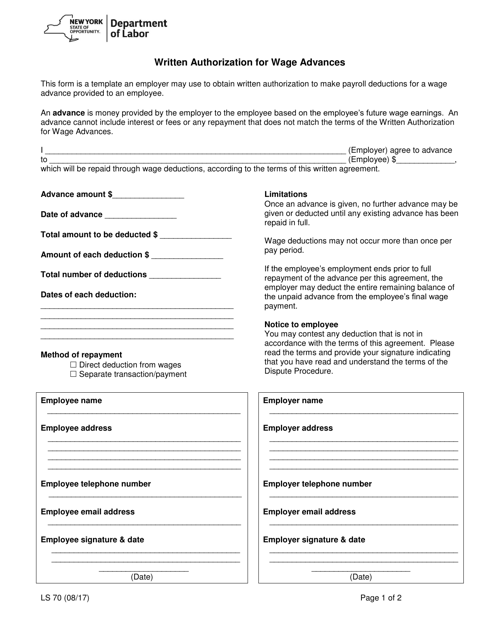

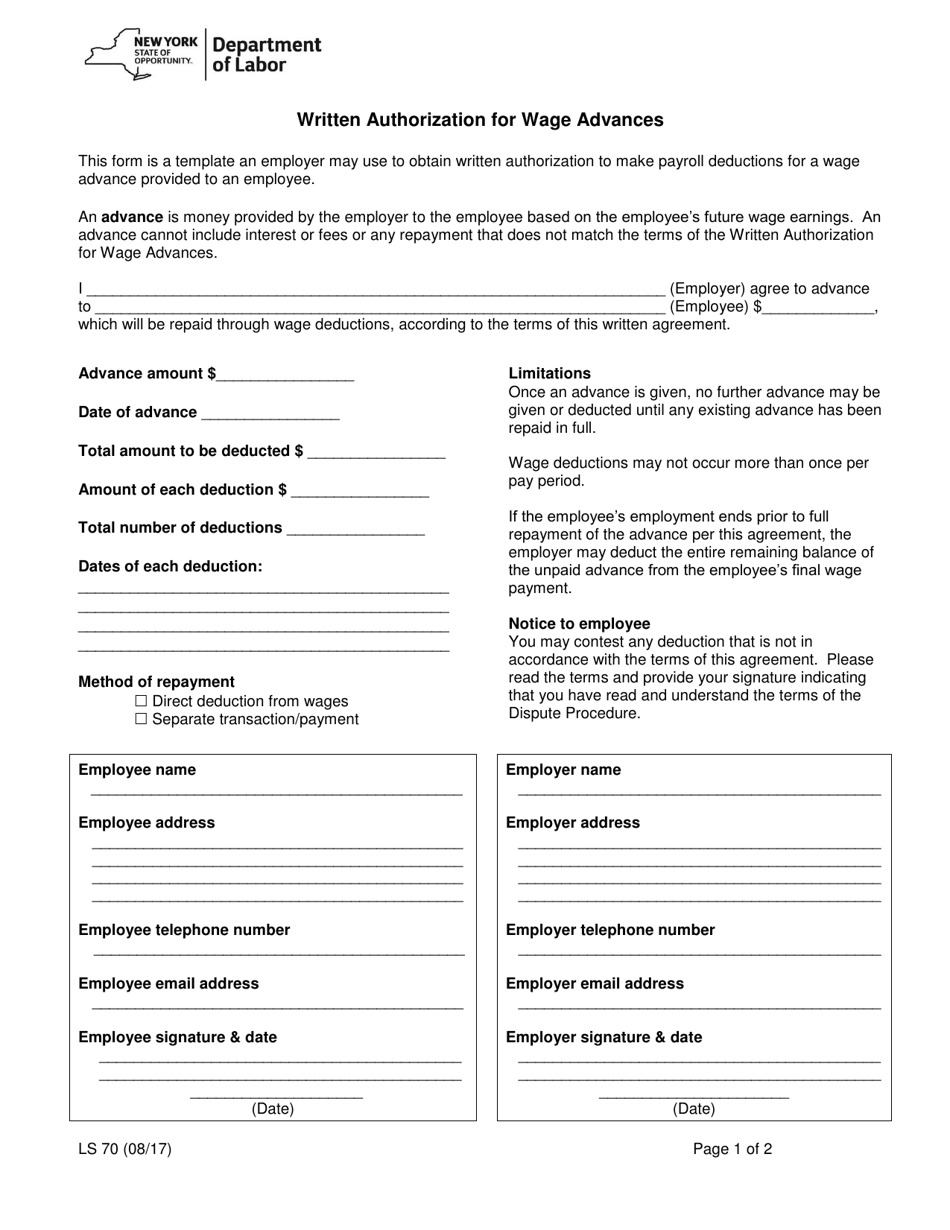

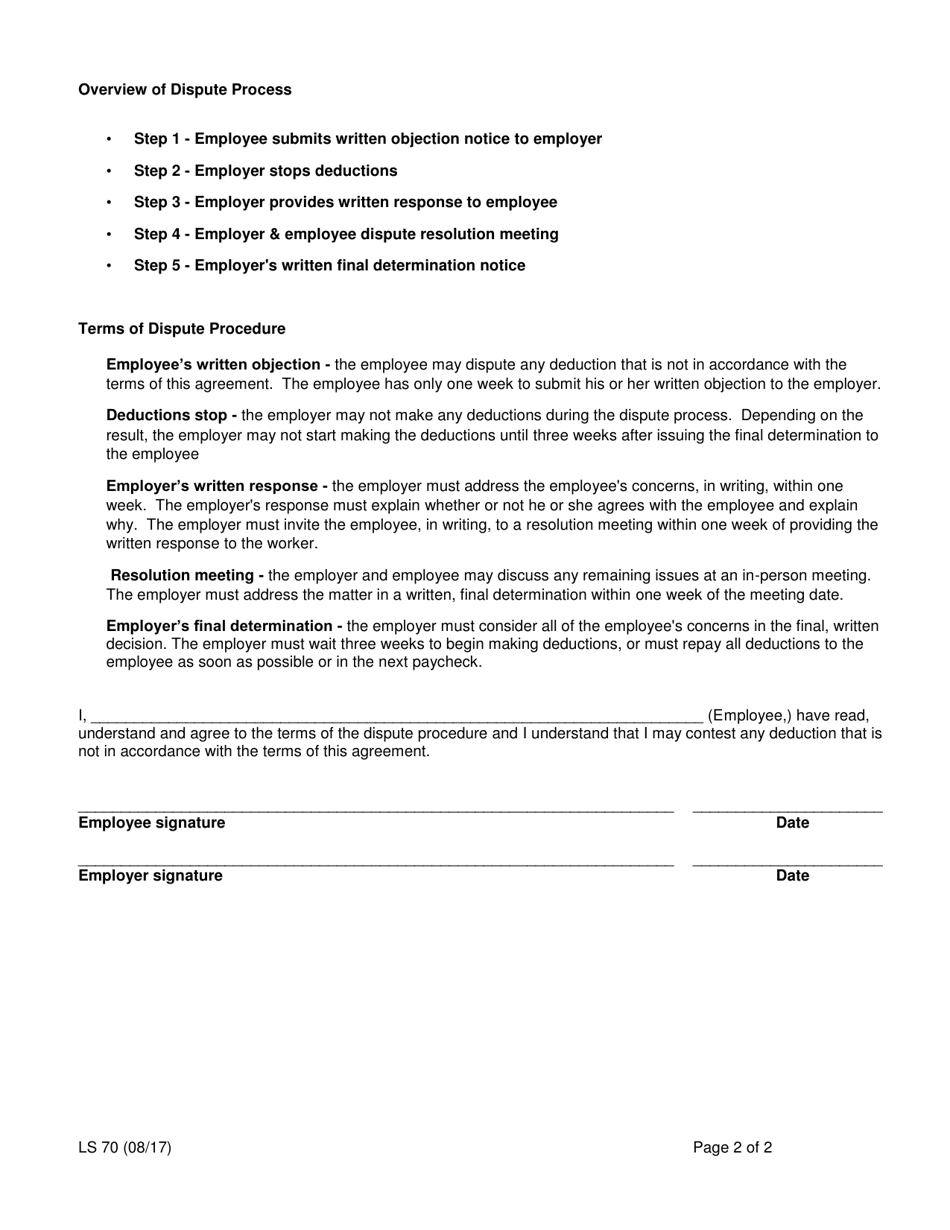

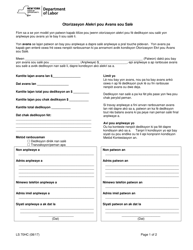

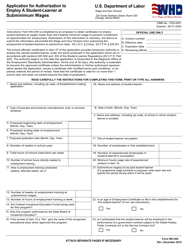

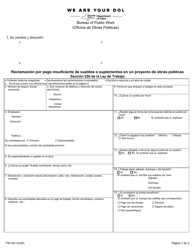

Form LS70 Written Authorization for Wage Advances - New York

What Is Form LS70?

This is a legal form that was released by the New York State Department of Labor - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the LS70 form?

A: The LS70 form is a written authorization for wage advances in New York.

Q: Who uses the LS70 form?

A: The LS70 form is used by employers in New York to obtain written authorization from employees for wage advances.

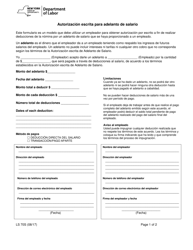

Q: What is a wage advance?

A: A wage advance is an early payment of a portion of an employee's wages before the regular payday.

Q: Why would an employee request a wage advance?

A: An employee may request a wage advance to cover unexpected expenses or financial emergencies before their next payday.

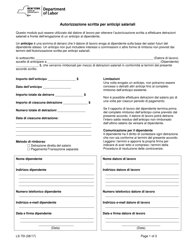

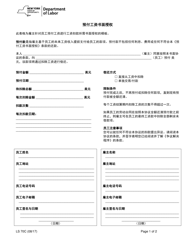

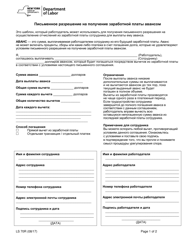

Q: What information is required on the LS70 form?

A: The LS70 form requires the employee's name, employer's name, amount of the wage advance, and the repayment terms.

Q: Are employers obligated to provide wage advances?

A: No, employers are not obligated to provide wage advances. It is at the discretion of the employer.

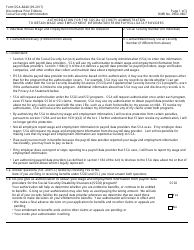

Q: Can employers charge interest or fees on wage advances?

A: No, employers cannot charge interest or fees on wage advances in New York.

Q: Can an employee be fired for requesting a wage advance?

A: No, an employee cannot be fired solely for requesting a wage advance. However, the employer is not required to grant the request.

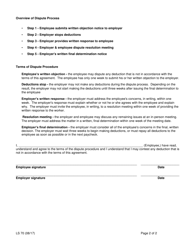

Q: What happens if an employee does not repay the wage advance?

A: If an employee does not repay the wage advance according to the agreed-upon terms, the employer may deduct the outstanding amount from the employee's future wages.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the New York State Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form LS70 by clicking the link below or browse more documents and templates provided by the New York State Department of Labor.