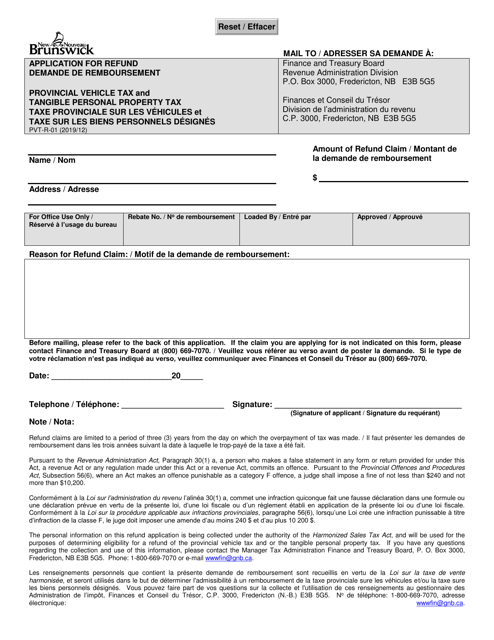

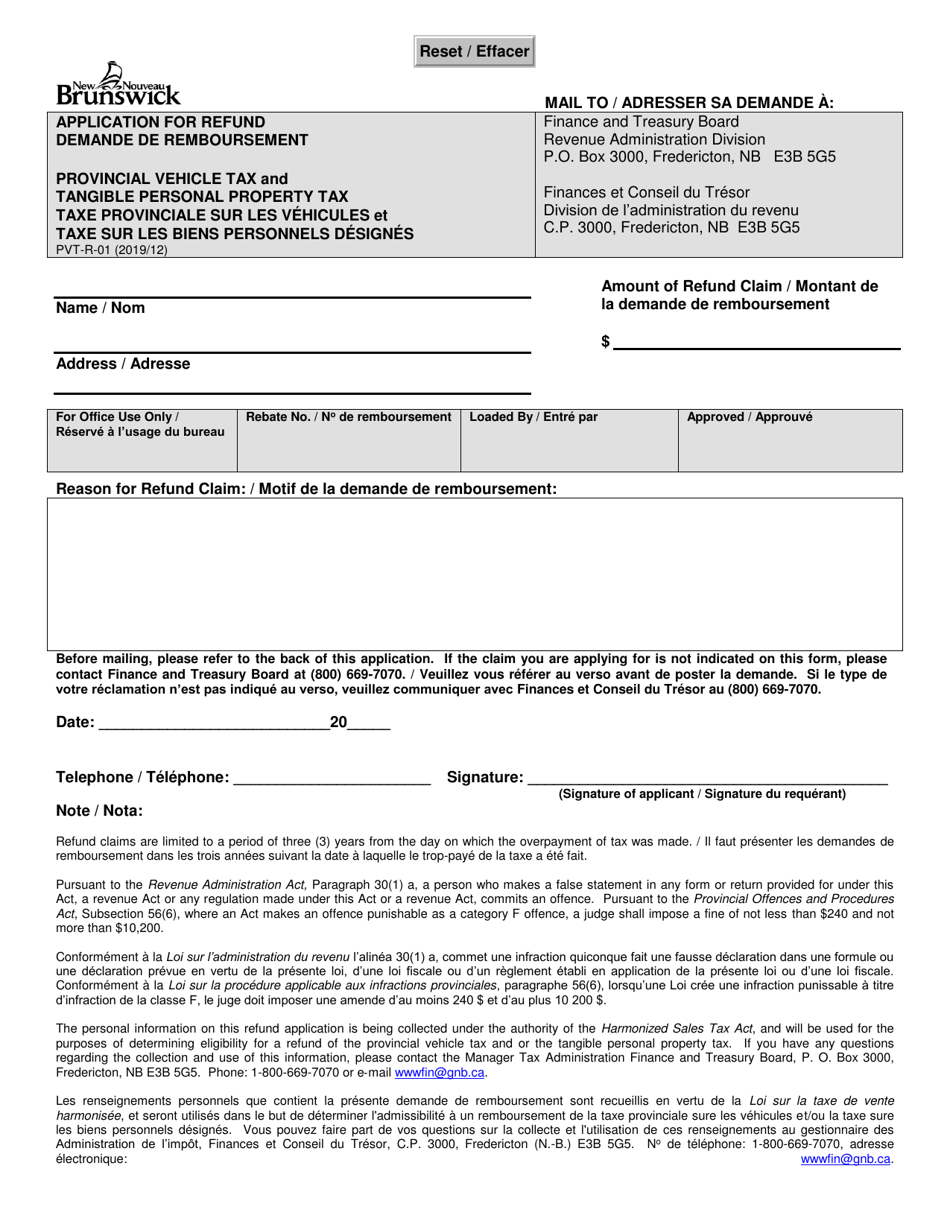

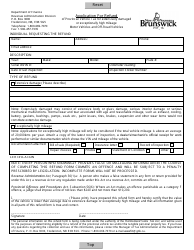

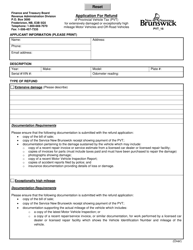

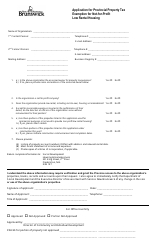

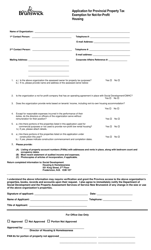

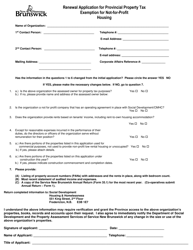

Form PVT-R-01 Application for Refund - Provincial Vehicle Tax and Tangible Personal Property Tax - New Brunswick, Canada (English / French)

Form PVT-R-01 is used to apply for a refund of Provincial Vehicle Tax and Tangible Personal Property Tax in the province of New Brunswick, Canada. It applies to both English and French speakers.

The Form PVT-R-01 Application for Refund - Provincial Vehicle Tax and Tangible Personal Property Tax in New Brunswick, Canada can be filed by individuals or businesses who meet the eligibility criteria for a refund.

FAQ

Q: What is Form PVT-R-01?

A: Form PVT-R-01 is the Application for Refund form for Provincial Vehicle Tax and Tangible Personal Property Tax in New Brunswick, Canada.

Q: What taxes does Form PVT-R-01 apply to?

A: Form PVT-R-01 applies to Provincial Vehicle Tax and Tangible Personal Property Tax.

Q: Is the form available in English and French?

A: Yes, the form is available in both English and French.

Q: What is the purpose of Form PVT-R-01?

A: The purpose of Form PVT-R-01 is to apply for a refund of Provincial Vehicle Tax and Tangible Personal Property Tax in New Brunswick.

Q: Who is eligible to use Form PVT-R-01?

A: Any individual or business who has paid Provincial Vehicle Tax and Tangible Personal Property Tax in New Brunswick may be eligible to use Form PVT-R-01.

Q: Are there any deadlines for submitting Form PVT-R-01?

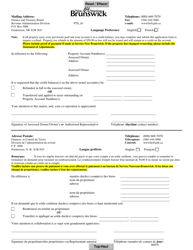

A: Yes, there are deadlines for submitting Form PVT-R-01. It is important to refer to the instructions on the form or contact the appropriate government department for specific deadlines.

Q: Is there any fee for submitting Form PVT-R-01?

A: There is no fee for submitting Form PVT-R-01.

