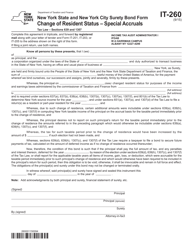

This version of the form is not currently in use and is provided for reference only. Download this version of

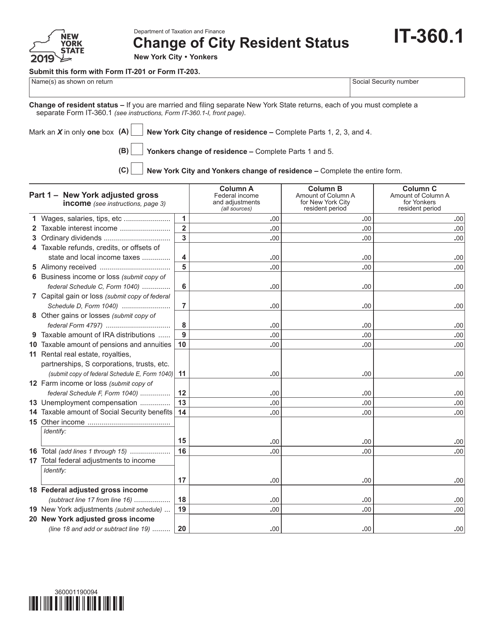

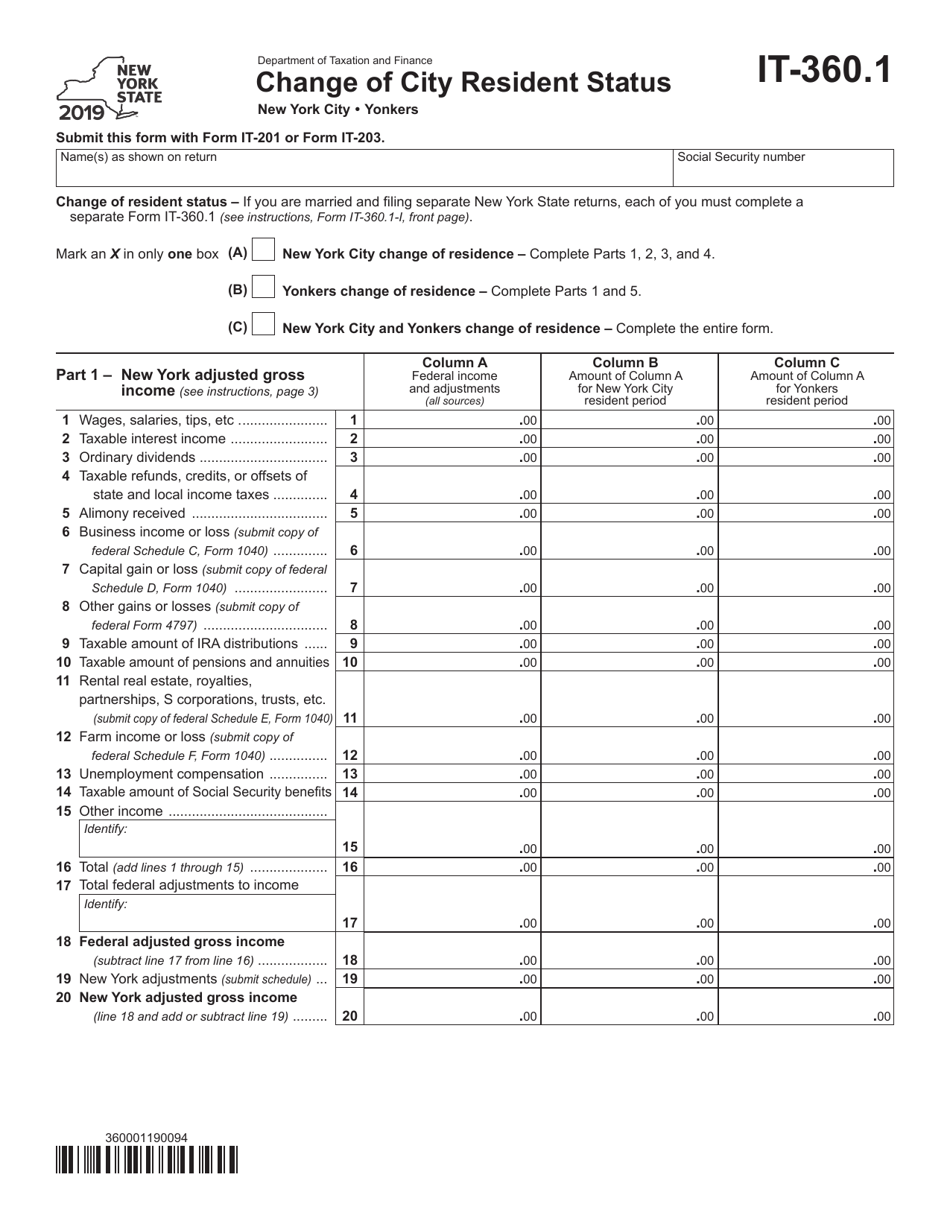

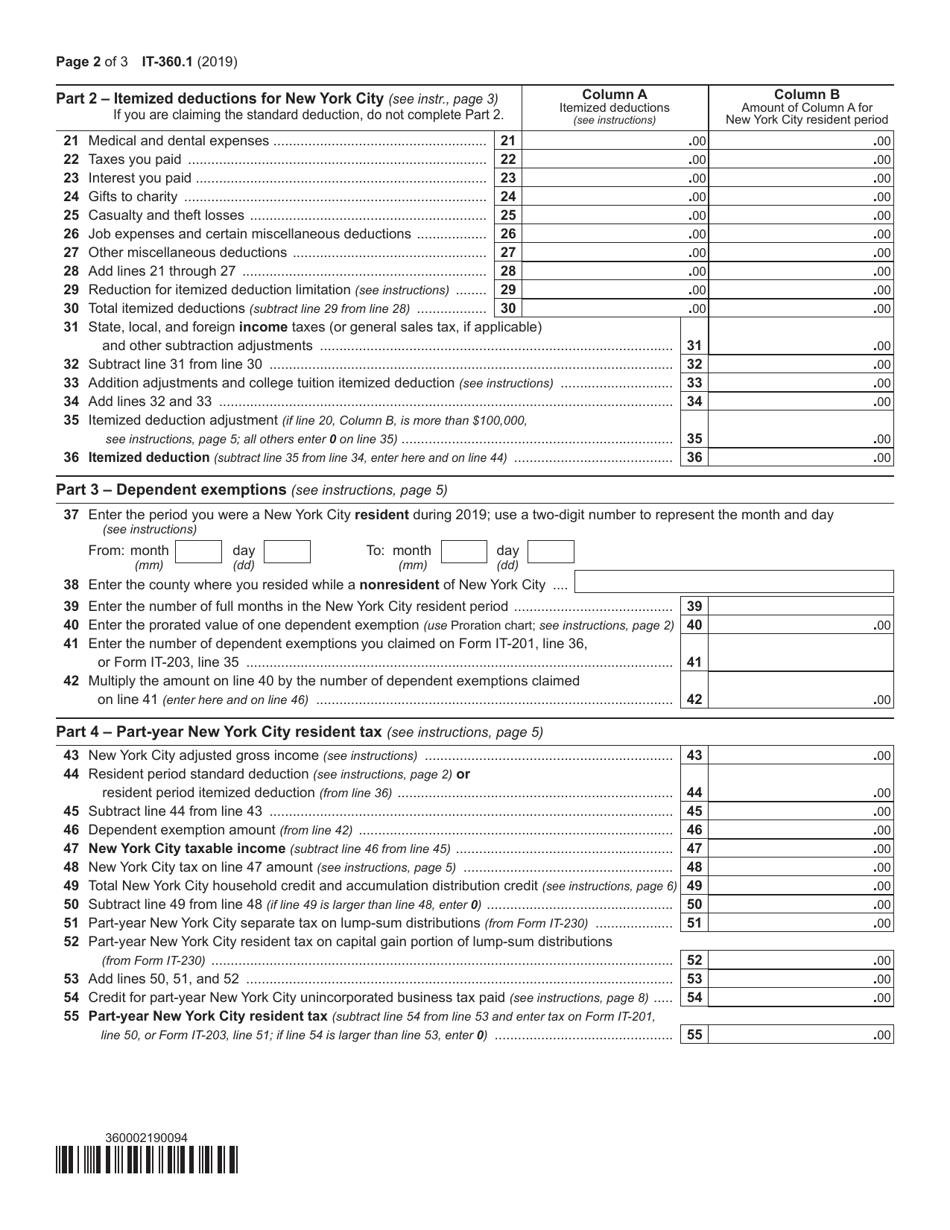

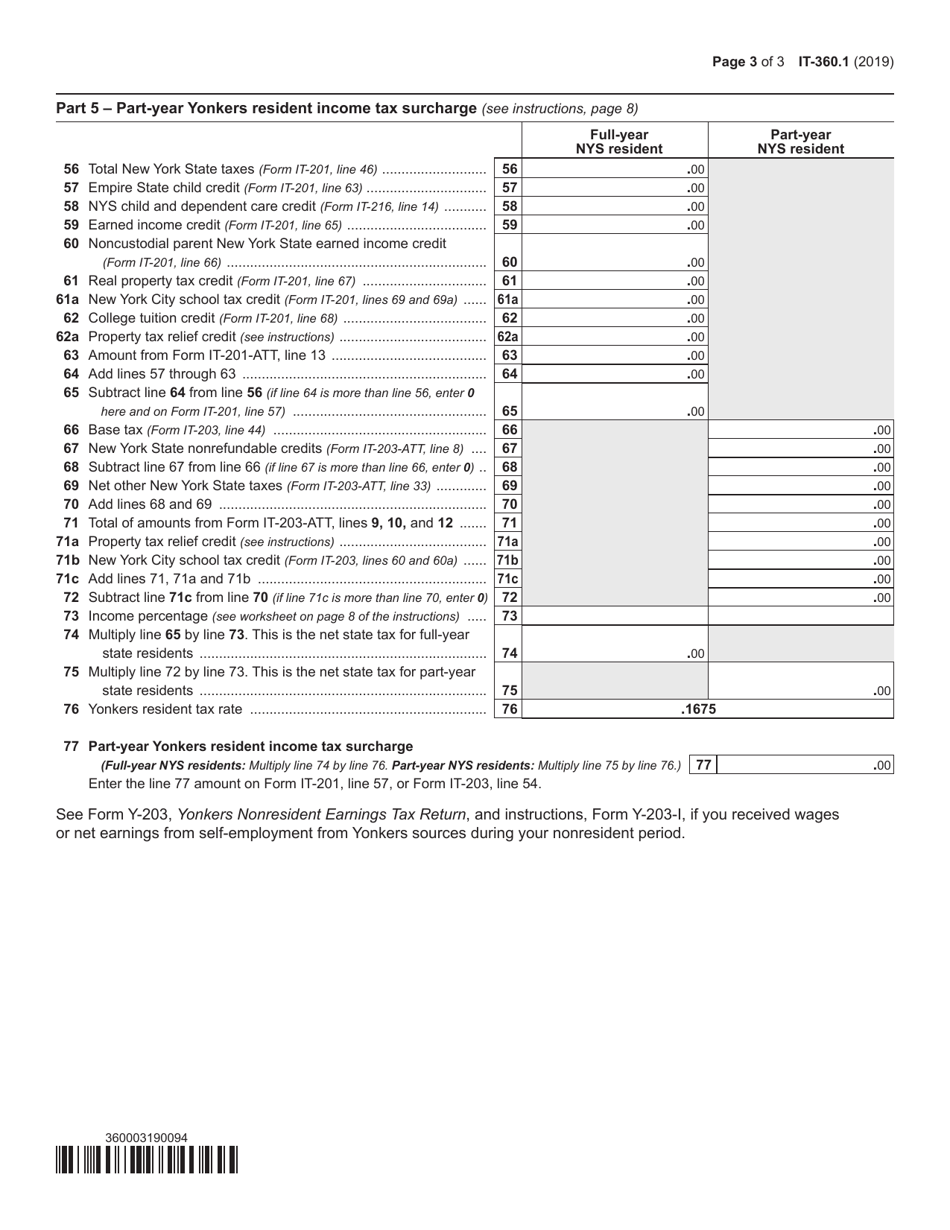

Form IT-360.1

for the current year.

Form IT-360.1 Change of City Resident Status - New York

What Is Form IT-360.1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-360.1?

A: Form IT-360.1 is a form used to report a change in city resident status in New York.

Q: Who needs to file Form IT-360.1?

A: This form needs to be filed by individuals who have changed their city resident status in New York.

Q: When should Form IT-360.1 be filed?

A: Form IT-360.1 should be filed within 30 days of the date you changed your city resident status.

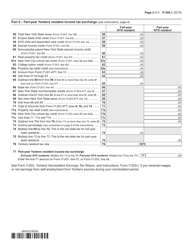

Q: What information is required on Form IT-360.1?

A: Form IT-360.1 requires information such as personal details, date of city resident status change, and details of income earned outside of New York City.

Q: Is there a fee for filing Form IT-360.1?

A: No, there is no fee for filing Form IT-360.1.

Q: What happens if I fail to file Form IT-360.1?

A: Failure to file Form IT-360.1 may result in penalties or interest charges from the New York State Department of Taxation and Finance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-360.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.