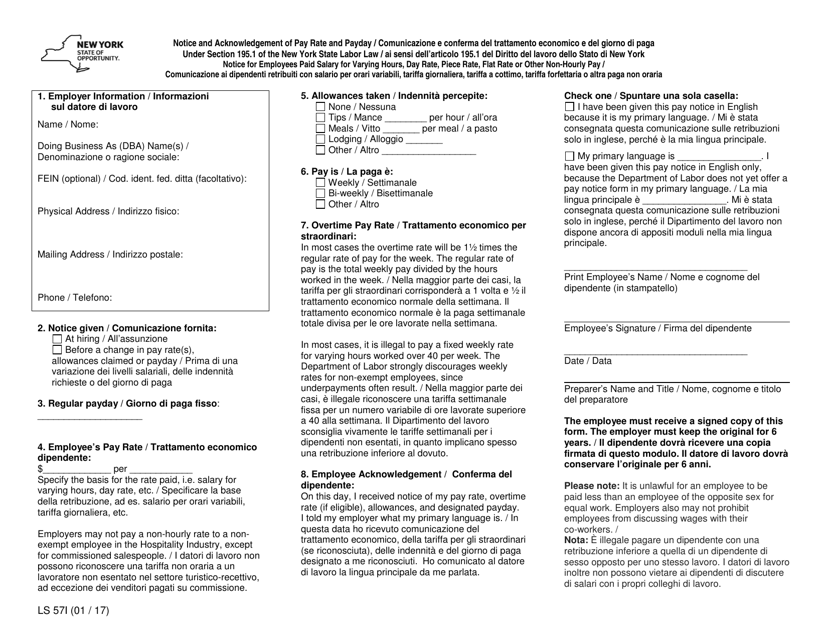

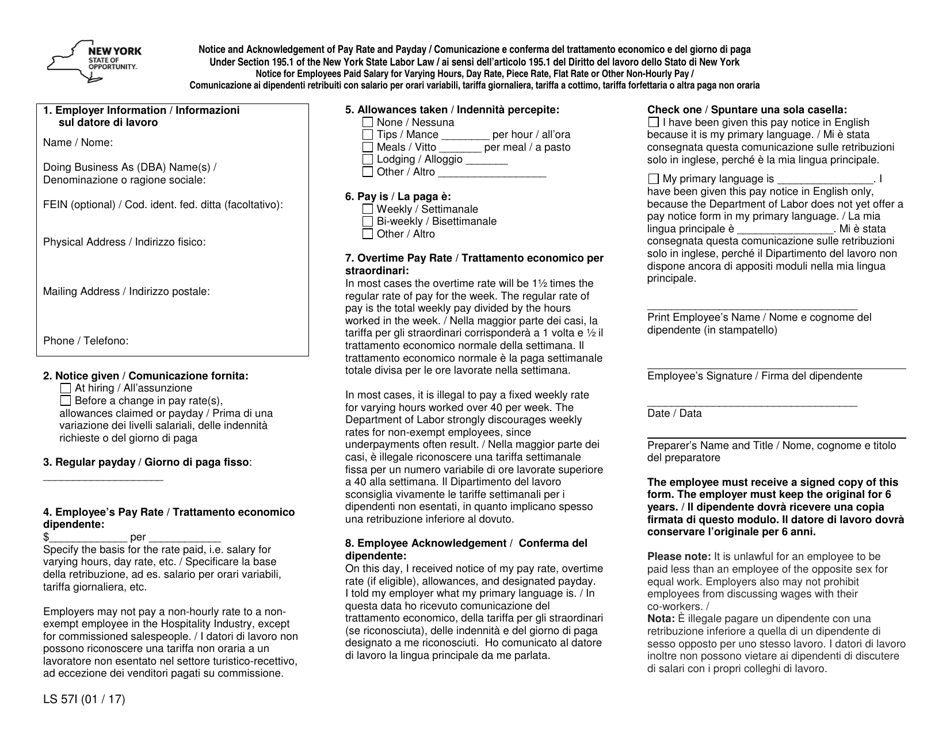

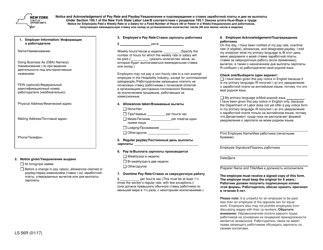

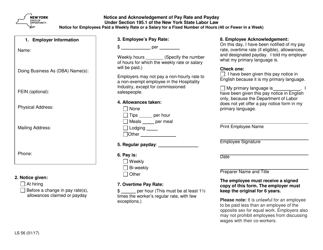

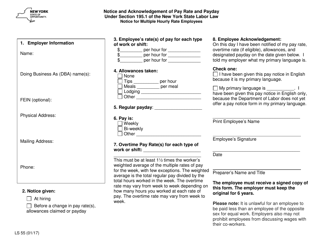

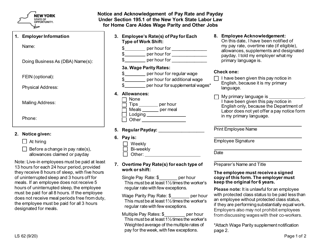

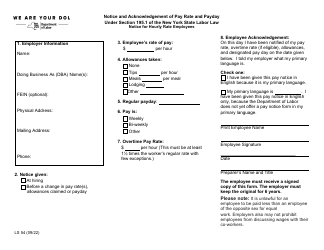

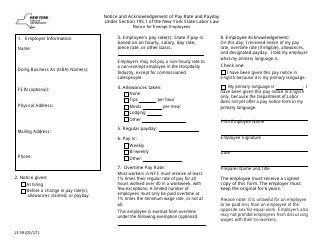

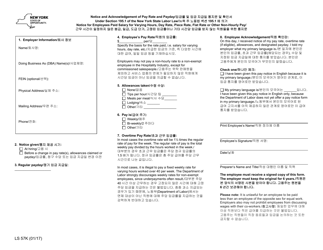

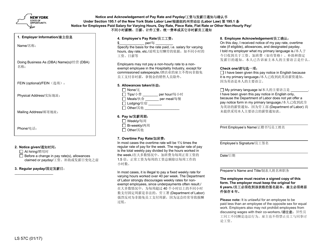

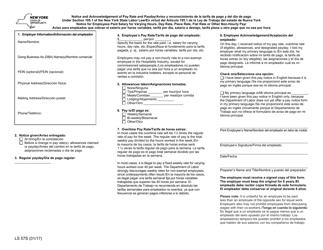

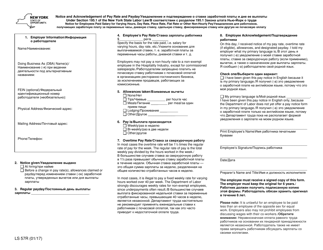

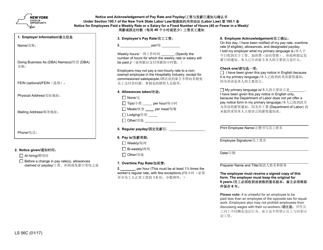

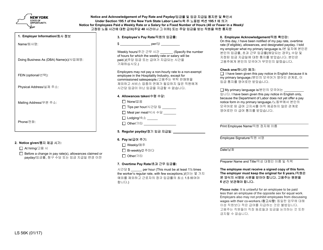

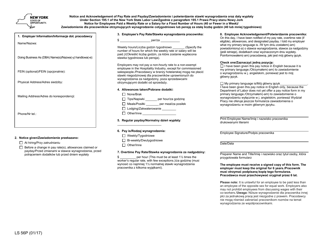

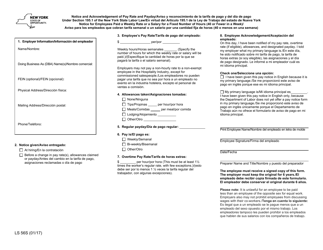

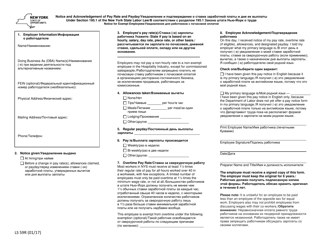

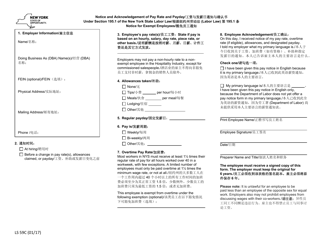

Form LS57I Pay Notice for Employees Paid a Salary for Varying Hours, Day Rate, Piece Rate, Flat Rate or Other Non-hourly Pay - New York (English / Italian)

What Is Form LS57I?

This is a legal form that was released by the New York State Department of Labor - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form LS57I?

A: The Form LS57I is a Pay Notice for Employees Paid a Salary for Varying Hours, Day Rate, Piece Rate, Flat Rate or Other Non-hourly Pay in New York.