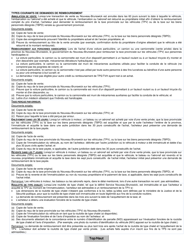

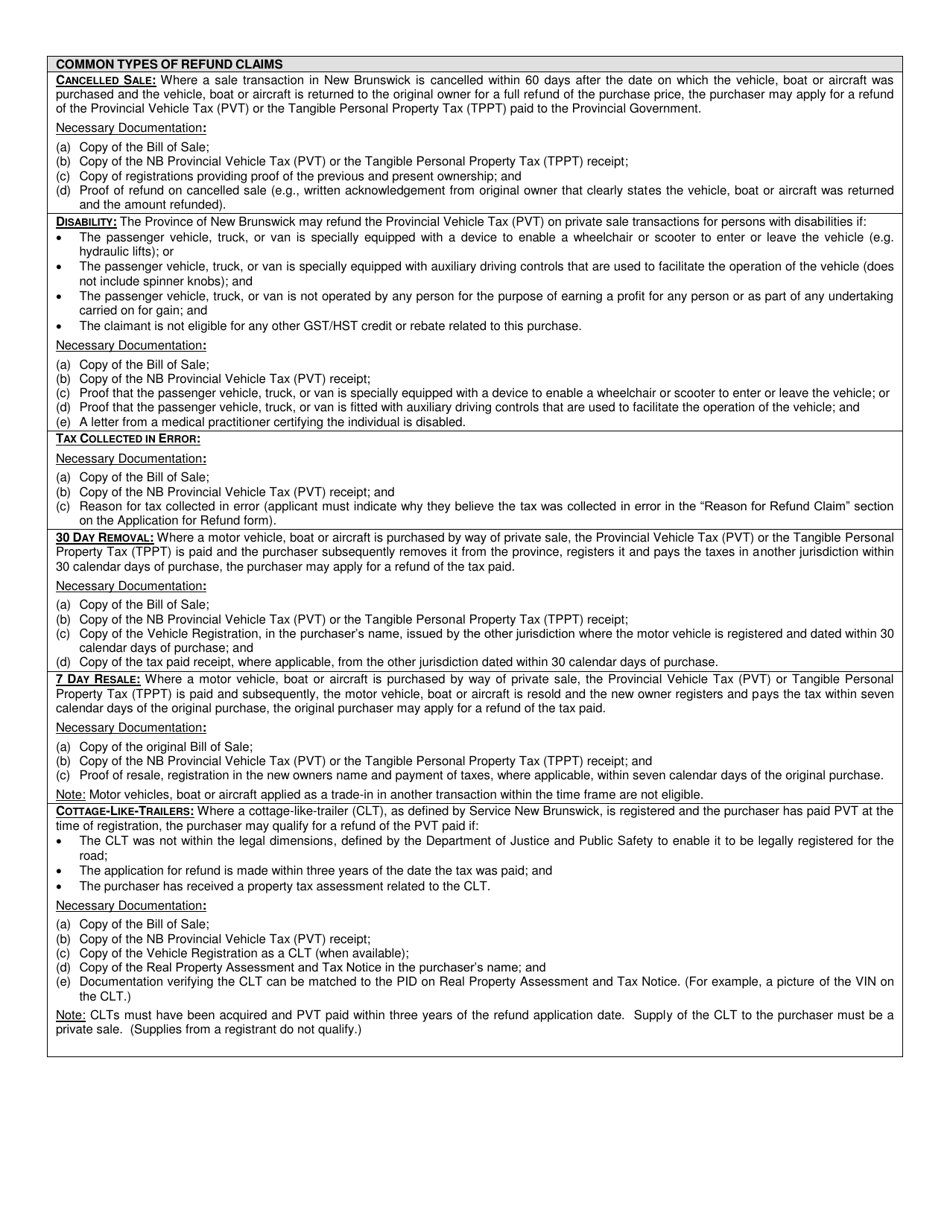

Q: What supporting documents are required with Form PVT-R-01?

A: The specific supporting documents required with Form PVT-R-01 may vary. It is important to refer to the instructions on the form or contact the appropriate government department for specific requirements.