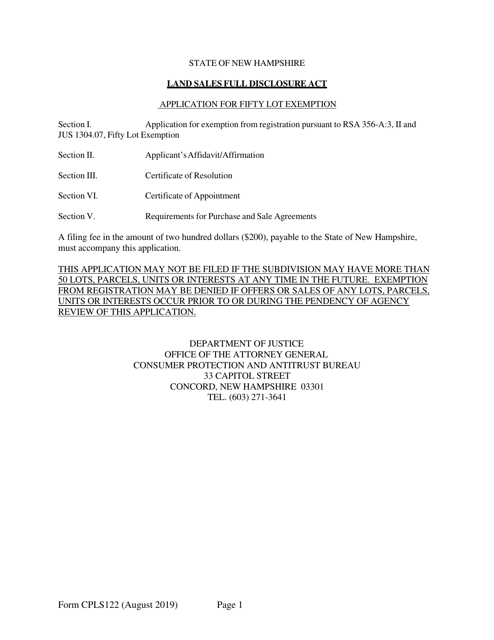

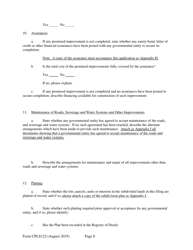

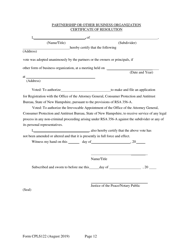

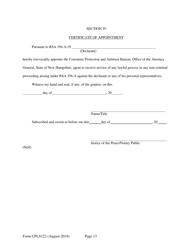

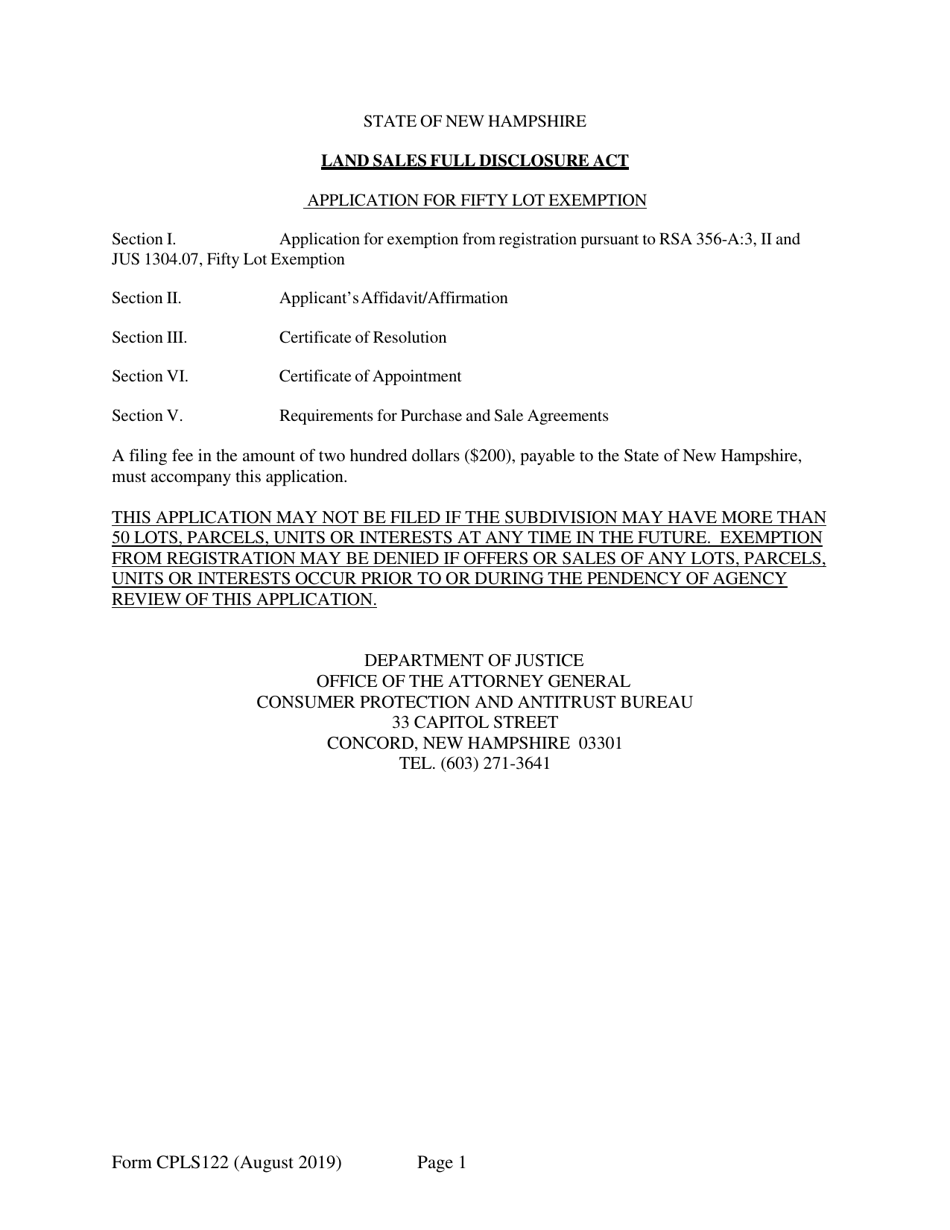

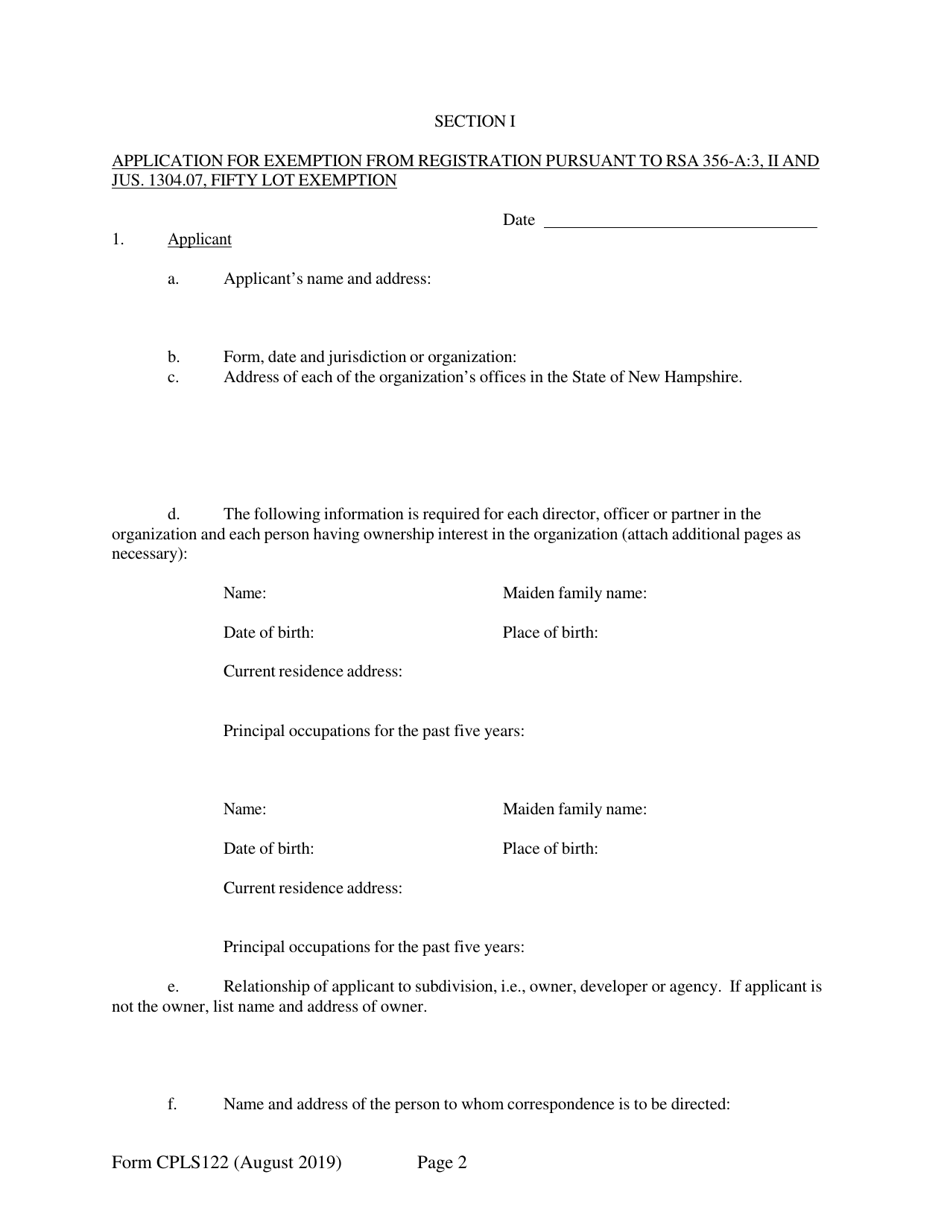

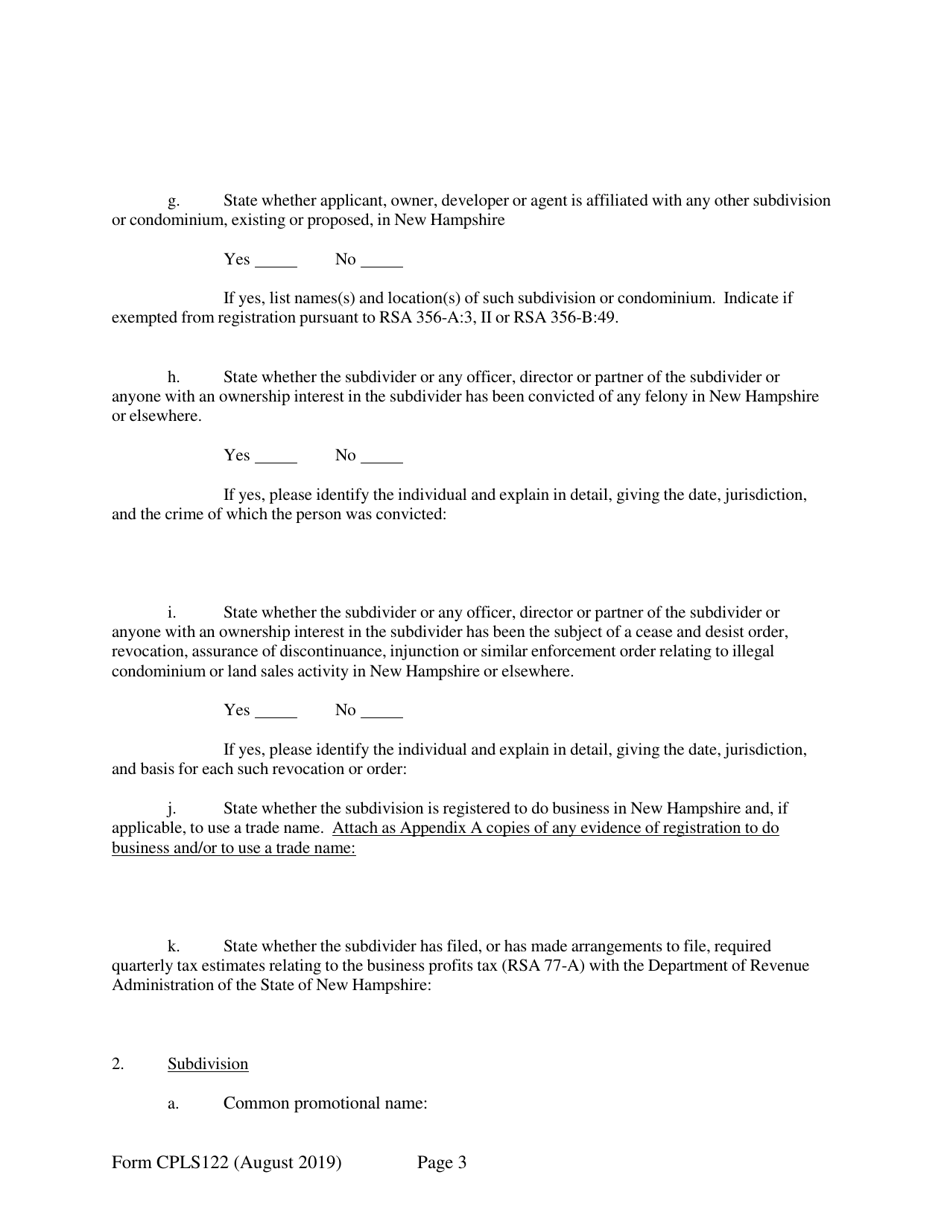

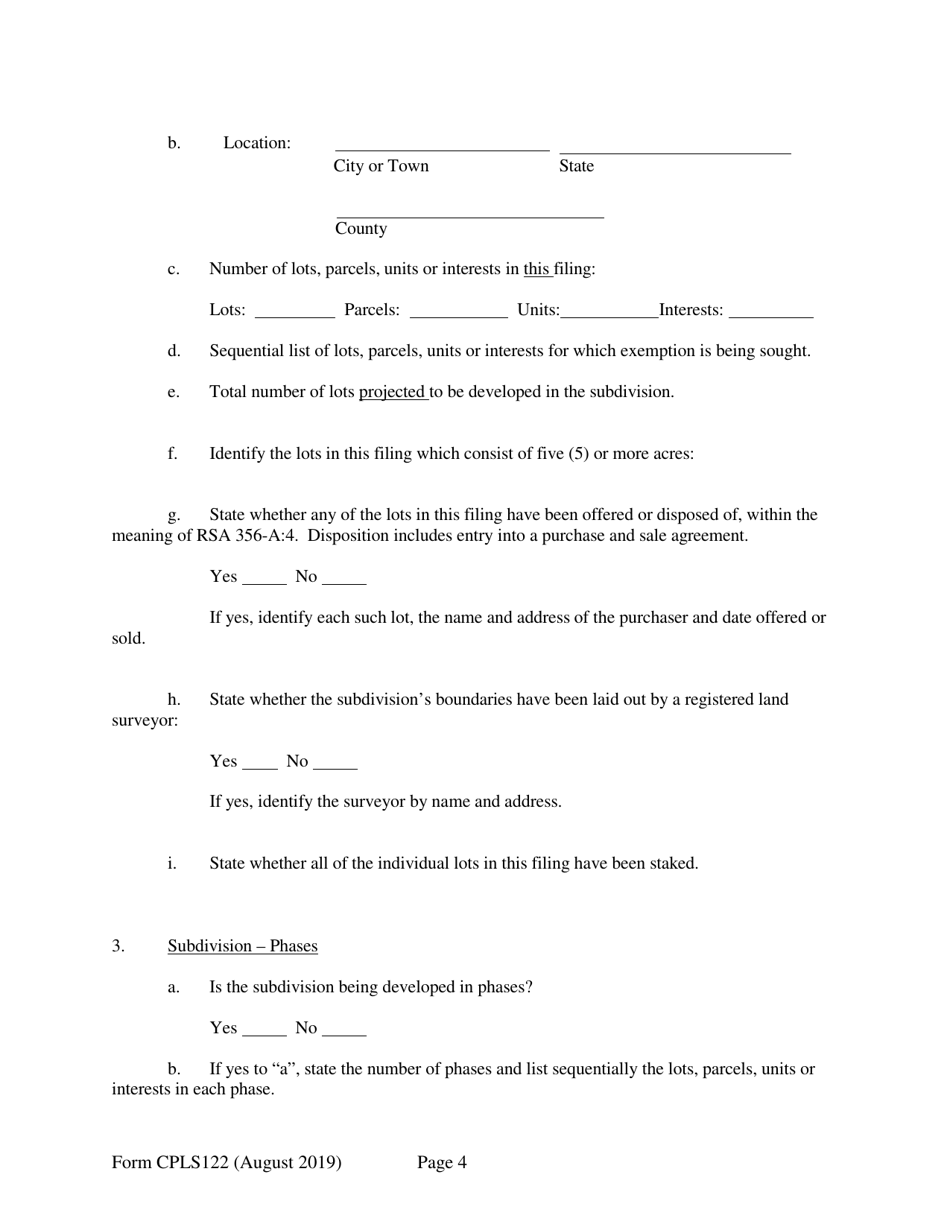

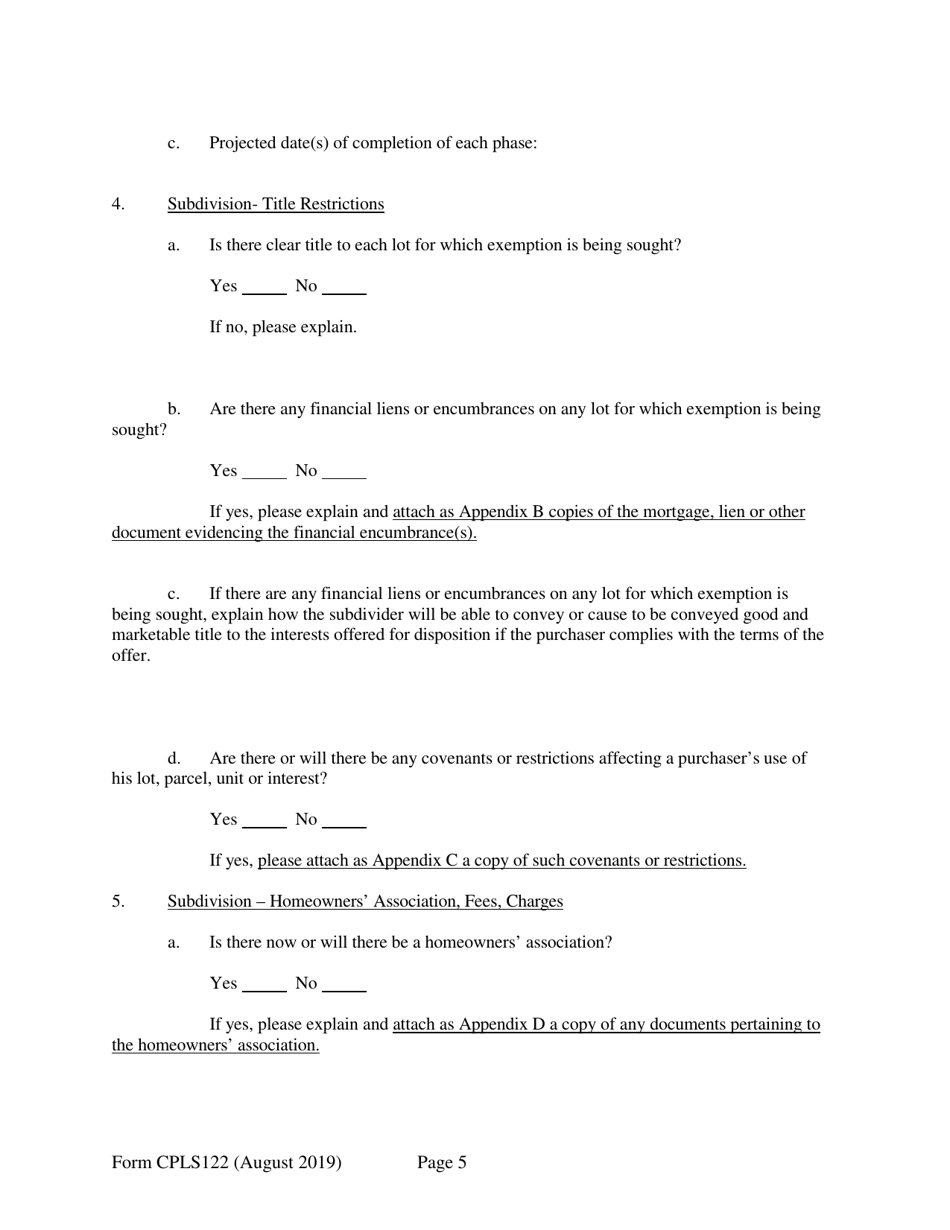

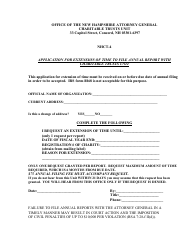

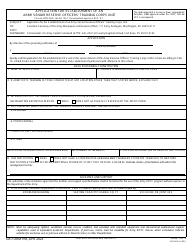

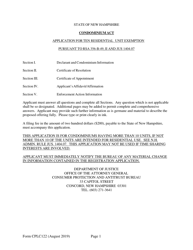

