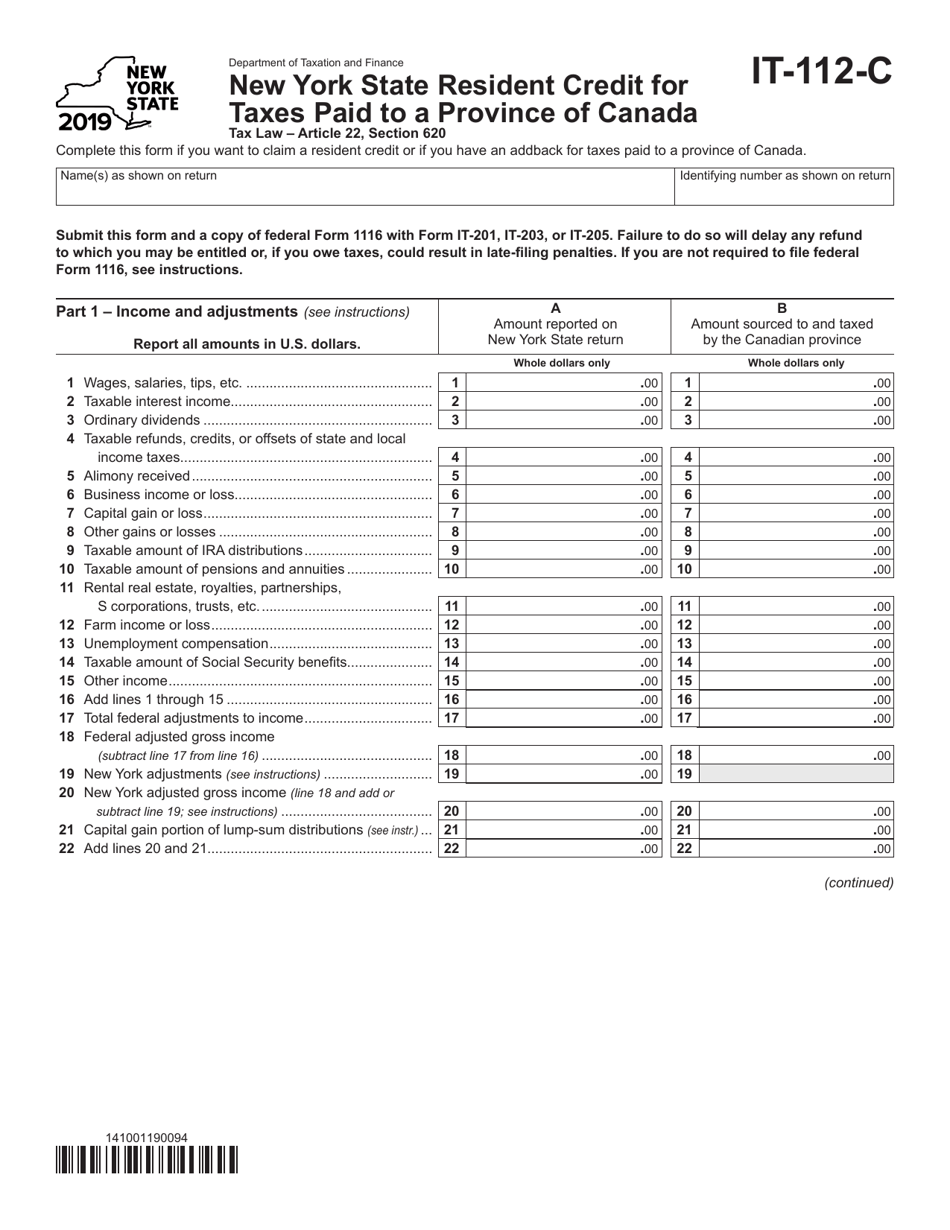

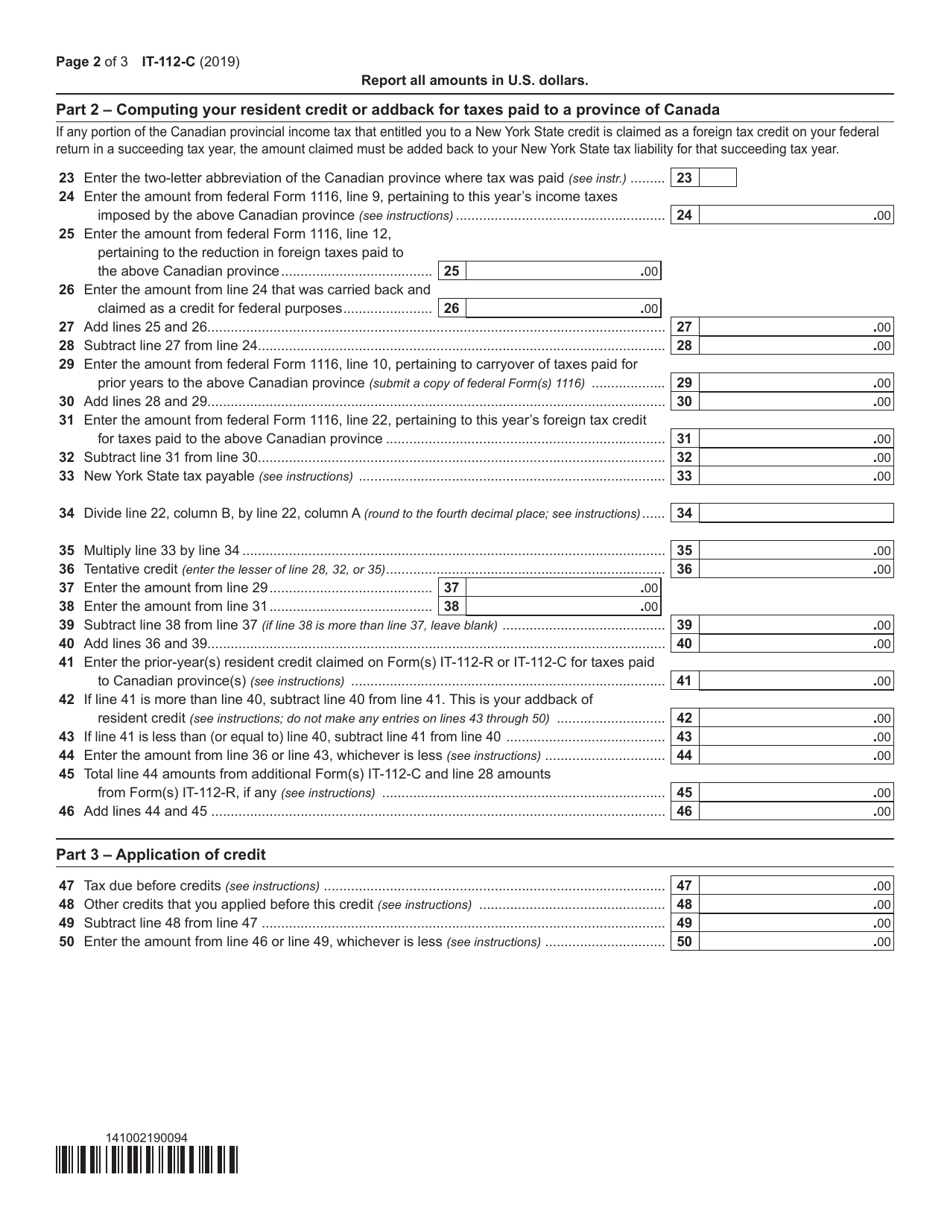

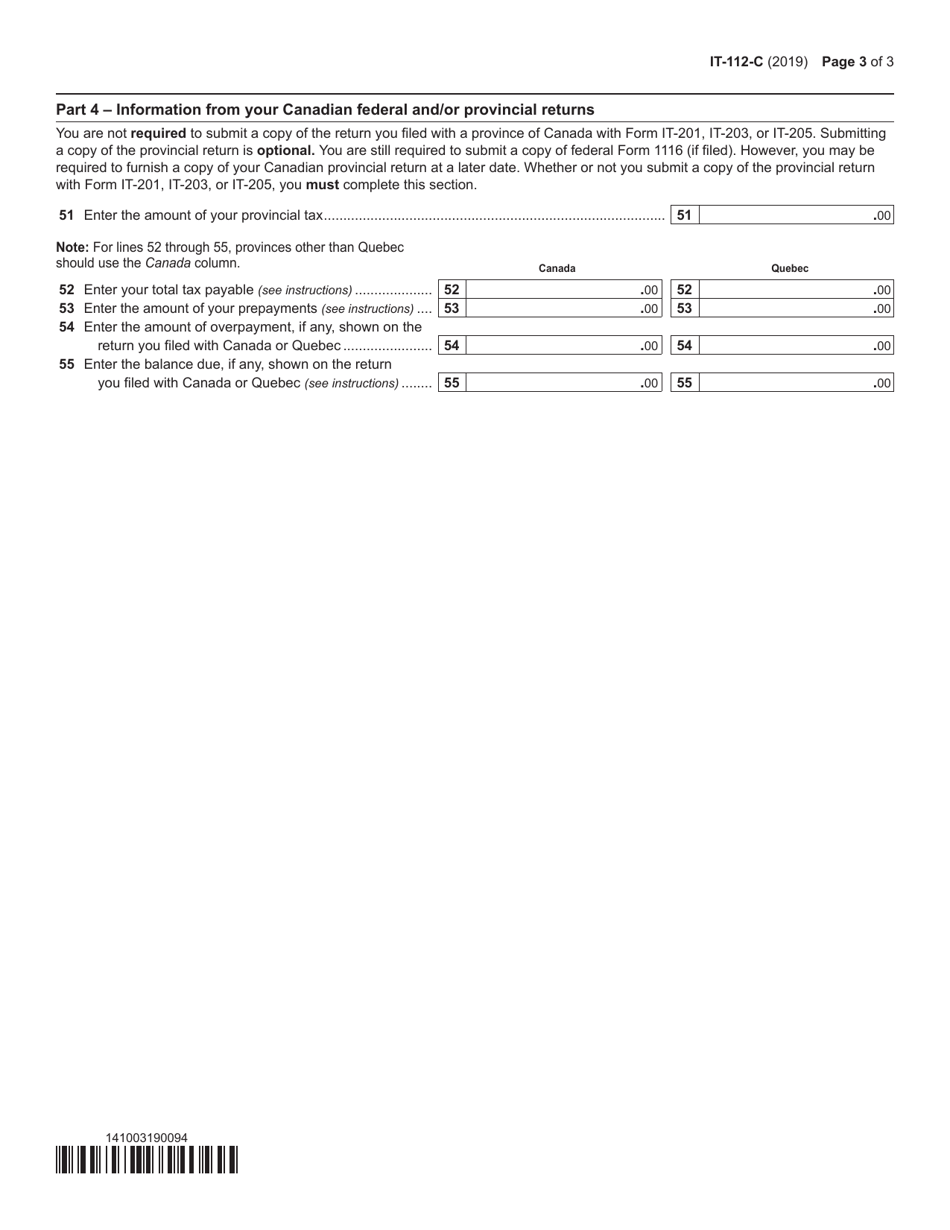

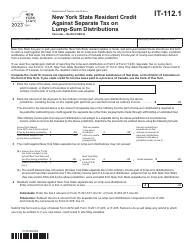

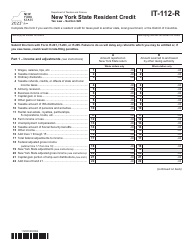

Form IT-112-C New York State Resident Credit for Taxes Paid to a Province of Canada - New York

What Is Form IT-112-C?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-112-C?

A: Form IT-112-C is the New York State Resident Credit for Taxes Paid to a Province of Canada form.

Q: Who is eligible to use Form IT-112-C?

A: New York State residents who have paid taxes to a province of Canada are eligible to use Form IT-112-C.

Q: What is the purpose of Form IT-112-C?