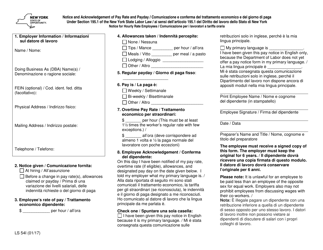

Q: Who should use the Form LS57I?

A: Employers in New York who pay their employees a salary for varying hours, day rate, piece rate, flat rate, or other non-hourly pay should use the Form LS57I.

Q: What is the purpose of the Form LS57I?

A: The purpose of the Form LS57I is to provide employees with a notice of how their wages are calculated when they are paid a salary for varying hours, day rate, piece rate, flat rate, or other non-hourly pay.

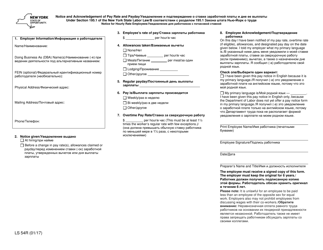

Q: What information should be included in the Form LS57I?

A: The Form LS57I should include the employer's name and address, the employee's name, the pay period covered, the employee's rate of pay, and details on how the employee's wages are calculated.

Q: Is the Form LS57I available in languages other than English?

A: Yes, the Form LS57I is available in English and Italian.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the New York State Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form LS57I by clicking the link below or browse more documents and templates provided by the New York State Department of Labor.