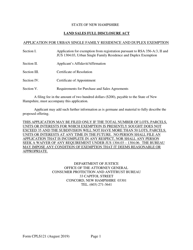

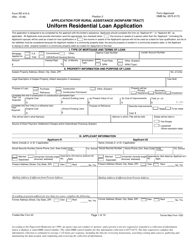

Form CPLS122 Application for 10 Residential Unit Exemption - New Hampshire

What Is Form CPLS122?

This is a legal form that was released by the New Hampshire Department of Justice - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

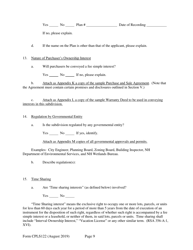

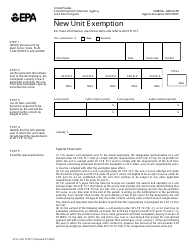

Q: What is the CPLS122 Application?

A: The CPLS122 Application is an application for a 10 Residential Unit Exemption in New Hampshire.

Q: What is the purpose of the application?

A: The purpose of the application is to request an exemption for a residential unit in New Hampshire.

Q: How many units can be exempted with this application?

A: This application allows for the exemption of up to 10 residential units.

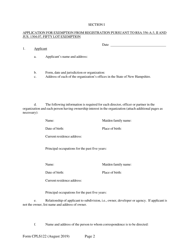

Q: Who can apply for this exemption?

