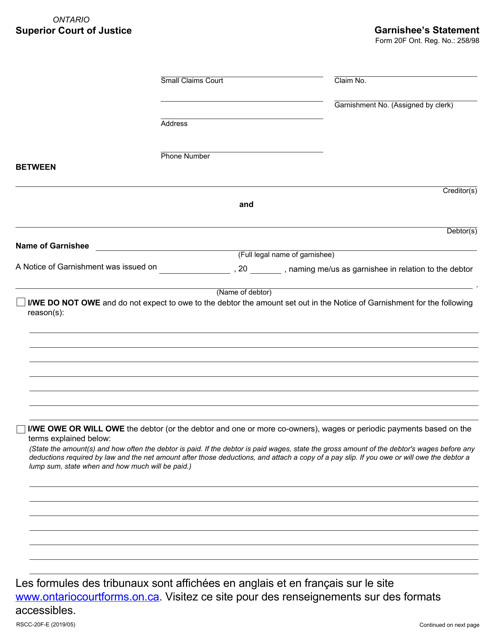

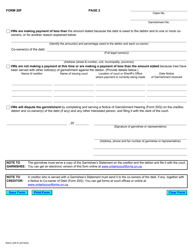

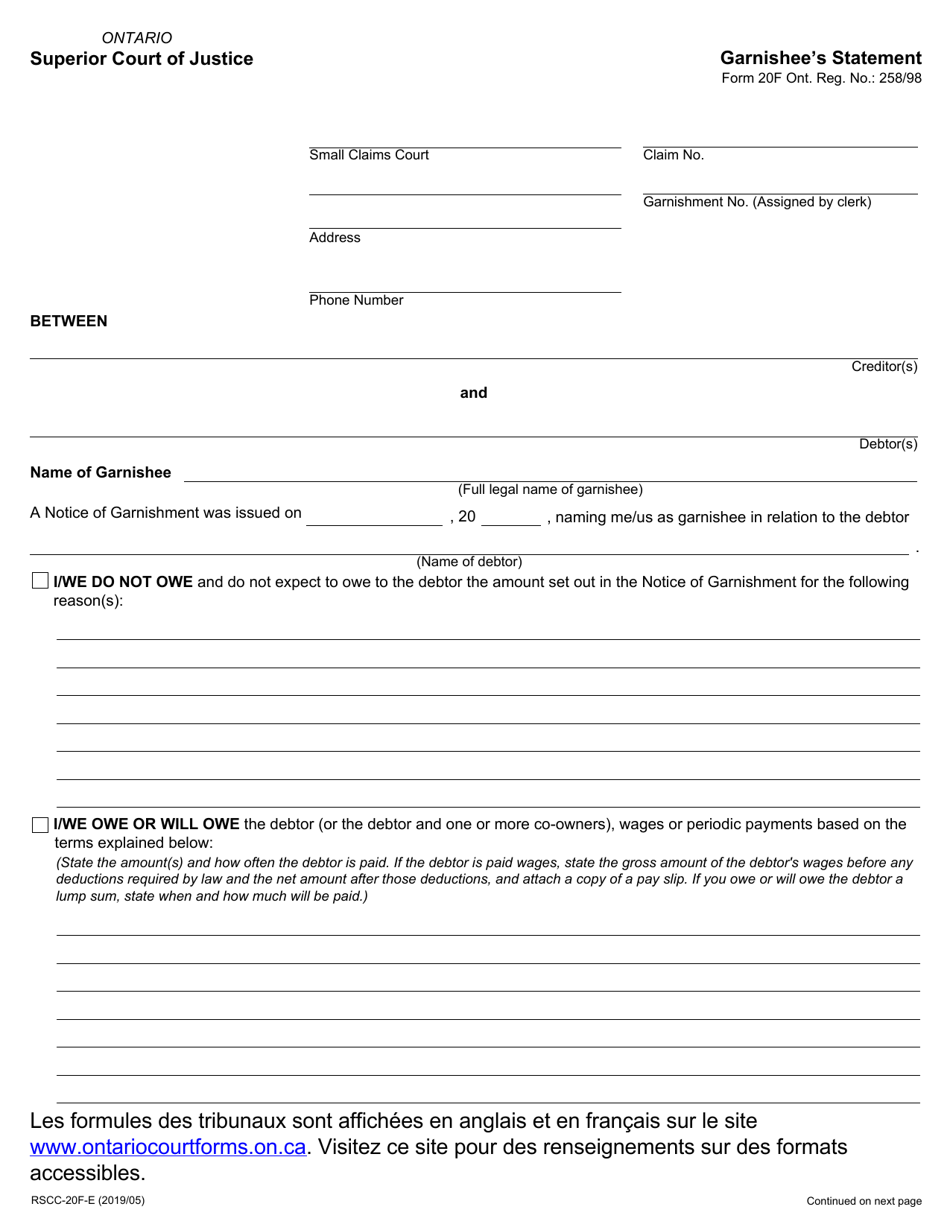

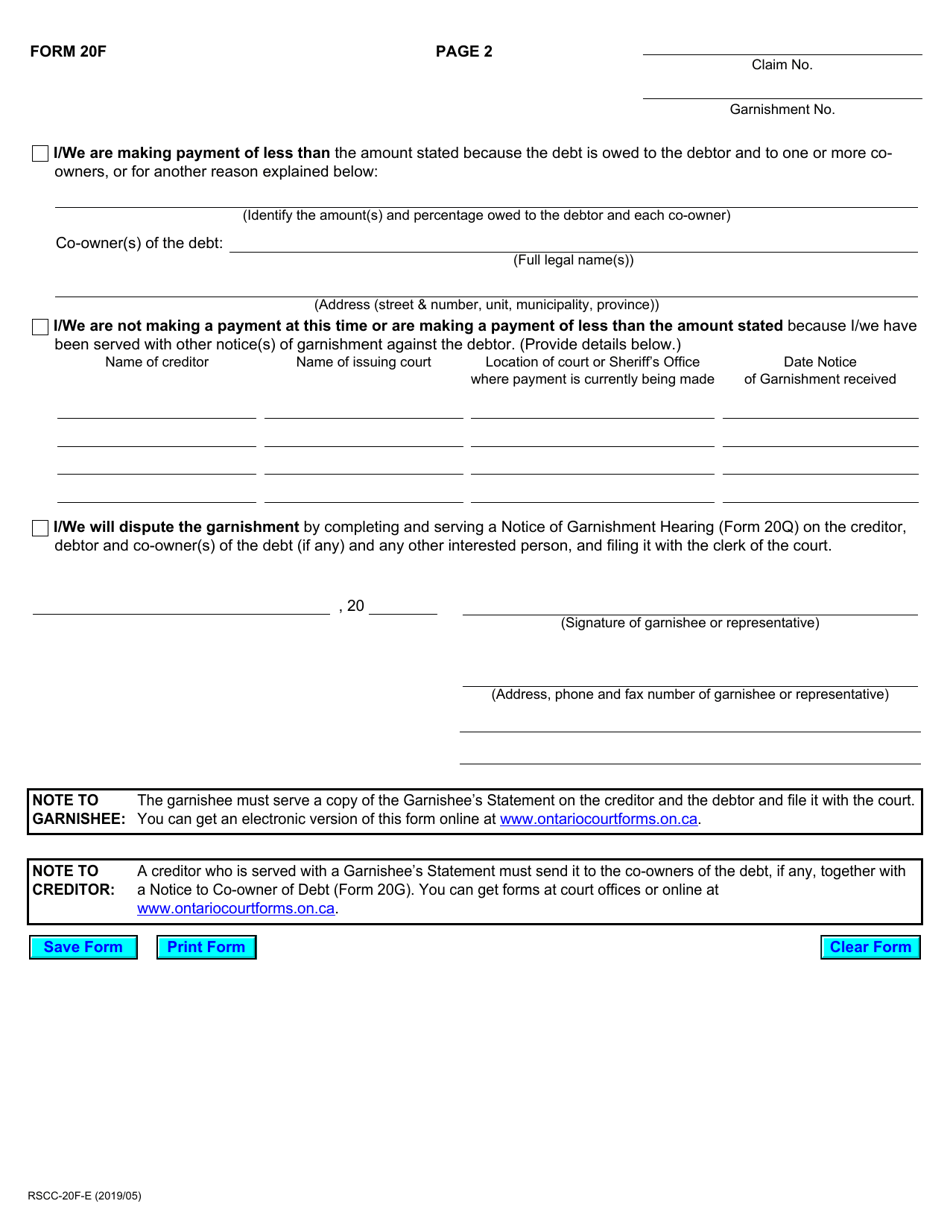

Form 20F Garnishee's Statement - Ontario, Canada

Form 20F Garnishee's Statement in Ontario, Canada is used to collect a debt owed by a person or organization. It allows a creditor to request information from a third party, such as a bank or employer, about any money or property they owe to the debtor.

In Ontario, Canada, the Form 20F Garnishee's Statement is typically filed by the garnishee (the person or organization holding the funds of the debtor) in response to a garnishment order.

FAQ

Q: What is a Form 20F Garnishee's Statement?

A: It is a legal form used in Ontario, Canada.

Q: Who is required to file a Form 20F Garnishee's Statement?

A: Anyone who has received a Notice of Garnishment in Ontario.

Q: What is the purpose of a Form 20F Garnishee's Statement?

A: It allows the garnishee (the person or entity holding the debtor's money) to report any money owed to the debtor.

Q: What information is required in a Form 20F Garnishee's Statement?

A: The garnishee must provide details about the debtor, their account held with the garnishee, and any money owed to the debtor.

Q: Is there a deadline for filing a Form 20F Garnishee's Statement?

A: Yes, the form must be completed and filed within 7 days of receiving the Notice of Garnishment.

Q: What happens if I don't file a Form 20F Garnishee's Statement?

A: Failure to file the form may result in penalties or legal consequences.

Q: Can I seek legal advice when completing a Form 20F Garnishee's Statement?

A: Yes, it is advisable to consult with a lawyer or legal professional to ensure accurate completion of the form.