A: The purpose of Form IT-112-C is to claim a credit for taxes paid to a province of Canada on the same income that is subject to New York State income tax.

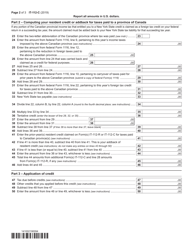

Q: How do I fill out Form IT-112-C?

A: You need to provide your personal information, details of the taxes paid to a province of Canada, and calculate the credit amount.

Q: Can I e-file Form IT-112-C?

A: No, Form IT-112-C cannot be e-filed. It must be filed by mail along with your New York State tax return.

Q: Is there a deadline for filing Form IT-112-C?

A: Yes, Form IT-112-C must be filed by the same deadline as your New York State tax return, which is usually April 15th.

Q: Can I claim the credit for taxes paid to a province of Canada if I am not a New York State resident?

A: No, Form IT-112-C is specifically for New York State residents.

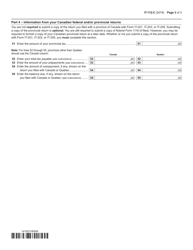

Q: What documentation do I need to include with Form IT-112-C?

A: You should include a copy of your Canadian tax return and any supporting documentation for taxes paid to a province of Canada.

Q: Is the credit for taxes paid to a province of Canada refundable?

A: No, the credit is non-refundable. It can only reduce your New York State income tax liability.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-112-C by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.