A: Any individual or entity that owns or operates residential units in New Hampshire can apply for this exemption.

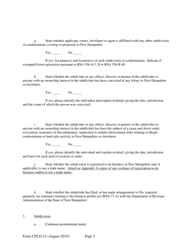

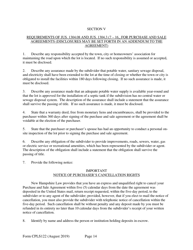

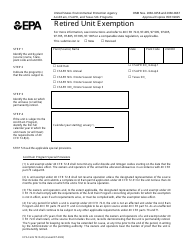

Q: What are the requirements for the exemption?

A: The requirements for the exemption vary, but generally include meeting certain criteria such as the number of units and the type of housing.

Q: Are there any fees associated with the application?

A: There may be fees associated with the application, depending on the specific circumstances and requirements.

Q: What is the deadline for submitting the application?

A: The deadline for submitting the application is typically specified in the application instructions or determined by the New Hampshire Department of Revenue Administration.

Q: Is the exemption guaranteed?

A: The exemption is not guaranteed and will be subject to review and approval by the New Hampshire Department of Revenue Administration.

Q: What happens if the application is approved?

A: If the application is approved, the residential units will be exempted from certain taxes or assessments as specified by the New Hampshire Department of Revenue Administration.

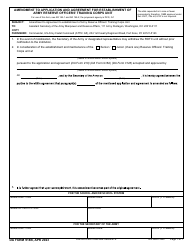

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the New Hampshire Department of Justice;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CPLS122 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Justice.